Summary:

- Comcast Corporation stock has delivered a robust return since my last BUY thesis in late 2022.

- The stock is now even stronger BUY in my view.

- Trading at 7x pretax earnings, it is a strong fit for Warren Buffett’s 10x EBT Rule.

SweetBabeeJay

Comcast stock: Still a buy despite recent rallies

I last wrote about Comcast Corporation (NASDAQ:CMCSA) about a year and a half ago. In that article, I argued for a BUY thesis based on Warren Buffett’s rule of 10x EBT (earnings before taxes). In particular, I argued that:

As a leading stock in the telecom sector, Comcast is trading at its secular bottom valuations. Under current conditions, it’s equivalent to a 10%+ equity bond with coupon growth built-in if you consider their perpetual growth and Buffett’s 10x Pretax Rule.

Fast-forward to now, the stock has delivered a robust return, as seen on the chart above. It has enjoyed a strong price rally on top of generous dividend payouts.

Against this background, the thesis of this article is that the stock has become an even stronger fit for the 10x EBT rule despite the large price rallies. Thus, in the remainder of this article, I will argue for an upgraded rating on the stock from BUY to STRONG BUY. And my argument will be anchored on three pillars: attractive valuation, long-term growth outlook, and near-term catalysts.

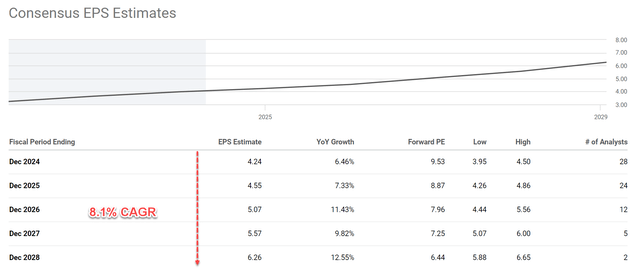

CMCSA stock trades at 7x EBT only

In tandem with the price advancements since my last writing, CMCSA’s earnings have grown quite a bit as well. As such, the stock currently trades at 9.53x of FWD EPS, as seen in the chart below. My projection for its effective tax rates is around 26% in the next few years. As also seen in the chart below, consensus EPS estimates for CMCSA stock point to an EPS of $4.24 for FY 2024. At a 26% tax rate, its implied EBT for FY 2024 would then be ~$5.72 per share. At the market price of $40 as of this writing, this translates into a P/EBT ratio of only 7x.

Now it’s a good time to introduce Buffett’s 10xEBT rule so we can better contextualize the 7x EBT. For readers who never heard about it, my blog article provides a detailed account. The gist is highlighted below for easy of reference:

The grandmaster paid ~10x pretax earnings for many of his largest and best deals. The list is a really long one, ranging from Coca-Cola, American Express, Wells Fargo, Walmart, Burlington Northern, and the more recent Apple. This is hardly a coincidence because:

- The best equity investments should be bond-like. When we speak of bond yield, that yield is pretax. So, a 10x EBT would provide a 10% pretax earnings yield, directly comparable to a 10% yield bond. Any growth will be a bonus.

- A second reason why the rule makes good sense is that after-tax earnings do not reflect business fundamentals. Taxes can change due to factors that have no relevance to business fundamentals, and there are plenty of ways for a company to optimize its tax obligations.

As such, an EBT multiple of 7x is only reserved for stocks that are permanently ill or stagnant in my mind. However, in the case of CMCSA, I see the opposite – I see both healthy growth in the near term and long term. Consensus estimates seem to share the same view. As seen, their estimates imply a CAGR of 8.1% for its EPS growth in the next 5 years. Next, I will explain why I think such a projection is very plausible.

CMCSA stock’s long-term growth prospects

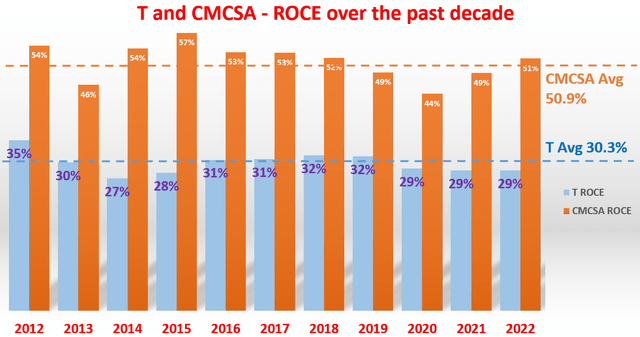

My method for estimating growth rates in the long term involves the use of ROCE and reinvestment rates. The details are provided in my other articles, and I will just quote the final numbers here:

The method involves the return on capital employed (“ROCE”) and the reinvestment rate (“RR”). The ROCE for CMCSA has been around 51% in the long term as seen in the chart below. Its RR is about 10% on average. With these inputs, CAT’s perpetual growth rate would be ~5.1% (51% ROCE x 10% RR = 5.1%). Note this number is the real growth rate without inflation. To obtain a notional growth rate, one would need to add an inflation escalator.

If we assume an average inflation escalator of 2.5%, this would bring the nominal rate to 7.6%, quite close to the CAGR of 8.1% implied in the consensus estimates mentioned above.

CMCSA stock’s near-term catalysts

Now, let me switch the focus to the near-term catalysts. There are a few strong catalysts in the next 1~2 years that could boost CMCSA company substantially in my view. The top one on my list is the broadcasting of the Summer Olympics. This year’s Olympics event is scheduled to kick off in Paris on July 26th and last through August 11th. CMCSA expects its Peacock to provide “the most comprehensive streaming destination ever for the Olympic Games.” The second near-term catalyst involves the U.S. presidential election later this year. I anticipate these events to create tailwinds for the company’s advertising revenue from the fanfare associated with the Olympics and also increased political campaign spending.

Finally, the last catalyst on my list involves the debut of Orlando’s Epic Universe, which is scheduled for 2025. According to management, Epic will be the first major amusement park to open in the U.S. in years. It covers more than 480 acres and features four themed lands connected to each other by a unique gateway. More specifically, Epic includes popular company-owned and licensed franchises, including Nintendo’s Super Mario Brothers, Harry Potter, and characters from the How To Train Your Dragon film series.

Downside risks and final thoughts

On the downside, CMCSA faces largely the same set of risks common to its telecom peers. In addition, there are also some risks that are more particular to CMCSA but not to other telecom stocks. The risks that are common to CMCSA and its peers include price competition, regulation changes, and also intense infrastructure costs. Here I will focus on the risks that are more peculiar to CMCSA. Given its history and legacy operations, Comcast is likely to experience further weakness within the traditional cable business. Such legacy businesses are more sensitive to the disruptions of new technologies. In the United States, video subscriber losses have averaged over two million a year since 2022 due to the growing popularity of both inexpensive streaming services and social media platforms like TikTok, YouTube, and Instagram. CMCSA is responding with its own Peacock streaming platform.

However, Peacock is still in an early stage in my view and its future remains uncertain. It made notable progress in 2023, with the total number of paid subscribers increasing 50% to roughly 30 million. However, the service has yet to report an operating profit. Meanwhile, Peacock continues to face intensifying competition from streamers that enjoy much greater scale, with Netflix and Disney+ leading the pack in terms of number of subscribers.

To conclude, the upside risks far outweigh these downside risks in my view. As such, this article argues for an upgraded rating on CMCSA to Strong Buy despite the large price advancements since my last coverage. The upgraded rating was mainly based on three considerations: attractive valuation, long-term growth outlook, and near-term catalysts. Despite recent price rallies, the stock’s valuation remains very attractive thanks to earnings growth. Its P/EBT ratio is only 7x for FY 2024, a multiple only reserved for terminally ill/stagnant stocks in my mind. Yet, I see robust growth catalysts in both the near term and longer term. In particular, consensus projected growth rates suggest a CAGR of 8.1% over the next five years, which is very plausible to me thanks to its strong ROCE and reinvestment rates sustained by its strong cash generation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.