Summary:

- Meta mentioned in the call that they grew conversions at a faster rate than impressions over the course of this quarter, making the ads more performant.

- Ad revenue from Advantage+ shopping and Advantage+ campaigns has more than doubled since last year.

- Capex guide range was increased from $30-37 Bn to f $35-40 Bn in 2024.

Kira-Yan

If you have been following Meta for some time, you probably are accustomed with after-hours (AH) volatility by now. While Meta (NASDAQ:META) was -20% at one point AH on Wednesday, it does seem a bit overdone. Of all the post-earnings drop that I have experienced following Meta since 2018, this one probably made me nervous the least.

Here are my highlights from tonight’s call.

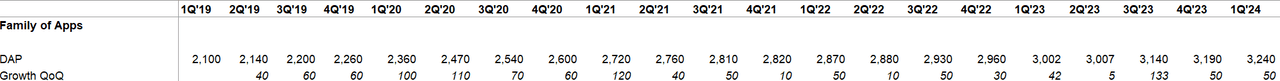

Users

This was another typical quarter for Meta adding ~50 mn Daily Active People (DAP) across its Family of Apps (FOA).

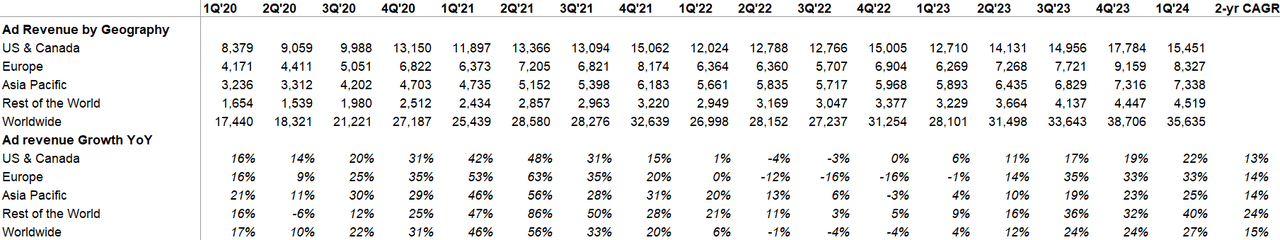

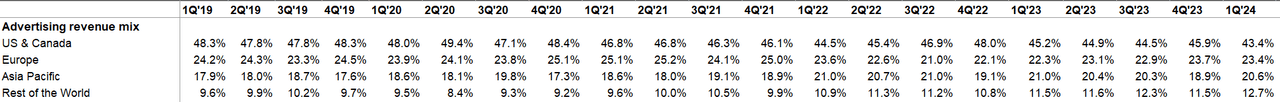

Ad revenue by Geography

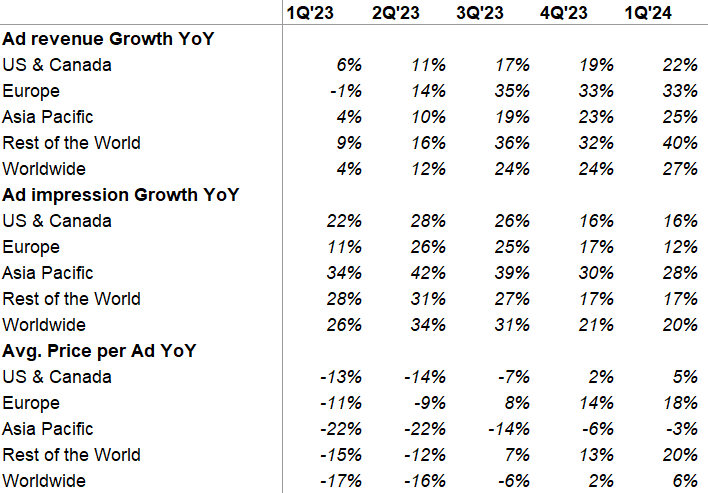

While ad revenue growth YoY continued at a brisk pace, this was the last quarter with easy comps and hence, 2-yr CAGR is likely better reflective of underlying trend.

Ad Impression and Avg. Price Per Ad

We got ad impression and ad price related disclosure by geography for the first time this quarter.

Overall impression grew by ~20% and avg. price per ad grew by ~6% YoY. Interestingly, the strongest ad price growth was in RoW segment (which includes Africa, Middle East, and LATAM) which incidentally also had the highest revenue growth.

Meta mentioned in the call that they grew conversions at a faster rate than impressions over the course of this quarter, making the ads more performant. Moreover, campaigns using Advantage+ audience targeting saw on average a 28% decrease in cost per click or per objective compared to using regular targeting.

Ad revenue from Advantage+ shopping and Advantage+ campaigns has more than doubled since last year.

Meta didn’t quantify China revenue, but did mention that they “are lapping periods of increasingly strong demand over the course of 2024 given the recovery of China-based advertisers in 2023 from their prior pandemic-driven headwinds.”

Ad revenue from North America was 43.4% of overall revenue which was the lowest in Meta’s history, indicating the increasingly global nature of Meta’s business as APAC and RoW segment ramps up and contributes more to revenue. In 1Q’21, these two regions in aggregate contributed 28.2% of Meta’s ad revenue but in 1Q’24, they were 33.3% of ad revenue.

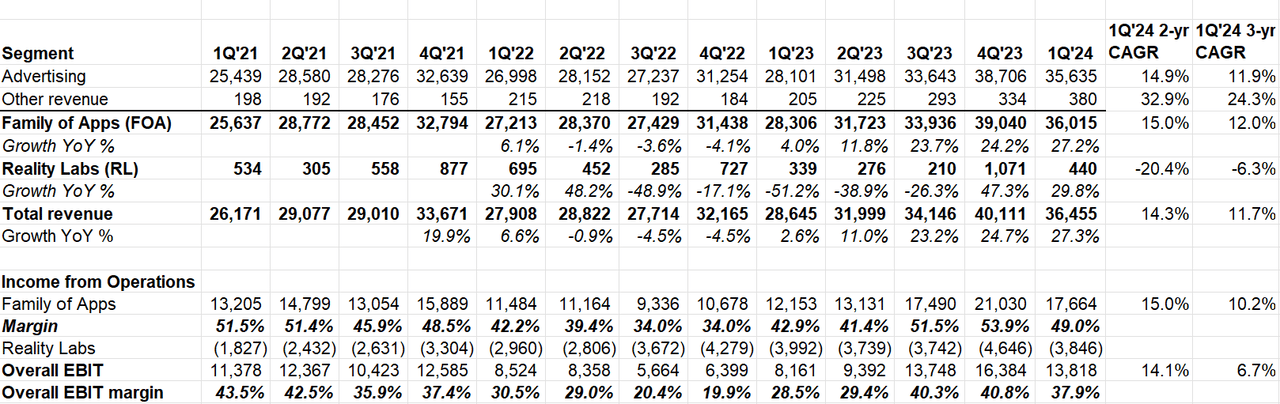

Segment Reporting

Overall 1Q’24 revenue was +27.3% YoY; on a 2-yr and 3-yr CAGR basis, Meta’s topline increased by 14.3% and 11.7% respectively.

FOA’s other revenue increased by 85% YoY, driven by business messaging revenue growth from WhatsApp business platform. Zuck called out business messaging to be “the biggest clear opportunity…it’s not like next quarter or the quarter after that scaling thing, but it’s not like a 5-year opportunity either.”

I expect this momentum in business messaging to continue for years to come.

FOA had another near ~50% operating margin quarter and Reality Labs ((RL_) had another quarter of continued bleeding.

Last quarter, I mentioned:

“I know some Meta bulls are tempted to look at FOA and try to imagine some SOTP by assigning Reality Labs valuation of zero…I would mostly just pay attention to Meta’s consolidated numbers.”

Zuck more or less made the same case as the two segments increasingly become intertwined:

One strategy dynamic that I’ve been reflecting on is that an increasing amount of our reality labs work is going towards serving our AI efforts. We currently report on our financials as a family of apps and Reality Labs were 2 completely separate businesses. But strategically, I think of them as fundamentally the same business with the vision of Reality Labs to build the next generation of computing platforms in large part to where we can build the best apps and experiences on top of them. Over time, we’ll need to find better ways to articulate the value that’s generated here across both segments. So it doesn’t just seem like our hardware costs increase as our glasses ecosystem scales, but all the value flows to a different segment.

Let’s look at some interesting comments from the earnings call:

Meta AI

Meta AI was the key focus on this call. Meta says the initial feedback is “very positive”:

The initial rollout of Meta AI is going well. Tens of millions of people have already tried it. The feedback is very positive. And when I first checked in with our teams, the majority of feedback we were getting was people asking us to release Meta AI for them wherever they are.

This has emboldened Meta to continue to invest more aggressively:

Overall, I view the results our teams have achieved here as another key milestone in showing that we have the talent, data and ability to scale infrastructure to build the world’s leading AI models and services. And this leads me to believe that we should invest significantly more over the coming years to build even more advanced models and the largest scale AI services in the world.

Zuck reminded investors that while it may be somewhat painful to go through, they have pretty compelling track record in building features and using their unparalleled distribution to monetize these features. While some investors may wonder whether this is more akin to RL investments or Reels/Stories investment phases, I think it’s exceptionally likely to be the latter. Meta AI is not a speculative/unproven ideas on which Meta is aggressively investing; business messaging, and high intent data from chat bots and hence getting more ad dollars from bottom of the ad funnel is likely to be an once a decade opportunity for Meta. It makes perfect sense to me that they would go after this rather quite aggressively:

As we’re scaling CapEx and energy expenses for AI, we’ll continue focusing on operating the rest of our company efficiently. But realistically, even with shifting many of our existing resources to focus on AI, we’ll still grow our investment envelope meaningfully before we make much revenue from some of these new products. I think it’s worth calling that out that we’ve historically seen a lot of volatility in our stock during this phase of our product playbook, where we’re investing in scaling a new products but aren’t yet monetizing it. We saw this with Reels, Stories, as newsfeed transition to mobile and more. And I also expect to see a multiyear investment cycle before we fully scaled Meta AI, business AIs and more into the profitable services I expect as well.Historically, investing to build these new scaled experiences in our apps has been a very good long-term investment for us and for investors who have stuck with us. And the initial signs are quite positive here, too.On the upside, once our new AI services reach scale, we have a strong track record of monetizing them effectively. There are several ways to build a massive business here, including scaling business messaging, introducing ads or paid content into AI interactions and enabling people to pay to use bigger AI models and access more compute. And on top of those, AI is already helping us improve app engagement, which naturally leads to seeing more ads and improving ads directly to deliver more value.So if the technology and products evolve in the way that we hope, each of those will unlock massive amounts of value for people and business for us over time.

The point about increased engagement is really crucial here. If there is ~10% higher engagement on Meta’s apps thanks to better recommendation system, simplistically assuming that may result in ~$10-15 Bn revenue opportunity. If you assume FOA’s ~50% operating margin for these incremental ad dollars thanks to higher engagement/time spent, ROIC on these capex is going to be pretty compelling! And Meta already has good evidence that this is the right path to take:

We’re seeing good progress on some of these efforts already. Right now, about 30% of the posts on Facebook feed are delivered by our AI recommendation system. That’s up 2x over the last couple of years. And for the first time ever, more than 50% of the content that people see on Instagram is now AI recommended.AI has also been a huge part of how we create value for advertisers by showing people more relevant ads. And if you look at our 2 end-to-end AI-powered tools, Advantage Plus shopping and Advantage Plus campaigns, revenue flowing through those has more than doubled since last year.…historically, each of our recommendation products, including Reels, in-feed recommendations etc. has had their own AI model. And recently, we’ve been developing a new model architecture with the aim for it to power multiple recommendations products. We started partially validating this model last year by using it to power Facebook Reels. And we saw meaningful performance gains, 8% to 10% increases in watch time as a result of deploying this. This year, we’re actually planning to extend the singular model architecture to recommend content across not just Facebook Reels, but also Facebook’s video tab as well. So while it’s still too early to share specific results, we’re optimistic that the new model architecture will unlock increasingly relevant video recommendations over time. And if it’s successful, we’ll explore using it to power other recommendations…with Meta AI, I think that we are on our path to having Meta AI be the most used and best AI assistant in the world, which I think is going to be enormously valuable. So all of that basically encourages me to make sure that we’re investing to stay at the leading edge of this.

Reels

Video also continues to grow across our platform, and it now represents more than 60% of time on both Facebook and Instagram. Reels remains the primary driver of that growth.

…we’re seeing healthy growth in the US…where the number of daily actives and message sends in the U.S. keeps gaining momentum

Threads

Threads now has 150 Mn MAU (vs 130 Mn in 4Q’23 and 100 mn in 3Q’23)

AR/VR

The Ray-Ban Meta glasses that we built with Essilor Luxottica continue to do well and are sold out in many styles and colors.…As the ecosystem grows, I think there will be sufficient diversity in how people use mixed reality that there will be demand for more designs than we’ll be able to build for example, a work-focused headset…Now to be clear, I think that our first-party Quest devices will continue to be the most popular headsets as we see today, and we’ll continue focusing on advancing the state-of-the-art tech and making it accessible to everyone. But I also think that opening our ecosystem and opening our operating system will help the overall mixed reality ecosystem grow even faster.

I have noticed Zuck put more emphasis on Meta Ray-Ban Glasses than VR headsets during this call. I have both Quest and the glasses and I think the adoption of glasses may inflect sooner than many may think. I myself have noticed after wearing the glasses, I have taken more photos/videos given how friction free it is which then get posted on social media. In the long-term, the biggest risk for Meta is lack of engaging content on its platforms, so the more it can unlock the velocity/quality of content, the better it is for Meta’s FOA platform.

Capital Allocation

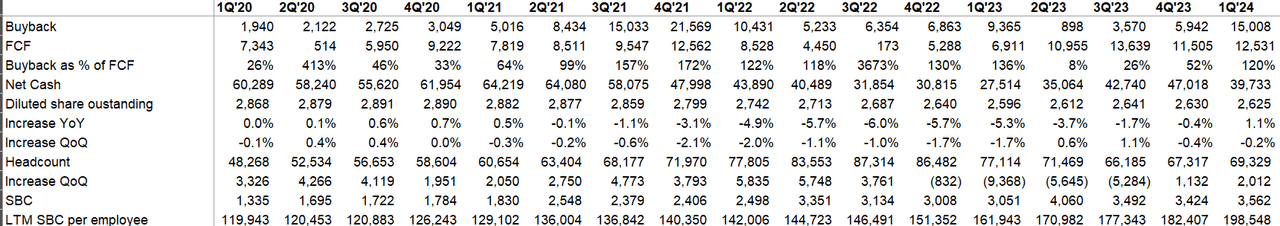

Meta bought back ~$15 Bn last quarter (~120% of FCF). Moreover, it also paid $1.2 Bn dividend.

Despite the buybacks, shares outstanding decreased by only 0.2% QoQ, thanks to Meta’s quite generous SBC program which is currently nearing ~$200k/employee.

Opex Guide

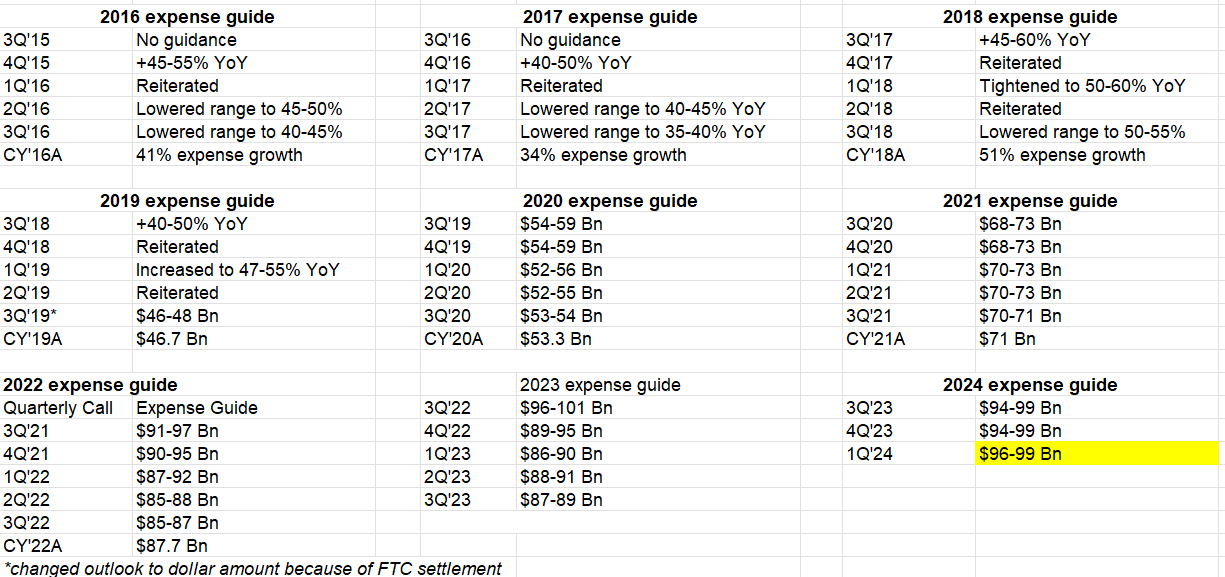

Anyone following Meta perhaps knows by now that Meta tends to decrease their opex guide as the year progresses. But last quarter, I did wonder whether this was mostly Dave Wehner-thing and now that we have a new CFO (Susan Li), she may have a different approach. She indeed has bit of a different approach as Meta guided for $96-99 Bn opex (vs $94-99 Bn) for 2024.

Capex

Capex guide range was increased from $30-37 Bn to f $35-40 Bn in 2024. As you can imagine, all the AI infrastructure related investments do not come cheap. Expect capex ramp up to continue:

“While we are not providing guidance for years beyond 2024, we expect CapEx will continue to increase next year as we invest aggressively to support our ambitious AI research and product development efforts.”

As mentioned earlier, this is a fundamentally different opex/capex plan for Meta compared to what they have done/are doing with RL. I consider these investments to be lot less speculative. If there is a terrible adoption rate of “Meta AI” and declining engagement by users, Meta can scale back the level of investments and just keep iterating based on what works. It is way less risky capital deployment than AR/VR investments in my opinion.

Regulation

While it does seem increasingly unlikely that the regulators can cause real pain to Meta, it remains a wild card:

we continue to monitor an active regulatory landscape, including the increasing legal and regulatory headwinds in the EU and the U.S. that could significantly impact our business and our financial results.We also have a jury trial scheduled for June in a suit brought by the state of Texas regarding our use of facial recognition technology, which could ultimately result in a material loss.

Outlook

2Q’24 topline guide is $36.5-39 Bn (~1% FX headwind). Mid-point YoY growth is ~19% (vs consensus estimates of ~20%)

Closing Words

When I shared my updated model on Meta, I did mention I sold ~10% of Meta shares I had after last quarter. As I deem market’s reaction to be rather excessively negative on Wednesday, I would be willing to buy those shares back at ~$400 , which would value the company at ~14-15x 2025 (consensus) EBIT. Given Meta’s significant weight in my portfolio, I am not going to chase the stock if it doesn’t come to $400 or below.

For more in-depth analysis on Meta Platforms, you can read my analysis here (February, 2024).

Disclosure: I own shares of Meta Platforms

Disclaimer: All posts on “MBI Deep Dives” are for informational purposes only. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.