Summary:

- Dell’s AI-optimized server backlog doubled to $2.9B, but it is still in the early stages of leveraging the AI gold rush.

- Dell’s profitability and free cash flow margins have remained strong, and its dividend payout has been upgraded by 20%.

- The AI hype underpins Dell’s thesis, but investors must question whether it has reached a peak.

- Sellers have rejected DELL’s buying momentum above the $130 level, suggesting profit-taking is underway.

- Buyers looking to exploit Dell’s early AI developments should realize they are likely late to the party.

JHVEPhoto

DELL Fell From Its All-Time Highs

Dell Technologies Inc. (NYSE:DELL) surged to a new all-time high earlier this month but has since given up most of the gains made in April, as the S&P 500 (SPX) (SPY) fell from its record highs. The leading technology hardware company benefited from the AI hype, even though Dell is still in the nascent stages of leveraging the AI gold rush.

Accordingly, Dell emphasized at its most recent earnings release that “the backlog for AI-optimized servers nearly doubled, reaching $2.9B.” However, that’s relatively insignificant compared to Dell’s FY25 midpoint revenue guidance of $93B, representing a 5% YoY growth. Therefore, investors must contextualize the surge in DELL over the past year. Even though it has retraced from its recent highs, DELL still posted a 1Y total return of 167%, easily outperforming the S&P 500.

Dell’s AI Thesis Looks Promising, But Still Early

I believe the market enthusiasm for Dell’s market-leading position in the client and enterprise space isn’t misplaced. Notwithstanding the industry’s supposedly commoditized and cyclical nature, Dell has maintained robust profitability and free cash flow margins over time. As such, it commands a best-in-class “A+” profitability grade, underpinning DELL’s bullish thesis. Furthermore, Dell management upgraded its dividend payout by 20% to demonstrate confidence in its execution for FY25, as it capitalized on the early momentum of Dell’s multi-year AI roadmap.

Therefore, Dell anticipates a more robust growth momentum for its infrastructure solutions group to underpin its optimism for FY25. Accordingly, management telegraphed mid-teens revenue growth prospects, undergirded by “artificial intelligence, alongside a return to growth for traditional servers and storage.” Consequently, Dell believes its ability to offer enterprise customers full-fledged solutions beyond just servers is critical to sustaining its moat with its enterprise base.

Moreover, the AI PC refresh should further strengthen its consumer-focused thesis. Recent commentary by Canalys analysts underscores the ongoing shift to AI PCs. The research firm anticipates a 44% CAGR in AI PCs through 2028, bolstering the “overall value of PC shipments from $225B in 2024 to over $270B in 2028.”

While there could be some concerns over the adjusted gross margin impact attributed to Dell’s AI-optimized servers, it isn’t expected to be significant. Management highlighted “a decline of roughly 100 basis points.” Given Dell’s well-diversified revenue segments, the impact should be well-contained. Analysts’ estimates suggest Dell’s gross margin could fall to 23.3% in FY25, down from last year’s 24.2%. Hence, the market has likely baked in the reduction, suggesting Dell investors shouldn’t be unduly worried.

DELL’s Valuation Looks Frothy

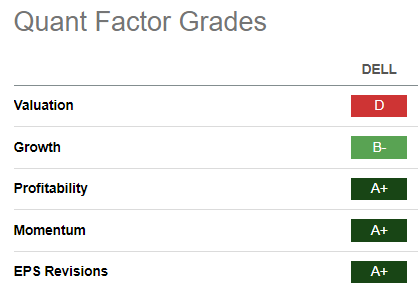

DELL Quant Grades (Seeking Alpha)

While the market’s optimism about Dell’s thesis and ability to execute is justified, the question of whether DELL’s valuation multiple is sustainable must still be asked.

Historical valuation multiples are likely less relevant if the shift toward an AI computing future continues to gain momentum. Despite that, DELL investors should note the relative growth premium (“D” valuation grade) baked into its current valuation. DELL’s forward adjusted earnings multiple of 15.6x is below its current hardware peers’ average of 19.4x (according to S&P Cap IQ data). Hence, DELL bulls could argue that the industry has been re-rated.

Therefore, Dell investors are likely in a quandary now as they assess whether they should continue chasing DELL’s surging momentum or wait for a steeper pullback to digest its recent FOMO rush.

Is DELL Stock A Buy, Sell, Or Hold?

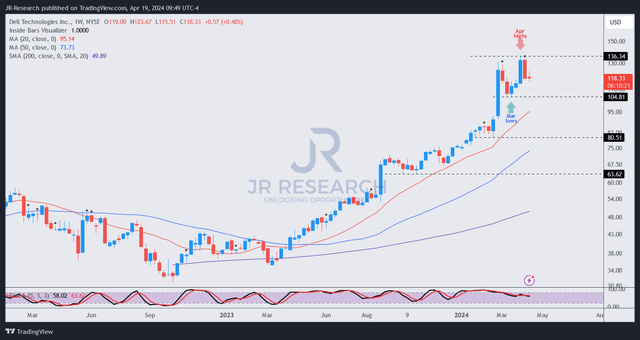

DELL price chart (weekly, medium-term, adjusted for dividends) (TradingView)

DELL’s price action suggests caution shouldn’t be thrown to the wind, as sellers took profit by rejecting its April highs. As a result, buyers could find the momentum of taking DELL well above the $130 zone highly challenging, worsened by the negative sentiments afflicting the current market pullback.

AI investors that have benefited significantly from FOMO over the past year could look to take more positions off to protect their gains, heaping more pain on late buyers to the fray. As a result, I assessed DELL’s risk/reward as relatively well-balanced but lean closer to the bearish side, corroborated by DELL’s unconstructive price action.

However, I have yet to glean a confirmed sell signal suggesting investors must cut significant exposure.

Dell has benefited from the AI hype over the past year, although its relatively insignificant backlog suggests the developments are still early. However, its business model has proved itself, notwithstanding the unpredictable cyclical nature of its industry.

Its well-developed solutions for its enterprise customers will likely play a pivotal role in spurring the adoption of its full-fledged AI solutions beyond the hardware. Therefore, AI is expected to be accretive to its thesis and should drive adjusted operating margin expansion over time as it scales. Despite that, DELL’s valuation and price action suggest significant optimism has been reflected, necessitating a more cautious posture.

Rating: Initiate Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!