Summary:

- Verizon stock dipped after weak Q1 results.

- We break down the Q1 results to see what VZ did well and where it struggled.

- We also review the valuation and the outlook for the stock and share our perspective on whether it is worth buying on the dip or not.

- We also share our view on VZ relative to its peer T.

z1b

Verizon (NYSE:VZ) stock recently dipped sharply lower (3.62% as of this writing) in the wake of releasing its Q1 results. We last covered VZ after it reported Q3 results and said that it was the better buy than its peer AT&T (T) at the time, stating:

Overall, both businesses are facing similar growth challenges while increasing free cash flow generation and deleveraging their balance sheets…VZ has a near 100 basis point higher dividend yield, a much better track record in terms of its dividend, and management sounds much more committed to continuing dividend growth moving forward. As a result, while T may offer investors a slightly more interesting proposition as a value opportunity, for dividend investors, VZ is the easy choice between these two…given its higher dividend yield plus growth and more trustworthy management.

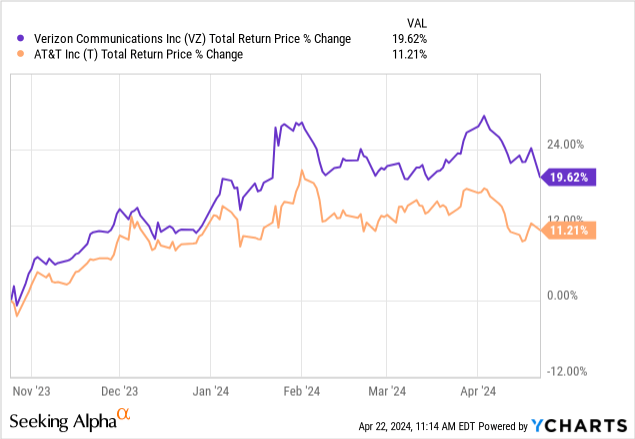

Since then, our stronger conviction in VZ has been rewarded with significant outperformance relative to T even after accounting for today’s sharp dip:

In this article, we will break down VZ’s latest quarterly results and provide an updated analysis of VZ stock.

VZ Stock Q1 Results

VZ reported very weak 0.3% year-over-year revenue growth in Q1, though the key wireless service revenue business (which makes up nearly 60% of VZ’s overall revenue) grew by a much more robust 3.4% year-over-year. Moreover, the retail postpaid phone segment grew by 253,000 and broadband subscriptions grew by 389,000 during the quarter and the company reported GAAP earnings per share of $1.09. Overall, the consumer side of the business saw growth of 0.8% year-over-year, while the business revenue declined by 1.6% year-over-year due to lower wireline revenue and lower wireless equipment revenue.

While the results were far from great with revenue growing way below the rate of inflation, management was at least able to reaffirm its earnings-per-share and free cash flow guidance for the year and expects adjusted EBITDA to grow between 1-3%. Management also stated that it continues “to see a clear path to meaningfully delever the balance sheet in the second half of this year.”

Management also emphasized the safety of their dividend and their intent to continue growing it, stating on the earnings call that:

Our dividend is healthy and secure. And our free cash flow dividend payout ratio continues to improve. We are focused on putting our Board in a position to continue to raise the dividend each year, building on our current industry record of 17 consecutive increases.

VZ Stock Valuation Update

From a valuation standpoint, VZ stock continues to look attractively priced, with an EV/EBITDA of 7.1x that is below its five-year average of 7.6x, a dividends yield of 6.7% that is well above its five-year average of 5.4%, and a levered free cash flow yield of 11% that is well above its five-year average of 9.2%.

VZ Stock Outlook

That being said, VZ continues to face significant growth challenges, with analysts projecting the company to grow revenue at a meager 1.5% CAGR, EBITDA at a 1.8% CAGR, earnings per share at a 1.4% CAGR, and dividends at an even slower 1.1% CAGR through 2028.

Its business segment is struggling as indicated by the year-over-year declines in revenue, while broadband net adds decelerated in both fixed wireless access and wireline adds during the quarter. Business retail postpaid phone net adds also decelerated, while prepaid net adds continued to decline. Its wireless equipment business declined year-over-year, even though its wireless service business posted decent growth that was roughly in line with inflation.

Moreover, while management believes that it is well-positioned to generate cash flow throughout the year and pay down debt, Q1 saw cash flow from operations dip by nearly 15% year-over-year, leaving some questions about management’s ability to deliver on these promises while also continuing to grow its dividend.

Investor Takeaway

VZ’s valuation remains reasonable and management seems very committed to not only sustaining but continuing to grow its dividend. As a result, it is a decent buy on the dip for income-focused investors.

However, from a total returns perspective, it is hard to get too excited about the stock right now as the discount to its historical valuation averages is not compelling enough to expect valuation multiple expansion unless interest rates decline. Moreover, while the yield is attractive, the growth is so anemic that it is unlikely to deliver total return outperformance.

VZ stock’s biggest challenge right now is sustaining its competitive positioning in an extremely competitive and capital-intensive industry while still generating sufficient free cash flow to deleverage to the degree that management wants to and continues to grow its already hefty dividend.

While we are certainly more positive on VZ stock than we are on its peer T given our greater confidence in its management team and its better dividend track record, we are not ready to buy VZ right now either as the recent strong performance in the stock price removed the margin of safety and the dip following Q1 seems to be warranted given the lack of cause for enthusiasm about forward growth and cash flow prospects in the report. As a result, we are downgrading VZ from Buy to Hold and need to see either an acceleration in growth/free cash flow generation and/or a much more sizable dip in the stock price to make us want to buy the stock here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to our Portfolio which has beaten the market since inception and all our current Top Picks, join us for a 2-week free trial at High Yield Investor.

We are the fastest-growing high yield-seeking investment service on Seeking Alpha with ~1,200 members on board and a perfect 5/5 rating from 166 reviews.

Our members are profiting from our high-yielding strategies and you can join them today at a compelling value.

With the 2-week free trial, you have nothing to lose and everything to gain.

Start Your 2-Week Free Trial Today!