Summary:

- Altria’s stock has been depressed due to global regulatory concerns and a decline in combustibles, but it has a strong portfolio of alternative nicotine products.

- Altria’s recent earnings report showed a decline in smoking and market share loss in some categories, but growth in oral tobacco overall and positive results with NJOY.

- We think the stock is considerably undervalued, and expect that as the business remains stable over time, MO’s multiple will mean-revert higher.

- We initiate coverage on MO with a ‘Strong Buy’ rating.

tomazl/E+ via Getty Images

A few months ago, we penned an article titled “British American Tobacco: 15%-24% Annualized Potential Upside From Now Until 2028”.

The main idea behind the article was that global regulatory concerns around tobacco products were overblown, and that British American Tobacco’s stock (BTI) was significantly undervalued. With dividends, earnings growth, and multiple expansion, we thought the stock could see 15-24% annualized total returns for the coming years, well into the latter half of this decade.

Altria (NYSE:MO), the similarly-sized American tobacco company, appears to be in a similar position. Global fears around the decline of combustibles, along with a relatively hostile regulatory environment have dented investor sentiment, driving the stock down to multi-year valuation lows.

Thus, in the same vein, we think the stock could see significant growth back to our Fair Value estimates, which lie 25%+ above where shares currently trade.

The key difference? In our view, MO is even more well positioned to whether the potential demise of combustibles with its strong portfolio of alternative nicotine products, which includes NJOY, on!, Helix, Copenhagen, and others.

Today, we’re going to explore MO, and look at why, despite the fears, we think the stock could be primed to produce incredibly strong returns over the coming years as earnings grow, dividend payouts continue, and the multiple potentially re-expands.

Sound good?

Let’s dive in.

Altria’s Recent Earnings Report

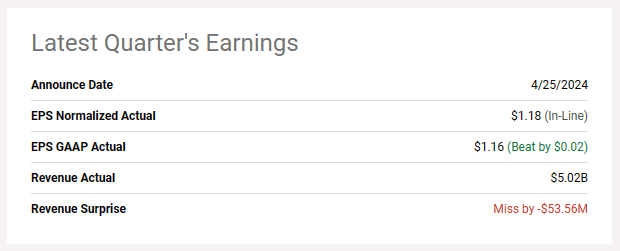

Yesterday morning, MO reported their Q1 2024 earnings, and the report was a relatively calm affair. EPS beat, adjusted EPS came in line, and revenue missed slightly:

Seeking Alpha

The stock had a moribund reaction, only moving up 1.44% on the day.

Putting this report into context, it would appear that a few things are currently going on under the hood at the company.

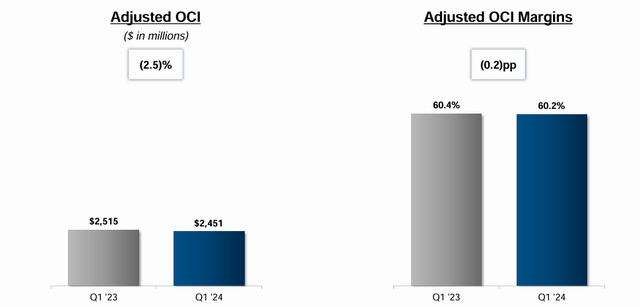

First off, it’s clear that smoking is on the decline. This much has been known for years now by basically all market participants, but still, the trend is persisting. YoY operating income and margins were both down for combustibles in Q1 2024, which shows the consistent headwind that MO’s core profit driver is currently battling:

These numbers also mask a large 9% drop in total stick volumes, which shows just how quickly overall demand is dropping for combustible products domestically.

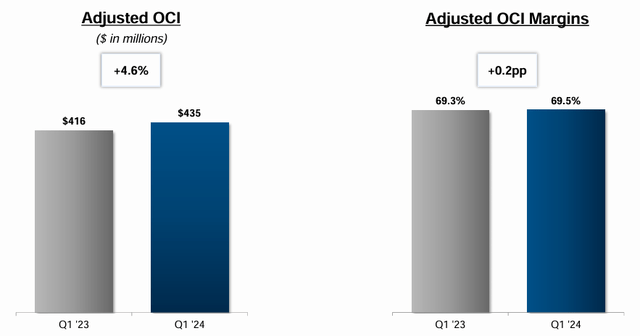

Oral tobacco was a mixed bag as well, with OCI and margins both growing slightly over the last year:

With higher margins and growing volumes, oral tobacco is beginning to contribute more and more to the company’s bottom line performance, a trend that we expect will continue.

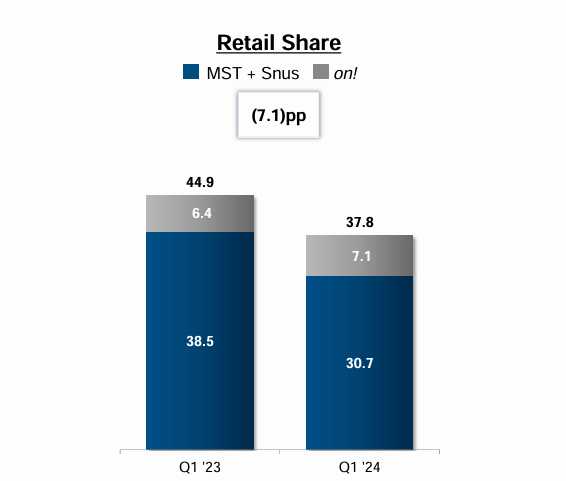

That said, MO did see a significant 7.9% loss of market share in MST + Snus, which was only partially ameliorated by growth in MO’s ‘on!’ brand:

Investor Presentation

This report shows just how much share Zyn (PM) has been taking from competitors, although management remains somewhat confident that current MST users switching to nicotine pouches will begin to switch more to the owned ‘on!’ line of products.

We think this assertion remains to be seen, but the company’s oral category as a whole should have a relatively stable/positive outlook going forward, hopefully recapturing some share from competitors.

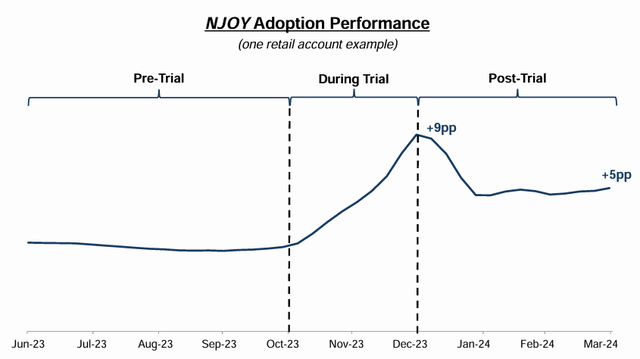

Finally, the company did manage to log an unmitigated win with NJOY. Following some retail account trials, MO saw an increase in adoption, with a solid, higher base stick following promotion:

In other words, after trying an NJOY product, consumers liked it and on average bought more of it than they did before trying it. This speaks to a strong product offering that we think could gobble up share looking ahead.

Some analysts have mentioned that growth for competitor products has been faster on a larger revenue base, but we think the progress here is more than enough to warrant excitement, especially given how nascent this effort is.

Taken together, we see MO’s future looking something like this:

- Sticks volume declines substantially in the coming decade, which is partially ameliorated by higher ASPs.

- on! grows considerably, and cannibalizes MST somewhat but also gains share more broadly in oral as a whole. As a higher margin product, this should boost MO’s profitability.

- NJOY grows enough to offset combustibles revenue losses by 2028, which should drive stronger results in the future.

Thus, MO is likely to see a structural change in revenue and profit composition going forward, with stable to lower revenues, but higher earnings on those revenues due to better velocity in high margin products like on! and NJOY.

In short, while the decline in combustibles is a drag, we expect that the company will be able to whether the storm and transition into a more profitable company down the line.

In the grand scheme, combustibles are dying slowly – there’s time for management to make the change.

Value

But what is the stock worth?

Right now, shares are trading at around $44 per share.

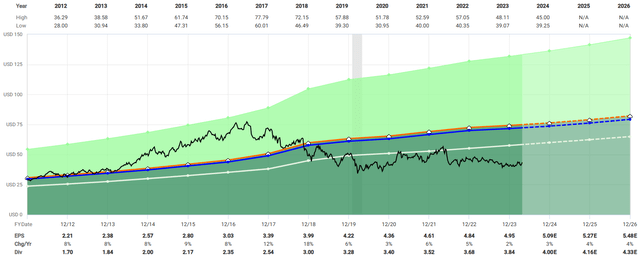

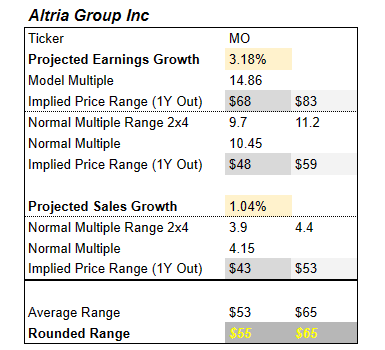

To us, realistically, we think the company is worth much more – more likely somewhere between $55 per share and $65 per share:

PropNotes

How did we arrive at this conclusion?

In short, by blending up the company’s expected earnings growth and revenue growth, along with historical and model multiples on those projected results.

Graphically, it can be seen visually by looking at the following chart:

After trading in a somewhat ‘expensive’ state throughout the 2010’s, the stock has become much cheaper following Covid. We expect that the company’s continued strength in results will cause investors to re-evaluate the stock and bid it up higher to where it has traded previously. At the very least, there is a significant margin of safety in buying up the stock at these levels.

In addition, the relaxing of global regulations that were set to target the industry should provide relief in investor sentiment in the sector.

Ultimately, whether or not the stock does end up re-rating higher, the robust dividend does a good job of incentivizing investors to wait, paying out a well-supported 9% in cold hard cash, no strings attached.

To us, the setup looks like a clear cut ‘Strong Buy’.

Risks

How does this go wrong?

There are a number of risks associated with an investment in MO, chief among them being the risk that our timeline is off.

If the sticks market dries up sooner than expected, it could leave MO without significant enough cash flow to re-fill its coffers from investments made into oral and smokeless products today. Lower earnings leads to a more dangerous looking dividend, which may lead to a cut and/or a lower overall market cap.

Additionally, the issues around oral market share losses to Zyn pose some concern. While on! is growing and seeing solid results, if MO loses substantial position in oral, which is one of the two markets that management is hoping to supplant combustibles with, then it could hurt earnings. Doubly so, given that the oral category also reports higher-than-average operating margins than the business as a whole.

Finally, there’s the risk that investor sentiment stays poor, and the stock simply trades down here at this bargain-basement valuation for the foreseeable future. We don’t think this will be the case, but it can take some time for positive developments to work their way through the market’s psyche. The 9% dividend does cushion this risk somewhat.

Summary

Overall, we’re bulls on MO. There are risks around the combustibles market, as well as concerns around Zyn stealing share as on! tries to play catch up, but if you zoom out, you’ll see a highly stable, profitable company, paying an immense, well supported dividend, that’s trading at an extremely attractive price.

For us, as value-conscious traders and investors, it’s hard to label that as anything other than a ‘Strong Buy’.

Cheers!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.