Summary:

- Nu Holdings Ltd. is a digital banking platform with a $50 billion market cap, based in São Paulo, Brazil.

- In Brazil, Nu Holdings serves >87 million customers, representing over 1/2 the country’s adult population. The company now seems to be trying to expand the same way to Mexico.

- A combination of a growing TAM, growing top line, and expanding margins should give NU more room to move higher, in my view.

- In 3 years, NU should trade at a P/E of 13.7, with an EPS CAGR of ~28.22% over that period.

- The growth potential I’ve calculated today is over 40% more than the current stock price. I therefore rate NU stock as a “Buy” today.

Kutay Tanir

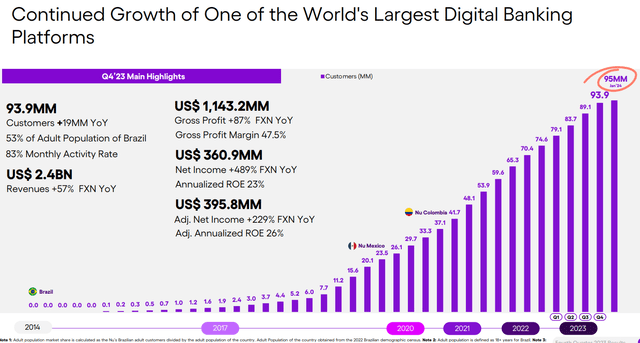

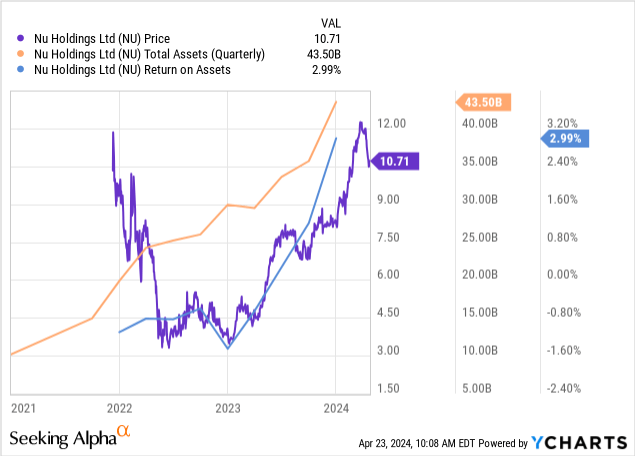

Based on Seeking Alpha’s description, Nu Holdings Ltd. (NYSE:NU) is a $50-billion market cap digital banking platform based in São Paulo, Brazil, serving customers across Brazil, Mexico, Colombia, Cayman Islands, Germany, Argentina, the United States, and Uruguay and offering a wide range of financial services including spending solutions, savings accounts, investing options, borrowing solutions, and insurance policies. Looking at the number of active users and customers, the company itself states in its most recent 20-F filing that it’s “one of the world’s largest digital banking platforms and one of the leading technology companies in the world.” And it becomes quite difficult to dispute this when we look at the dynamics of the number of these customers in recent years:

One of the most significant achievements in Q4 FY2023 was the addition of nearly 5 million new customers (that’s in Q4 alone!), bringing NU’s global customer base to a staggering 93.9 million by the end of the year – this trend kept going with already 95 million customers using the firm’s products. It looks like Nu is indeed one of the fastest-growing digital banking platforms globally. In Brazil, their stronghold, they now serve >87 million customers, representing over 1/2 the country’s adult population. But what’s impressive is not just the sheer number of customers but also how engaged they are: according to the press release, Nu saw their Monthly Average Revenue per Active Customer (ARPAC) increase 23% YoY to $10.6 in Q4 FY2023. On top of that, Nu became the primary bank for >61% of their monthly active customers, which, I think, is a real testament to their ability to capture and retain their customers’ loyalty.

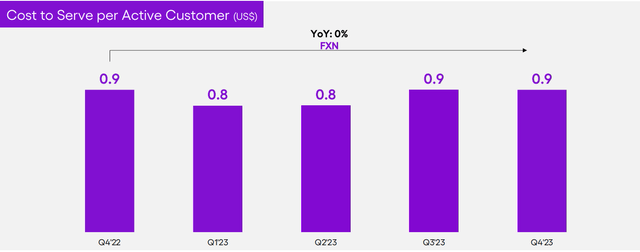

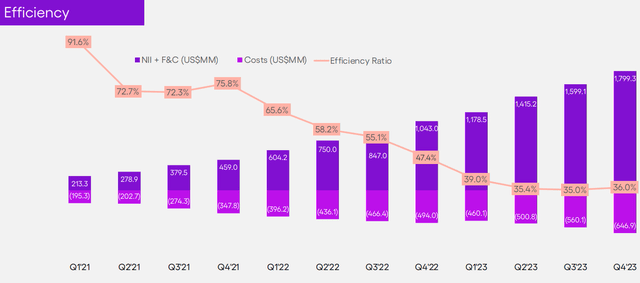

Those strong unit economics metrics led to stellar financials as well: Q4 revenues surged to $2.4 billion (+57% YoY) with net interest income almost doubling (+95.6% YoY) for the same period amid cost efficiencies (the company’s efficiency ratio reached 36.0%, improving 19% compared to FY2022 results).

The gross profit margin of NU reached 47.5% in Q4 – that’s an improvement of 760 basis points YoY, which is a lot. It’s becoming increasingly obvious that the company’s business model is exceptionally well-built, as such strong growth in profit margins is a rather rare positive phenomenon among growth fintech companies (at least from what I have seen recently).

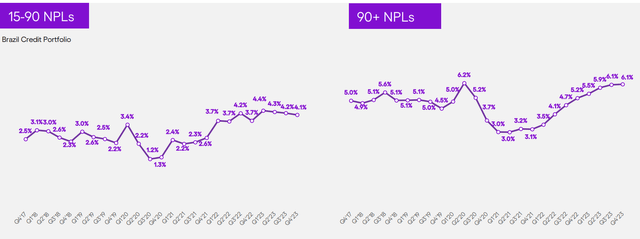

What definitely confuses me is that NU’s NPLs are rising quite rapidly – apparently, the company has decided not to soften down the “aggressiveness” of its approach to business expansion despite the high-rate cycle and the generally difficult macro in Latin America.

However, I’m glad that the current 90+ NPL figure of 6.1% still seems limited. In addition, Goldman Sachs analysts have noted (proprietary source) that Nu Holdings has mechanisms in place to mitigate credit risk, including lower average ticket sizes and shorter durations than are common in the industry. This allows the company to promptly adjust its strategies in response to changes in the credit landscape. In addition, Nu Holdings has revised its modeling assumptions and anticipates that NPLs may be higher in the future than previously. Nevertheless, the company is confident that the loans will still have value even if NPLs double, GS analysts added.

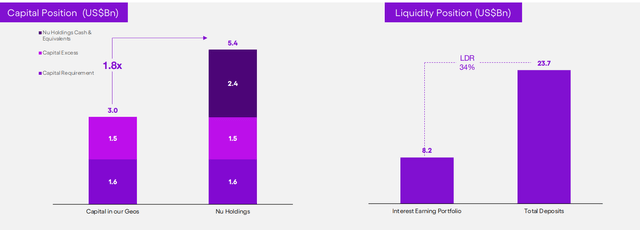

In general, I have no obvious good reasons to find fault with the creditworthiness of the company. Judging by the balance sheet and income statement, overall growth seems to me to be of high quality, meaning that NU’s sales, asset base, and profitability are growing, with no red flags for balance sheet stability.

NU’s recent IR materials

Nu’s team continued to expand their product offerings and geographical reach throughout FY2023. In Mexico, they added ~1 million new customers in Q4 alone, surpassing 5.2 million in total. Their multi-product platform, including credit cards, personal loans, and insurance policies, has seen significant adoption, with >41 million active credit card customers and >1 million active insurance policies. The management anticipates that Mexico’s ARPAC has the potential to surpass that of Brazil over time – this optimism stems from differences in banking penetration, regulatory environment, and the structure of the credit card industry between the 2 countries. Considering how quickly Nu Holdings is scaling its activities in Mexico, I assume that such a development will not be far off in the next few years.

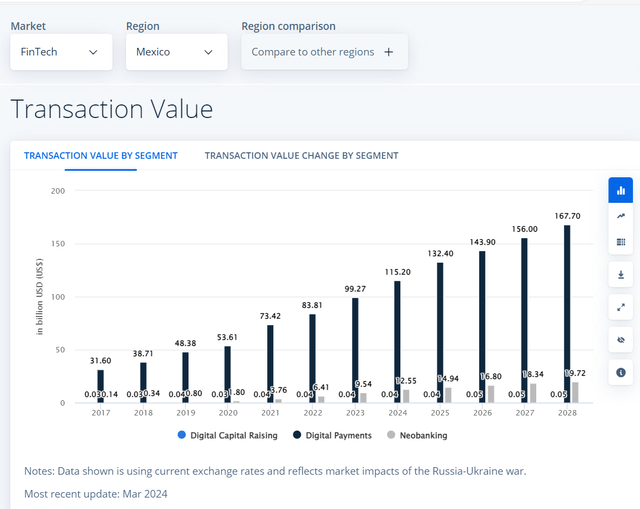

GS analysts also have something to say on this front: they believe that by prioritizing retail deposits as a growth strategy, Nu can approve a higher percentage of applicants compared to credit cards, where approval rates were previously lower. In other words, we may expect that Nu’s customer base and market share in that particular region will only accelerate shortly. The predicted phenomenal growth of the digital payments market in Mexico should, in my opinion, provide an excellent backdrop for this scenario.

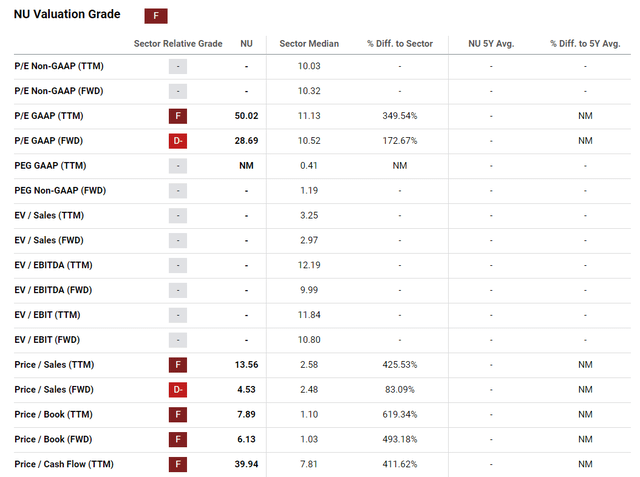

However, when a company grows as fast as NU has done recently, this often comes at a high price for investors. According to Seeking Alpha Premium, NU’s price-to-earnings ratio for the next year is ~28.7x, more than 170% above the sector median:

Seeking Alpha, NU stock’s valuation

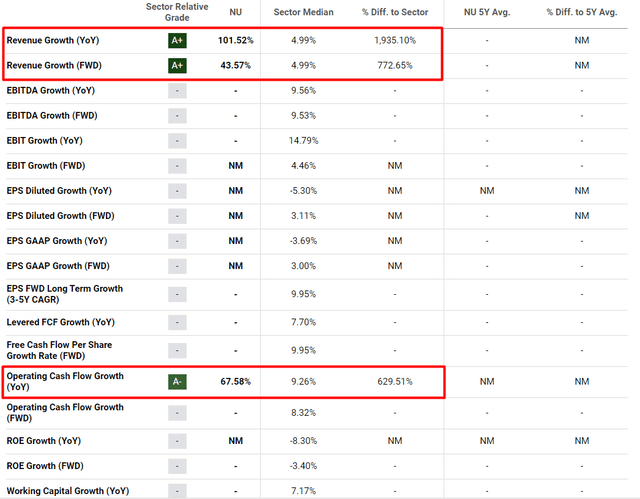

On the other hand, this premium – which, by the way, must fall from year to year due to the implied multiple contraction – exists against the backdrop of important growth figures that exceed sector norms many times over.

Seeking Alpha, NU’s Growth, the author’s notes

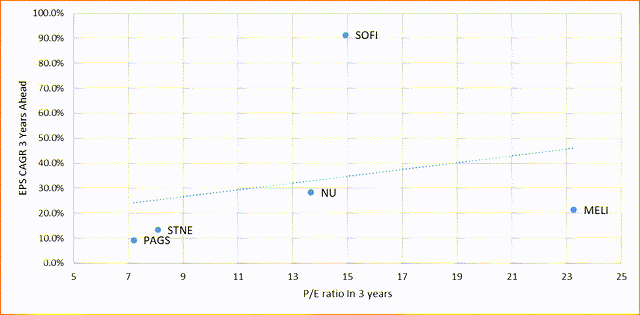

If you look at the comparison of NU with its closest (in my opinion) competitors, you can see that the stock doesn’t look too expensive. In 3 years, NU should trade at a P/E of 13.7, with an EPS CAGR of ~28.22% over that period – the implied multiple is lower than StoneCo Ltd. (STNE) or PagSeguro Digital Ltd. (PAGS), but NU’s EPS growth is also predicted to be much higher. The superior SoFi Technologies, Inc. (SOFI) in the chart below is only so high because the company will only reach its first positive EPS this year (so the base effect makes it look like a super high-growth company, and cheap).

Seeking Alpha data, the author’s work

If we assume that NU actually generates earnings of $0.57/share in FY2025 and its P/E multiple remains at 25x due to the growth premium in Latin America (especially Mexico and Brazil), the price target of $14.25 doesn’t seem too high to me. That’s a ~32% upside from the current stock price. The GS analysts see an upside potential of about the same size (just a bit lower), using a target growth-adjusted P/E (PEG ratio) of 0.5x. But their $14/share price target is for 12 months, so I think despite our different ways of calculating it, our fair price estimates for NU are roughly the same (GS’s prediction might be even a bit more bullish).

Goldman Sachs [proprietary source, February 2024]![Goldman Sachs [proprietary source, February 2024]](https://static.seekingalpha.com/uploads/2024/4/23/49513514-17138836119807293.png)

Concluding Thoughts

The main risk to my thesis is the potential pressure on margins from the significant growth in deposits and loans in Mexico (this should put pressure on gross margins as it leads to higher interest expenses and the company front loads provisions). As I may have underestimated this risk, I may be a little too optimistic today. Moreover, despite higher growth rates, NU’s valuation multiples are indeed much higher than those of STNE or PAGS – if competition does not allow NU to justify its current multiples, there could be a strong re-rating, which is not in the interest of today’s buyers.

Despite the risks around Nu Holdings, I like the way the company is growing and developing. I also like the way management is trying to find new levers for growth while closely monitoring the state of the company’s balance sheet. NU seems to me to be exactly the growth stock that investors with a high-risk tolerance are looking for a combination of a growing TAM, growing top line, and expanding margins should give NU more room to move higher. The growth potential I’ve calculated today is over 40% over the current stock price – that’s a lot. And if NU continues to beat analysts’ EPS projections, this potential could be even greater. I therefore rate NU stock as a “Buy” today.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in NU over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!