Summary:

- Netflix is diversifying its content offerings to attract both active and passive viewers, including unscripted TV and live sports streaming.

- The addition of an ad-supported membership tier is expected to drive significant revenue growth through ads and subscriptions and may bring higher retention rates.

- The inclusion of live sports streaming could attract a new customer base and potentially lead to the introduction of higher-tiered premium memberships or a sports marketplace.

Image Source/DigitalVision via Getty Images

Netflix (NASDAQ:NFLX) is positioning itself to grow on multiple fronts while creating new content segments between unscripted TV and live sports streaming. Arguably, the firm is repositioning itself closer to traditional linear TV with the additional content as well as the paid + advertisement package, similar to Warner Bros. Discovery’s (WBD) business model. Though the firm remains adamant in being an original content creator, diversifying across multiple content loads can allow for the firm to cast a wider net for passive and active viewership. I believe that this model will have the ability for Netflix to gain additional paid viewership, even at the lower-tiered, ad-supported streaming service. I provide NFLX shares with a BUY recommendation and with a price target of $610.93/share at the end of FY25.

Operations

I’d like to briefly discern what I mean by active vs. passive viewership. Active viewers are those that seek to attentively view content and are fully engaged in the story. Passive viewers are those that will turn on their TV as background noise. One of the values that unscripted content brings to the table is that it draws in the attention of the more passive viewers in a series that isn’t necessarily meant to be followed as a storyline. I am under the impression that these viewers are most accustomed to having the background noise while working or doing other daily activities around the house. My impression of these viewers is that they aren’t necessarily seeking out a movie or show, but looking for something familiar that can periodically draw their attention. I anticipate that this style of content for this type of viewer has the ability to draw in lower-tier, ad-supported membership fees while offering content that typically comes with a lower production cost. Management anticipates their ad-supported membership to become a more meaningful contributor to the business by eFY25. I expect this membership tier to be driven primarily by these passive viewers as it relates to unscripted and licensed content. I also expect this content to hold a higher retention rate as these viewers seek out familiarity and watch more habitually rather than seeking out the next season of a series. I believe that this is what drove the 65% sequential growth in their ad-supported tier in Q1’24.

Ad-supported tiers have been found to be highly profitable, as the revenue stream does not stop at the viewer. Using high-quality, targeted content, Netflix has a strong opportunity to garnish a premium for bringing in advertisers to place ads within their content. Netflix is partnering with Kantar and Lucid for brand awareness and recall, and with Nielsen Catalina Solutions to effectively engage with advertisers in sales campaigns. Each of these services provides significant value to both Netflix and advertisers as they leverage data-drive models and value chains to provide each party the greatest outcome. Nielsen Catalina Solutions is especially beneficial as it matches the ad to the right audience, allowing for higher quality content and engagement. This service analyzes a customer’s previous purchases to better identify additional sales streams. Though I do not believe that this software was part of Roku’s (ROKU) acquisition of Nielsen’s Advanced Video Advertising business, Roku does leverage this piece of technology for their own streaming services for advertisement optimization. Overall, I anticipate Netflix’s ad-supported membership tier to drive significant growth, as the firm continues their voyage into unscripted content, live sports, and entertainment.

In terms of revenue streams, I anticipate this model to work best in UCAN as targeted advertising is more feasible given privacy laws. Netflix’s European customer base may not offer advertisers the same level of value as North American advertisers, with the constraints coming from GDPR. I believe this is one of the factors that drove down ARPU for Netflix’s EMEA segment, given the growth in new paid members. This may also be one of the driving factors behind management dropping paid membership reporting. Though this announcement potentially led to the negative pressure on the stock, the reporting mechanism makes sense given the firm’s growing lower-tier, ad-supported membership programs. I anticipate continued growth in new viewer acquisition as well as higher retention rates with these newer tiers; however, I anticipate a modest decline in ARPU as a result.

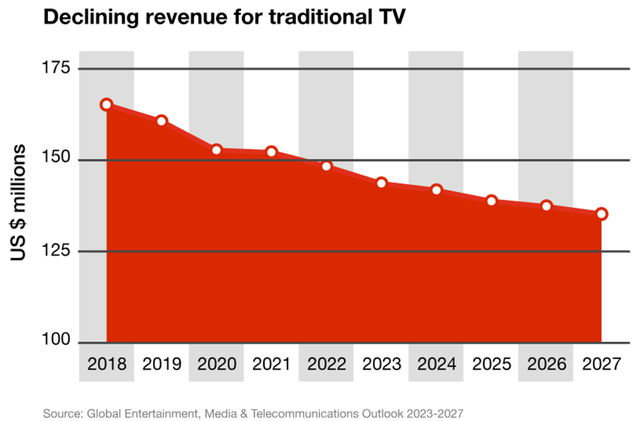

PWC

I do expect the addition of live sports streaming to add a new customer-base to Netflix’s premium tiers. As more consumers adjust their streaming habits away from linear TV to other streaming platforms like Netflix, Amazon (AMZN), YouTube (GOOG) (GOOGL), and short-form streaming platforms like TikTok and Instagram (META), I believe Netflix’s adoption of live entertainment is the most logical next step in the process. Though this is a roundabout way of bringing linear TV to streaming platforms, I anticipate this addition to their content load to add paid members that may be attached to traditional TV to watch their games. The inclusion of the weekly WWE Raw will add a dedicated viewership cohort to their weekly streaming load as the production brings in around 1.75mm viewers each week with a peak of 2.3mm on the week of April 8, 2024. If Netflix continues streaming combat-based sporting events like Mike Tyson Vs. Jake Paul in the future, this can add a significant upswing in viewership that may provoke Netflix to add a higher-tiered premium membership or a sports marketplace. Though I do not anticipate Netflix to compete for NFL content immediately, I do anticipate the platform to explore other opportunities in growing, yet underserved segments in the US, like Formula One. Adding unique events like the Netflix Cup into the mix that pairs two viewer bases can be an additional avenue to continue exploring.

Corporate Reports

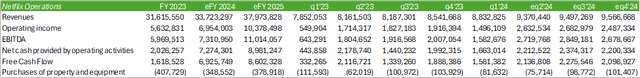

In terms of growth, I anticipate Netflix to realize continued strength in revenue and stronger margins going into eFY24-25 as the firm explores these new segments of revenue generation. I anticipate the firm’s advertising content to bolster margins as it pulls from two separate value-added revenue streams while maintaining churn at the lower-cost tier. I believe Netflix will be successful in enhancing customer retention with the lower-cost subscriptions as well as the addition of premium sports content.

Valuation & Shareholder Value

Corporate Reports

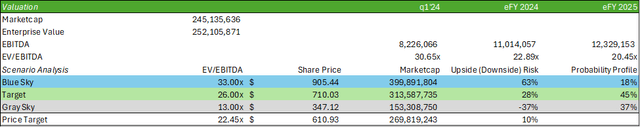

NFLX shares are currently trading at 30.65x trailing EV/EBITDA, down from their recent high of 38.52x. I believe this was an unjustified selloff, as the firm is in the middle of restructuring their business model for more durability and longevity. Though removing a reporting feature is never a good sign for Wall Street analysts, I do believe that the firm remains in a good position for growth and margin expansion. Given my forecast, I value NFLX shares at $610.93/share at 22.45x eFY25 EV/EBITDA and provide a BUY recommendation. For the firm to reach the blue-sky scenario, I believe that the firm must prove its ad-supported tiers hold strong retention and viewership growth, as this can provide revenue through both paid subscriptions and advertisers. The gray-sky scenario provides for a lackluster customer retention and higher churn away from premium tiers to the lower-tier memberships, and risks a reduced ARPU across all regions.

Corporate Reports

Though Netflix may face significant risk in changing their business from being a pure content streaming service into linear/live TV, I believe that this can unlock some value for the firm that otherwise would be won over by competitors such as Disney‘s (DIS) Hulu. I believe offering the assortment of content will only bolster the firm’s attachment rate; however, I do anticipate that if subscription fees were to climb too far too fast, subscribers may fall off. Netflix is also putting itself in a position of vulnerability with the addition of ad-supported streaming, in which advertising and marketing budgets oftentimes swing with the strength of the economy. If the US economy were to slide into a recession or experience a significant slowdown, Netflix may not realize the anticipated strength in advertisement revenue. This also puts the firm in the position of lower ARPU in which, if consumers are pressured to reduce their service to an ad-supported tier paired with fewer advertisement dollars, may lead to Netflix losing out on revenue from both ends.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.