Summary:

- Meta Platforms, Inc.’s origin story sets it apart from other Silicon Valley companies, with its advertising engine being developed on Wall Street and by venture firms.

- Despite concerns about its valuation, Meta’s strong stock performance and potential in AI make it a fundamentally strong company.

- Meta’s collaborative approach and concentration in digital advertising position it well in the AI market, with potential for growth and innovation.

- Meta initially sold off after its Q1 earnings showed higher than expected CAPEX, but the company’s fundamentals and AI competitiveness remain compelling.

Derick Hudson

“A blind deference to multiples without understanding their limitations can severely hamper the effectiveness of an investment process.” –Michael J. Mauboussin.

Meta Platforms, Inc. (NASDAQ:META) fundamentally differs from other Silicon Valley companies in its origin story. Unlike Microsoft, Apple, or Google, Meta’s founder didn’t create the ultimate path to monetization single-handedly. He created a wonderful platform, but the advertising engine that became the bread and butter of the commerce behemoth was made on Wall Street and Valley venture firms. Ultimately, some of Meta’s persistent strengths and ability to pivot reflect this history, and I think it is key to the company’s adaptable character.

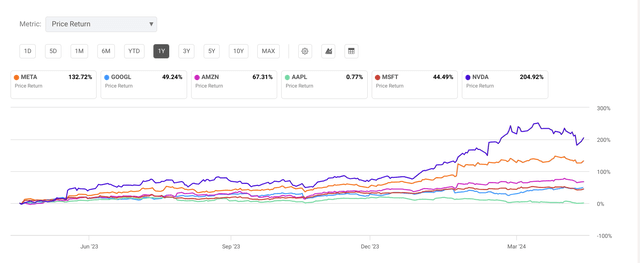

What seemed like a weakness long ago of a young and inexperienced founder has turned into a long-term strength that has resulted in a formidable corporate entity even when measured against the best of Silicon Valley. Meta is up over 130% in the past year, yet its relative valuation is still compelling among key metrics, and in some facets, it is just beginning to enter the AI fray in a way that is publicly visible on the same scale as ChatGPT.

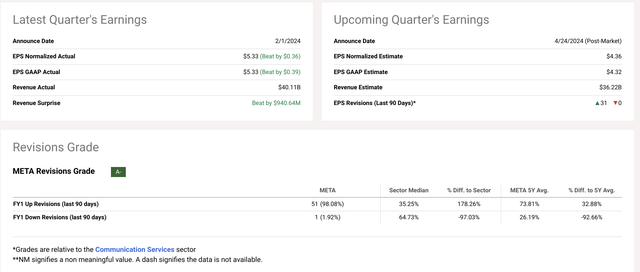

The firm reported Q1 earnings on Wednesday, April 24th, after the bell. The expectations were very high. Despite beating on the top and bottom line, the stock fell. The earnings results were as follows:

- The stock beat significantly on the bottom line, and marginally on the top line.

- Daily active users, or DAU, were up 7% YoY and the average price per ad increased 6 YoY.

- Ad impressions increased by 20% YoY, potentially suggesting success of AI integration to the firm’s digital ad platform.

- The guidance on CAPEX and expenses seems to be what caused investors to initially sell the report. The 2024 CAPEX range went up from $35-40 billion from $30-37 billion.

- Overall, the selloff seems unjustified to me. This was an incredibly strong report and was Meta’s third consecutive quarter of 20% plus growth when its prodigious AI efforts are really just heating up.

- The company still has Wall Street analysts unable to catch up with their pace of growth, and persistent economic strength suggests their growth can continue.

UBS recently downgraded Meta along with other megacap tech names to neutral from outperform. However, despite Meta’s recent prolific rally, I think this is a fundamentally strong stock that has gotten ahead of the analysts on AI prowess, and it is only starting to be fully appreciated by the investing public. The company’s efforts into mass AI tools is just beginning, and many industry insiders are praising the efforts even if they are worried about the valuation. I am convinced Meta can continue price gains because the firm is highly correlated to economic activity, which is persistently strong.

Meta has been the best performer of the Magnificent Seven besides Nvidia (NVDA), and many are concerned that its valuation simply has come too high and too fast to be sustained. I think this concern is based more on an understanding of human psychology than on Meta’s business. I’m convinced the stock will recover anything it loses in tomorrow’s trading relatively quickly as the somewhat irrelevant effects of the Fed staying higher for longer becomes apparent.

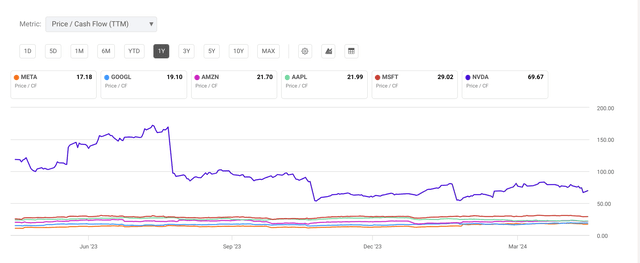

Meta’s commercial advantage is unlikely to be dented by high rates, and it is priced at multiples of its cashflow that imply it must be competitive for decades to come. In this vein, I see increasing CAPEX now during a period of such spectacular growth as a great management decision, not a reason to sell this incredible stock.

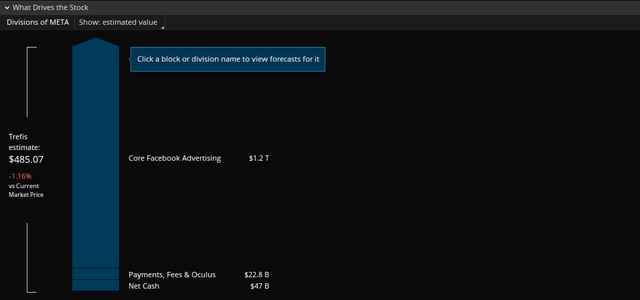

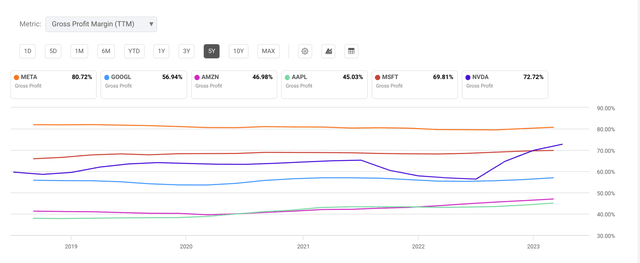

There are ample reasons why the firm can continue beating estimates and rewarding shareholders. They are just becoming competitive in the AI arms race that is transpiring with Microsoft (MSFT). But there is a reason for Meta’s supremacy, aside from Nvidia. It has the best margins of the Mag Seven. It even surpasses Nvidia.

Mr. Zuckerberg created a commercially precious network when he introduced Facebook as a kid. He has been crucial to the vision, but by necessity of his age, the “adults” did a lot, and it looks like they built a more resilient company with the leeway they had compared to other megacaps. That’s probably also very much why Meta has such high margins, in addition to the specifics of its ad-driven business model. Furthermore, the company remains the most undervalued compared to peers when using the crucial P/FCF measure.

The firm’s path to public markets and the money-making machine it became was largely a result of a collaborative relationship between Mr. Zuckerberg and the venture and Wall Street professionals involved in the company’s ultimately successful mega-cap strategy. It’s difficult to remember in our hyper-focus on the flaws and shortcomings of these companies, as we must focus on them as investors, the immense execution it took any company to get into the trillion-dollar club.

The earnings revision grade on Meta implied that Wall Street has not yet caught up to its growth. The report today bolstered that thesis. The firm has a tendency to beat during periods of economic strength, and economic strength is likely to continue.

Meta Helps Prove that Collaborative Leadership is Better at Maturing Companies

While there is an element of purity and genius that surrounds the accomplishments of Steve Jobs, the accomplishments of CEO Mark Zuckerberg successfully collaborated to create the massive digital ad engine used by businesses all over the world. I have written about Founder worship elsewhere and the myth of the indomitable founder. One area where this myth isn’t as prevalent anymore, and where the benefits of collaboration can be shown, is with Meta.

Unlike the usual resentment and mutual suspicion between Wall Street and Silicon Valley, like that which boiled over in the doomed SPAC endeavor, Meta is a result of their fruitful collaboration. While some may have viewed that as a “poser” approach compared to the steely grip maintained on Tesla (TSLA) by CEO Elon Musk, shareholders have let management know which approach they prefer more.

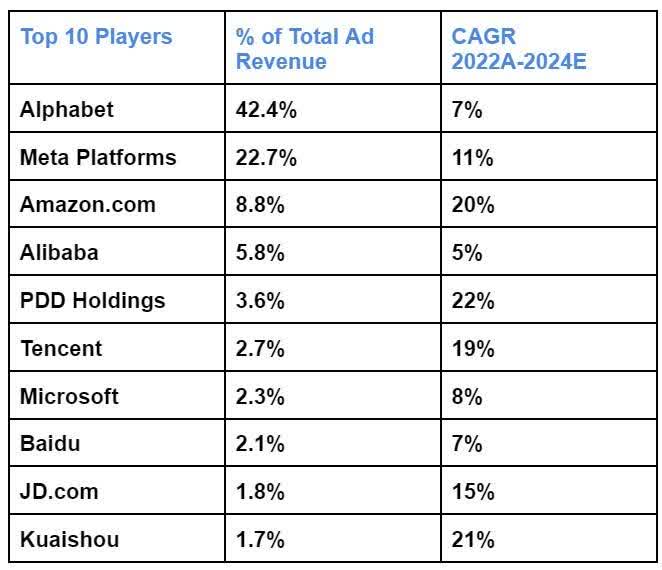

I have been much less of a fan of Mr. Musk’s autocratic approach toward management than Mr. Zuckerberg’s more collaborative approach, even though this approach did create some unfortunate externalities that are difficult to quantify and understand. But Meta has such a prime position in the digital add triopoly that it may be able to enhance quicker than competitors with its approach to artificial intelligence. It was already growing faster than its key ad-spend rival, Alphabet (GOOG, GOOGL).

VisibleAlpha.com

Still, despite this persistent risk, the firm has managed to reinvent itself and quickly pivot as a prime competitor in the brewing artificial intelligence duel between the largest, most successful companies on Earth. The firm’s path to AI monetization is significantly more clear than some of its competitors at this point. This is one of the virtues of being highly concentrated in digital advertising. This is a method of monetization that can be easily improved with AI, and thus Meta can charge a premium to customers as it integrated functionality that offers more direct value more quickly than many proposed paths to mass AI monetization.

- Meta has launched its llama3 large language model in direct competition with ChatGPT. There is a lot of uncertainty about the future of AI, but Meta is currently vying for a top spot among major beneficiaries of the AI trend.

- The company has undergone very sharp cost-cutting measures. 2023 was the “year of efficiency,” and the markets and shareholders seemed to like it.

- Meta’s major CAPEX expenditure into AR and the Metaverse may be able to dovetail existing AI capabilities and the open-source aspect of its AI stack to build new functionality as technology improves.

- Underlying economic strength in the U.S. is a major positive for Meta. Its concentration in digital ads makes the firm very aligned to general economic activity.

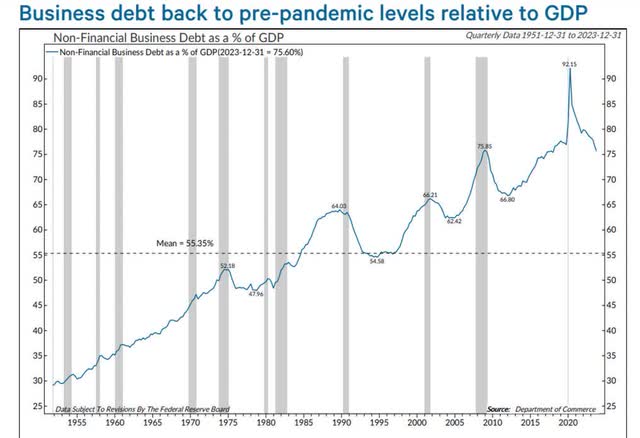

- Unlike many economic booms in the past, businesses have been deleveraging on the net, a very positive environment for Meta.

Ultimately, the path of digital ads is very dependent on the financial strength of US businesses. Many feel that after such a period of persistent economic expansion, U.S. businesses and consumers should be tapping out. But if you look at US businesses, as I pointed out, they have been deleveraging. Meta has been investing a lot in CAPEX and given its success in past acquisitions and product development, I think management deserves the benefit of the doubt.

Risks and Where I Could Be Wrong

Meta’s financial viability is very concentrated in digital ad spending. Anything that results in this being curtailed, namely economic weakness, will likely result in the stock being punished. However, in the AI arms race the stakes are high, and there are always risks of a major product SNAFU like Google just experienced with Gemini. For Meta, macroeconomic risks are the main thing to worry about in my estimation, given its pristine track record of cost-cutting this year and the ability of AI to improve its core product quickly.

Furthermore, any of the below economic risks could derail the market.

- Fed policy error.

- The banking crisis worsens.

- Return of inflation.

- CRE meltdown.

- Write-downs of private assets.

- Increased political risk during an election year.

Ultimately, rising rates or higher for longer rates could curtail the high multiple stocks. However, I think Meta is relatively less exposed to this as a drag given the strength of its customers and the likelihood of its product economics improving on the back of its integration with artificial intelligence.

Conclusion

Ultimately, I think Meta is one of the strongest companies in the Magnificent Seven, and I think further strength is ahead for this firm despite its recent rally and the post-earnings selloff. The firm will do well as long as economic strength remains robust and businesses remain willing and able to pay for their digital ads. All indications from Wall Street analysts being behind their earnings and the robust revisions trends suggest further strength is ahead.

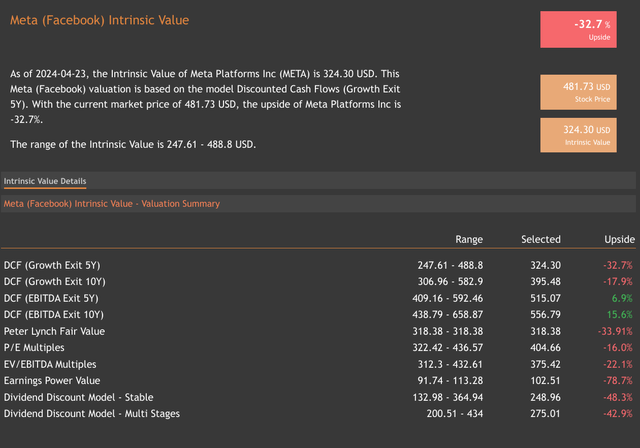

While Meta may appear overvalued on a short-term basis, longer-term discounted cash flows, or DCFs, suggest it is still undervalued. If you own a company like Meta, that is making investments for far in the future, you should pay attention to the longer-dated DCFs. In my estimation, this is a great stock to own for the long-term, one of the most competitive companies for the artificial intelligence themes, and a prime beneficiary of persistent US economic strength. Furthermore, there is clearly a valuation premium in today’s market for having a leading-edge artificial intelligence product, and Meta’s has only just been introduced.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.