Summary:

- After nearly tripling in price, Exxon Mobil Corporation stock is no longer a bargain and investors should adjust their expectations.

- Management remains focused on the long-term success of the company, which could upset short-term oriented market participants.

- I remain cautiously optimistic about Exxon’s Q1 2024 results, but I wouldn’t hold my breath.

imaginima

Exxon Mobil Corporation (NYSE:NYSE:XOM) is among the staple names in the energy names and with that, the stock price is sometimes driven by emotional biases that market participants tend to exhibit during inflection points.

It is astonishing how a large and well-understood business like the one of Exxon could undergo such a drastic shift in investors’ sentiment in just a few years.

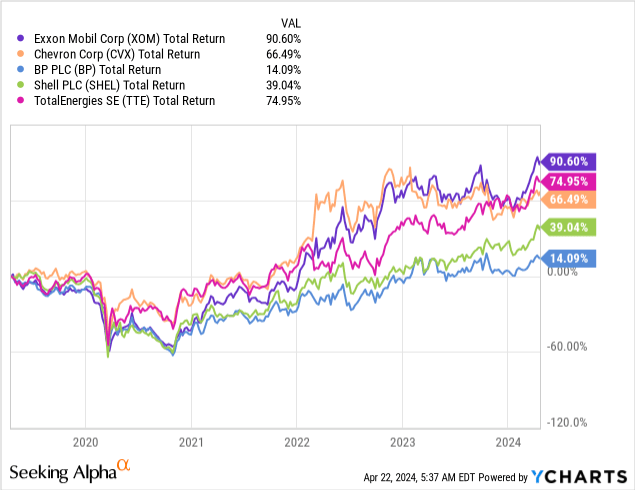

Less than 4 years ago, the predominant sentiment was that XOM was heading for extinction, just as the stock price was trading at around $35 a piece. Nowadays, we are much closer to the other end of the spectrum, as the main narrative about the Oil & Gas sector has proven incorrect and Exxon’s management has also proven that the right capital allocation decisions could make all the difference when it comes to shareholder returns.

The latter was the main reason why XOM has become the best-performer within its peer group, with a vast performance gap with lower quality Oil & Gas Majors, such as BP (NYSE:BP).

The share price performance lately, however, is by no means an indication about future returns, no matter how enticing the current narrative is. That is why it is essential to put the current share price in context when evaluating Exxon’s share price prospects through the rest of 2024.

Exxon Isn’t Cheap Anymore

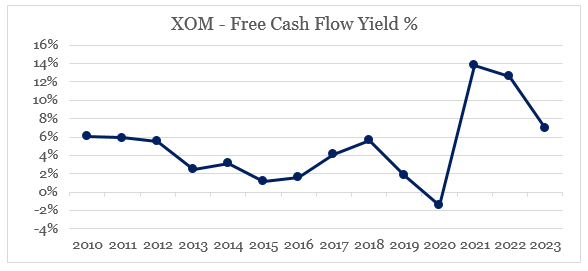

Even after its spectacular returns recently, Exxon Mobil’s share price remains reasonably priced, which is a reason enough for some to remain very excited about future returns.

On a free cash flow basis, for example, the stock trades at a current yield of roughly 7% which is significantly higher than the historical average since 2010.

prepared by the author, using data from Seeking Alpha

With Exxon likely to benefit from multi-year tailwinds within the energy space and the company having among the strongest competitive advantages in the sector, it is not difficult to envision why the share price is still getting lots of attention at these levels.

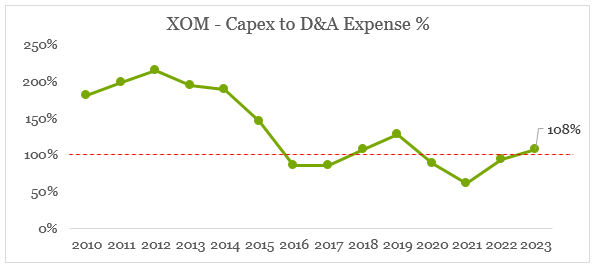

Having said that, however, we should also consider the fact that Exxon’s top-line figure is expected to decline in the coming year, the 10-year yields on U.S. Treasuries (US10Y) are at their highest levels since 2007, and most importantly – we are coming off a period of record low business reinvestment rates.

The last point is clearly illustrated by Exxon’s capital expenditure to depreciation & amortization expenditure ratio, which stood at 108% in FY 2023, with an average of below 100% for the 2016-2023 period.

prepared by the author, using data from Seeking Alpha

It is unlikely that this ratio will remain so low, given the need to invest in more in lower emission and various capacity-expansion projects.

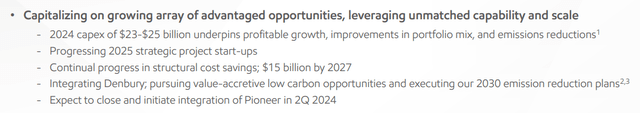

Exxon Mobil Investor Presentation

In FY 2024, capex is expected to be in the range of $23bn to $25bn, which would represent an annual increase of 5% to 14%.

Exxon Mobil Investor Presentation

This would be a major headwind for Exxon’s free cash flow going forward. More importantly, however, the market is often more concerned with short-term results and sometimes fails to properly price-in the benefits of multi-year long projects. This is a topic that I covered in further detail back in 2020 and which could result in temporary mispricing of XOM’s share price.

The fact that XOM’s management engaged in two large all-stock acquisitions in 2023 is also a sign that the company’s share price is by no means cheap at this point and it is beneficial to finance these deals with Chevron shares.

The merger is an all-stock transaction valued at $59.5 billion, or $253 per share, based on ExxonMobil’s closing price on October 5, 2023. Under the terms of the agreement, Pioneer shareholders will receive 2.3234 shares of ExxonMobil for each Pioneer share at closing. The implied total enterprise value of the transaction, including net debt, is approximately $64.5 billion.

Source: Exxon Mobil Website (emphasis added).

Exxon Mobil Corporation (XOM) today announced it has closed its acquisition of Denbury Inc. (NYSE: DEN) in an all-stock transaction valued at $4.9 billion, or $89.45 per share, based on ExxonMobil’s closing price on July 12, 2023. Under the terms of the agreement, Denbury shareholders will receive 0.84 shares of ExxonMobil for each Denbury share.

Source: Exxon Mobil Website (emphasis added).

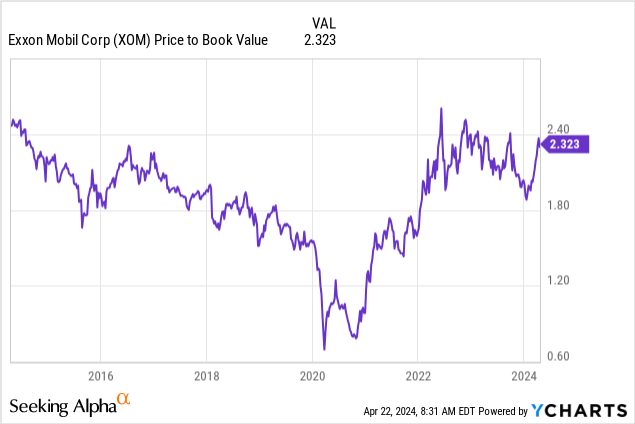

On a historical basis, the company trades near record-high price/book multiple and this is likely to weigh on returns in 2024, even if Exxon continues to deliver on its long-term strategy.

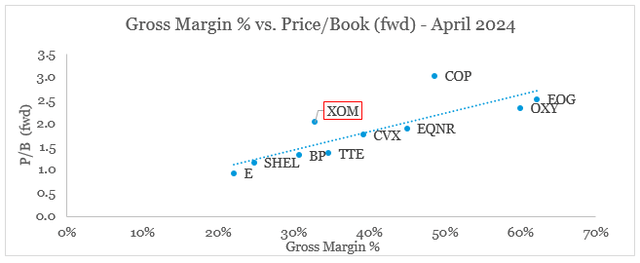

Against its major peers in the Oil & Gas space, XOM also trades at a significant premium to its book value of equity when considering gross margins.

prepared by the author, using data from Seeking Alpha

The Upcoming Quarter

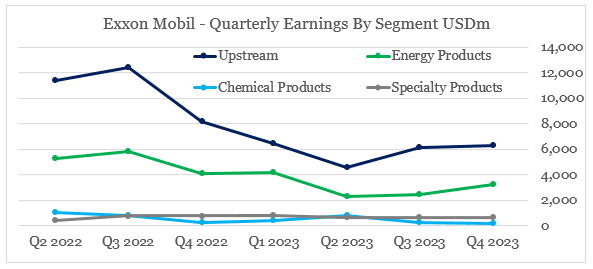

On a quarterly basis, Exxon’s earnings in Upstream and Energy Products appear to have reached a bottom in the second quarter of last year and have noted a gradual improvement since then.

prepared by the author, using data from Earnings Releases

* Q4 2023 Upstream results are adjusted for impairment.

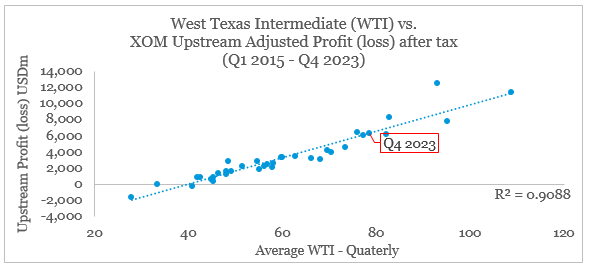

Not surprisingly, this trend is a direct consequence of recent movements in energy prices. Although margins in Energy Products are less related to changes in oil prices, earnings in the upstream segment exhibit a strong relationship with the West Texas Intermediate (WTI) price (CL1:COM).

prepared by the author, using datа from SEC Filings and FRED

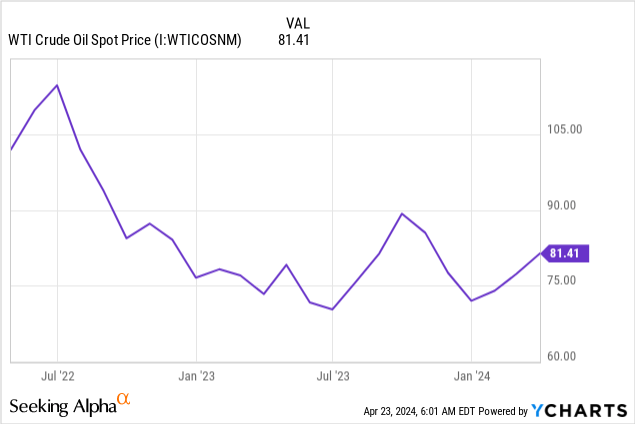

During Q4 of 2023, the average price of WTI stood at $78.5 a barrel, which is higher than the $77.5 price during Q1 of 2024.

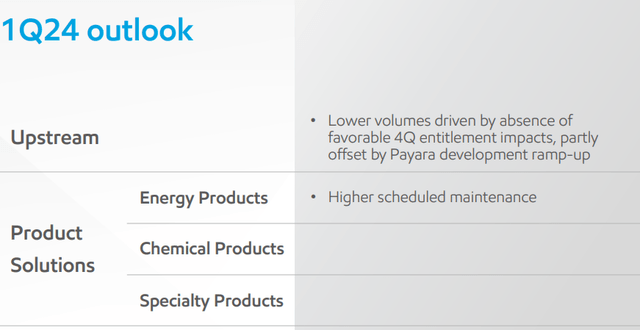

On top of the lower oil price in Q1, the Exxon’s management has also provided a guidance for lower volumes during the quarter, alongside higher scheduled maintenance in refining.

Exxon Mobil Investor Presentation

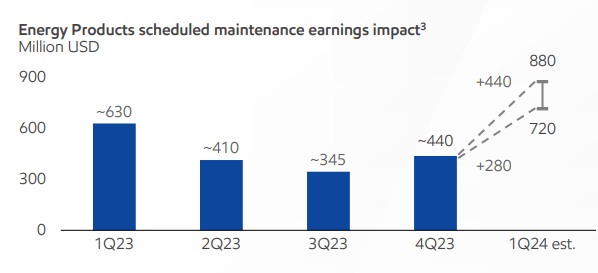

The impact on earnings from the higher scheduled maintenance will be significant and is expected to be within the range of $720m to $880m.

Exxon Mobil Investor Presentation

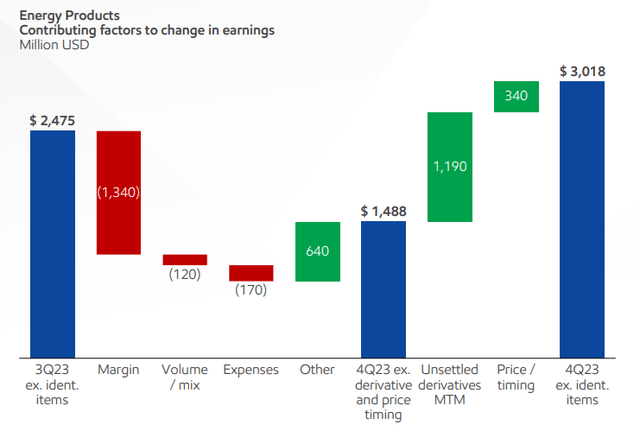

Moreover, Q4 earnings in the segment also included a notable one-off tailwind from derivative transactions.

Exxon Mobil Investor Presentation

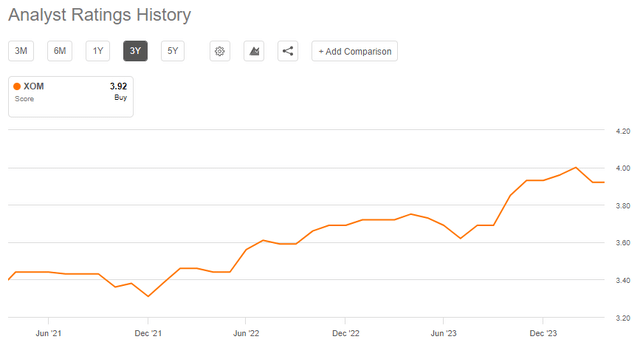

While all that is expected by the sell-side analysts, the recent flurry of analyst upgrades significantly increases the probability of a negative reaction following the release of upcoming earnings. And even if XOM delivers better-than expected results, the predominant optimism around the stock in combination with the elevated multiples would limit any potential upside in the months to come.

Investor Takeaway

Exxon Mobil Corporation stock remains as one of my favorite long-term plays in the energy sector. But after delivering a total return of more than 300% since 2020, it is difficult to remain optimistic about the share price, at least in the short term. The stock is no longer priced discounted, and the need for more long-term investments is likely to put pressure on free cash flow in the coming year. Not only that, but there are other short-term headwinds that the market might not see favorably.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CVX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Looking for similar well-positioned high quality businesses in the energy space?

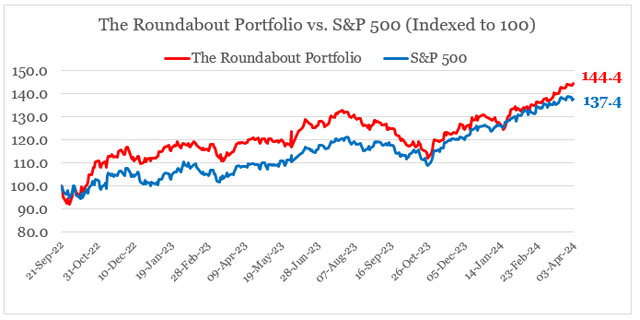

You can gain access to my highest conviction ideas in the sector by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

Performance of all high conviction ideas is measured by The Roundabout Portfolio, which has consistently outperformed the market since its initiation.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.