Summary:

- In 10 years, Nu reached 94 million customers through a lean business model, and by focusing on user experience, the bank is beginning to threaten the big banks.

- Despite the strong growth in the number of customers, the company does not have tight margins, on the contrary, Nu has the highest margins among its peers.

- However, the valuation is extremely stretched with a P/B of 8x. And despite having excellent management, I believe that Nu will face major challenges to continue growing.

J Studios

Investment Thesis

I recommend holding shares of Nu (NYSE:NU). Nu achieved an incredible feat, the bank was able to scale operations in the middle and low income segments in Brazil, characterized by high default rates, and still be profitable in its operations. The digital bank created just 10 years ago is already a real threat to large banks and could reach 100 million customers by 2024.

Now, Nu plans to scale its operations in Mexico and in the high-income segment of Brazil. With a stretched valuation of 51x P/E and 8x P/B, the market seems to be pricing in a perfect scenario where the company will be able to replicate its success, but I am skeptical about Nu’s ability to reach these new markets with the same efficiency.

Introduction

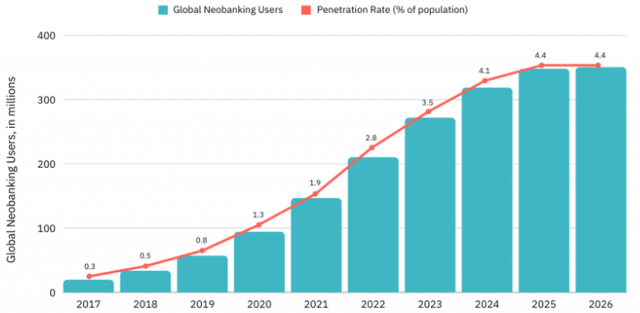

Neobanks have been revolutionizing the banking market with their wide range of financial services. Studies indicate that the global neobank market was valued at $18.6 billion in 2020 and is expected to grow at a compound annual rate of more than 50% until 2026, when will it reach $333.4 billion.

Data indicates that transactions carried out by neobanks are expected to reach $6.37 trillion in 2024. The average transaction ticket per user in the Neobank market is expected to be $21.11 thousand in 2024, while user penetration should be 3.89% in 2024 and is expected to reach 4.82% in 2028. Finally, the number of users is expected to reach 350 million by the end of 2026:

Global Neobanking Users (Grand View Research)

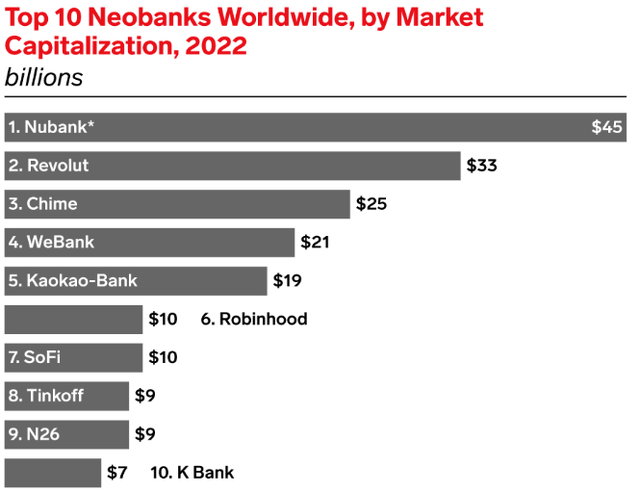

Brazil is a global reference when it comes to neobanks. More than 43% of the population uses a neobank app. The country also has the largest digital bank in the world, Nu, which has a higher valuation than big names Revolut, Chime, Robinhood (HOOD), SoFi (SOFI) and N26:

Top 10 Neobanks (Simon-Kucher & Partners)

Now let’s better understand the history and how the business model made the company stand out worldwide.

History

Nu was created in 2013 in the city of São Paulo and started as just a zero-fee credit card managed by a mobile app and, through rapid growth, has expanded into a full-service banking offering, from checking accounts to investments and insurance.

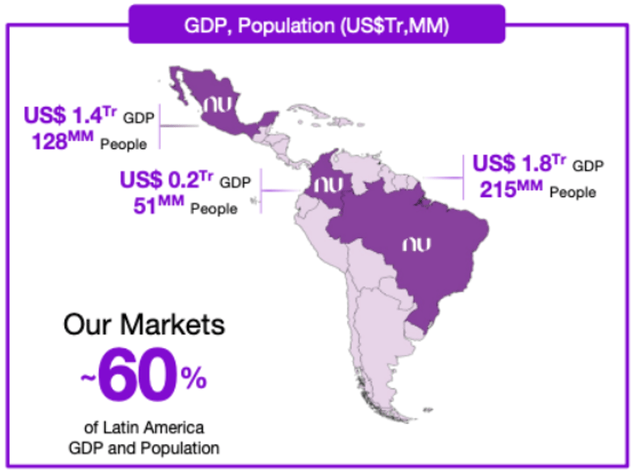

The company currently has 94 million customers in Brazil, Mexico and Colombia, making it the largest neobank in the world and the 5th largest financial institution in Latin America.

Addressable Market (IR Company)

Now, let’s better understand what stage the business is at in each of the countries where the company operates.

Brazil

Around 10 years ago, the Brazilian population was served by 5 large banks: Banco do Brasil (OTCPK:BDORY), Bradesco (BBD), Itaú (ITUB), Santander (BSBR) and Caixa Econômica. These banks did not offer the best service to the population in my view. Nu then appeared, and little by little it grew and expanded its banking operations.

Currently, Nu has one of the most valuable brands in Brazil, and is close to reaching the number of customers that Itaú has achieved in its 100 years of history. Nu recently did a survey with Mastercard (MA) that brought interesting insights:

- Brazil is at an advanced stage of banking compared to LatAm. Brazil has card penetration in 70% of the population, and 55% make great use of it.

- Around 84% of adults have access to financial accounts but may lack financial education to progress on the inclusion journey. Furthermore, one in two adults in Brazil already has an account on Nu.

- The study also suggests that making payments with prepaid cards can be a starting point for accessing financial products. More than 80% of people who used Nu’s prepaid card used it as their first financial product, then 67% started to have access to credit products, and 36% progressed to making investments.

Mexico

In the Mexican operation, customer growth continues to accelerate. After the launch of Cuenta Nu, there was a record of almost 1 million net additions in the quarter, totaling 5.5 million customers and making Nu the largest card issuer in Mexico.

Nu’s investment in Mexico exceeds US$1.3 billion, and it is already one of the largest foreign investors in Mexico. However, Nu intends to expand its products, including investments, salary portability and higher deposit limits. To this end, Nu México requested a banking license from the National Banking and Securities Commission (CNBV), the local regulator.

Generally speaking, a banking license in Mexico allows financial institutions to offer various types of investments, including equities, salary portability, car loans, high-value mortgages, products aimed at SMEs and access to a higher level of insurance.

Colombia

Nu Colombia already has more than 500 thousand customers inviting others through its referral plan and continues to maintain an NPS close to 90, well above the industry average. The company recently announced its digital account for Colombia, where it reached more than 400 thousand users at launch. Cuenta Nu has an annual return of 13% and is very competitive.

Mexico and Colombia have a combined population similar to that of Brazil, which has 203 million inhabitants. But the accounts show us less than 1% of Nu’s customers. Now let’s better understand the bank’s business model

Business Model

Until it reached its current scale in Brazil, Nu monetized in two ways:

- The main source of revenue is interchange. Every time you make a purchase with your credit card, the merchant pays a fee. Part of this money goes to the card machine, another part goes to the brand, and a third part goes to Nu.

- The second source of income is interest charged by those who delay the invoice or finance it. Nu started out offering lower interest rates than the market (50% on average), but changed that a few years later.

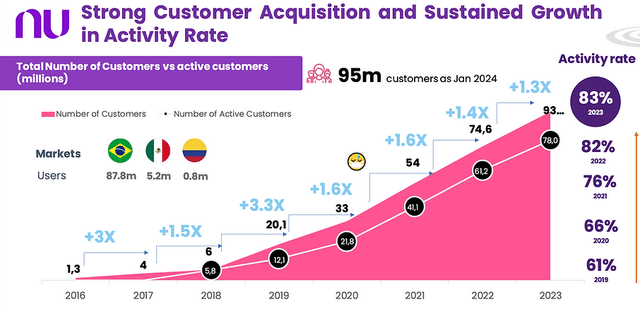

To ensure profitability in this business model, Nu focuses on efficiency, technology and application experience. Using this business model, the company achieved this growth:

Number of Costumers (IR Company)

With this large customer base, the company offers other services of excellent quality, such as insurance, investments, loans, among others. Now let’s analyze the company’s fundamentals versus its competitors and understand how its leadership in the global neobank market is reflected in its numbers.

Nu Fundamentals

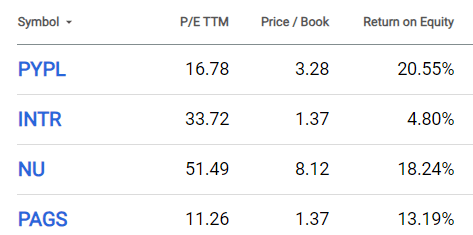

As Nu is the largest neobank in the world, I intend to compare it with peers in Brazil and USA, such as PayPal (PYPL), Inter (INTR) and PagSeguro (PAGS):

| Ticker | Nu | PayPal | Inter | PagSeguro |

| Country | Brazil | USA | Brazil | Brazil |

| Market Cap | $52B | $67B | $2.3B | $3.7B |

| Revenue | $3.7B | $29.8B | $0.6B | $3.2B |

| Revenue Growth 3 Year [CAGR] | 105% | 11.5% | 52% | 33% |

| Net Income | $1B | $4B | $0.06B | $0.3B |

| Net Income Margin | 28% | 14% | 9% | 10% |

| ROE | 18% | 20.5% | 4.8% | 13% |

Well, in our financial analysis, it is clear that Nu has a disruptive business. The bank has the highest revenue growth among its peers in the last 3 years and has not lost margin as a result, as Nu also has the highest margin among its peers.

But we need to make some reservations. PayPal can be considered a winner in its business, being the first pure fintech in the world. However, PayPal has 426 million customers and a market value very close to Nu, which has not yet reached 100 million customers. Does that make sense? This disparity supports my thesis of holding the shares.

It is interesting to highlight that PayPal has a different business than Nu; however, it currently has a higher ROE. To deepen our reflection, let’s see the valuations of the companies below.

Valuation Is Stretched

Let’s perform a comparative evaluation of Nu against its peers and analyze the P/E TTM, and the Price / Book with the Return on Equity:

P/E, P/B and ROE (Seeking Alpha)

When we look at the valuation based on the P/E multiple, the company is expensive compared to its peers. And when we look at the P/B multiple, we have the same conclusion, even with PayPal presenting a higher ROE than Nu.

In my assessment, there is no doubt that Nu is disruptive, but the price is high in my view, which is why I recommend holding the shares while waiting for a better entry point.

Another evaluation metric that shows how expensive the company is through its market cap divided by the number of customers:

| Ticker | Nu | PayPal | Inter | PagSeguro |

| Number of customers | 95M | 426M | 27M | 30M |

| Market Cap | $52B | $67B | $2.3B | $3.7B |

| Market Cap / Number of Costumers Ratio | 547 | 157 | 85 | 123 |

Once again, we came to the conclusion that Nu is expensive compared to its peers, and finally, we will analyze the Quant Rating and Factor Grades data from Seeking Alpha to make sure that the company’s shares are expensive.

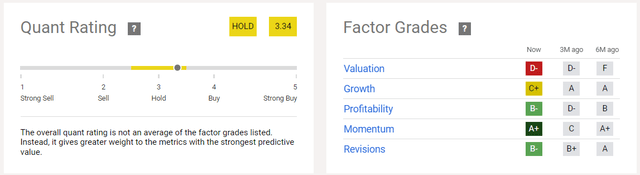

Nu According to Seeking Alpha Quant Rating and Factor Grades

Using Seeking Alpha Quant’s tools to corroborate my explanation so far, I see the company has excellent scores for profitability, momentum and revisions:

Quant Rating and Factor Grades (Seeking Alpha)

However, the tool gives a bad rating for valuation, and indicates a hold for the company’s shares, confirming my thesis for the case. But before concluding that the company’s shares are expensive, it is necessary to understand the projects and check whether they have the potential to justify the valuation. So, let’s see the company’s latest results.

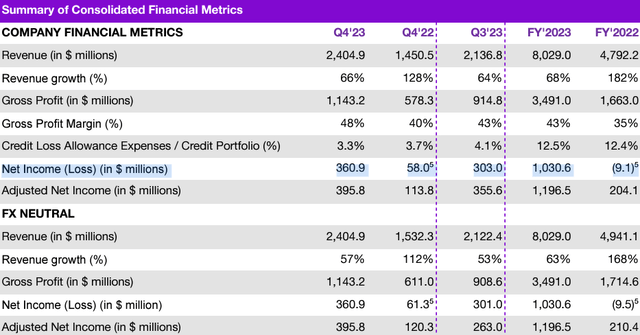

Latest Earning Results

Nu surprised with its results in 4Q23. Although the $361 million profit (23.5% ROE) fell short of the $400 million that many local investors were expecting, the quarter was still very strong.

Net profit was in line with consensus, but with an EBT of $560 million, 10% above consensus. And this even with greater investments in Mexico, which brought $ 1 billion in deposits, but at a high cost/CAC, at least in the initial phase.

In this sense, Nu recently stated that it intends to grow in Mexico and in the high-income segment in Brazil, but will it have the same success as it has achieved so far? Let’s better understand the risks to the thesis.

Outlook For Mexico And Risks

The recent National Financial Inclusion Survey finds that, in May 2022, only 49.1% of adults aged 18 to 70 had a bank account. Although 3.4 million people have been included since 2018, they represent growth of just 2%.

The profile is totally different from the Brazilian population. In Brazil, only 3% of the population currently does not have a bank account, and Nu was the winner by bringing a better product to people who did not have good service with their previous bank.

Nu’s CFO himself stated that operations in Mexico will not reach profitability in 2024. And he stated that the bank needs to “learn how to work with people who have no credit history.”

I’m not disbelieving Nu’s potential to scale in the Mexican market, however, a P/B above 8x is high for me while the company tests the best way to captivate Mexican consumers, which apparently still has a culture of greater security, including preferring cash over a digital account. What about the bank’s plans to reach the upper-income class in Brazil?

Outlook For Brazil And Risks

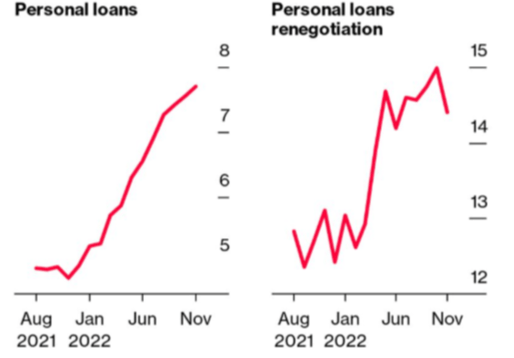

Another priority for Nu is to reach the high-income public in Brazil, and this is an even more difficult task in my view. Nu managed to achieve profitability by scaling the low and middle income audience in Brazil, and this is incredible as this audience has been showing huge defaults in recent years:

Delinquency (Brazilian Central Bank)

But how did Nu achieve this? Nu is committed to providing the best service and delivering the best application experience. The bank also managed to build a brand and was thus able to serve very well customers who until then had been “forgotten” by others.

This is a much more difficult audience to work with, both in credit analysis and in several other nuances, which is why several Brazilian banks specialize solely in the high-income segment, such as BTG Pactual and Itaú.

Itaú, for example, is currently the largest bank in Latin America. The bank is 100 years old, has more than 4,000 physical branches, and has expertise built over decades to serve the high-income niche. In this segment, the customer has a private account manager, and it doesn’t seem so simple for the customer to “abandon” all this security to use a digital account.

As I see all these difficulties in the niches that Nu intends to reach in the future, I reiterate my recommendation to hold the shares, giving the benefit of the doubt to the bank’s managers, who are very good.

The Bottom Line

Nu’s success in reaching 90 million customers in 10 years while being profitable is reflected in a stretched valuation of 8x P/B and 50x P/E. The market seems to ignore the new challenges that the company will face in its strategy of reaching scale in the Mexican and Brazilian high-income markets.

It is necessary to emphasize that the recommendation is not to buy exclusively for valuation reasons. Nu’s management has done a great job; however, it seems dangerous to me to price a business to perfection in all the operations it carries out.

Based on this analysis, I recommend holding Nu shares. In my view, the company has already proven its excellence in being able to scale business and be innovative, however, the risk/return on investment ratio does not seem attractive to me given the challenges that the company will face.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.