Summary:

- Analyst expectations for AMD’s Q1 earnings are subdued, with weakness in the company’s core business and guidance anticipated.

- Advanced Micro Devices faces growing competition in the processor market, particularly from Qualcomm’s new Snapdragon Elite and Plus series chips.

- Geopolitical risks and the potential slowdown in AI growth could impact AMD’s profitability and valuation in the upcoming earnings release.

da-kuk

Advanced Micro Devices (NASDAQ:AMD) will release its latest earnings on Tuesday after the market close. In this article, I will discuss the expectations and the outlook for competition in the sector.

Analyst expectations for Q1 are subdued

AMD will release its first quarter earnings this week, and some analysts are expecting weakness in the company’s core business and guidance.

The company should post in line, or “slightly weaker” guidance when it reports first-quarter results later this week, due to weakness in the PC market, Susquehanna said.

However, Analyst Christopher Rolland said there could be some upside from AMD’s artificial intelligence offerings, though he added that upward revisions may be “necessary” for the MI300 processor to impact the valuation, Seeking Alpha reported.

However, the outlook for this earnings release has been tempered by rival Intel’s (INTC) first-quarter earnings last week. There were some signs of improvement in the PC market, but the company still reported a loss, while management guidance was below Wall Street’s expectations.

In my view, this will not be a game-changing quarter for Advanced Micro Devices. Data center growth of 38% year-on-year for Q4 was strong, while there were also record quarterly sales for the MI300 Instinct GPU, but investor optimism on artificial intelligence growth has suffered in recent months. It will remain to be seen over coming quarters if the demand for GPUs was front-loaded by the AI hype and geopolitical fears of chip export bans.

A growing portfolio but growing competition

The company noted in the earnings release that it had recently launched the AMD Ryzen 8040 Series processor for mobile and desktop.

The latest chip is said to have significant advancements for AI computing, with “up to 30% greater performance for demanding mobile workstation applications.”

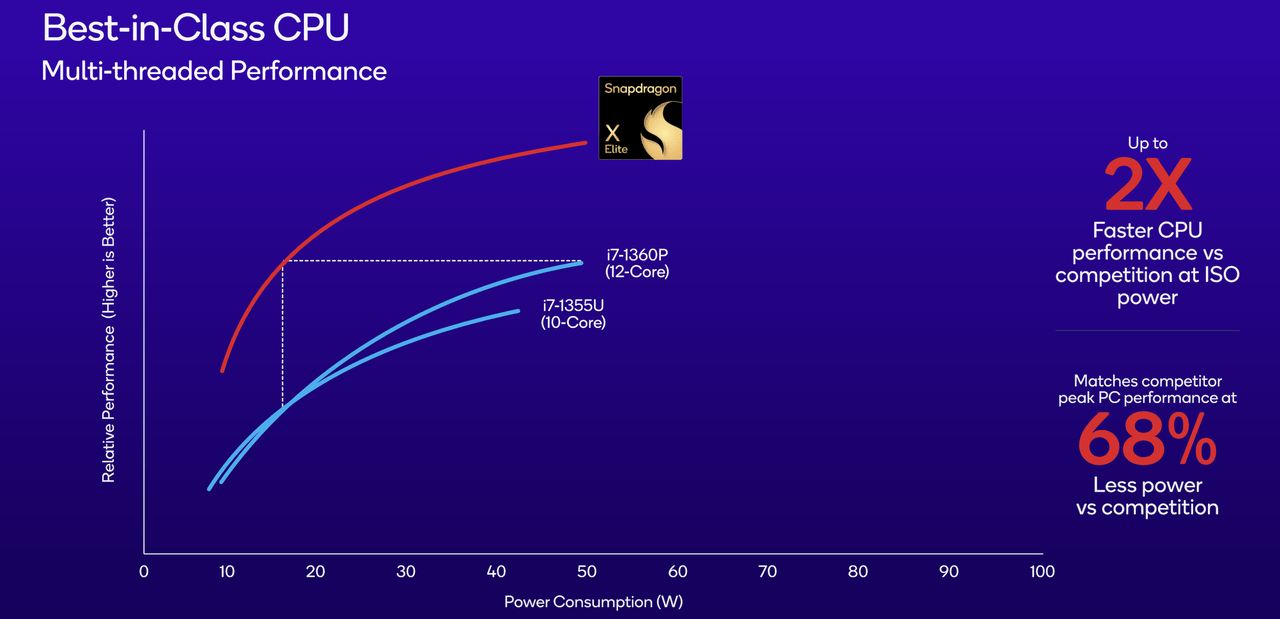

One headwind for AMD could be the growing arms race in processors, and Qualcomm (QCOM) recently announced its new Snapdragon Elite and, Plus series. The company claims that its new chip is superior to similar-level chips from AMD, Apple, and Intel. That could eat into AMD’s market for PC and mobile devices.

Snapdragon Performance (Qualcomm)

This is the headwind for AMD beyond the upcoming earnings in my view, and that is largely based on valuation.

According to Seeking Alpha data, AMD has a forward price/earnings ratio of 43X, which is 83% higher than its peers on average. Qualcomm in comparison has a forward P/E ratio of only 17X.

I tipped the latter for AI-related gains in July of last year, and the stock is currently up 33%. If the Snapdragon chips are successful, then it can grab new market share.

The market expectations for the semiconductor industry have been rattled in recent weeks after Taiwan Semiconductor lowered its forecast for 2024, while Super Micro Computer failed to pre-announce its upcoming earnings.

Growing inventory is also a problem at AMD, with $4.35 billion inventory as of December 2023, up from $3.77 billion a year earlier. That may require a future write-off, as technological advances could make it irrelevant.

Geopolitical risks versus AI growth rate

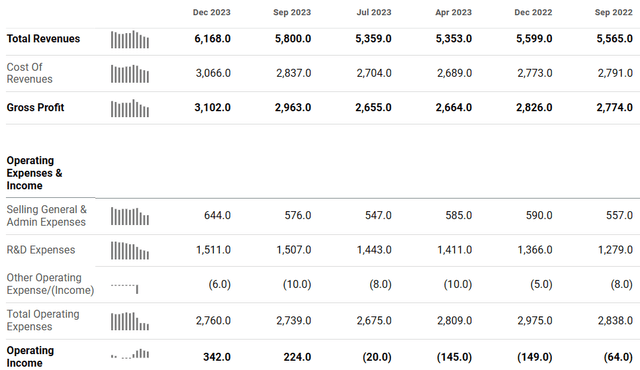

This earnings release will be important for AMD because the AI rush has helped to secure a positive operating income after three consecutive losing quarters.

AMD Financials (Seeking Alpha)

A $368 million increase in total revenue in the fourth quarter led to a $342 million operating income. If the company sees a slowdown in revenue in the first quarter, then it is likely to have a similar effect on profitability. That could see investors repricing the company’s growth-based valuation.

Gross margins were up 4 points year-over-year in the fourth quarter to 47%, but were flat on a non-GAAP accounting basis. AMD’s profitability is therefore at risk in this earnings release if demand for chips was slower, or if guidance disappoints.

Data center revenue will be the key driver, with analysts looking for further traction with the Instinct GPU.

The market for AI chips is still unknown after an initial rush from big tech firms. AMD’s offers better value for money but would require an expansion of the AI boom from the current rush to create Large Language Models (LLMs) such as ChatGPT and Meta’s Llama.

Moving forward, there is also still a risk from geopolitical headwinds, particularly through China. The U.S. and China are still seeking to defend their hold over chip technology. Both nations are set to discuss AI technology in the coming weeks, but that could hurt chip stocks if they end in stalemate. The China/Taiwan outlook will also be heavily important to AMD, due to its reliance on Taiwan Semiconductor for its supply chain.

Finally, a new threat is emerging in power usage by data centers. Investment bank Goldman Sachs sees data center power demand growing at a 15% compound annual growth rate from 2023-2030. This growth trajectory is expected to bring data centers’ share of total U.S. power demand to 8% by 2030, up from 3%.

Companies seeking to build data centers are facing electricity constraints, and that could hamper growth in the sector going forward. There is also a need to build new infrastructure, and GPUs could reach a bottleneck moment sooner than many think.

Conclusion

AMD should have some near-term tailwinds with GPU chip demand, which can help with this earnings release, but the outlook is clouded for the full year. AMD’s Instinct chip should support revenue in Q1 and Q2, but there are risks and headwinds for the company going further. The first half will determine how much GPU demand is there from big tech after the initial AI gold rush. However, AMD’s current valuation and flat margins mean that the company is at risk from a slowdown in the market that could see the valuation lowered.

I am Neutral on AMD at this price level and analyze data center revenue and Instinct sales in this Q1 release.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.