Summary:

- AGNC Investment Corporation’s profit prospects are set to improve despite the resurgence of inflation.

- The stock price has recently bounced off the 200-day moving average line, indicating a bullish trend.

- AGNC Investment has seen the second consecutive quarter of tangible net book value growth, making it an attractive investment.

Nuthawut Somsuk

AGNC Investment Corporation (NASDAQ:AGNC) is a large mortgage REIT whose profit prospects are set to improve moving forward, ever after the latest inflation numbers were revealed.

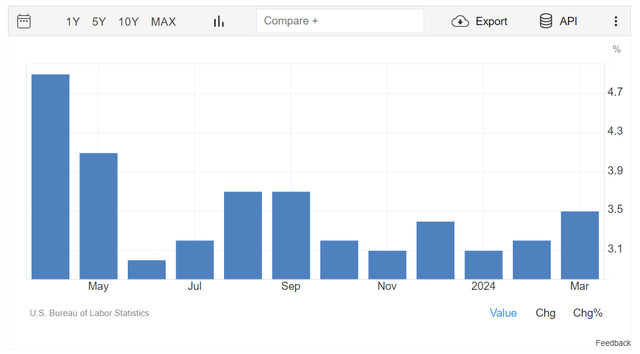

With consumer prices going up 3.5% in March, following a 3.2% increase in February, the resurgence of inflation is a short-term headwind for mortgage trusts.

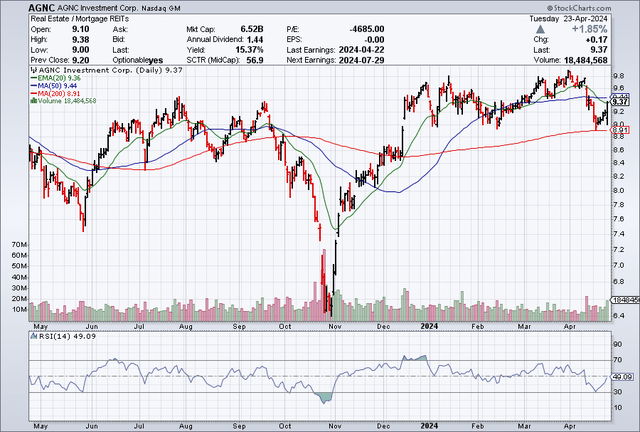

However, AGNC Investment’s stock price has recently bounced off of the 200-day moving average line, which makes the chart picture a lot more bullish in the short- and medium-term.

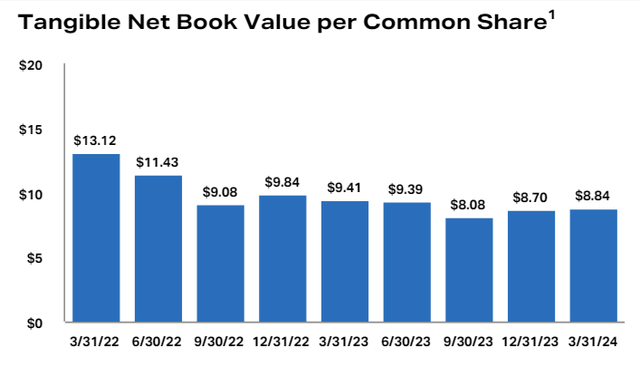

I think that the value proposition for AGNC Investment has improved since the mortgage REIT reported earnings for the first quarter, particularly because passive income investors have seen the second consecutive quarter of tangible net book value growth.

My Rating History

I modified my stock classification for AGNC Investment from Buy To Hold due to the mortgage trust selling at a premium valuation.

With inflation coming in hotter-than-expected in both February and March, higher short-term rates represent a risk for mortgage trusts, but we are moving closer to the end of the rate hiking period. With cuts anticipated in the latter half of the year, AGNC Investment could see ongoing book value growth.

Portfolio Review

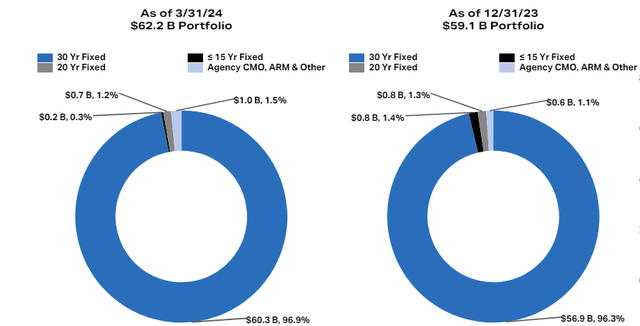

As of March 31, 2024, AGNC Investment’s portfolio consisted mainly of 30-year fixed rate mortgages that produce recurring income for the mortgage REITs.

Like Annaly Capital Management, Inc. (NLY), AGNC Investment is mainly invested in high quality mortgage-backed securities. The Agency portfolio was valued at $62.2 billion as of the end of 1Q24, representing a 5% QoQ increase.

Portfolio Overview (AGNC Investment Corp)

Based on the last reported inflation figures that came out at the beginning of the month, inflation heated up again in March, with prices rising more-than-anticipated and reaching the highest point since September 2023. The uptick in inflation is highly relevant for a large mortgage REITs like AGNC investment because the central bank is likely to keep interest rates elevated, but only in the short-term.

The central bank is widely anticipated to lower short-term interest rates in the latter half of the year which implies that mortgage REITs are faced with a lower-cost environment which in turn could improve the profitability of AGNC Investment.

Furthermore, falling short-term interest rates are poised to be a valuation catalyst for mortgage-backed securities on which mortgage trusts like AGNC Investment and Annaly Capital Management.

Inflation (U.S. Bureau Of Labor Statistics)

Technical Analysis

AGNC Investment’s stock just bounced off the 200-day moving average line which sends a bullish signal for the mortgage REIT’s chart profile.

AGNC Investment is technically in neutral territory with the Relative Strength Index flashing a value of 49.09, but recent selling pressure (after inflation numbers were reported) did not cause the resistance line to break.

Though AGNC Investment in neither overbought nor oversold, the successful test of the 200-moving average line pushes AGNC Investment into a bullish setup.

Moving Averages (Stockcharts.com)

Second Consecutive Quarter Of Book Value Gains

With less spread volatility and lower interest rates on the horizon, pressure is coming off of AGNC Investment’s portfolio and book value which can be seen in the chart below that shows the trust’s tangible net book value per share.

In 1Q24, AGNC Investment’s net book value was $8.84 per share, reflecting a QoQ increase of 2%. It was also the second consecutive increase for the mortgage trust’s net book value after the central bank’s start of the rate hiking cycle in 2022 obliterated AGNC Investment’s book value.

Tangible Net Book Value Per Common Share (AGNC Investment Corp)

AGNC Investment Offers An Improved Value Proposition

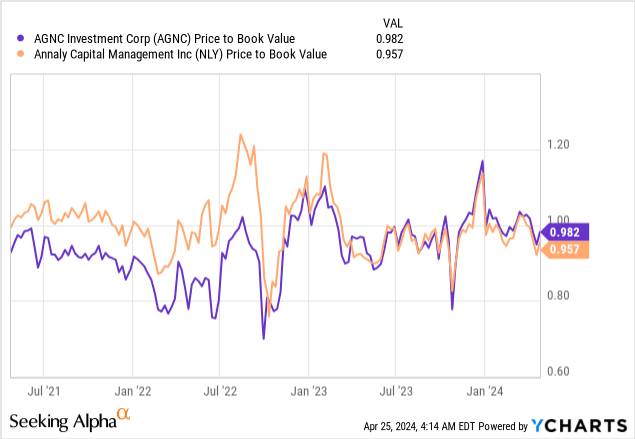

AGNC Investment’s stock is presently selling for a 2% discount to GAAP book value which makes a purchase interesting from an intrinsic value angle. AGNC Investment’s GAAP book value is my reference point for intrinsic value as the company mainly invests in highly liquid mortgage-backed securities that could be sold quickly.

AGNC Investment’s GAAP book value is $9.54 per share which means passive income investors can buy the mortgage trust’s 15% yield at a small discount to book value.

Annaly Capital Management is selling for a 4% discount to GAAP book value which is also an increasingly attractive value proposition for passive income investors. Both AGNC Investment and Annaly Capital Management managed to claw their way back to a premium valuation after the central bank gave guidance for potential rate cuts in December 2023.

Why An Investment In AGNC Investment Might Disappoint

The recent inflation trend is to a certain extent a cause for concern because higher inflation also means higher-for-longer short-term rates which might delay a catalyst for AGNC Investment’s mortgage-backed securities portfolio.

AGNC Investment, however, stands to profit greatly from a reset of short-term interest rates and taking into account that the stock can be bought below book value, I think the risk/reward relationship has become more compelling.

My Conclusion

AGNC Investment’s second consecutive increase in its tangible book value is a very assuring development. The mortgage REIT recently bounced off of the 200-day moving average line as well which is sending a bullish signal to investors.

With AGNC Investment’s stock selling below book value again, I think that the mortgage trust is in an increasingly attractive setup. Though it may take longer for short-term interest rates to get slashed, it will only be a question of time until the central bank lowers rates, thereby paving a path for the trust’s MBS portfolio to re-rate higher.

From a risk standpoint, I think the value proposition has improved for AGNC Investment and I am modifying my stock classification from Hold to Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AGNC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.