Summary:

- AT&T is growing customer count and margins in its wireless and broadband businesses, offsetting a drag from Business Wireline.

- This growth, along with lower debt payoff and capex requirements, sets up the likelihood of a dividend increase in 2025.

- Short-term concerns, like the network outage and data breach, are being handled by management and have not significantly impacted financial results.

- The stock remains cheaper than Verizon with better EPS and dividend growth potential, keeping AT&T a Buy.

Luis Alvarez

Still Laying The Groundwork For Share Price Recovery

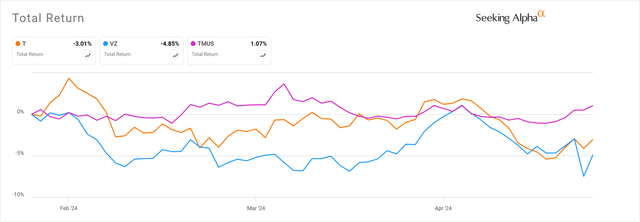

I have been covering AT&T’s (NYSE:T) quarterly earnings regularly here on Seeking Alpha. I have rated it a Buy since July 2023, during which time the stock has returned over 16%. The share price has stalled out in 2024, however, trading mostly sideways since my last article, where I labeled AT&T “The Ultimate Patience Tester”.

AT&T stock performance this year has not been out of line with its two biggest competitors, Verizon (VZ) and T-Mobile (TMUS). An increase in longer-term interest rates since the start of the year probably played into this, making AT&T’s and Verizon’s dividends less attractive by comparison. However, the market has also been fed a couple of pieces of bear fodder this quarter specific to AT&T. First, the company experienced a service outage on Feb. 22. This was nothing nefarious but was a significant internal error resulting from improper procedures during an expansion project. Second, the company announced at the end of March that customer data had been released on the dark web. While we would prefer these types of incidents not happen in the first place, AT&T’s response has been appropriate, and I do not expect them to have a long-term impact on financial results.

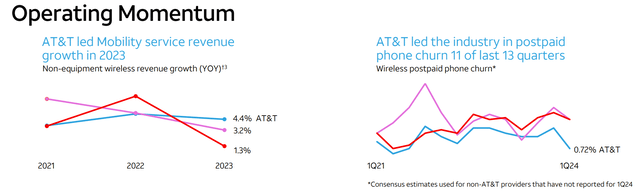

On the metrics that I think do matter, the AT&T’s Q1 results show that the company is on track to deliver its strategy to grow profitable 5G wireless and fiber customer relationships. The company had 349,000 postpaid phone net additions in the quarter. While this growth rate is slowing, it continues to show relative strength compared to peers. Wireless service revenue growth went from tied for last place in 2021 and 2022 to best in class in 2023. The company even managed to grow average revenue per user 1% compared to Q1 2023 even with the rebates provided to customers for the February service outage. The outage also did not seem to affect customer retention, as postpaid phone churn was a company record and best in class low of 0.72% in Q1.

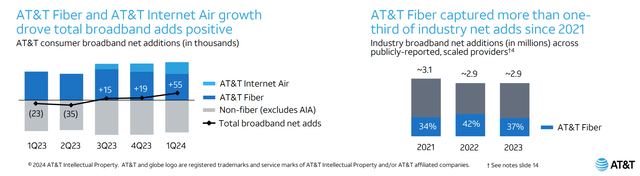

On the broadband data side, AT&T remains committed to its unique fiber strategy but is also deploying wireless internet through its AT&T Internet Air product. As a result, the company’s growth in these two delivery methods is now exceeding the number of drops in older technology, resulting in net positive subscriber growth. While this growth is lower than T-Mobile and Verizon, who are much heavier into fixed wireless internet, AT&T is still capturing over 1/3 of total industry broadband net additions over the last 3 years.

Fiber remains a better solution for internet access, especially for larger households with higher data usage. This allows AT&T to earn more per connection than competitors. Fiber ARPU in Q1 was $68.61, up 4.1% from last year, and new fiber customers are paying over $70 per month on average.

Finally, it’s worth calling out the Latin America segment. While this business unit is small, it continues to have strong growth with sales up over 20%. The business just swung to positive operating income in Q1 after having turned EBITDA positive a couple of years ago.

The one drag on these positive results is the Business Wireline segment, which continues to have declining sales. Operating income is even on the verge of going negative. This is because of fast-dropping revenues from legacy voice services. To mitigate this, AT&T is speeding up its planned cost cuts in this business unit, part of the overall planned $2 billion per year savings across the company by 2026. The company is also promoting Internet Air for business, which can allow it to grow share by adding more small businesses, rather than the large enterprises that used its legacy services.

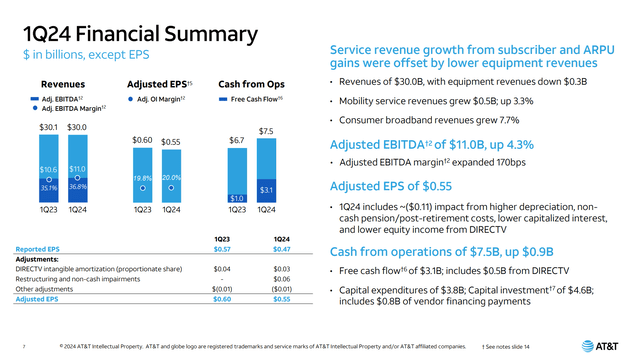

As we see from the Q1 financials, these efforts are producing improvements in operating margins, and while EPS is not growing yet, the decline of the past few years seems to be bottoming. With Q1 non-GAAP EPS of $0.55, the company is on track to deliver the 2024 guidance of $2.20 per share. Free cash flow is improving at a faster pace, reaching $3.1 billion in the quarter, compared to $1.0 billion in Q1 2023. Reduced capex and vendor financing helped drive this, but operating cash flow was up as well, even with a lower contribution from DirecTV.

Market reaction to these results on earnings day has been mixed, with the stock ranging from up 3.2% to down a little. However, the results show that the strategic areas of wireless and broadband are growing enough to counter worse than expected performance in Business Wireline. While AT&T won’t suddenly turn into a growth stock, or even grow faster than T-Mobile, which is unburdened by legacy wireline businesses, the results do indicate that the company can support its generous dividend and possibly increase it once the leverage target is reached next year. The stock now yields 6.6%, close to Verizon despite AT&T’s cheaper valuation.

Capital Management

Following the WarnerMedia (WBD) spinoff, AT&T was slow to pare its debt levels due to the need to invest in spectrum for its 5G build out. With this cash requirement behind it, we are now seeing debt being paid off at a faster pace. In the past 4 quarters, net debt has come down $6 billion, to $128.7 billion from $134.7 billion last year. In terms of leverage, that takes net debt/EBITDA to 2.94 from 3.22.

While free cash flow improved considerably compared to Q1 last year, it is still seasonal, so the full year target of $17-$18 billion is still intact after delivering the below-ratable $3.1 billion in Q1. The $1.11 total dividend will use $8 billion of cash. There is an additional $7 billion of debt due this year, so AT&T can easily pay this out of FCF with an additional $2.5 billion left over to rebuild cash balances drawn in Q1.

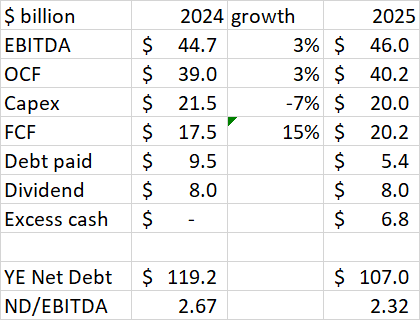

At the end of 2024, we should therefore see net debt $9.5 billion lower, or $119.2 billion. The EBITDA guidance remains at 3% growth from 2023, or $44.7 billion. That puts year-end leverage at 2.67.

Looking ahead to 2025, I am predicting continued modest EBITDA growth of 3% and continued moderation in capital spending. Under these conditions, AT&T can reach the $20 billion FCF goal set out at the time of the WarnerMedia spinoff, albeit a couple of years late. The company also has an unusually low amount of debt due in 2025, at $5.4 billion. (The average debt due per year over the next 4 years is $7.25 billion. See Note 11 of Form 10-K for details.) Paying off the $5.4 billion of debt while keeping the dividend the same would produce $6.8 billion of excess cash and result in a below target leverage of 2.32. This strongly suggests the possibility of a dividend increase in 2025.

Author Spreadsheet

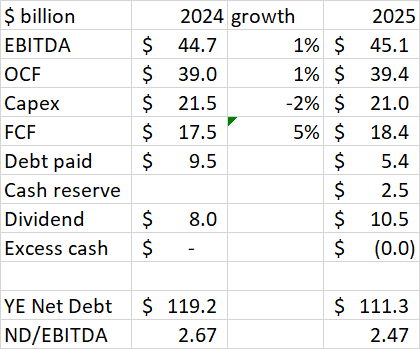

It’s understandable for investors to be skeptical about this forecast given the performance of the last few years. However, even a more conservative case suggests the likelihood of a nice dividend raise. Let’s assume EBITDA grows only 1% and capex declines only $0.5 billion. Additionally, let’s say AT&T reserves an extra $2.5 billion for debt payoff since 2025 has less than usual debt due and 2026 has more. Even in this case, there is room for $2.5 billion worth of dividend increase. This would take the dividend to $1.46 annually ($0.365 per quarter), a 31.5% increase from the current level. The company would still hit its 2.5 leverage target in this case.

Author Spreadsheet

Valuation

With a 2024 earnings estimate of $2.20 per share, AT&T is valued at 7.6 times earnings. Verizon is forecasting EPS of $4.60, valuing it at 8.6 times earnings. This 12% discount is about the same as it was 1 quarter ago. While Verizon’s EPS decline from 2023 to 2024 is only 2.6% compared to 8.7% for AT&T, we see that AT&T has superior expected forward EPS growth. Looking at 2028 estimates, we see that AT&T is expected to earn $2.51 in 2028 (3.4% CAGR), while Verizon’s 2028 EPS estimate is $4.96 (1.9% CAGR).

AT&T and Verizon are both less than half the P/E valuation of T-Mobile, which has a much higher EPS growth rate of 20% per year on average through 2028. T-Mobile is not burdened by legacy wireline services and is probably a better pick for those investing for total return. As a dividend play, however, AT&T is the clear winner over Verizon with a similar current yield, better payout growth, and a lower valuation.

Risks

Loss of customer satisfaction from any further network outages would be a risk for AT&T, however the one incident in February does not seem to have increased churn. Financially, most of the cost of this incident was already accounted for in Q1, so further impacts should be minimal.

The customer data breach in Q1 appears to be from a data set from 2019 or earlier. It impacted approximately 7.6 million current AT&T account holders and approximately 65.4 million former account holders, according to the company’s press release. This does not put it in the list of top 10 data breaches by number of users, but with social security numbers among the data involved, it could have an outsize impact on individuals on the list. AT&T is providing credit monitoring to the affected individuals. That is a minimal cost compared to the size of the company, but a bigger risk is the possibility of regulatory scrutiny, legal claims, or reputational damage. I do not consider this risk unusually specific to AT&T and expect nearly every large company to face a data breach in the future, but for now, AT&T is the one in the spotlight.

As discussed last quarter, the ACP, or Affordable Connectivity Program, is expiring this month. This was a government subsidy for low-income consumers to obtain internet access. As these customers were low-margin, there will not be a big impact on AT&T’s income statement, but the company may update its capital plans, including deployment of additional AT&T Internet Air service to help retain these customers. They may also offer discounts, with the goal of retaining these customers and moving them to a higher cost plan when they can afford it.

Conclusion

AT&T is now showing growth in customer count and revenue from its focused investments in 5G and fiber growth strategy. Unfortunately, this is being offset by a decline in Business Wireline, delaying recovery in net income growth.

Still, AT&T will be able to pay off all debt due in 2024 and cover its 6.6% dividend yield. Looking forward, both capex and debt payoff requirements should be lower in 2025, setting up the likelihood of a dividend increase next year.

AT&T is still valued more cheaply than Verizon despite better forward growth projections. While recent problems including the network outage and data breach are yellow flags, the company is managing through them and does not appear to have lost customers as a result. The stock is a Buy for dividend investors based on the well-covered 6.6% yield with the potential for growth next year.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.