Summary:

- Tesla’s recent price action suggests a shift in sentiment, with a potential wave higher in the near term.

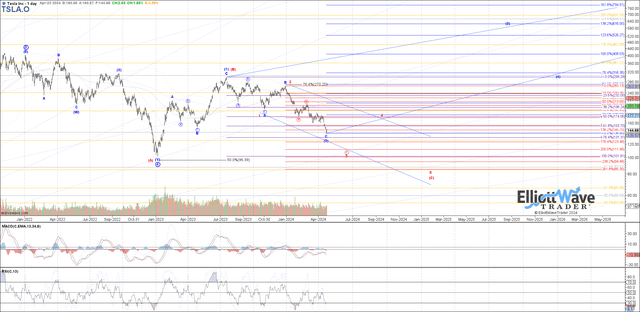

- The most likely scenario is shared on the chart included here.

- If price breaks below the $138 low, it would indicate a lower path, but sentiment appears to have bottomed out for now.

Hiroshi Watanabe

By Levi at Elliott Wave Trader; Produced with Avi Gilburt

If you have been following our analysis regarding (NASDAQ:TSLA) you will remember that we put out two articles for the readership last year showing ‘hold’ ratings, in September 2023 with “In A Holding Pattern. Or, Something Else?” and this one at the end of December, “Moments Of Clarity Followed By Bewilderment”. In both cases price declined sharply and we were rewarded with fresh buy setups after covering our short Wave Setups. Now, please allow for a brief recap of the recent action and then we’ll get to the forward-looking projections.

For easy reference, the two buy setups were “Looking For A 180 From $180” at the end of January of this year and “The Ultimate Sentiment Machine” in mid-March. Now in both of those buy scenarios, price did advance briefly but then was turned down at resistance. The conclusion of the most recent article stated, “Should price break below $152 and see continuation lower than it’s more probable that something else is playing out, and we may stop out of these new positions. Conversely, if this scenario plays out as drawn up, we will update the next resistance levels overhead and raise support as this progresses. Remember, $183 is the next main level to be conquered.”

After having entered a trade myself at the $163 level, price did advance up to key resistance, striking $184, but was turned down, and personally, I stopped out with 4 points profit via a trailing stop as support gave way in that microstructure. From there, the $138 level was seen, very close to the $135 level that was acting as the next pivotal area we were monitoring. With all of this preamble having been shared, where are we now?

Are The Tides Of Sentiment Shifting For Tesla?

It would appear so, at least in the near term. I chatted with Zac Mannes a few days ago regarding its current stance. Here’s what he had to say:

“TSLA is cautiously bullish at KEY support, and at risk of pivoting to the ALT path for the wider [C] of P.4. Price action off the low here will be key, but complicated since the next wave up we expect should be an ABC move.” – Zac Mannes

This means it could be in the shape of 3 waves and even appear to be a corrective structure. Let’s look at Garrett’s chart he shared with our members today:

chart by Garrett Patten – StockWaves – Elliott Wave Trader

Note the two most probable paths he has identified. The most likely being a potential wave [3] higher that would take an ABC structure up. It is plausible to also see the Red 4 that is on the chart, although it seems a lesser probability at the moment. In the Red path, price would seek approximately the $200 level next.

Should price instead first break back below the $138 low struck last week, then we would stand aside and let the lower path play out once again. But, it would appear here that sentiment has bottomed out in the near term. So, once again, we are showing a buy setup with a fair risk vs reward opportunity. Could this turn into more?

Wait A Minute . . .

So, you’re saying that this could either go up or go down? Yes, that’s exactly what we’re saying. How in the world is this helpful? Please recall that in our methodology, we view the markets through a probabilistic lens. This simply means that the structure of price on the chart will tell us what is more likely next. It also will tell us when that probability is shifting. So, yes, of course the market can go up or down. But, do you have a system in place that can give you specific levels and how to determine which path is more likely at any given time?

This is Elliott Wave Theory at work and applied correctly. It is also Fibonacci Pinball, used as an overlay onto Elliott Wave Theory to remove much of the subjectivity possible with many other types of analysis.

Would You Like To Learn How The Markets Truly Work?

Our founder, Avi Gilburt, frequently writes articles to update the readership regarding market direction. The title “Sentiment Speaks” is followed by the main thought to be communicated via that missive (for example, see a recent article here). What is sentiment, and how does it help us in our investing/trading?

In the most straightforward of terms, sentiment is simply fear and greed. It is human behavior that unfolds in front of our very eyes via the price of the stock or index on the chart. This structure displays self-similarity at all degrees or intervals of time. These forms are fractal in nature and will therefore repeat from the smaller to the larger scale. This is what gives the methodology that we use its true utility and power.

The Practical Application Of Theory

Theory is wonderful, but it won’t make us any money in our trading/investing. There must be a practical application of the theory and the ability to turn this into action in the real world. So, how will we know if we are right in Tesla? Well, if $138 was truly a pivotal low, then price should now move back above $160 and proceed to the $200 level next. It would seem that the $160 resistance was conquered in the after-hours session with the reaction to earnings.

Conclusion

There are many ways to analyze and track stocks and the market they form. Some are more consistent than others. For us, this method has proved the most reliable and keeps us on the right side of the trade much more often than not. Nothing is perfect in this world, but for those looking to open their eyes to a new universe of trading and investing, why not consider studying this further? It may just be one of the most illuminating projects you undertake.

(Housekeeping Matters)

If you would like notifications as to when our new articles are published, please hit the button at the bottom of the page to “Follow” us.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in TSLA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

STOCK WAVES: Where fundamental analysis meets technical analysis for highest-probability investment opportunities! Get leading Elliott Wave analysis from our team, along with fundamental insights and macro analysis from top author Lyn Alden Schwartzer.

“Stockwaves is my bread and butter, and that’s only catching maybe 10% of the charts they throw out! I had 7-10x+ trades with SW last year, and dozens more that were “slackers” (LOL) with “only” 3-4-5x returns. Amazing!” (Nicole)

Click here for a FREE TRIAL.