Summary:

- Netflix reported strong Q1 earnings, beating revenue and EPS estimates, driven by higher-than-expected subscriber growth.

- The company’s operating income increased by 54% y/y, and free cash flow rose slightly to $2.14 billion in Q1.

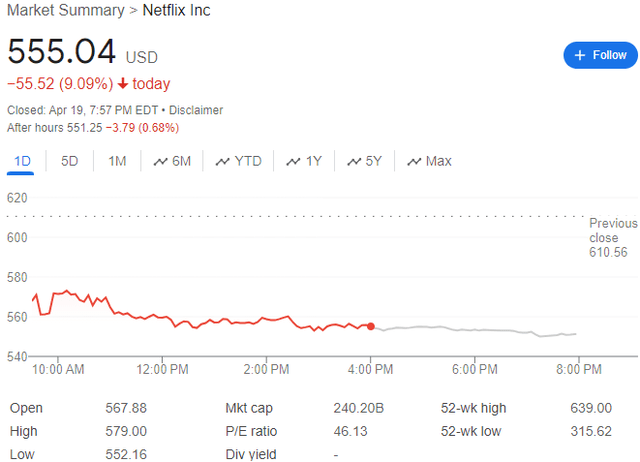

- Netflix’s stock declined by approximately 9% post-earnings due to concerns about future revenue growth and the company’s decision to stop disclosing quarterly membership figures.

- Trading at a rich premium, Netflix’s long-term risk/reward is unattractive. NFLX stock looks like dead money for the next 3-5 years.

stockcam

Brief Review Of Netflix’s Q1’24 Earnings Report

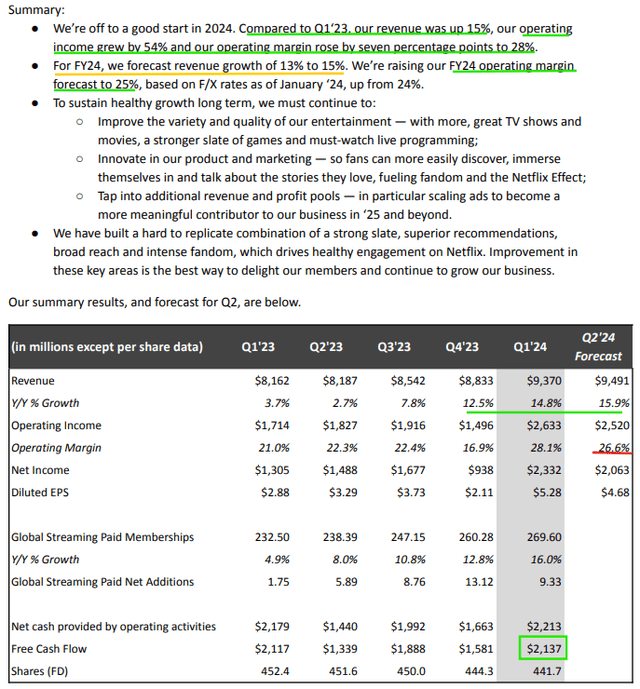

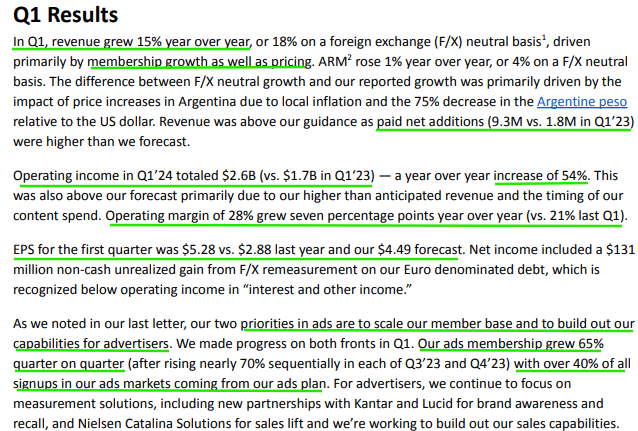

On April 18, Netflix (NASDAQ:NFLX) released its Q1 2024 earnings report, wherein the streaming pioneer delivered a solid double beat [Q1 revenue: $8.83B (+14.8% y/y) vs. est. $8.71B; Q1 EPS: $5.28 vs. est. 4.54] driven by stronger-than-expected paid subscriber growth [9.3M (up from 1.8M in Q1’23) vs. est. 4.8M].

Netflix Q1 2024 Shareholder Letter Netflix Q1 2024 Shareholder Letter

On the back of revenue growth and margin expansion, Netflix’s operating income jumped +54% y/y to $2.6B (operating margin: 28%), and free cash flow rose to $2.14B in Q1’24.

Netflix Q1 2024 Shareholder Letter

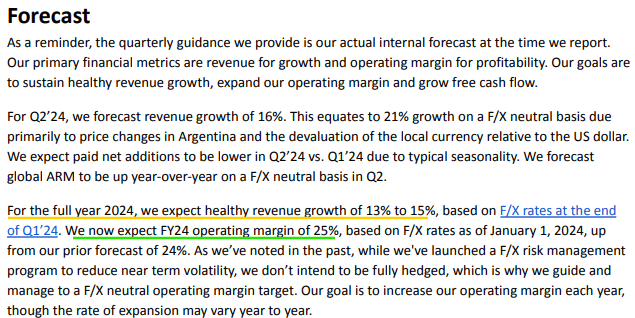

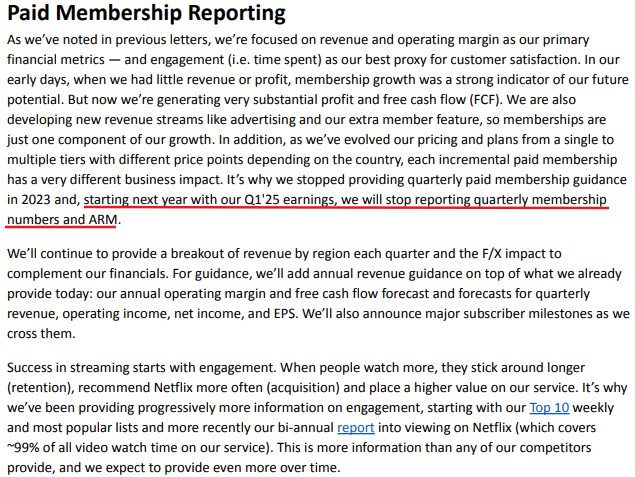

For Q2’24, Netflix forecasted further acceleration in top-line growth, with revenues projected to come in 16% higher compared to Q2’23. However, Netflix’s Q1 revenue beat and healthy growth guide for Q2’24 was overshadowed by management’s forecast for growth moderation in H2 2024 [implied in full-year guidance of 13-15% growth] and an announcement regarding paid membership reporting.

Netflix Q1 2024 Shareholder Letter

As of writing, Netflix’s stock is trading down by ~9% post-earnings. With Netflix (a subscription business) set to stop disclosing quarterly membership figures from next year, the investor community is only naturally fretting about future subscriber growth.

Over the last year or so, Netflix’s ad-tier and paid password-sharing initiatives have reignited sales and earnings growth at the streaming giant. However, as we lap over the launch of these initiatives, Netflix’s growth will likely moderate once again, and management’s guidance for the full year and decision to stop providing subscriber figures provide an inkling of this impending slowdown.

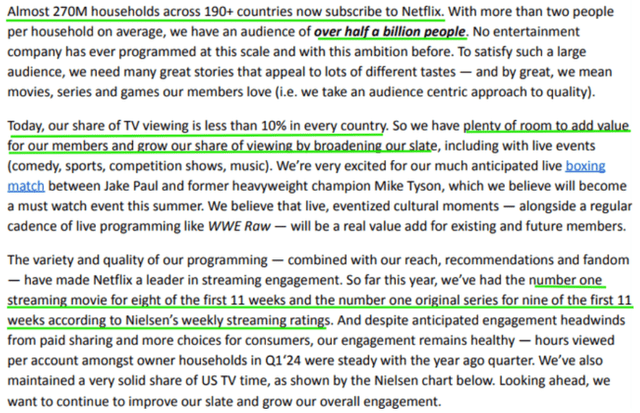

With that said, Netflix remains the “King of Streaming” (as evidenced by its domination of Nielsen viewing charts for movies and series).

Netflix Q1 2024 Shareholder Letter Netflix Q1 2024 Shareholder Letter

Now, Netflix’s management continues to see huge room for growth in streaming TV hours; however, I think that Netflix’s growing slate of content that now includes live sports and gaming renders “pricing” a more important lever for continued double-digit top-line growth over the medium term.

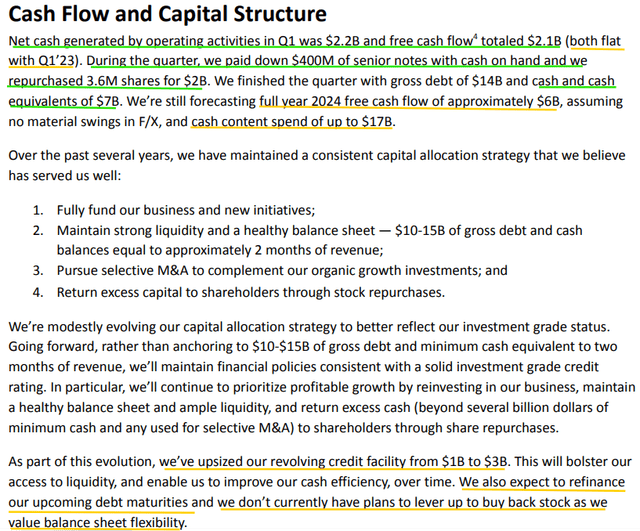

As of the end of Q1’24, Netflix had a liquidity cushion of $7B (cash + short-term investments) against total debt of $14B. While Netflix is set to refinance upcoming debt maturities (potentially at higher interest rates), management sees 2024 free cash flow at ~$6B. Hence, I am not concerned about Netflix’s liquidity profile. As the only profitable streamer in the market, Netflix could be a big consolidator in this space over the next 12-24 months (via strategic M&A and content licensing), and the credit facility expansion from $1B to $3B could be an indication of future transactions.

Netflix Q1 2024 Shareholder Letter

Considering Netflix’s market capitalization of $240B, the streaming giant currently trades at ~40x 2024E P/FCF. While I have come around to the idea of Netflix generating healthy double-digit sales growth for the medium term, I continue to view NFLX’s FCF multiple as too rich for my taste. Netflix is a media company in a mature growth stage, and unfortunately, it is being priced like a bleeding-edge technology company in hypergrowth.

Also, in my view, buying back stock at ~40x 2024E P/FCF is an imprudent use of capital, and I would rather see Netflix’s management preserving its cash flows for a rainy day and/or utilizing them for paying down debt or driving inorganic growth via M&A.

Concluding Thoughts: Is Netflix A Buy, Sell, Or Hold After Its Q1 2024 Report?

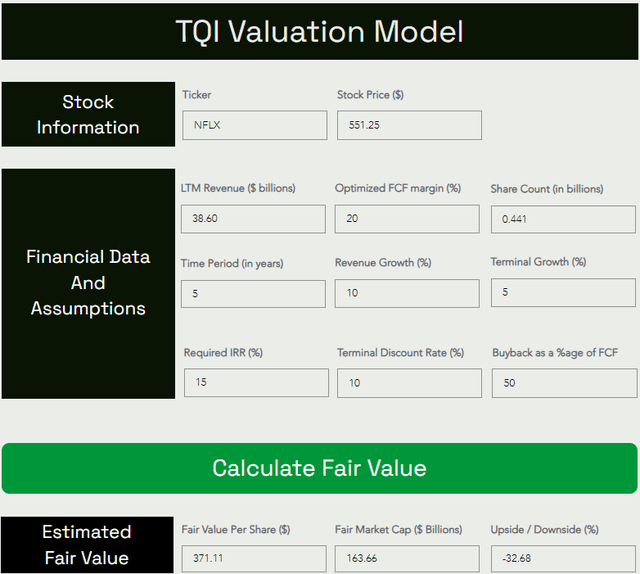

To answer this question, let us determine Netflix’s fair value and expected return using our valuation model:

Despite using generous assumptions for steady-state free cash flow margins and future revenue growth in our model, Netflix came out to be overvalued by ~50% (i.e., NFLX has a downside of -33% to its fair value estimate of $371).

TQI Valuation Model (TQIG.org) TQI Valuation Model (TQIG.org)

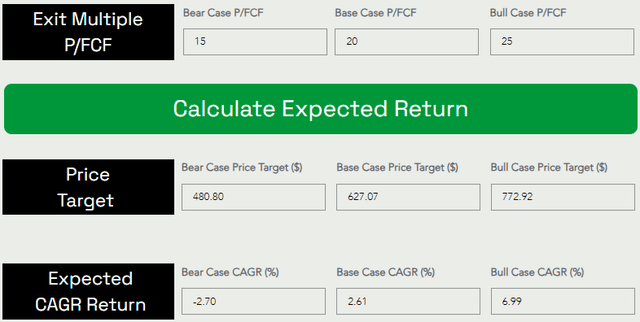

Furthermore, Netflix’s expected 5-year CAGR return of ~2.6% falls well short of our investment hurdle rate of 15%. With risk-free treasuries yielding 5-5.5%, I can’t even fathom the idea of buying Netflix at current levels.

Since Netflix is a high moat, recurring revenue business that’s seemingly going from strength to strength, I would never consider shorting the stock. However, NFLX’s long-term risk/reward looks poor at current prices, and investors would do well by taking profits here and reinvesting the proceeds elsewhere. The post-earnings dip in Netflix’s stock is deserved, and if I had a long position, I would be a seller here. If you are looking at Netflix for a fresh investment, I suggest you look elsewhere.

Key Takeaway: I rate Netflix a “Sell/Avoid” in the mid-$500s.

Thank you for reading, and happy investing! Please share any questions, thoughts, and/or concerns in the comments section below or DM me.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

We Are In An Asset Bubble, And TQI Can Help You Navigate It Profitably!

Your investing journey is unique, and so are your investment goals and risk tolerance levels. This is precisely why we designed our investing group – "The Quantamental Investor" – to help you build a robust investing operation that can fulfill (and exceed) your long-term financial goals.

At TQI, we are pursuing bold, active investing with proactive risk management to navigate this highly uncertain macroeconomic environment. Join our investing community and take control of your financial future today.