Summary:

- When KO reports Tuesday morning, 4/30/24 before the market opens, the street consensus is expecting $0.70 in EPS on $11 billion in revenue, and $3.6 billion in operating income.

- Both free cash flow and eventually margins were expected to improve when Coca-Cola Bottling was spun off, thus making the remaining syrup business far less capital intensive, with better margins.

- The most positive news I’ve heard out of KO in the last few years was just last week, when it announced a 5-year “strategic partnership” to “align” the company’s worldwide technology.

Georgiy Datsenko

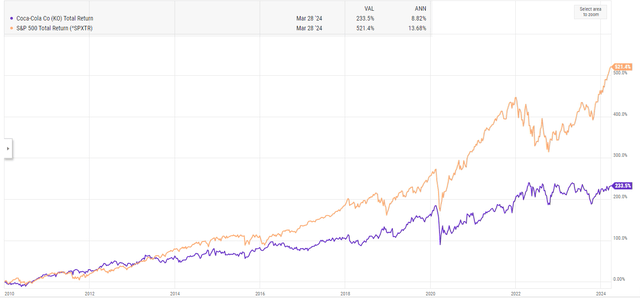

As a consumer staple, there is really not much to talk about with Coca-Cola (NYSE:KO) as the total return since 2010 has been pretty paltry relative to the S&P 500.

Source: Ycharts

But consumer staples – in terms of portfolio construction – are designed to be lower-beta weights, which provide stability and consistency in revenue and earnings growth, and names that clients can look at and not worry too much about, in terms of valuation and volatility.

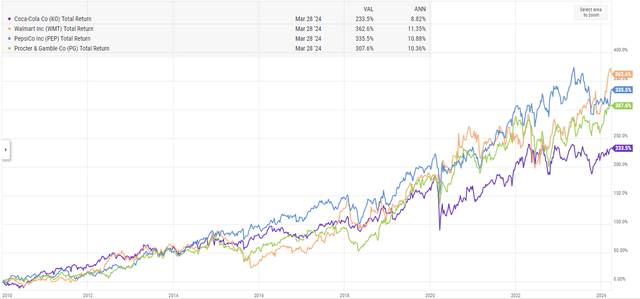

That being said, KO has underperformed Walmart (WMT) by about 250 bps a year since 1/1/2010, while Walmart has outperformed PepsiCo (PEP) by about 47 bps a year during that same time frame.

(Other staples may have performed better or worse, but this blog doesn’t follow the entire group fundamentally. When Procter & Gamble (PG) was thrown into the mix, Walmart actually outperformed PG by 99 bps a year for the same time period.)

Source: YCharts

The point is KO’s long-term performance is just “meh”.

When Coke reports Tuesday morning, 4/30/24 before the market opens, the Street consensus is expecting $0.70 in EPS on $11 billion in revenue, and $3.6 billion in operating income, for expected year-over-year growth of 3%, 0% and 4% respectively.

Can KO ever generate a better operating margin?

Here’s the 10-year history of KO’s operating margin (as of 12/31/23):

- 4-qtr avg: 29.1%

- 12-qtr avg: 28.7%

- 20-qtr avg: 28.9%

- 40-qtr avg: 27.2%

Let’s take a look at trailing 12-month free cash flow (TTM FCF):

- 4-qtr avg: $9.6 billion

- 12-qtr avg: $10.2 billion

- 20-qtr avg: $8.9 billion

- 40-qtr avg: $7.1 billion

The whole point of showing these two metrics is that both free cash flow and eventually margins were expected to improve when Coca-Cola Bottling was spun off, thus making the remaining syrup business far less capital intensive, with better margins.

Coca-Cola Bottling was spun off between 2015-2018 (everything KO does at the corporate level is so remarkably slow. Corporate talked about the bottling divestiture for probably 3 years and then took another few years to get everything done and the bottling ops divested. One thing Coke does not do is move at the speed of a tech company.)

Summary/conclusion: KO’s position in client accounts is probably 1% or so, but the most positive news I’ve heard out of the company in the last few years was just last week, when it announced a 5-year “strategic partnership” to “align” the company’s worldwide technology. (The following paragraph was cut-and-pasted from Briefing.com):

“Microsoft and The Coca-Cola Company (KO) announce a five-year strategic partnership to align Coca-Cola’s core technology strategy systemwide; enable the adoption of leading-edge technology; and foster innovation and productivity globally

- As part of the partnership, Coca-Cola has made a $1.1 billion commitment to the Microsoft Cloud and its generative AI capabilities. The collaboration underscores Coca-Cola’s ongoing technology transformation, underpinned by the Microsoft Cloud as Coca-Cola’s (KO) globally preferred and strategic cloud and AI platform.

- Through the partnership, the companies will jointly experiment with groundbreaking new technology like Azure OpenAI Service to develop innovative generative AI use cases across various business functions. This includes testing how Copilot for Microsoft 365 could help improve workplace productivity.”

The obligatory mention of “generative AI” and a strategic cloud and AI platform might be KO’s first serious move into getting the beverage giant to move at a speed just a hair faster than the US government.

Where any AI and productivity improvement will show up is in the operating margin and free cash flow.

KO’s valuation always looks pricey, trading at 20-21x EPS for expected 5-6% EPS growth and 3% revenue growth is not going to get anyone excited about owning the stock. Again, its portfolio purpose is to play defense in bad equity markets. The stock does sport a 4% free cash flow (FCF) yield.

The biggest worry is that the dividend is now chewing up the lion’s share of free cash flow, i.e. 75-80% of free cash.

To James Quincey’s credit, he’s tried to get innovative, but Berkshire put an end to the cannabis innovation, although KO has introduced its first alcoholic beverage in the last few years.

After modeling KO for years, it’s just frustrating that they move so interminably slowly.

Other consumer staples companies might warrant the investment more than KO does, but this blog will give it a little more time.

None of this is an advice or a recommendation. Past performance is no guarantee of future results. Investing can involve loss of principal even for short periods of time. All EPS and revenue data is sourced from LSEG. Readers should gauge their own comfort with portfolio volatility and adjust accordingly. Capital markets can and do change quickly, for better and worse.

Thanks for reading.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.