Summary:

- Altria Group reported Q1 earnings that met expectations and confirmed its strong EPS guidance for 2024.

- NJOY sales continues to see increasing distribution and product shipments. Altria is set to grow its dividend later this year.

- Altria’s attractive valuation and double-digit earnings yield make it an appealing investment for dividend investors.

krblokhin

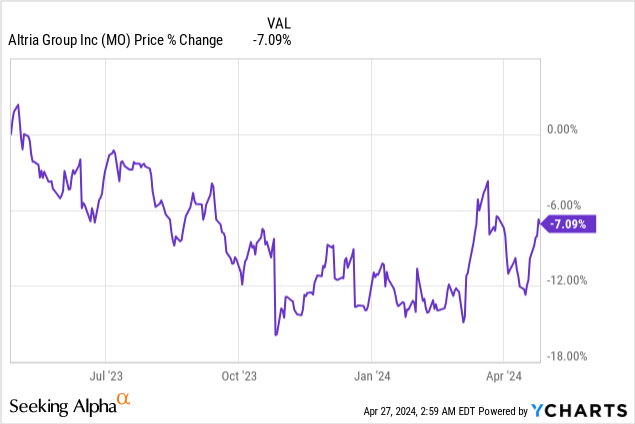

Altria Group, Inc. (NYSE:MO) reported first fiscal quarter earnings on Thursday, April 25 that met expectations on an EPS basis and the company confirmed its adjusted, diluted EPS guidance for 2024 as well. Altria’s NJOY distribution also continues to grow, and the forward dividend coverage ratio implies that dividend investors are set to get another dividend raise later this year. Altria’s accelerated share repurchase program, worth $2.4B, also adds value for dividend investors. With Altria’s alternative product business momentum being intact and the company selling at a very attractive, double-digit earnings yield, I believe dividend investors especially should consider adding Altria to their income portfolios!

Previous rating

I rated shares of Altria a strong buy — Altria Is Now A Value Stock — in February after the tobacco company submitted its fourth-quarter earnings sheet because it announced a $1.0B upsize to its stock buyback authorization at the time. Altria last week reported Q1’24 earnings that showed solid momentum for NJOY’s distribution as well as strong shipment momentum. The dividend is very safe in my opinion and has room to grow in FY 2024.

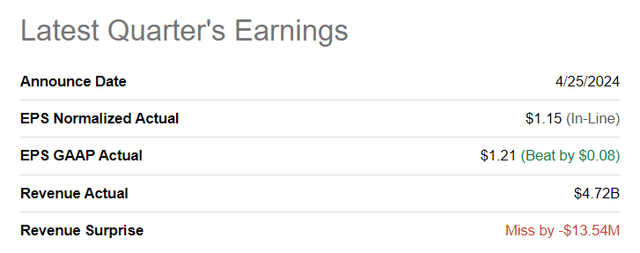

Top line and EPS beat

Altria met the earnings consensus expectation for the first quarter last week, but fell short of top line expectations. Altria reported adjusted earnings per share of $1.15 per share while the company’s top line came in at $4.72B, missing the average prediction by $13.5M.

Top line challenges, but NJOY has distribution and sales momentum

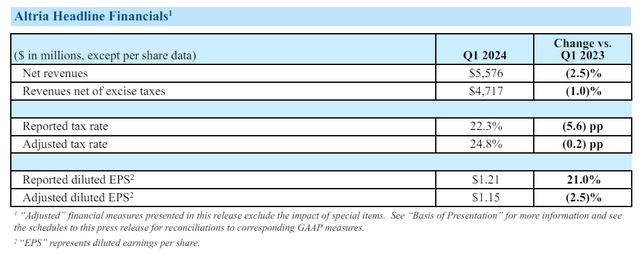

Altria’s net revenues declined 2.5% year over year to $5.58B in the first quarter, before excise taxes, and approximately 1.0% year over year to $4.72B, after excise taxes. While Altria slightly missed on the top line, revenue declines are priced into shares of the company at this point, largely because it is still reliant on its core tobacco business.

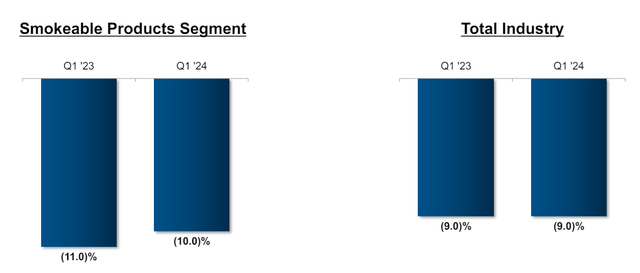

The decline in Altria’s revenue base is driven by consumers moving away from traditional tobacco products. The estimated industry decline rate in the first quarter was 9% which was the same level as last year. With tobacco shipment volumes declining, it is becoming more important than ever that Altria is growing alternative products like NJOY.

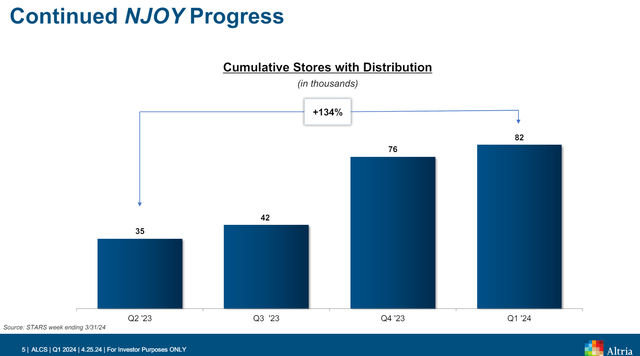

Altria acquired NJOY’s e-vapor product portfolio last year for $2.75B in a bid to grow the company’s alternative product portfolio and react to persistent top line challenges. One key driver of growth for Altria in the first quarter was continual momentum in customer adoption of NJOY’s e-vapor products, especially of the NJOY ACE, a pod-based vaping device. In the first quarter, NJOY grew its store representation to 82k, showing 134% growth, amid denser retail distribution and a concerted effort to broaden the distribution footprint for the vaping device. In total, NJOY shipped 11.9M NJOY units (devices and consumables) in Q1’24. I continue to see upside potential for NJOY as the number of vapers is growing, especially in the younger demographic.

Confirmed EPS guidance, low payout ratio leaves room for dividend growth

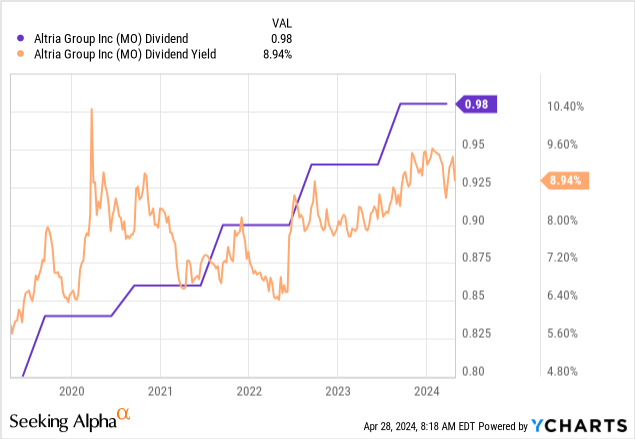

Altria guided for $5.05 to $5.17 in adjusted diluted EPS in FY 2024 which implies a year-over-year earnings growth rate of up to 4.5%. Assuming that Altria will raise its quarterly dividend by an estimated 4 cents again later this year (my prediction), the tobacco company remains an attractive investment from a distribution perspective.

I project that Altria will raise its quarterly dividend to $1.02 per share mid-year which implies a full-year dividend payout of $4.00 per share. Based on Altria’s confirmed EPS guidance, the tobacco firm is set to pay out approximately 78% of its diluted adjusted earnings this year. Excess cash is likely to be returned through the company’s accelerated share buyback as well: This program was announced in March 2024 and management upsized the existing stock buyback authorization from $1.0B to $2.4B.

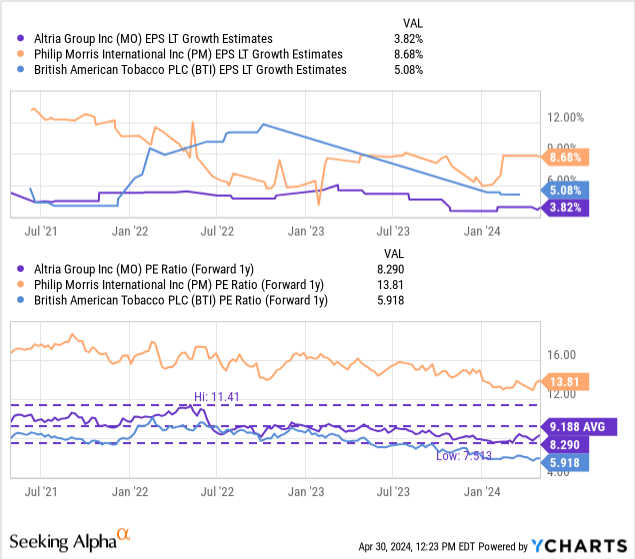

Altria’s valuation

Integral to Altria’s value proposition is that the company is trading at a very competitive P/E ratio of 8.3X which implies an earnings yield of 12%. Shares of Altria are currently valued below the 3-year average P/E ratio of 9.2X as well which reflects a discount of approximately 10%. My fair value estimate for Altria, given its longer-term P/E valuation average, is $49, implying 13% upside potential which would obviously come in addition to the 9% dividend yield. Altria, however, has the lowest expected EPS growth rate in its industry group — which includes Philip Morris International Inc. (PM) and British American Tobacco p.l.c. (BTI) — that investors also need to consider. Although Altria is expected to grow more slowly than either Philip Morris or British American Tobacco, I believe the low valuation together with a 9% yield compensates dividend investors for this shortcoming. The industry group P/E ratio is 9.3X which implies that Altria is currently trading at an 11% discount to the group average.

Philip Morris is trading at a higher P/E ratio of 13.8X in large part because the tobacco company receives the majority of its revenues from abroad which translates to better EPS growth prospects. I discussed the value proposition of Philip Morris here: A Top Income Stock With A 6% Yield. British American Tobacco, of which I also have a favorable opinion, ranks in the middle in terms of long-term EPS growth rate (~5%) and has a P/E ratio of only 5.9X.

Risks with Altria

Altria is set to become more reliant on alternative product categories like NJOY going forward which are meant to offset secular declines in the company’s core tobacco segment. The single biggest commercial risk for Altria is that the firm starts to see slowing growth in its NJOY distribution and under-earns its dividend with adjusted diluted EPS. What would change my mind about Altria is if the tobacco company were to see shipment declines for its NJOY products and if the dividend coverage ratio declined.

Final thoughts

Expectations for Altria’s first fiscal quarter earnings were not especially high going into earnings and the company neither disappointed nor crushed estimates. Rather, Altria delivered a predictable earnings sheet that didn’t include any unwelcome surprises. The company’s guidance for FY 2024 EPS strongly implies that the tobacco firm will be able to deliver a dividend raise mid-year… which I continue to believe is the main reason why investors would want to own Altria. Improving the value proposition, however, is the fact that Altria’s shares are trading at a double-digit earnings yield which improves investors’ safety margin, and that the company recently announced a $2.4B accelerated stock buyback. With a forward dividend yield approaching 9%, I believe Altria remains a top holding for investors focused on securing steady dividend income!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO, PM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.