Summary:

- Airbnb’s profitability has improved by 4,000 bps since 2019.

- The company is becoming a free cash flow generating machine.

- Airbnb’s expansion beyond its core business could unfold new and profitable opportunities.

stockcam

Airbnb

Imagine just for a moment that you have never heard of Airbnb, Inc. (NASDAQ:ABNB). Pretend that it’s just a name and that you have no clue whatsoever about what it means and what it does if it does anything at all.

Upon first hearing about Airbnb, you immediately stumbled across this sentence: “Airbnb has more than 7 million homes all over the world,” taken from its last shareholder letter.

You pause. You read it once again. And you find yourself fascinated by that simple verb full of implications: “has.”

It must be a REIT, which would be your conclusion.

But then, you read on and you find its balance sheet. You expect the company to report its properties, and you bet you’ll find a big number in that item line.

Well, you read through a few times, and you find no place where the 7 million homes are accounted for.

How’s this possible?

Well, you have stumbled upon Airbnb’s secret: The company has 7 million homes available for temporary stays, but it doesn’t own them.

However, Airbnb is so iconic that each of these 7 million homes is named after the company. We all rent an Airbnb, rather than a nondescript “John’s home.”

ABNB’s Business Model

Airbnb is, first and foremost, a community where hosts offer stays to their guests. As a result, the company really offers over 7 million homes, but it never had to face the massive investment of buying them and then maintaining them. What Airbnb does, however, is create a huge network of guests and hosts whose relationships are protected by the company and strengthened through services and policies. Airbnb’s network effect is massive and in every earnings call we are reminded that Airbnb didn’t grow through massive marketing campaigns, but rather through word-of-mouth and imitation. The majority of Airbnb’s hosts started by being guests.

While many believe Airbnb is easily replicable and has thus no real moat, we should not underestimate the value of a well-built network where hosts and guests have found a way to interact positively while receiving value. It’s no easy endeavor to start from the ground up a new platform able to grab from Airbnb its home supply and its guests.

As a result, Airbnb’s business model is quite simple: It matches supply and demand for short-term rental stays. But by doing so, it’s the owner of this huge network, and it has in custody every transaction that moves through the platform. This means Airbnb has two main revenue streams: Fees and interest income. Airbnb’s fees are quite simple: Hosts pay 3% of their revenues, and guests pay 14% of the total price.

However, guests book in advance and pay right away. Hosts are paid only after check-in. During this period, Airbnb holds these funds on behalf of its customers. And since Airbnb has full visibility on when that money will need to be paid, it can manage these funds effectively with short-term investments. The interest income earned is easy money that trickles down to the bottom line with almost no cost of acquisition.

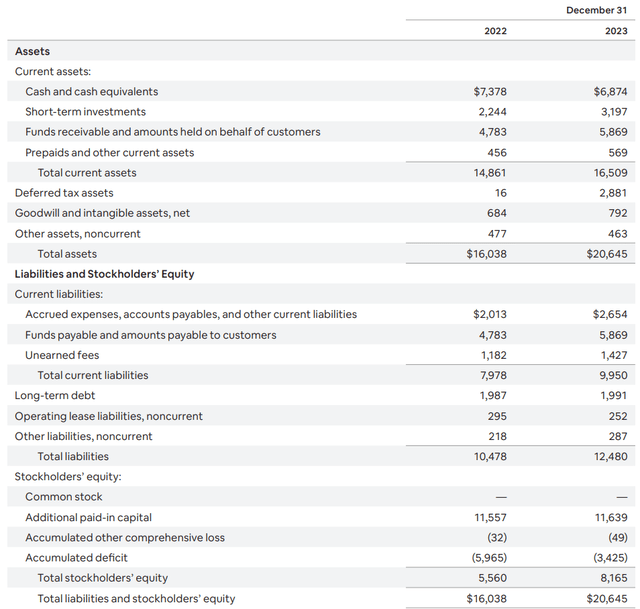

We can understand better Airbnb by looking at its balance sheet:

Here we have the proof of what I have explained above. Property, plant, and equipment is not even mentioned, but it falls under the item “other assets,” which overall is worth $463 million. This is a miniscule amount compared to the company’s total assets worth more than $20 billion.

In addition, we see that Airbnb reports under its current assets the item “funds receivable and amounts held on behalf of customers.” At the end of FY 2023, this was worth $5.87 billion. If we move to the income statement, we see that Airbnb reported $721 million in interest income. This is 15% of Airbnb’s earnings from continuing operations. That’s not peanuts.

Airbnb’s Financials

Airbnb IPOed in late 2020 amid the bull market triggered by the anti-COVID vaccines. While the stock has been quite volatile, shooting up to $200 to then retrace back to $80, Airbnb’s financials have not followed the same path, but have delivered a steady and convincing trajectory of increasing profitability.

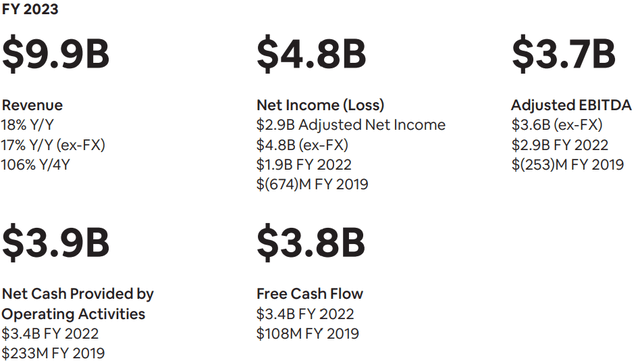

Since its IPO, Airbnb has generated more than $9 billion in FCF thanks to an incredible 4,000 bps margin expansion. In 2019, Airbnb had an EBITDA margin of -5%, while at the end of 2023, it reported a 37%.

In Airbnb’s last shareholder letter, we find some highlights that can give us an idea of the company’s current size.

First of all, Airbnb’s revenues came just shy of $10 billion, with an 18% YoY growth and over a 2x vs. 2019.

Net income was $4.8 billion, a 153% growth YoY and an increase of almost $5.5 billion vs. 2019. However, this incredible number was related to a tax benefit. As a result, the adjusted net income was $2.9 billion, which is still incredible if we consider that in 2019 the company reported net income of $-674 million. Of the $9 billion in FCF generated by Airbnb since its IPO, over 38% were made during FY 2023.

ABNB Q4 2023 Shareholder Letter

This has been possible because, thanks to the crisis Airbnb faced during the pandemic, the company had the opportunity and made the choice to focus only on its core business, making it stronger, seamless, and more resilient.

The results are now before our eyes.

In the last earnings call, Airbnb also explained how it wants to keep offering value by taking action with its hosts to moderate price hikes. The average daily rate (ADR) increased only 3% YoY to $157. Moreover, almost 66% of hosts offer weekly or monthly discounts.

This has helped cancellations decrease by 36% year-over-year, making Airbnb’s network effect even stronger and more effective.

A great success for Airbnb was its 18% growth in active listings, with double-digit supply growth everywhere around the globe. This addressed some concerns investors had about Airbnb not being able to grow its supply anymore.

Ellie Mertz, Airbnb’s CFO, addressed this in the last Morgan Stanley Technology, Media & Telecom Conference:

If you rewind to the early days of the pandemic, like say ’21, our supply completely stagnated. So, supply was not growing. So, what did we do? First, we turned our marketing to host, which is actually something that we had not done previously. And what we saw was that we were able to speak to guests who said, “Oh, I’ve had a great experience as a guest on Airbnb, but I’ve never even considered hosting. Maybe I could host.” And we saw a really nice acceleration in terms of traffic to all of our host landing pages. We then looked at the online experience about onboarding and said, man, there’s a lot of improvement we could do here to make it more intuitive, easier, frankly, more fun to list your space. And so, we revamped that.

We added a feature to the onboarding called setup, where we’ll have a prospective host contact an Airbnb Superhost ambassador and have a human connection to understand what it is like to host and get their questions answered. We improved our AirCover for hosts, which improved the assumption and the belief that Airbnb would be there for hosts when we needed them. […] We were at flat 0% year-over-year growth a few years ago and we ended 2023 at 18%.

Airbnb’s Q4 nights and experiences booked totaled $99 million, a 12% YoY growth. This shows that Airbnb is not done growing, even after the recovery effect after the pandemic started to wind down.

Airbnb’s Inflection Point

Overall, 2023 was a great year for Airbnb and its shareholders. But what matters the most to us is what’s in the pot. As far as I can tell, it has gone somewhat unnoticed that both in the last earnings call and at the Morgan Stanley Conference, Airbnb has talked about new horizons for the company, believing it’s not time to expand beyond its core business.

Brian Chesky, co-founder and CEO of Airbnb, for example, talked about this frontier with the following words:

We spent the past three years perfecting our core service, and now we’re ready to embark on our next chapter. To unlock more growth opportunities, we’re investing in under-penetrated international markets, and we’re seeing great results. Following the success we’ve seen in recent quarters in Germany, Brazil, and Korea, we’re now expanding our playbook to countries including Switzerland, Belgium, and The Netherlands. We also believe that now is the time for us to expand beyond our core business and reinvent Airbnb. While this will be a gradual, multi-year journey, we’re excited to share more about this later in 2024. […] And now that Airbnb’s core business is running at full steam, it can be time to unfold new projects that can lead to more revenue streams

When Airbnb talks about expanding beyond the core, everyone starts thinking about sponsored listings. It would be a tremendous revenue stream. But, so far, Airbnb has been quite cautious with this possible feature. The reason was well explained by Mertz at the Morgan Stanley Conference:

We have the opportunity to transform from effectively what’s been a one-revenue stream business into a business that in coming years, we hope to be layering on incremental services and products to continue to drive top-line growth. One of the historical, I wouldn’t say, obstacles of consideration in terms of Airbnb offering a sponsored listing or a paid placement product is when we think about what is differentiated about Airbnb, it is our exclusive individual host. And when we think about a classic paid placement product, we know that it would likely be preferred by property managers. And so, when we think about how we might roll that product out, we would want to be extremely nuanced such that it didn’t change the distribution of what we were merchandising and what we are known for, which is that differentiated exclusive listing base. That being said, I don’t think that is a non-starter. It’s just something that we will need to be very thoughtful of in terms of how we implement such that we don’t erode what is differentiated to Airbnb.

The reasoning is clear: Airbnb knows its uniqueness is in its exclusive individual host community. These hosts wouldn’t be able to compete marketing-wise with professional property managers. Sponsored listings, therefore, would distort Airbnb’s offering, twisting the platform to the advantage of property managers and the detriment of individual hosts.

So, as Airbnb is about to release its earnings, we should stay tuned and pay close attention to anything hinting about upcoming new business lines Airbnb is going to attach to its core business. From my point of view, before Airbnb dives into sponsored listings, I believe it will strengthen its Experiences business.

Airbnb’s Q1 Earnings

Airbnb’s guidance for Q1 2024 sees the company’s revenue barely above $2 billion, which would be a 13.3% growth YoY. This is a nice growth rate. But we also have to consider that the Easter holiday this year was in Q1. As a result, Airbnb’s take rate (revenue divided by gross booking value) will be higher because of a larger percentage of check-ins on the total booking value. Airbnb estimates the Easter holiday moves around 1 to 2 percentage points of revenues. This is why Q2 estimates see a YoY growth of 10%.

I think Airbnb will beat its guidance. We’re in an environment where last-minute bookings happen and have a big impact, especially in the case of urban stays. Since Airbnb has consistently reported strong recovery in its urban segment, I believe we could see the company report revenues close to $2.1 billion. This would be equal to a 15.5% growth YoY. Without assuming any margin expansion, we would then have around $1.7 billion in operating income. Net income should come above $600 million. This means the company’s quarterly EPS could be close to $0.96, not counting any particular adjustment.

If these numbers are confirmed, it would not be absurd to expect Airbnb to report FY 2024 revenues of $11.5 billion and a net income of $3.45 billion. This would be equal to FY EPS of $5.41, which would make Airbnb trade below a 30 fwd P/E (29.76 to be precise). Considering Airbnb was trading in the high 40s, we’re now in a much better situation and the deal looks reasonable, considering its growth rate (graded with a B+ by Quant).

But what matters even more than Airbnb’s earnings is its free cash flow.

Airbnb, as I have explained, is designed to be an FCF-generating machine, a true powerhouse. It hasn’t reported any capex for the past three fiscal years, meaning its cash from operations coincides with its FCF. Not many companies can achieve such a result.

As of now, operating cash is about 38% of total revenues, which means Airbnb could deliver almost $4.4 billion in FCF by the end of this year. This is a forward FCF yield of 4.3%, which is not expensive.

There’s one issue. Airbnb’s SBC is quite high, reaching $1.12 billion in 2023. This is more or less 25% of the company’s FCF, which is a lot. The company has addressed this issue by approving a buyback program that aims at offsetting the impact of SBC. But, still, this buyback is costly for Airbnb’s shareholders. In 2024, Airbnb has an ongoing repurchase program authorized to buy up to $6 billion of its common stock, which sums up to the remaining $750 million of the previous authorization. More or less, we’re talking about a buyback program worth around 7% of the current market cap.

However, given Airbnb’s strong financials, I would not be surprised to see the company announce its first quarterly dividend, just like Salesforce, Inc. (CRM) and Alphabet Inc. (GOOG, GOOGL) recently did.

Airbnb is sitting on over $10 billion in cash and more will be added during this fiscal year. Since it’s not running a business needing huge capex, the company will soon face the issue of having too much cash on its balance sheet. To me, it is just a matter of time before we hear of Airbnb’s dividend. Given what is going on in the market, a dividend may well be coming sooner than anticipated.

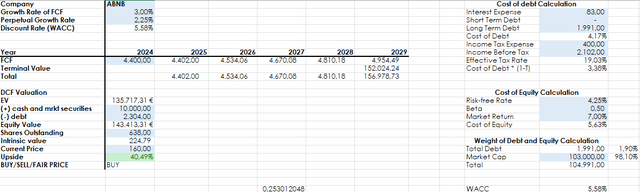

When I run my discounted cash flow model, even when I use a very low FCF growth rate of 3% for the next five years, I end up with a considerable upside of 40%, which equals a target price of around $225.

As much as we try to temper and moderate Airbnb’s prospects, these numbers don’t lie: Airbnb’s growth path is prosperous. This is why I believe Airbnb to be still a buy, even before earnings. And in case the stock drops, it will offer an even better opportunity to step in and take a position in one of the stocks I see better positioned for the next 10 years.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABNB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.