Summary:

- McDonald’s stock is dropping. Many are wondering whether to pull the plug or not.

- Lack of top-line growth and recent challenges have raised concerns about the company’s future, creating a mixed outlook.

- As MCD reports Q1 earnings, we should look at the whole picture.

pedrosala/iStock Editorial via Getty Images

Introduction

With shares dropping from $300 to $260, McDonald’s (NYSE:MCD) is once again close to the price range that triggered my last buy rating on the stock.

As the fast-food behemoth’s Q1 earnings approach, I have the urgency to go over the company and assess whether this may be a buying opportunity. After all, with the stock market close to its all-time highs, finding good and rewarding investments is becoming harder and harder. As a matter of fact, I have not bought a lot in the past six months, and I have stacked up some cash to take advantage of drops or corrections.

McDonald’s is a consumer favorite among fast food restaurants, surpassed only by Chick-fil-A (a company I wish would be publicly traded). But this has not protected it against some recent headwinds that added some concerns to the issues the company had tried to cope with in the past years.

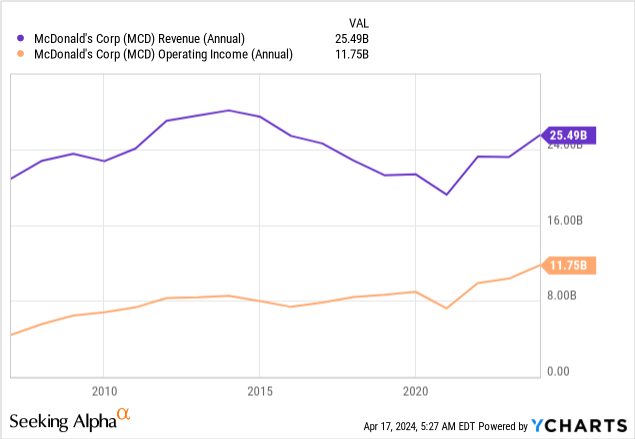

Lack of top-line growth has been a red flag that many investors would give a pass because of growing profits thanks to the conversion of directly operated restaurants into franchised ones.

But recently, McDonald’s experienced challenges in Arab countries. Tensions in the area made McDonald’s decide to repurchase its 30-year-old franchise from Alonyal: 225 restaurants and more than 5,000 employees will soon report directly to the company.

The stock also is on the sell-side of a pair trade with Pool Corp. (POOL) suggested by Oppenheimer analysts.

To address its lack of growth, McDonald’s announced a massive expansion plan targeting 50,000 restaurants by 2027 (8,000-plus restaurants compared to now). It also is carefully assessing its new CosMC’s concept to see if it can challenge Starbucks’ leadership in caffeinated beverages.

So, investors continually face different, if not opposite, news, and inputs that make it harder to predict the company’s future path.

Let’s then go over the last annual report with all of this in mind. Our goal is to read through the challenges to see whether it’s short shelf-life stuff or if it significantly undermines the company’s fundamentals.

McDonald’s Business Model

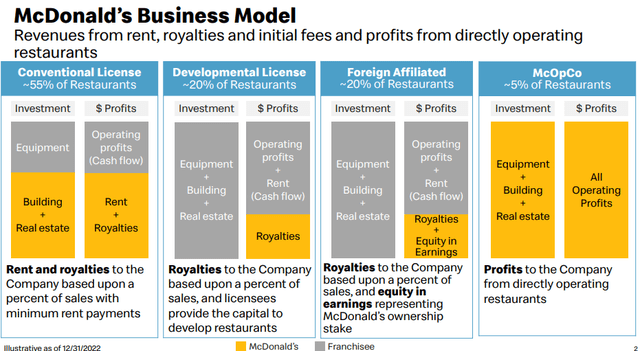

While many sophisticated and seasoned investors on Seeking Alpha may find this paragraph redundant, I happened to find several investors who are still unaware of how McDonald’s truly works. As a result, I feel necessary to share this slide highlighting it.

MCD Investor Relations Website

The most important thing to understand is how McDonald’s revenues come in. The company mainly works as a franchisor, collecting royalties. Approximately 95% of the restaurants at year-end 2023 were franchised. This means McDonald’s also is the owner of the building, collecting rent. This helps the franchisee reduce its initial investment, and it gives McDonald’s control of very important assets which usually appreciate over time due to their highly profitable location. Only 5% of the company’s restaurants are fully owned and operated by McDonald’s. This means most of McDonald’s revenue is recurring and with less operational risk than the revenue a franchisee collects from its restaurant sales. This is why I have heard more than once the saying that McDonald’s is a REIT.

This business model is highly defensive, as McDonald’s explains in its annual report: “The Company’s heavily franchised business model is designed to generate stable and predictable revenue, which is largely a function of franchisee sales, and resulting cash flow streams.”

At the same time, if sales fluctuate a bit, McDonald’s takes a weaker hit than its franchisees. Moreover, at the beginning of this year, McDonald’s raised its royalty rates to 5%, after more than three decades of a 4% fee. Considering the company is massively investing to open new restaurants, we can expect this move to generate an immediate boost to the company’s top line. Even more interesting is the initial $45,000 franchise fee that McDonald’s collects. Therefore, we can calculate that in 2024, assuming 2,000 new openings, we have right off the bat $90 million of revenue that goes down directly to the bottom line apart from what needs to be paid in taxes. While $90 million is just 0.3% of the company’s revenues, the net income coming from it (78% if we assume a 22% tax rate) is close to 0.8% of the 2023 reported net income. Not meaningful percentages, but if we don’t compare them to the company’s massive size, we can use these numbers to understand how McDonald’s profit-generating business model proceeds. There also are many other fees franchise owners pay: Advertising fees, rent, POS fees, kiosk fees, etc.

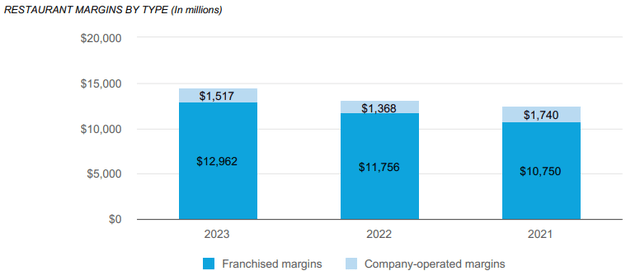

In the restaurant industry, an important metric is restaurant margins, which McDonald’s measures as revenues from franchised restaurants less franchised restaurant occupancy costs. Almost 90% of the company’s restaurant margin dollars come from franchised margins ($12.96 billion out of $14.48 billion).

Because of this business model, McDonald’s carries a high amount of total debt: $53.15 billion. Its net debt is $48.57 billion. Considering its EBITDA is $13.68 billion, we have a net debt/EBITDA ratio of 3.5, which is above the maximum threshold I usually want for my holdings: 3.

However, most of this debt has been raised to purchase land and buildings. On its balance sheet, McDonald’s reports property, plant & equipment of $57.08 billion. Now, we can be almost 100% sure that most of its properties, land, and equipment have appreciated over time at a faster pace compared to the 3.7% current interest rate of its total debt. Therefore, McDonald’s debt is less concerning than what it may appear to be at first glance.

MCD 2023 Annual Results

Underpinning everything we are going to see is the company’s strategic plan called “Accelerating the Arches,” whose targets are:

- 2.5% annual net restaurant unit expansion

- Operating margin expansion in the mid-to-high 40% range

- Capex of $2.5 billion in 2024, with sequential increases of about $300-$500 million each year through 2027

- FCF conversion rate above 90%

In 2023, McDonald’s comparable sales grew by 9% and guest counts grew by 3% globally last year. This exceeds the company’s targets and is good news.

Among its main financial highlights, I want to highlight 10 of the most important ones we can find in the annual report:

- Consolidated revenues increased 10% to $25.5 billion.

- Systemwide sales increased 10% to $129.5 billion.

- Consolidated operating income increased 24% to $11.6 billion.

- Operating margin increased from 40% in 2022 to 46% in 2023.

- Diluted EPS of $11.56 increased 39%.

- Operating cash was $9.6 billion, a 30% increase YoY.

- Capital expenditures of $2.4 billion were allocated approximately 50% to each reinvestment in existing restaurants and new restaurant openings.

- Free cash flow was $7.3 billion, +32% YoY.

- More than 2,000 new restaurants were opened.

- The cash dividend per share increased by 10% to $1.67 for Q4, equivalent to an annual dividend of $6.68 per share. Total shareholder returns were $7.6 billion through dividends and share repurchases.

These were great results from any point of view. But what’s ahead?

McDonald’s In 2024 Faces Some Challenges

Just a month ago, McDonald presented at the UBS Global Consumer And Retail Conference, announcing that this year it expects to reach nearly $130 billion in system-wide sales, up from $119 billion in 2023.

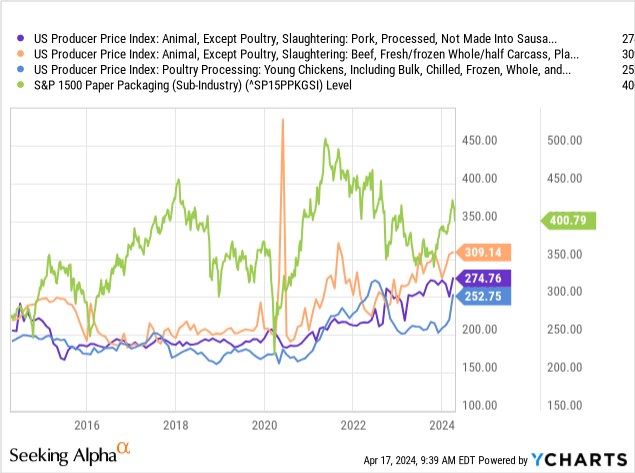

One major issue for McDonald’s will come from high commodity prices: Every year, the company spends more than $50 billion on food packaging and services. Even though its buying scale means that McDonald’s has the lowest cost in the industry, margins will be pressured, as we can see from the price indexes of beef, pork, chicken, and paper packaging, all close to, if not at, ATHS.

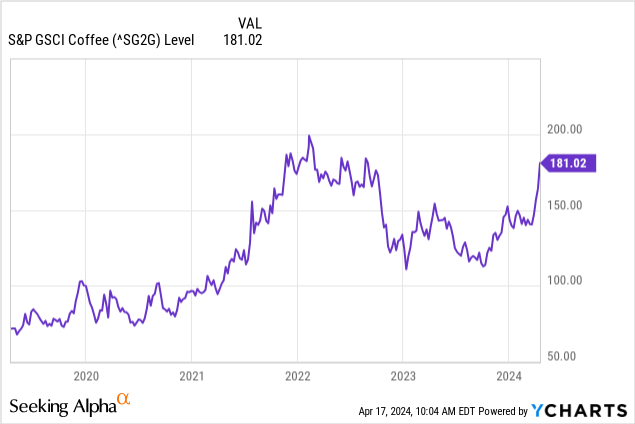

Of course, McDonald’s is exposed to beef, pork, and chicken. But not many are aware that McDonald’s also has a big coffee business as one of its core menu focus area that sells nearly 8 million cups of coffee per day, making McDonald’s the second-largest player in the category. And, guess what? Coffee is skyrocketing.

So, although McDonald’s hedges its commodity exposure, it can’t just completely offset the impact of these high prices. It will either take a hit on its margins or it will raise prices. Since it already raised its royalties, I expect retail prices to go up, as well.

McDonald’s Q1 Earnings

McDonald’s doesn’t give any traffic guidance from one quarter to the next.

But we know the company expects 2% growth in system-wide sales from its new restaurant openings. SG&A should be around 2.2% of system-wide sales, but operating margins are still expected to be between 45% and 49%.

Interest expenses, however, are projected to increase by around 10% due to higher average debt balances and interest rates. As a result, we should see an interest expense of around $1.5 billion.

We need to add another $2.6 billion in capex, half of which will fund 2,100 new restaurant openings.

So, considering McDonald’s reported $5.9 billion in total revenues in Q1 2023, we can expect top-line growth of 6% to be a bit conservative, considering pricing and restaurant growth. My forecast is thus quarterly revenue of $6.25 billion.

As said, we have increasing costs, so I will stay on the low side of McDonald’s operating margin guidance: 45%. This leaves us with $2.81 billion in operating cash. Interest expense should be higher and could be around $400 million. Taxes are expected to be around 22%. So we can have a quarterly net income around $1.88 billion, which is a 4.3% growth YoY.

Divided by the 722 million shares outstanding, we have a Q1 EPS projection of $2.60.

Compared to the current consensus, I have a higher revenue estimate ($6.25 billion vs. $6.17 billion), but a lower EPS forecast ($2.60 vs. $2.73). This paints the picture of some uncertainty as to how much the current investments for the expansion plan will impact the bottom line of McDonald’s. In addition, it’s hard to precisely predict the impact of high commodity prices on the company’s operations.

For sure, if EPS comes below my estimate, it would be a bad report. If McDonald’s comes on top of the current consensus, the stock could start picking up strength once again. Over the long term, I have almost no doubt McDonald’s will do just fine. But this earnings report is quite crucial because it could lead to some major and unexpected movements in a stock that’s usually seeing low volatility.

Valuation

How is McDonald’s valuation right now? After the drop, McDonald’s is trading at D- Quant valuation grade.

As far as I can see, the company rarely earns a C (the last time was during the 2022 bear market), showing that investors price the company at a premium, considering it a safe haven. However, its fwd PE already earns a C-, being 21.4, which, for the stock, is low.

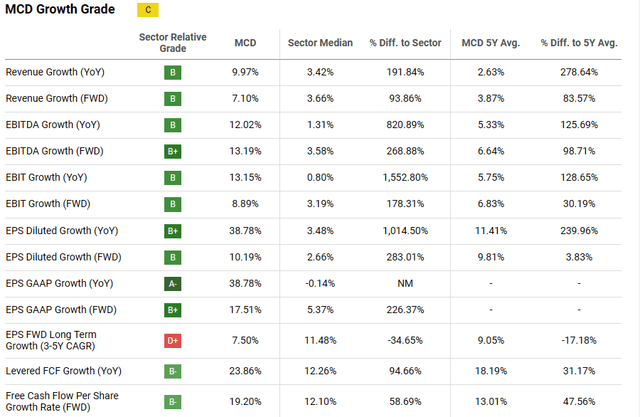

Its growth grade is strengthening and is currently a C, but most of its metrics are already at a B.

This shows how McDonald’s growth is not only a narrative, but it’s a fact with financials supporting it.

As far as profitability goes, it’s not hard to imagine that McDonald’s rightly deserves an A+.

So, we have a mature and extremely profitable company with a rather high valuation and some decent growth. What should we make of this situation?

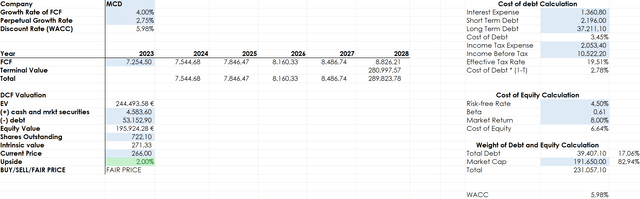

If I run a discounted cash flow model, plugging in the latest available financials, I find the following. I used a WACC of 6% and an FCF expected growth rate for the next five years of 4%. I might have been too prudent, but the company is going to spend more on capex and this can create some unpredictable variables.

The result is that McDonald’s fair price is $271, 2% above the current price.

My spreadsheet ranks this result as a fair price range.

What does fair price mean? It means the investment is actionable: We’re getting enough value from what we pay. It also sets the range for investors to calculate their own margin of safety. For example, I usually take the fair value estimate and discount it by 10% to 20% depending on the industry, the company, and some other factors. In the case of McDonald’s its stability and predictability make me discount my fair estimate by 10%. This makes me think a good entry point could be around $244. As a result, I rate the stock as buy because the overall picture seems healthy and promising. But I, personally, will wait, especially because there’s an important earnings report that could move the price to the downside. Investors may thus want to wait a few days and decide after the report what to do.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MCD over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.