Summary

- Recent market downturn due to inflation, high rates, geopolitics, and commodity costs presents dividend stock buying opportunities for higher yields, growth stability, and an inflation hedge.

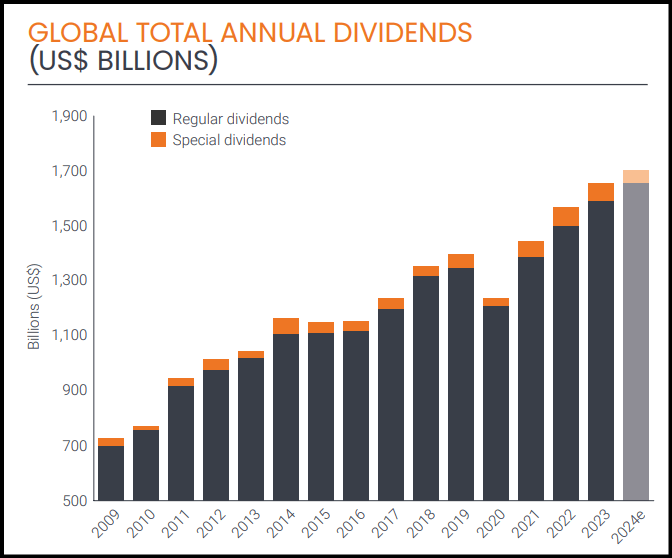

- Dividend payments worldwide and in the U.S. hit all-time highs in 2023, a year that ended with record levels of cash on corporate balance sheets.

- Using SA’s Dividend Scorecard, the Quant Team picked 10 stocks with average forward yields ranging from 3.22% to 9.29% and consecutive payouts of up to 61 years.

- Each stock also has Strong Buy and/or Buy SA Quant Ratings, exhibiting solid collective growth, profitability, and momentum, and an average FWD yield of 5.40%.

In the past few weeks, there’s been a downturn in the stock market. Factors like inflation worries, prolonged high interest rates, geopolitical issues, and increasing commodity costs have led to market fluctuations and weakness. Amidst this, it’s a chance to purchase dividend-paying stocks at discounted rates and secure higher yields. Stocks with solid dividend growth can offer investors a steady flow of income and serve as a potential hedge against inflation and market volatility. Through the power of compounding, reinvesting dividends can significantly enhance the value of one’s portfolio over time. The market environment is supportive of dividends, with record cash on corporate balance sheets and near record low payout ratios. At the end of 2023, the average payout ratio of the S&P 500 stood at 36.5% vs. a 97-year average of 56%, signaling substantial room for potential growth.

Meanwhile, global dividend payouts hit a record high of $1.66 trillion (+5% YoY) in 2023 and are projected to rise another 4% this year, while U.S. dividends rose 5.1% to an all-time high of $602.1 billion. US dividends have grown yearly since 2011, including through the pandemic, and roughly tripled in value.

Annual Global Dividend Payments (Janus Henderson)

Quant Dividend Grades

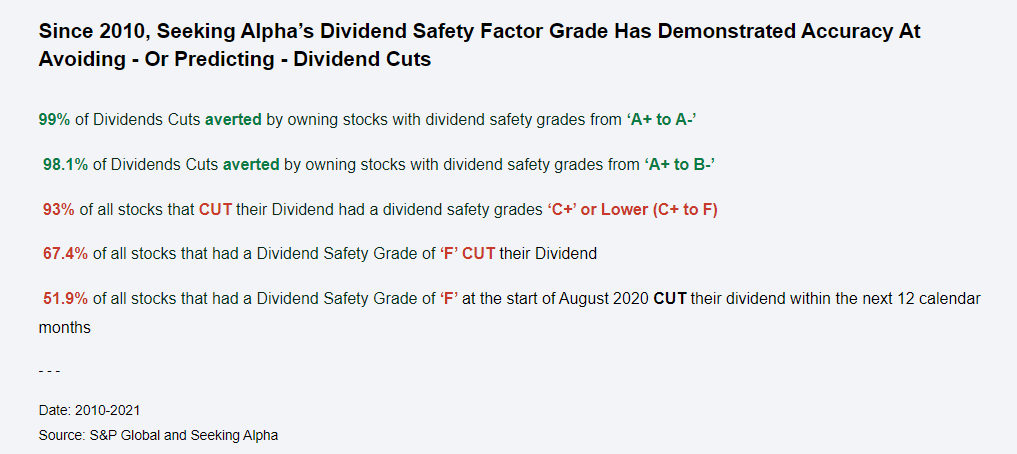

Seeking Alpha’s Quant Dividend Grading System can help preserve your capital and keep you on track with your income goals. Two critical elements for this objective are Quant Dividend Safety Grades and Quant Dividend Growth Grades. Seeking Alpha’s Quant Dividend Grades can provide an instant characterization of each stock’s dividend strength or weakness compared to its sector. Indicators like payout ratios, dividend coverage ratios, interest coverage ratios, debt ratios, profitability metrics, and weak cash per share figures can flag when a dividend is at risk.

Dividend Safety Factor Accuracy (SA Premium)

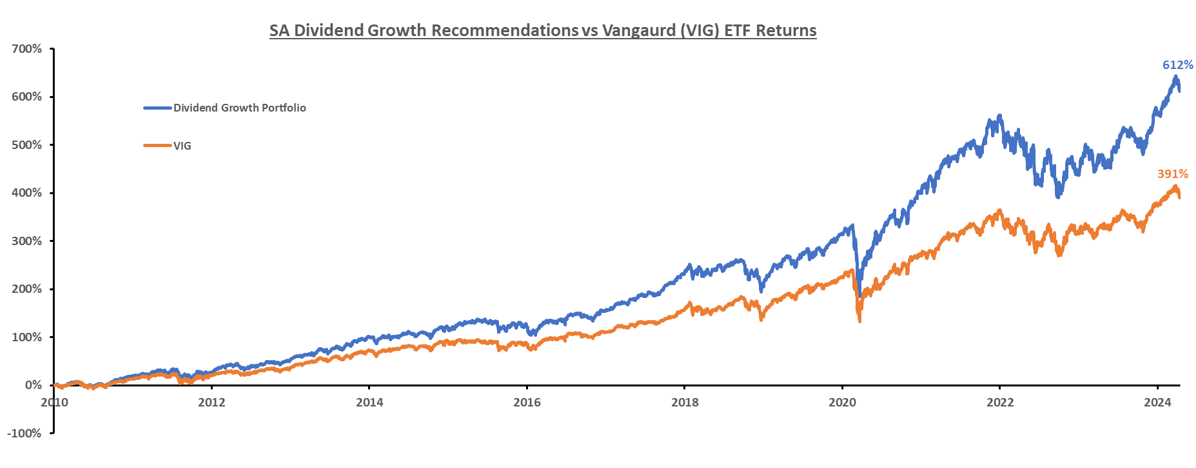

Seeking Alpha’s Quant Dividend Growth grade assesses nearly all U.S. securities with dividends, our quant algorithm picks stocks with the strongest dividend growth metrics vs. the peer sector.

Seeking Alpha’s Quant Strong Buy A+ Dividend Growth Grades +612% vs. Vanguard (VIG) ETF +391% ($10k investment)

SA Dividend Growth Grade Performance (S&P Global and Seeking Alpha (4/16/2024))

The SA Quant Team has identified ten stocks with high yields, strong growth, and solid investment fundamentals based on SA’s Dividend Grading System.

Top 10 High-Yield Dividend Stocks

SA’s Quant Team identified ten dividend stocks with high yields, solid investment fundamentals, and Strong Buy or Buy Quant Ratings.

1. NewLake Capital Partners, Inc. (OTCQX:NLCP)

- Forward Dividend Yield: 9.29%

- Dividend Growth Rate 3Y (CAGR): –

- Dividend Safety Grade: A+

- Dividend Growth Grade: C

- Market Capitalization: $384.63M

- Quant Rating: Strong Buy

*the above rating and figures are as of 4/22/24

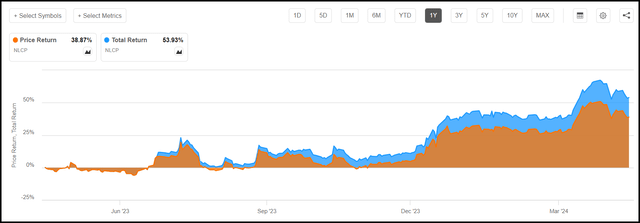

NewLake Capital Partners, Inc. is a REIT that provides real estate capital to state-licensed cannabis operators, with a portfolio of 31 properties, including 14 cultivation facilities and 17 dispensaries. NLCP, a small-cap stock founded in 2019, went public in August 2021 and is the #1 quant-rated Industrial REIT stock and #1 in the Real Estate sector. NLCP is up ~40% in the past year and 53% in total returns.

NLCP 1 Year Price Performance & Total Return

NLCP 1Y Price Performance and Total Return (SA Premium)

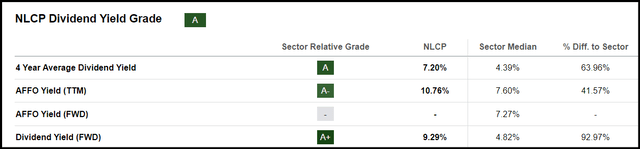

NLCP’s annual payout FWD of $1.64 represents an impressive 9.29% dividend yield FWD, driving an ‘A’ Dividend Yield Grade. NLCP’s 4-year average yield is 7.20%, and the Adjusted Funds From Operations (AFFO) yield TTM, a critical REIT metric, is 10.76%. The one-year yield on cost is nearly 13% vs. the sector’s 5%, while earnings yield non-GAAP FWD is 6%.

NLCP Dividend Yield Grade (SA Premium)

The NLCP has an ‘A+’ Dividend Safety Grade, underpinned by a solid balance sheet and strong profitability metrics. NLCP’s short-term debt is zero, and LT debt is a mere $2 million versus $25.84 million in cash. Interest coverage, the ratio between EBIT and debt expenses, is a staggering 65x, and the FFO interest coverage ratio is 105x. Net income to total debt sits at 1,229%.

2. Prudential Financial, Inc. (PRU)

- Forward Dividend Yield: 4.70%

- Dividend Growth Rate 3Y (CAGR): 4.31%

- Market Capitalization: $39.75B

- Dividend Safety Grade: A

- Dividend Growth Grade: A

- Quant Rating: Strong Buy

*the above rating and figures are as of 4/22/24

Prudential is ranked #3 among quant-rated Life and Insurance stocks, up ~30% in total returns in the past year, with an annual payout at $5.20 and a forward yield of 4.70%. Prudential has delivered 15 consecutive years of dividend increases, driving its ‘A-‘ Consistency Grade. Prudential, in Q423, authorized what will be the 16th consecutive year of dividend increases.

Prudential Dividend Scorecard (SA Premium)

Prudential’s ‘A’ Dividend Growth Grade is highlighted by EPS FWD of +15% and Return on Net Tangible Assets TTM of +855% vs. the sector’s +97%. The ‘A’ Safety Grade indicates the company has strong financial capabilities to continue paying the current dividend amount, showcased by cash per share of $54 vs. the sector’s $7.29. Prudential has had a Strong Buy Quant Rating since early February with an ‘A’ in profitability quant factor grade and solid momentum and valuation metrics with PEG Non-GAAP FWD of 0.73 40% below the sector.

3. Innovative Industrial Properties, Inc. (IIPR)

- Forward Dividend Yield: 7.73%

- Dividend Growth Rate 3Y (CAGR): 16.5%

- Market Capitalization: $2.67B

- Dividend Safety Grade: A-

- Dividend Growth Grade: B+

- Quant Rating: Strong Buy

*the above rating and figures are as of 4/22/24

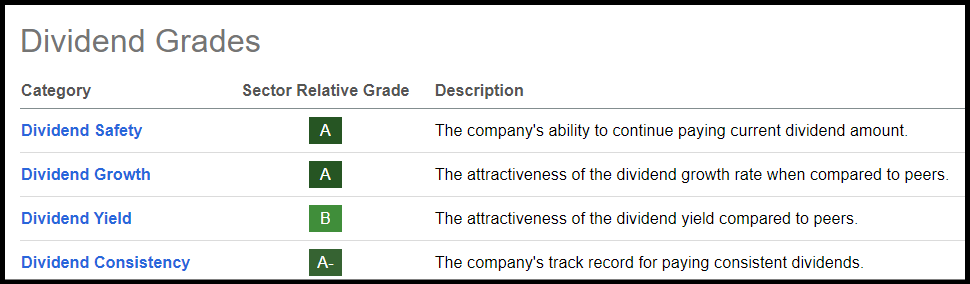

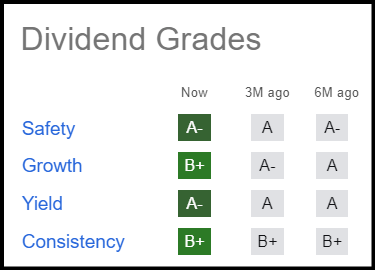

IIPR is a REIT focused on the acquisition, ownership, and management of properties leased to state-licensed operators for regulated cannabis facilities and is ranked #2 among quant-rated Industrial REITs. IIPR is up 38% in 1Y price performance and 50% in total return, soundly outperforming the real estate sector (XLRE), and flashes green across all four dividend grades.

IIPR Dividend Grades (SA Premium)

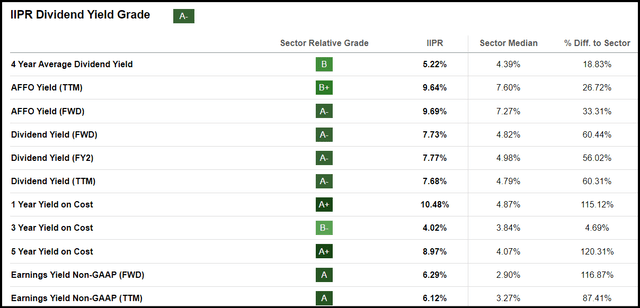

IIPR, with an annual payout FWD of $7.28, showcases a solid dividend yield of 7.73% and a 4y average of 5.22% for an ‘A-‘ Yield Grade. 1Y yield on cost of 10.48% and 5Y yield on cost of 8.97% are more than double the sector medians. AFFO Yield FWD is over 9%, and Earnings Yield FWD 6.11%, both handily beating peers.

IIPR Dividend Yield Grade (SA Premium)

IIPR’s ‘A-‘ Safety Grade is underpinned by an interest coverage ratio of 10 and a staggering net income/total debt of 54%, 760% above the sector. IIPR’s dividend has grown by a (CAGR) of 38% in the past five years. IIPR has a Strong Buy Quant Rating and top-notch Factor Grades with ‘A’s’ in Valuation, Growth, Profitability, and Momentum. IIPR presents the best of many worlds – amazing fundamentals that signal the stock has a good chance to consistently pay out high-quality dividends while delivering solid and stable earnings.

4. ONEOK, Inc. (OKE)

- Forward Dividend Yield: 4.97%

- Dividend Growth Rate 3Y (CAGR): 1.01%

- Market Capitalization: $44.99B

- Dividend Safety Grade: B+

- Dividend Growth Grade: B

- Quant Rating: Buy

*the above rating and figures are as of 4/22/24

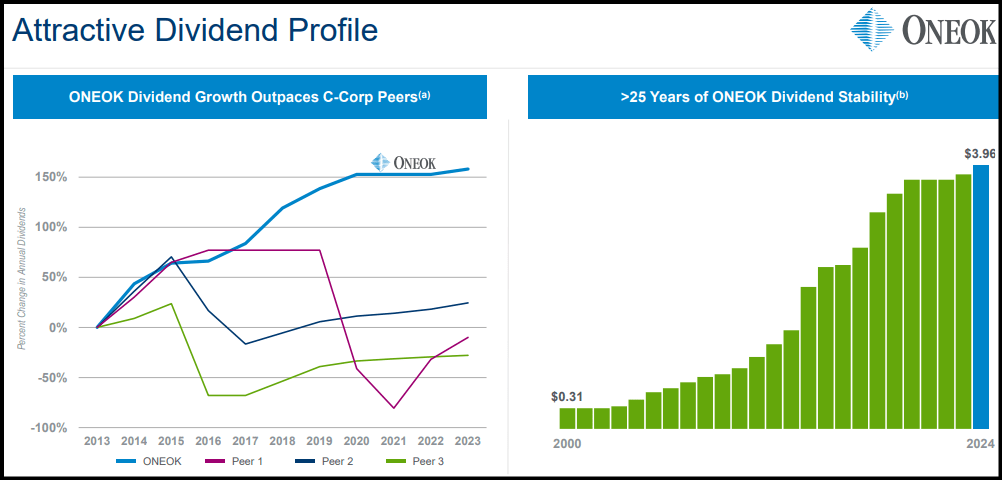

ONEOK, Inc. engages in processing, fractionating, storing, and transporting natural gas and natural gas liquids (NGL) in the United States, ranked #15 among quant-rated stocks in its industry. The Tulsa-based company has delivered dividends to shareholders for 25 straight years and has a forward dividend yield of 4.97% and an annual payout FWD of $3.96. OKE’s dividend has grown at a (CAGR) of 10% for the past decade and has posted a 4-year average yield of 7.25%.

OKE Dividend Profile (Investor Presentation)

5. FirstEnergy (FE)

- Forward Dividend Yield: 4.45%

- Dividend Growth Rate 3Y (CAGR): 0.85%

- Market Capitalization: $21.97B

- Dividend Safety Grade: B

- Dividend Growth Grade: B-

- Quant Rating: Buy

*the above rating and figures are as of 4/22/24

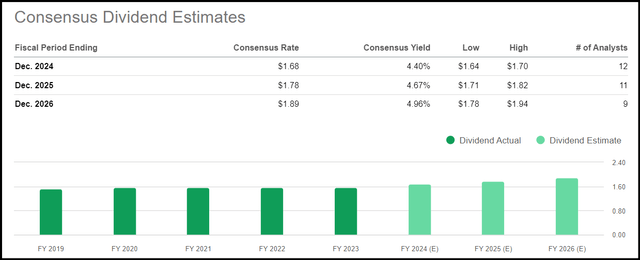

FirstEnergy Corp. is an Akron-based electric utilities company, ranked #3 among quant-rated stocks in its industry, which also delivered dividends for 25 straight years. FE has a dividend yield of 4.45% and an annual payout of $1.70. According to consensus estimates, the dividend rate is expected to grow to $1.89 by 2026.

FE Dividend Estimates (SA Premium)

6. Conagra Brands, Inc. (CAG)

- Forward Dividend Yield: 4.57%

- Dividend Growth Rate 3Y (CAGR): 12.28%

- Market Capitalization: $14.64B

- Dividend Safety Grade: B-

- Dividend Growth Grade: B+

- Quant Rating: Buy

*the above rating and figures are as of 4/22/24

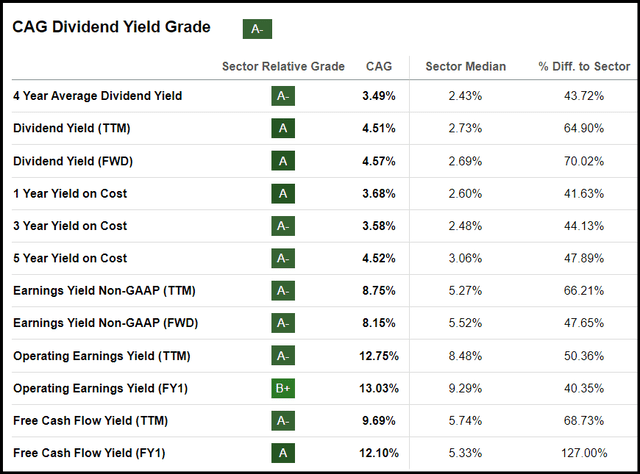

Conagra Brands is a consumer packaged goods food company that operates through Grocery & Snacks, Refrigerated & Frozen, International, and Foodservice segments. Quant-ranked #11 among Packaged Foods and Meats Stocks, CAG has 34 consecutive years of dividend payments, an annual payout FWD of $1.40, a forward yield of 4.57%, and a solid 3Y dividend growth rate of 12%. CAG has attractive underlying Yield Grade metrics, with A’s in every key sector relative grade. FCF yield F1 is 12%, more than 120% above the sector median, and operating earnings yield FWD is 13%.

CAG Dividend Yield Grade (SA Premium)

7. Tyson Foods, Inc. (TSN)

- Forward Dividend Yield: 3.27%

- Dividend Growth Rate 3Y (CAGR): 3.89%

- Market Capitalization: $20.72B

- Dividend Safety Grade: B-

- Dividend Growth Grade: B

- Quant Rating: Strong Buy

*the above rating and figures are as of 4/22/24

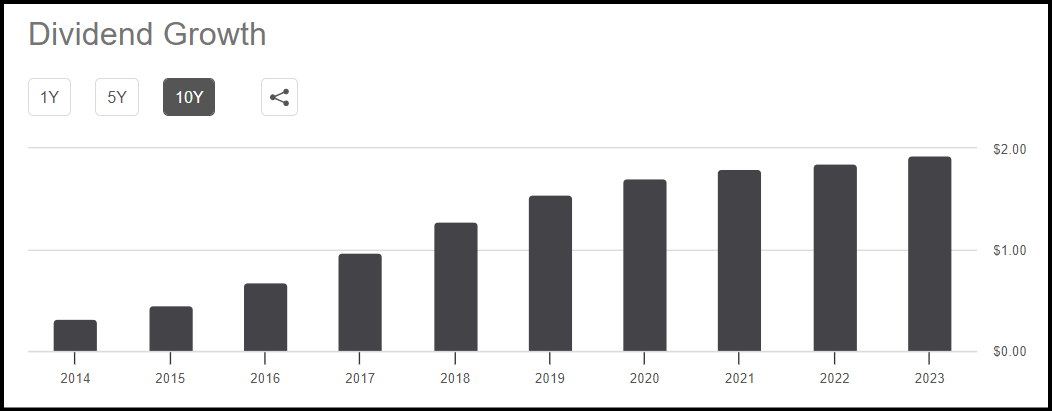

Tyson, one of the world’s largest packaged food companies, is a Strong Buy ranked #5 among quant-rated Consumer Staples stocks and #4 in the Packaged Foods and Meat industry. TSN has provided investors with a dividend for 34 straight years, including 12 consecutive years of growth. TSN has a ‘B’ Dividend Growth Grade marked by an impressive long-term track record with a 10Y (CAGR) of 22% (vs. the sector’s 5%). Tyson’s dividend grew from $0.33 in 2014 to $1.93 in 2.23 (+445%). TSN’s annual dividend payout FWD is $1.96 for a yield of 3.27%.

TSN Dividend Growth (SA Premium)

8. The Coca-Cola Company (KO)

- Forward Dividend Yield: 3.22%

- Dividend Growth Rate 3Y (CAGR): 4.17%

- Market Capitalization: $259.40B

- Dividend Safety Grade: B

- Dividend Growth Grade: A+

- Quant Rating: Strong Buy

*the above rating and figures are as of 4/22/24

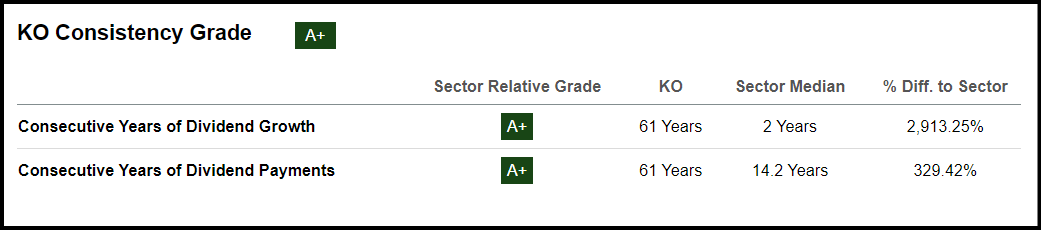

Coke is one of Warren Buffett’s favorite dividend stocks, and for good reason, given its best-in-class consistency and long-term growth. Rated #1 among quant-rated Soft Drink stocks, Coke has delivered a dividend to shareholders for a mind-boggling 61 straight years, including 61 years’ worth of growth, capturing ‘A+’ marks in Growth and Consistency. Coke’s 68% payout ratio is high compared to the sector, but its solid investment fundamentals drive a ‘B’ Safety grade, highlighted by a net income margin of 23% and ROE of 42%. Coke’s annual payout FWD is $1.94, with a 3.22% yield.

Coke Dividend Consistency Grade (SA Premium)

9. Kinder Morgan, Inc. (KMI)

- Forward Dividend Yield: 6.10%

- Dividend Growth Rate 3Y (CAGR): 2.48%

- Market Capitalization: $41.81B

- Dividend Safety Grade: C+

- Dividend Growth Grade: C+

- Quant Rating: Buy

*the above rating and figures are as of 4/22/24

Kinder Morgan, a Texas-based gas and oil pipeline company, has a solid dividend yield forward of 6.10% and a 4-year average yield of 6.50%. KMI’s dividend yield is 75% above the energy sector median, driving a ‘B- Dividend Yield Grade. KMI has delivered 12 straight years of dividends, including six consecutive in growth for a ‘B-‘ Consistency Grade. Although KMI has a ‘C+’ for growth, according to consensus estimates, the dividend rate is projected to rise to $1.22 by 2026.

10. Ardmore Shipping Corporation (ASC)

- Forward Dividend Yield: 5.73%

- Dividend Growth Rate 3Y (CAGR): –

- Market Capitalization: $659.57M

- Dividend Safety Grade: B-

- Dividend Growth Grade: A+

- Quant Rating: Strong Buy

*the above rating and figures are as of 4/22/24

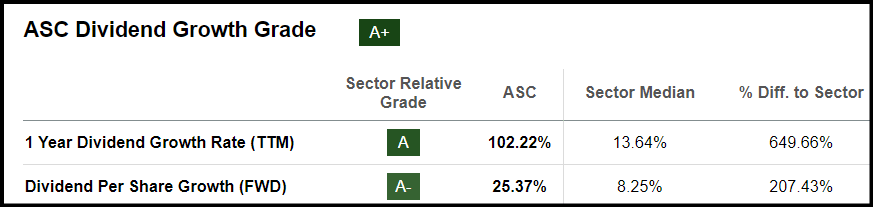

Ardmore Shipping engages in seaborne transportation of petroleum and chemical products worldwide and offers a solid forward dividend yield of 5.73%. ASC’s 1Y dividend growth rate TTM is a whopping 102%, and dividend per share growth FWD is 25%, buttressing an ‘A+’ Dividend Growth Grade. ASC also possesses solid investment fundamentals with a Strong Buy Quant Rating and A’s in Profitability and EPS Revisions, ‘B+’ in Growth, and a ‘B’ in Valuation.

ASC Dividend Growth Grade (SA Premium)

To identify more dividend opportunities, go to SA’s High Dividend Yield stock screener, which showcases stocks with yields above 6% and Strong Buy or Buy Quant Ratings. Or filter on key fields such as dividend grade and other metrics to identify stocks that are at risk of cutting dividends.

Concluding Summary

With global dividend payments hitting record numbers and record cash on balance sheets – the timing is not bad for diving into dividends. Dividends that deliver consistent growth and safety can help investors boost long-term portfolios and mitigate inflation and market volatility. SA’s Quant Team used its Dividend Grading System to identify ten dividend stocks with yields ranging from 3.33% to 9.11%, with consecutive payments of up to 61 years and long-term CAGRs as high as 16.5%. Consider using Seeking Alpha’s’ Ratings Screener‘ tool if you prefer alternate dividend stocks with higher Dividend Safety or strong Dividend Growth grades. Alternatively, Alpha Picks might be ideal if you’re interested in two monthly stock picks of the top ‘strong buy’ quant stocks.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

I am Steven Cress, Head of Quantitative Strategies at Seeking Alpha. I manage the quant ratings and factor grades on stocks and ETFs in Seeking Alpha Premium. I also lead Alpha Picks, which selects the two most attractive stocks to buy each month, and also determines when to sell them.