Summary:

- AMD stock has seen significant gains in the recent past, but fundamentals have failed to keep pace.

- In fact, AMD’s operating income has been declining steadily over the past 3 years, while analyst estimates for future revenue and EBIT have plummeted.

- I argue that market participants have made a major mistake pumping up the stock; and, investors will now likely experience the correction of this mistake.

- On a technical level, AMD stock has already started to break aggressively, dropping close to 30% from all-time-highs made in early March this year.

- Looking at AMD’s upcoming earnings release for the second quarter of 2024, I expect the sell-off to continue. My target price stands at $101.

bunhill

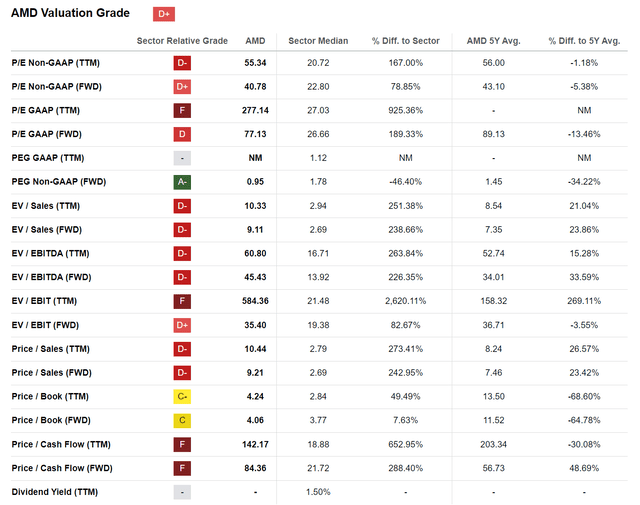

Advanced Micro Devices (NASDAQ:AMD) stock has been a big winner over the past few years: Bolstered by the sentiment tailwind associated with GenAI, the shares have returned approximately 63%, compared to a gain of less than 20% for the S&P 500 (SP500), a 3x out-performance. However, investors should note that this bull run has exclusively been driven by multiple expansion. Today, AMD shares are trading at a rich 9x EV/Sales (FWD) and 45x EV/EBITDA, suggesting overvaluation relative to the sector by approximately 240% and 230%, respectively.

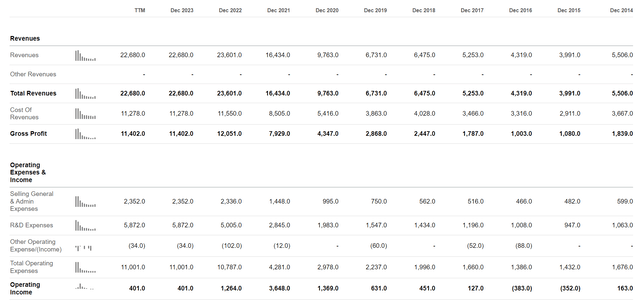

In theory, when stocks show such a rich valuation as seen with AMD, then the underlying companies usually show strong earnings growth. However, this has not been the case for AMD. In fact, AMD’s operating income has steadily contracted over the past 3 years: for the trailing twelve months, AMD has generated about $401 million of operating income, compared to $3.6 billion of operating income reported in CY 2021.

Now, readers will be right to point out that my argument discusses historical numbers, and investing is all about the future. On that note, I highlight that projected fundamentals for the next 12-24 months do not look rosy enough to justify AMD’s valuation either — despite the strong chip demand momentum on the backdrop of the GenAI hype.

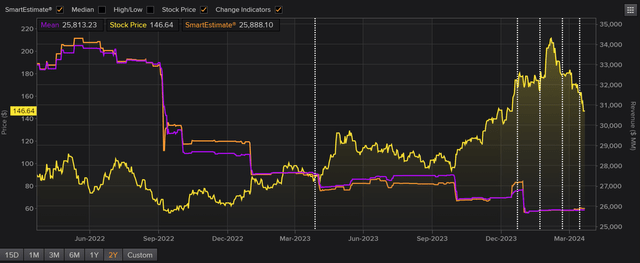

According to data collected by Refinitiv, analyst estimates for AMD’s FY 2024 revenue numbers have steadily decreased over the past 2 years, while shares have rallied. Compared to estimates projected in Summer 2022, AMD’s topline expectation for FY 2024 are now about 25% lower, trending around $26 billion.

Similarly to the trend seen in sales numbers, EBIT expectations have plummeted: As of late April, analyst consensus expectations call for a FY EBIT of around $6.6 billion, which is approximately 40% lower than what was projected about 2 years earlier.

Pointing to the diverging numbers observed in AMD’s fundamentals/ analyst projections versus the share price performance, I argue that market participants have made a major mistake pumping up the stock; and, investors will now likely experience the correction of this mistake. On a technical level, AMD stock has already started to break aggressively, dropping close to 30% from all-time-highs made in early March this year.

Cavenagh’s Expectations For AMD’s Q1

Looking at AMD’s upcoming earnings release for the second quarter of 2024, I expect the sell-off to continue. On a high-level note, I think that the fundamentals for compute vendors in the first quarter were possibly weaker than expected. In fact, the momentum for PC builds in Q1 has reportedly slowed materially compared to the stronger trends observed in Q4. According to data collected by Counterpoint Research, global PC shipments in Q1 2024 are estimated at 56.8 million, down about 13% QoQ compared to 65.1 million seen one quarter earlier, in Q4 2023. Meanwhile, AMD faces rising competitive intensity in AI accelerators, notably from Nvidia with their Blackwell chip, as well as custom chip rivals including Broadcom (AVGO) and Marvell (MRVL). Zooming in on Nvidia’s Blackwell, I highlight that the company teased a 2 to 5 times performance improvement over their current AI product, Hopper. Moreover, Nvidia also seems willing to sell Blackwell for less than twice the price of Hopper. Looking ahead to 2025, analysts broadly expect that AMD will generate around $9 billion of sales with MI300, which would reflect a market share of 7-8%; however, I am concerned about whether these targets are realistic given competitive dynamics. Similarly, while it is true that AMD has potential upside in AI GPU revenue, investors must also acknowledge – again – Nvidia’s dominance within the graphics processing market, which should again limit AMD’s market share and growth upside over the foreseeable future.

Specifically pointing to financials, I expect the following from AMD’s Q1 2024 print:

- Data Center: Revenues should remain stable as growth in MI300 sales offsets declines in server CPUs.

- Personal Computing: Expected to decline by about 10-15% from the previous quarter, which is in line with seasonal trends, but also reflects worse-than-expected PC sales momentum.

- Gaming: A significant drop in revenues, likely 25-35% YoY, reflecting broader market trends and inventory adjustments.

- Embedded Systems: A decline in sales of 10-15% YoY, due to ongoing inventory adjustments.

So overall, I see AMD’s Q1 sales coming in at around $5.2-5.3 billion, compared to $5.5 billion estimated by consensus, and compared to $6.2 billion reported in the prior quarter. On profitability, I expect gross margins are predicted to improve slightly, driven by pricing power and a more value-accretive product mix; However, margin benefits should be offset by higher R&D expenses.

Another, more structural, risk that I see relates to AMD’s exposure to China. Investors should note that AMD, like many global technology companies, has significant exposure to the Chinese market, both in terms of sales and supply chain dependencies. On that note, the U.S.-China trade relationship has been marked by increasing tension, with technology and telecommunications being a focal point of disputes. In that context, on April 12th, The Wall Street Journal reported that China has directed the nation’s top telecommunications providers to stop using foreign-made chips. According to the mandate, telecom companies must switch out international core processors with domestic ones by 2027. Last year, AMD reported that 15% of its sales came from China.

Fair Value Likely At $101 Per Share

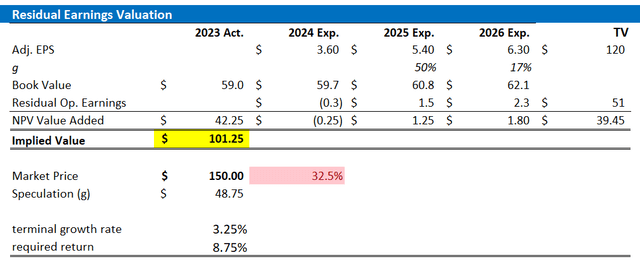

I continue to view a residual earnings model as the adequate framework to value AMD shares; however, since I last covered AMD on November 11th, I am updating my numbers in line with analyst consensus estimates as collected by Refinitiv (+/- 10%). That said, I now project that the chip-designer’s EPS in 2024 will likely end up somewhere between $3.5 and $13.7.

Additionally, I am updating my EPS forecasts for 2024 and 2025 to $5.4 and $6.3, respectively. Concurrently, while I maintain a terminal EPS growth rate of 3.25% beyond 2026, I lower my cost of equity assumption by approximately 50 basis points to 8.5%, primarily to reflect a more favorable interest rate environment. Given the highlighted updates, I now calculate a fair implied share price for AMD equal to $101/ share, seeing close to 30% downside.

Refinitiv; Company Financials; Author’s Calculations

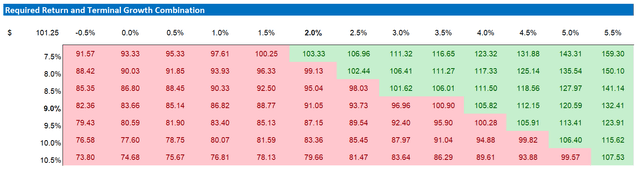

Below is also the updated sensitivity table.

Refinitiv; Company Financials; Author’s Calculations

Investor Takeaway

AMD stock has seen significant gains in the recent past, but fundamentals have failed to keep pace. In fact, AMD’s operating income has been declining steadily over the past 3 years, while analyst estimates for future revenue and EBIT have plummeted. I argue that market participants have made a major mistake pumping up the stock; and, investors will now likely experience the correction of this mistake. On a technical level, AMD stock has already started to break aggressively, dropping close to 30% from all-time-highs made in early March this year. Looking at AMD’s upcoming earnings release for the second quarter of 2024, I expect the sell-off to continue. My target price stands at $101.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.