Summary:

- Verizon’s Q1 earnings were mostly in line with expectations, with EPS beating by $0.03 and revenue missing by $230mn.

- The company’s free cash flow increased by $400mn, driven by a reduction in CapEx.

- The stock’s performance has been affected by higher interest rates, but I believe rate cuts later this year will be a catalyst for a rebound.

marketlan/iStock via Getty Images

Written by Sam Kovacs

Introduction

Since suggesting buying Verizon (NYSE:VZ) in February, the stock has gone… nowhere. That is fine by me, I’m in no rush. Good things take time.

Verizon just reported its earnings for the 1st quarter of 2024. Its results were mostly in-line, with EPS of $1.15 beating by $0.03, and company revenue of $32.98bn missing by $230mn. Now, I know $230mn seems like a lot of money, but it really is just 0.6% off of analysts’ estimates. As far as I’m concerned, the results came in line with analyst expectations.

In my February article, I concluded:

We could see the payout ratio further decline in 2024, which is encouraging.

VZ’s price decline was an anomaly, it is now among the 8% of stocks in the US with the best momentum, and should continue to have a strong year.

Now is still a fantastic time to load up.

Alongside the earnings report, the macro backdrop and our outlook has shifted somewhat during the past 3 months, which justifies an update on our VZ outlook. Let’s dig in.

Q1 results: Encouraging developments

Let’s start our discussion of results with a few soundbites from the latest earnings call (emphasis is mine).

On the Q1 results:

Our execution in the first quarter keeps us on track towards our full year 2024 guidance, as we continue to deliver against our key financial metrics. We grew Wireless Service revenue and adjusted EBITDA and generated solid free cash flow.

On CAPEX and capital allocation:

We are back to business as usual level on CapEx spend, as we had promised. And we have struck a balance between profitable growth and free cash flow that supports both our dividend and a stronger balance sheet. This gives us greater flexibility to accelerate deleveraging throughout the second half of the year, bringing us closer to our long-term leverage targets. Our dividend is healthy and secure, and our free cash flow dividend payout ratio continues to improve.

We are focused on putting our board in a position to continue to raise the dividend each year, building on our current industry record of 17 consecutive increases.

This is what we expected coming into 2024, and so far, I’m quite satisfied with what we’ve seen so far.

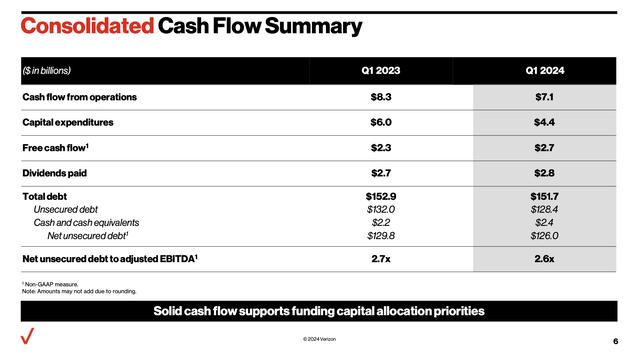

As you can see in the table above, free cash flow is up $400mn in a quarter where cash flow from operations was down $1.2bn. This is simply a function of CapEx being $1.6bn lower. What contributed to the lower cash flow from operations? Well, there was an interest expense drag of $300mn, then there was a voluntary pension contribution of $365mn, and other working capital investments which should normalize throughout the year.

So the real point of concern is the higher interest expense. While the debt load has been improving, investors are often concerned by the $151.7bn sticker. That seems like a lot of debt. In reality, it is 2.6x EBITDA, and on the way down.

The timing has been good for VZ. It completed a large CapEx cycle with 5G just as it would start to feel more pressure from interest rates. However the reduction in CapEx vastly outpaces the increase in interest expenses, which frees up cash flow, and should continue to show better metrics as the year advances.

Operationally, I think the investing community is not giving VZ enough credit, and is treating it like a bond proxy. Talking of which…

Higher for longer: The biggest share price risk

Last week there was — let’s see, how can we put this — a recalibration of expectations regarding the market and interest rates.

Jerome Powell turned hawkish, saying:

The recent data have clearly not given us greater confidence and instead indicate that it’s likely to take longer than expected to achieve that confidence. Right now, given the strength of the labor market and progress on inflation so far, it’s appropriate to allow restrictive policy further time to work and let the data and the evolving outlook guide us.

I think the market is now overly pessimistic on inflation and when rate cuts will come, and still believe that sometime this summer will see a first rate cut. (I explained my views in a recent article, so check those out, I won’t repeat all the details here)

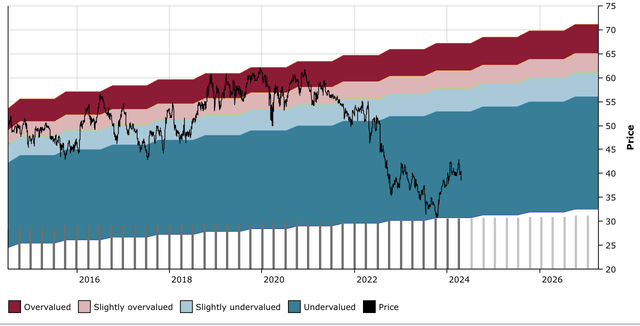

And you see, this will be a big catalyst for VZ. Yes, because it means interest expense will be lower in the future. But more because the stock is trading as a bond proxy, because of its stable dividend, high cash flow and steady eddy nature. As you can see on VZ’s DFT chart below, the stock fell hard in 2022, outside of its historical range, as higher rates drove the stock lower.

VZ DFT Chart (Dividend Freedom Tribe)

How can we explain this? Two obvious ways. The first is that as rates go higher, investors expect more yield from equities because they can get a high risk-free yield. The second is that as rates go higher, the risk of the stock goes up because of the higher interest payments, and therefore investors sell it.

The consequence of all of these viewpoints are the same: As long as rates remain higher, and that the opinion is that rates will remain higher, VZ will fail to make a comeback.

If rates remain higher for longer, and in a worst-case scenario where they are not cut, we will not see any resumption of bullishness regarding VZ’s share price. The dividend is not at risk as the lower CapEx spending in upcoming years frees up a lot of cash even despite the higher rates.

However given that I believe that we will see rate cuts this year, that will be our catalyst for VZ’s stock to bounce back. I believe $50 to $55 to be very fair share price targets.

Dividend profile and Valuation

For a patient income investor, VZ offers a fantastic 6.7% yield, which provides ample income to dividend investors. Even if it continues to grow at just 2% per year, you’ll be handsomely rewarded, especially if you reinvest the dividends.

At 15x earnings, VZ isn’t exactly expensive, but as dividend investors we know that P/E or DCF models of valuations are limited. The former are only applicable to comparing among peers, and must be adjusted for growth considerations. The latter are only as good as the inputs. I’ve seen first-hand analysts change numbers in their fancy Excels to get a DCF value which matches their assumptions.

Here’s the thing. For the past decade, VZ yielded between 3.95% and 5% for 75% of the time. The remaining 25% of the time, it has yielded more. Nearly all of that period has been since 2022 when the Fed raised rates.

Since 2023, it has yielded as much as 8.6% and as little as 6.4%. I believe that the 8.6% bottom was overly pessimistic, so we can likely tighten up the range from say 6.5% to 7.5%.

This gives us two valuation ranges: one between $35 and $42, which will likely last until sentiment towards rate cuts eases, and one between $53 and $66, which VZ will return to over time when rates abate.

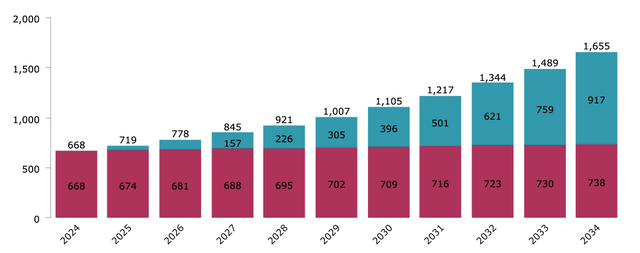

Assume you invest $10K in VZ today, and reinvest the dividends yearly at a similar yield as the dividend grows at 2% per year. Then 10 years from now, you’d be receiving $1,655 in annual dividends, or 16.55% of your original investment.

VZ Income Simulation (Dividend Freedom Tribe)

This is a phenomenal level of income, as I’m sure you’d agree.

Conclusion

To conclude, I’d say that while the macro backdrop is challenging VZ’s price in the short term, and could make it drop back to $35-$36, management is executing perfectly on their plans regarding CapEx, cash flow, and deleveraging, the dividend is safe, and I still believe that October 2023 marked a long-term bottom for VZ. It’s one of my top steady eddy picks for 2024, and the Q1 results confirmed this.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want to Buy Low, Sell High & Get Paid to wait…

The first thing you want to do is hit the orange "follow" button, so we can let you know when we write more dividend related articles.

But if you want the best experience, join the Dividend Freedom Tribe!

Our model portfolios are ahead of the market, and our community of nearly 900 members is always discussing latest developments in dividend stocks.