Summary:

- Textron is a conglomerate involved in defense, aviation, industrial products, and more.

- TXT stock plunged by about 10% after the company reported Q1 results for 2024, presenting a buying opportunity.

- Textron’s Q1 earnings slightly missed expectations, but the company completed $317 million in share buybacks and has strong earnings estimates for the future.

Ryan Fletcher/iStock Editorial via Getty Images

Textron Inc. (NYSE:TXT) is a conglomerate, leading in defense, aviation, industrial products and more. This company owns several well-known brands such as Bell, and Cessna, which can be seen below. Textron makes everything from planes to golf carts, to helicopters to snowmobiles. I have followed this company off and on for years, and what brought me to take another look just now is because the stock plunged by about 10%, after the company reported Q1 results for 2024. I think the stock is likely to rebound after this selloff and view this as a solid buying opportunity. Let’s take a closer look:

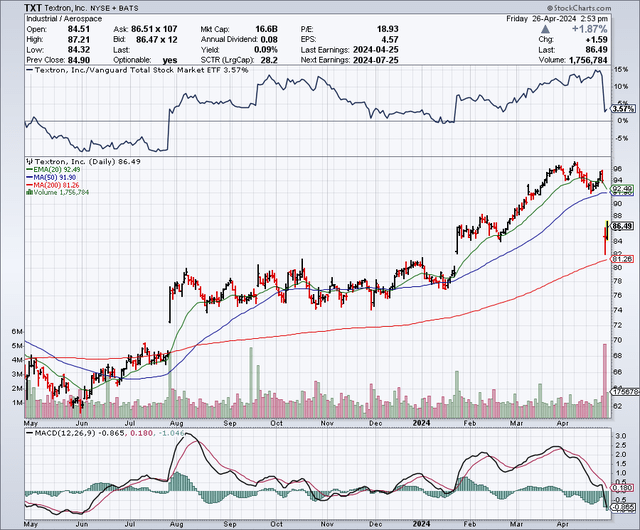

The Chart

As the chart below shows, this stock had been in a solid uptrend since the start of 2024, but the shares plunged after the company reported Q1 earnings. The 50-day moving average is $91.90 and the 200-day moving average is $81.17. After the Q1 earnings plunge the stock is now trading just slightly above the 200-day moving average and this should be a strong support level.

Q1 Earnings For 2024

For Q1, 2024, Textron reported non-GAAP earnings of $1.20 per share, which was a slight miss of $0.03. Revenues for the quarter came in at $3.13 billion, which was up 3.3% year over year, but a miss by $130 million. For the full-year, Textron is guiding for between $6.20 to $6.40 in non-GAAP earnings per share. During the quarter, Textron completed $317 Million in share buybacks.

The company also said it was expanding a 2023 restructuring plan and that would include some layoffs in 2024, which will result in severance costs of $25 million to $30 million in the second quarter of 2024. The market did not seem to like this news or the very slight miss, but the nearly 10% drop in the share price after the earnings report was released could have also been due to the fact that the stock had run up into earnings and was due for some profit taking and consolidation.

Earnings Estimates And The Balance Sheet

Analysts expect Textron to earn $6.31 per share in 2024, with revenues coming in at $14.65 billion. For 2025, earnings estimates are at $7.03 per share, on revenues of $15.42 billion. For 2026, earnings are expected to rise to $7.79 per share, with revenues at $15.93 billion. With Textron shares trading around $86 right now, this implies a price to earnings ratio of just over 13 times for 2024, and even less looking forward to 2025, and 2026 earnings estimates.

Textron also has a very strong balance sheet with $4.26 billion in debt and $2.12 billion in cash.

The Dividend And Share Buybacks

Textron’s dividend is so small that it is hardly worth mentioning, but with the amount being so small, it also has a lot of room to grow larger if the company wanted to do so. Textron pays a quarterly dividend of just $0.02 per share, which totals $0.08 per share on an annual basis. When looking at the dividend history of this company, it does not seem like either the dividend payout or increasing it, is something that management is focused on. However, it is worth noting that what Textron lacks in dividend yield, it is more than made up for in share buybacks when it comes to being shareholder-friendly.

Citibank (C) compiled a list of the 20 companies that are buying back the most shares in 2023, and Textron made the list. In 2023, Textron repurchased $1.1 billion in shares, resulting in a 6.5% reduction in the share count. As mentioned earlier, Textron completed $317 million in share buybacks in the first quarter of 2024, so this trend of major share buybacks is continuing into 2024.

Let’s Review Some Of The Different Business Divisions

This company makes a lot of really cool products that have touched most of our lives in some way. Here are just a few of the businesses and products this company makes:

Bell: This company is known for making helicopters that are suited for the military as well as commercial use. In terms of business outlook, Bell has a wide moat in many ways because of the long history of this company and because of the complexity of building helicopters. It does have some existing competition, but it’s very expensive and an uphill battle to start a new helicopter company from scratch. Bell has long-term contracts with the military and just last year, Bell won a huge contract to make helicopters that would replace the Blackhawk which could be worth more than $70 billion over the next ten years.

Cessna: This division makes planes, including very popular turboprops as well as business jets like the Citation. Cessna is a very well-known brand name with pilots and other aviation enthusiasts. It has a number of competitors as well. The small plane market is expected to grow about 5.8% annually for the next few years and possibly through 2030.

Beechcraft: This division offers piston-engined planes and turboprops, and it makes the well-known “King Air” model. Beechcraft also has great brand recognition amongst small plane pilots and enthusiasts. It also has a similar (to Cessna) level of competition and potential growth rate.

E-Z-Go: This company manufactures golf carts and personal use vehicles. E-Z-Go is a well-known brand, but I don’t see this division as having a wide moat because golf carts and utility vehicles are not as regulated or complex to build when compared to aircraft. This business will likely grow (or contract) along with the U.S. economy for the most part.

Cushman: This division offers utility vehicles that are often used by businesses to do maintenance with as well as patrolling sites. It also makes golf carts. Cushman has a similar competitive and growth profile to that of E-Z-Go.

Arctic Cat: This company makes snowmobiles, and all-terrain vehicles for off-roading. Arctic Cat has brand recognition, but again, the moat for a snowmobile maker is not too significant because it is not as complex to build and there is plenty of competition coming from Asia. Here again, I see this business as going the same way as the U.S. economy for the most part. If the economy expands, sales will grow, but this type of expenditure is easy to cut back on when there is a recession.

I think there is potential for this company to spin off or sell some business divisions, and that could unlock significant value for shareholders.

Based On A Number Of Metrics, Textron Appears Undervalued

I think this stock looks oversold and undervalued from a technical viewpoint, but more importantly, I think it is undervalued when you consider the fundamentals. I also believe this stock is trading at a “conglomerate discount”, which is often the case because companies frequently achieve a higher valuation when they are not part of a conglomerate, whereby disparate businesses are all part of one entity. It is less confusing for investors and analysts to value a standalone company or a company that is just in a single sector of business. I bring this up because I believe the different businesses this company owns would be worth more in the event of a spinoff or a sale of one or more of these divisions. That being said, I don’t know of any specific plans for Textron to consider a spinoff or a sale, but there is a history of conglomerates doing spinoffs or sales of certain divisions in order to create shareholder value, so this should not be ruled out and could become a potential upside catalyst if it occurred.

With Textron being a conglomerate with disparate business divisions, it is nearly impossible to find any peers that could be direct comparisons. But there are some other companies that have some overlap with many of Textron’s business divisions.

Polaris (PII) makes snowmobiles and small utility vehicles that compete with Textron’s Arctic Cat snowmobiles and its E-Z-Go and Cushman utility vehicles. I recently wrote an article about Polaris because it also appears undervalued, and it trades for just around 12 times earnings.

General Dynamics (GD) owns Gulfstream which is a manufacturer of business jets that compete with Textron’s Citation jets. General Dynamics trades for about 20 times earnings, which is significantly higher than Textron. I think the market gives General Dynamics this multiple because it has a wide moat and many long-term contracts. Textron also has these characteristics in many, but not all, of its businesses.

Lockheed Martin (LMT) owns Sikorsky Helicopters, which competes with Textron’s Bell Helicopters. Lockheed Martin trades for about 18 times earnings, which is similar to General Dynamics, and it also has a wide moat (high barriers to entry) and long-term contracts, as does Textron in some of its divisions.

When you look at the examples above, it is clear that companies that have wide moats in terms of high barriers to entry and long-term defense contracts (like Lockheed Martin and General Dynamics), typically trade for about 18 to 20 times earnings. However, Textron is currently trading for just around 13 times earnings, and that is about the same multiple as Polaris. Yet, Textron has a very significant number of businesses that enjoy the same high barriers to entry and the long-term contracts, as the defense contractors do, but it is trading more like a lower moat company that has no long-term defense contracts. This is another reason why I see Textron as undervalued, and I believe it deserves a higher multiple.

My Buying Strategy

I bought some shares on the post-earnings plunge that Textron just experienced. However, it has rebounded a little already, but it could still retest the recent lows of around $82 per share. This is very close to the 200-day moving average of just over $81 per share. So I plan to buy more shares if the stock trades at or very close to the $81 to $82 range, and of course, below those levels as well. I believe Textron is a good value now based on what its defense contractor and aviation peers trade at, and I think the downside risk from here is limited since Textron is trading close to the 200-day moving average. I would also consider selling put options on some forward months at the $80 strike price to earn some option premium and/or get a chance to buy at this level.

Potential Downside Risks

This company does make military products, so spending cuts in the defense budget would be a potential downside risk. However, it does have a lot of business outside of the defense sector, so that would help to mitigate this risk. Textron could also have potential downside risks from foreign exchange and from product liability that comes as part of manufacturing complex products.

The biggest potential downside risk would be a recession because it would impact almost every business this company owns. A recession could lead to businesses cutting back on major purchases including business jets, and maintenance vehicles, and consumers could curtail spending on snowmobiles and small planes.

In Summary

Textron is a collection of very interesting businesses, and the stock appears undervalued. This company has leading brands in many of the sectors it competes in, and I believe it deserves more of a premium valuation than it has now. There is a lot to like about buying Textron shares, especially after a pullback. This includes the undervalued level of the stock and the fact that Textron has been and continues to be one of the top companies in terms of share buybacks. I like the balance sheet strength this company has, and I also think the company could look at spinning off some business divisions in the future to unlock more shareholder value.

No guarantees or representations are made. Hawkinvest is not a registered investment advisor and does not provide specific investment advice. The information is for informational purposes only. You should always consult a financial advisor.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TXT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.