Summary:

- Microsoft is set to report its fiscal third-quarter results, with investors hoping it will shift focus away from negative macroeconomic factors.

- Azure and Office performance, particularly revenue growth, will be a key factor in determining the direction of MSFT stock, with 28% and 15% being the magic numbers.

- The market has become more fearful, providing a more favorable setup for Microsoft’s stock heading into earnings.

wdstock

It’s been a rough couple of weeks in the markets leading into big-tech earnings season, as the macroeconomic backdrop is becoming increasingly negative, taking AI-mania’s spot in the center of attention.

Microsoft (NASDAQ:MSFT), one of the leaders of the AI craze, is set to report its fiscal third-quarter results this Thursday, April 25th.

Investors will look to the largest company in the world in terms of market cap, with the hope it will take back the focus from macro, to micro.

Let’s prepare for the highly anticipated print, and go over the key aspects to monitor.

Introduction

I’ve been covering Microsoft on Seeking Alpha since May of last year, maintaining a Buy rating throughout the period.

In my first deep dive, I detailed my still-relevant long-term thesis on Microsoft. In short, Microsoft is the industry leader across several highly profitable and fast-growing categories. Through Azure, Office, LinkedIn, and Bing, Microsoft covers the most attractive categories in tech, including advertising, cloud, security, productivity, and data.

Microsoft’s path for 15% or higher FCF per share growth for the foreseeable future is very clear, and accordingly, so is the company’s path to generate significant market-beating returns.

So far, our thesis worked out exceptionally well. Now, let’s look ahead.

The Setup – Beat & Raise Isn’t Always Enough In A Dark Macro Backdrop

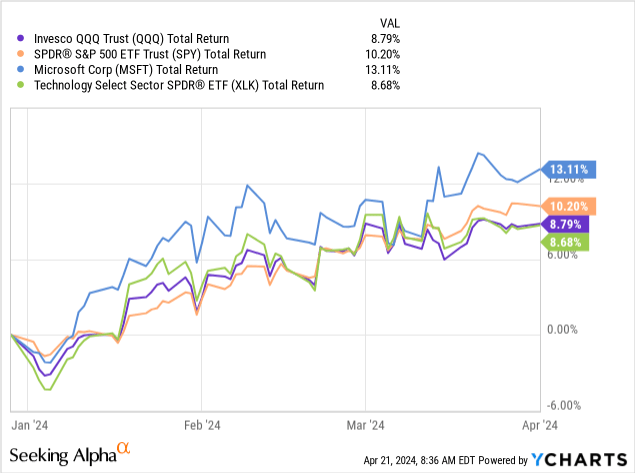

Heading into this earnings season, calling the markets greedy would have been an understatement. In the first quarter that ended in April, the Nasdaq 100 (QQQ) was up 9%, while the S&P 500 rose 10.2%, and Microsoft outperformed both with 13.1% returns.

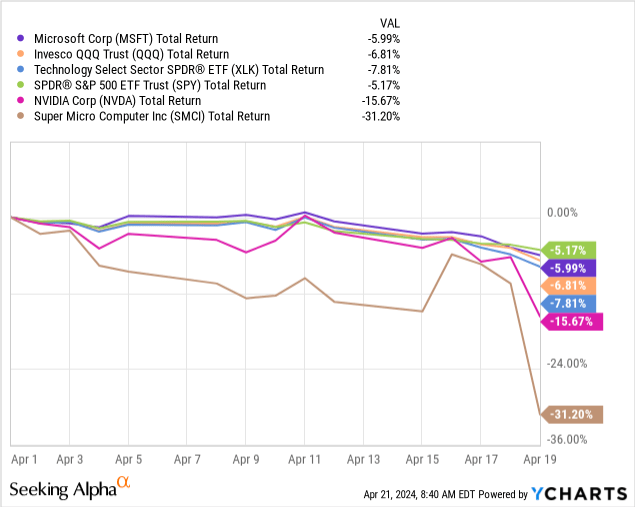

Stickier inflation prints and a more hawkish fed have led to a dissolution in the market, and gave rise to increasing worries over an AI bubble, sending AI leaders like Nvidia (NVDA) and Super Micro Computer (SMCI) into sharp declines.

Even a company like Netflix (NFLX), which reported much better than expected results, saw its stock drop almost 10% in a day.

The market quickly turned from extremely greedy to much more fearful, and while it’s never fun to see red, it does provide a more favorable setup for Microsoft’s stock heading into earnings.

So, let’s dive into the most important factors that will determine where the stock goes from here.

Azure Tops The Ladder, 28% The Magic Number

In Azure, we expect Q3 revenue growth in constant currency to remain stable to our stronger-than-expected Q2 results.

– Amy Hood, EVP & CFO, Q2’24 Earnings Call

In Q2’24, Azure grew 28% on a constant currency basis, and I expect Azure will come 1 or 2 percentage points above that in Q3, based on management’s guidance and consensus positivity from channel check reports.

It’s as simple as that. If Azure delivers growth below the 28% consensus, I can’t think of anything that would stop shares from falling sharply, no matter how strong other business lines come (although if Azure disappoints, it’s unlikely other businesses will perform much better).

Azure captures the most important tailwinds for Microsoft, including GenAI and cloud computing. It also provides a material read through for the IT spending environment in general, which is crucial for a company that has so much presence in the value chain.

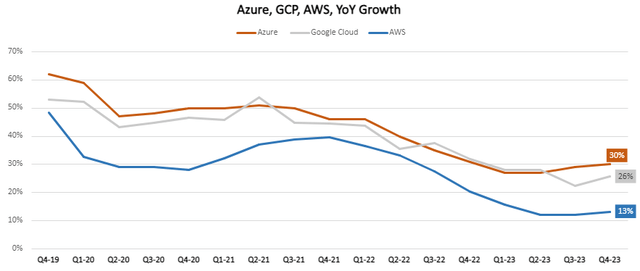

Created and calculated by the author using data from the companies’ financial reports; Microsoft’s fiscal quarter is two periods ahead of the calendar year, meaning Q4-23 is Microsoft’s fiscal Q2-24.

Last quarter, Azure drove 30% Y/Y growth, or 28% on a constant currency basis, outgrowing both AWS (AMZN) and the much smaller Google Cloud (GOOG). Management said that AI services contributed 6 points of growth, and it’d be very interesting to see if this level accelerates this quarter.

Notably, all three hyper scalers gave optimistic guidance heading into this quarter, saying the optimization phase is largely over.

Office Comes At Number Two

Despite its size, Microsoft’s Office Suit remains one of the fastest-growing product categories, with Office Commercial growing 15%, and Office 335 growing 17% last quarter.

The company surpassed 400 million paid seats last quarter, up 9% Y/Y, reflecting a mixed contribution from volume, mix, and pricing, as revenue per seat continues to grow.

Last quarter, there was no significant revenue from copilots, aside from the GitHub copilot, which is a business that’s probably worth billions by itself already, with 1.3 million paid subscribers, growing 30% quarter-over-quarter.

Since then, Microsoft several Copilots for a variety of use cases, including finance, security, sales, Teams, and more.

Investors will look for updates on the reception of these enhanced offerings. While I don’t expect these to become a material contributor to revenues in calendar 2024, early figures about major productivity gains should support the long-term bull case.

Management expects constant currency growth of 15% for Office 365, reflecting a marginal slowdown from the recent quarter.

Capex & Profitability

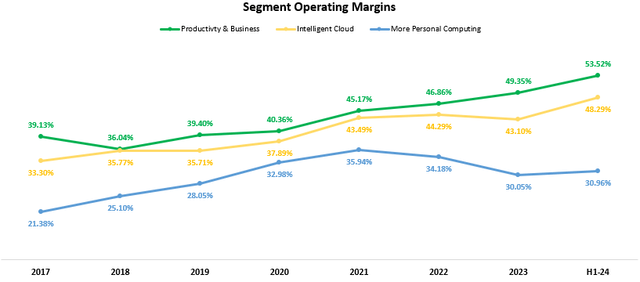

Many lines have been written about Microsoft’s management team, and its ability to drive industry-leading innovation while maintaining an efficient organization, as reflected by the consistent margin improvements and relatively high ROIC.

Created by the author using data from Microsoft’s financial reports.

We’re seeing the margin expansion continue in FY24, with operating margins coming at 45.5% in the first half of the year, driven by improvements across all segments.

Based on management’s guidance for Q3, we should expect almost a 1 percentage point improvement in margins (both Y/Y and Q/Q), and that’s despite the negative effect of Activision Blizzard.

Management also said it expects capex to gradually increase, as they invest heavily into the AI paradigm shift. We’re seeing news about plans to build a $100 billion supercomputer, and it would be interesting to see if management confirms what is currently a rumor.

Other Small Items

It seems like every big tech company must have its “other” bucket, which combines multiple smaller businesses that don’t receive much investor attention, although Microsoft’s bucket, which includes Bing, LinkedIn, hardware, gaming, Windows, and more, is arguably much more attractive than some of its peers.

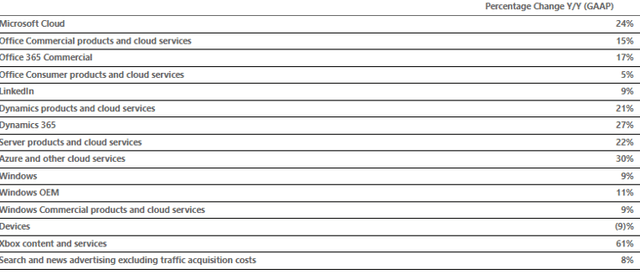

Microsoft Q2’24 Earnings Release

Most of these businesses are either declining or growing at a single-digit pace, affected by different tailwinds and headwinds.

Heading into the quarter, I want to flag LinkedIn, as an important reflection of the job economy and ads, as well as the gaming divisions, where we’ll want to hear how the Activision acquisition is progressing. Also, an update to the new AI-fueled Bing and the AI Microsoft Surface could add some value.

Valuation

I’ve shown my DCF model for Microsoft in my November article, where I provided a price target of $400 a share. In this article, I’d like to stick to simple valuation multiples, as I want to focus on the setup for earnings.

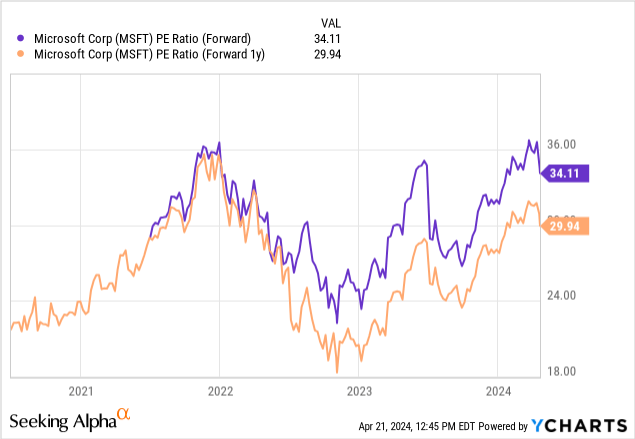

Microsoft is currently trading at a 34x multiple over its FY24 expectations, and a 30x multiple over FY25. Importantly, Microsoft’s fiscal calendar is two quarters ahead, so to put Microsoft’s valuation in the right context, we should use a next-twelve-months multiple, which will cover calendar 2024.

Based on the consensus estimate taken from Seeking Alpha, Microsoft’s CY24 EPS estimate is $12.2, reflecting a 32.7x multiple.

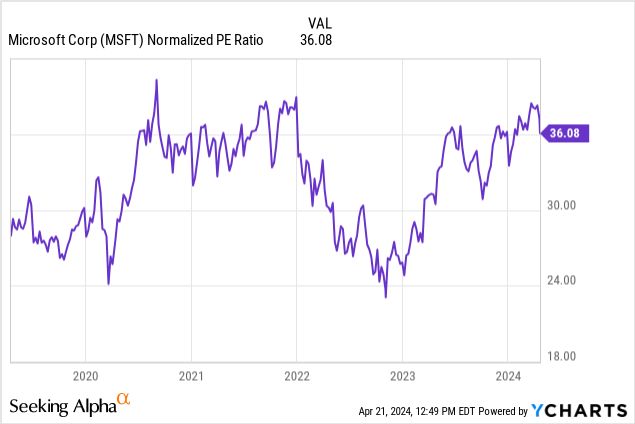

A 32.7x multiple is lower than several slower-growing software names like Adobe (ADBE), Salesforce (CRM), and Intuit (INTU). It’s also right around the 5-year average for the stock.

So why is this a favorable setup?

First, Microsoft almost always beats estimates, so the multiple is much lower. Second, the recent selloff took out much of the AI-driven market cap, as Microsoft is now at a pre-ChatGPT multiple. And lastly, Microsoft should beat and raise, meaning estimates will go up as soon as next week.

Importantly, if you enter a position in a high-quality compounder at a fair valuation, it means you’re well positioned for returns that are in line with the company’s earnings and FCF growth.

For Microsoft, the company is expected to grow EPS at a mid-teens CAGR for the rest of this decade, and the path to achieving that is quite clear.

Therefore, for those who missed buying Microsoft at the 2023 levels, I think now is a decent to initiate a position.

I have no idea how the stock will react to earnings, but I have very high confidence that earnings will come in higher than expected.

Conclusion

Microsoft is set to report its third-quarter results this Thursday, amid deteriorating market sentiment.

I expect the company will beat growth expectations for its most-watched businesses, which primarily include Azure and Office, and I estimate continued margin expansion and industry-leading ROIC.

Following the recent selloff, Microsoft now trades at its 5-year average, which means a lot of the AI-driven value is no longer reflected in the stock price.

I expect the company will provide at least 15% annual returns from these levels, and reiterate Microsoft as a Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT, AMZN, META,GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.