Summary:

- Exxon Mobil’s share price has increased by over 16% while the S&P 500 has only increased by a few percent.

- The company had strong quarterly results, but now has a high valuation of almost $470 billion.

- Exxon Mobil’s growth engine is in Guyana, but there are risks associated with the company’s slow adjustment to climate change and a volatile pricing environment.

CHUNYIP WONG

In February, we discussed Exxon Mobil (NYSE:XOM) as a company that was a valuable opportunity due to its steady execution. Since then, the company’s share price has gone up by more than 16% versus close to 3% for the S&P 500. That, combined with a weaker pricing environment, shows how the company needs perfect execution to justify its valuation.

Exxon Mobil Quarterly Results

Exxon Mobil had strong results from the quarter, but investors need to pay attention to what’s now a lofty valuation of almost $470 billion.

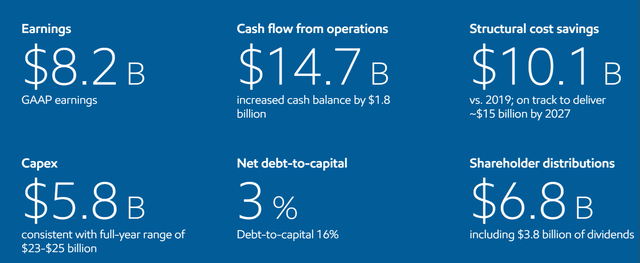

Exxon Mobil Investor Presentation

The company had $8.2 billion quarterly GAAP earnings, giving the company a P/E ratio of more than 14. The company had $14.7 billion in CFFO, and continues to invest heavily in its business, to the tune of almost $6 billion in capital expenditures. That means the company’s FCF is $9 billion, giving the company a FCF yield of 7.6% annualized.

It’s not bad FCF, but it’s nothing to be particularly excited about from a shareholder return perspective. The company’s net debt remains minimal, and the company does continue to spend most of its cash flow to shareholder returns, primarily through a dividend of just over 3%. Those are total shareholder returns of almost 5.8%, a strong yield.

Exxon Mobil Guyana

The company’s growth engine continues to be Guyana. There’s an asterisk here that the company has filed for arbitration over Chevron’s planned acquisition of Hess Corporation. Chevron has said that it will walk away if it cannot purchase Guyana, but there is an outcome where Exxon Mobil can purchase Hess Corporation’s stake in Guyana, helping it substantially.

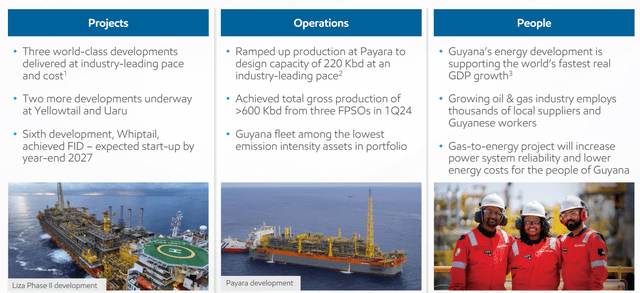

Exxon Mobil Investor Presentation

The company has continued to build up numerous world-class FPSOs with three already delivered at an industry-leading pace and cost. The company has two more developments underway at Yellowtail and Uaru, which together will add almost 500 thousand barrels / day of production. The company has also achieved an FID on Whiptail.

The 4th and 5th projects will take production from the asset towards a massive 1 million barrels / day, as the company’s 3 FPSOs have passed >600 Kbd in production in the 1Q24. The immense assets and fleet here will enable substantial shareholder returns.

Exxon Mobil Growth Projects

Exxon Mobil’s growth projects are expected to substantially help overall earnings, showing continued strength in execution.

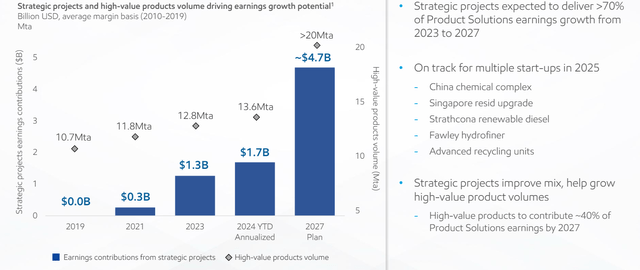

Exxon Mobil Investor Presentation

The company is focused on building a strong portfolio of high-volume products, and by 2027 it expects to have >20Mta, providing billions of USD in profits. The company expects these projects to drive a substantial % of the company’s growth. The company has multiple projects that are started up and with a high-grade portfolio, it can continue to upscale them.

These growth projects with high margins connected to the company’s existing assets make it a valuable investment.

Exxon Mobil Investor Presentation

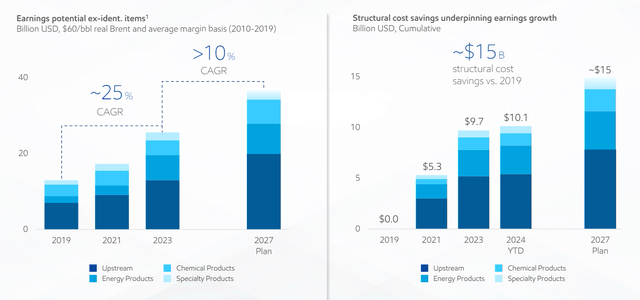

The company expects overall earnings to be able to increase substantially from current levels towards $40 billion by 2027. The company expects to be benefited by structural cost savings as well. Overall earnings of almost $40 billion would show some consistent earnings growth.

However, it also shows how the company is overvalued.

Exxon Mobil Guidance

Exxon Mobil is focused on continued strong shareholder returns as a part of its guidance. However, to justify its valuation, the company needs to maintain its strength.

Exxon Mobil Investor Presentation

The company expects double-digit earnings growth through 2027 as it ramps up Guyana and continues to ramp up a number of other strong initiatives based on the company’s assets. The company expects structural cost efficiencies will help the company significantly as well. However, with a P/E of more than 14x, the company needs significant earnings growth.

However, even with this earnings growth, the company is still going to have a double-digit P/E ratio. That’s at the relatively high prices in the current market. The company also operates in a market where long-term demand remains questionable as the world moves beyond fossil fuels. Exxon Mobil is slow to adjust to climate change and that remains a huge risk.

The company at its current valuation can’t easily drive double-digit shareholder returns, making it a poor investment in a risky environment.

Thesis Risk

The largest risk to our thesis is the pricing environment. Brent crude is at just a hair under $90 / barrel, with continued conflict in the Middle East, however, natural gas prices remain incredibly weak at less than $2 / mmBtu. LNG projects are expected to continue growing, supporting prices, but the overall market is expected to remain weak. That could dramatically hurt earnings.

Conclusion

We discussed above how Exxon Mobil was a strong investment due to its steady execution. Since then, the company’s share price has gone up almost 20%. That has changed the thesis for the company and its ability to continue driving long-term shareholder returns. The company now needs perfect execution, especially in a volatile pricing environment.

That’s tough to do. The company has long-term risks if oil and natural gas demand go down, and already in the U.S. natural gas demand is being pressured. LNG can help, but the problem with commodities is inelastic supply, that could put strong pressures on prices. We don’t recommend selling Exxon Mobil, but we recommend being cautious about additional investments at current prices.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.