Summary:

- Microsoft reported strong third quarter FY 2024 earnings, with revenue from Microsoft Cloud reaching $35 billion, up 23%.

- Azure remains a top choice for companies transitioning to the cloud.

- The market may overvalue the stock at current prices.

jetcityimage

I initiated my Microsoft Corporation (NASDAQ:MSFT) coverage in early November 2023 with a hold. Although the company has a high potential upside due to its competitive advantages and leading position in generative Artificial Intelligence (“AI”), it sells at a high valuation. Now that the company reported third-quarter fiscal year (“FY”) 2024 earnings on April 25 that beat analysts’ revenue and earnings estimates on the back of Microsoft Cloud, which was up 23% in the quarter to $35 billion in revenue, it is time to update my thoughts on the company.

After reviewing Microsoft’s results, I found reasons for investors to continue to be excited about this company. Enterprises continue to adopt cloud computing, and Azure is one of the best choices for companies that want to transition to the cloud. Additionally, the company remains an AI leader. Intelligent Cloud, its largest and fastest growing revenue reporting segment, continued growing briskly, up 21% year-over-year to $26.708 billion. On April 25, Seeking Alpha reported that Pacific Investment Management Company co-founder Bill Gross said on X, ‘Microsoft is the best tech stock for investors to get into “if they must.”‘ Still, one of the few reasons you should be cautious about buying the stock today is its valuation.

This article will discuss Microsoft’s cloud and AI businesses, review the latest earnings, discuss its valuation and risks, and explain why I still rate the stock a hold.

Microsoft’s Cloud and AI business

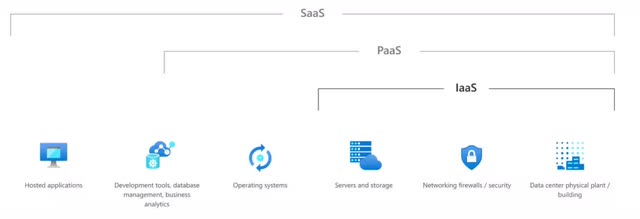

A novice investor and maybe even some experienced investors might become confused with the company’s cloud and AI products, so this section of the article will discuss how all of Microsoft’s products fit together. Although generative AI products create most of the buzz among investors today, the meat and potatoes of Microsoft’s business is still cloud computing. As its cloud computing business goes, so goes Microsoft and analysts expect cloud computing growth to be healthy this year. In late November, Gartner published an article that forecasted public cloud spending to grow 20.4% from $563.6 billion in 2023 to $678.8 billion in 2024. The article also stated, “All segments of the cloud market are expected to see growth in 2024. Infrastructure-as-a-service (IaaS) is forecast to experience the highest end-user spending growth in 2024 at 26.6%, followed by platform-as-a-service (“PaaS”) at 21.5%.” The best part is that according to cloud computing Datadog, Inc. (DDOG), the long-term growth drivers for cloud computing are still in the early innings.

During the company’s third quarter FY 2024 earnings call on April 25, Chief Executive Officer (“CEO”) Satya Nadella said (emphasis added), “It was a record third quarter, powered by the continued strength of the Microsoft Cloud, which surpassed $35 billion in revenue, up 23%.” Whenever you hear management refer to Microsoft Cloud, they are talking about the company’s entire cloud portfolio.

The company reports its cloud and other revenue in three segments: Productivity and Business Processes (“PBP”), Intelligent Cloud (“IC”), and More Personal Computing (“MPC”) segment. PBP and IC segments offer Microsoft Cloud products to customers. Although the company does generate some revenue from the cloud within the MPC segment, Microsoft doesn’t break out cloud revenue figures in the segment.

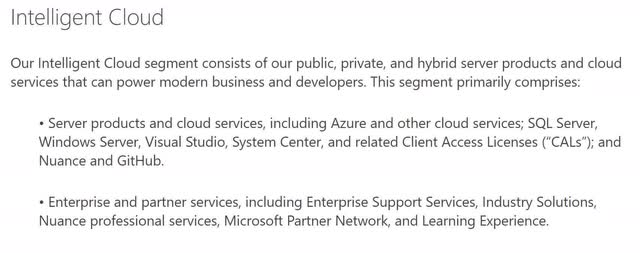

Let’s discuss the IC first. The following image from Microsoft’s website shows this segment’s components.

Some people refer to all the company’s cloud products as Azure. However, the above image shows that Azure is only one of several Microsoft cloud services. Azure is the infrastructure underlying many of Microsoft’s cloud services and offers customers a better way to use computers through its IaaS, PaaS, and Software-as-a-Service (SaaS) products. The following image from Microsoft’s website shows the components of IaaS, PaaS, and SaaS products.

1. IaaS

Any company that wants to run applications or store data needs servers, storage, security, and a physical location for the servers. Companies of all sizes may not want to spend large sums of money to buy and maintain the equipment and hire people with the expertise to manage all the server and storage assets. Instead, they may rent those services from IaaS providers like Azure. IaaS cloud solutions have far less of a moat around them than PaaS or SaaS cloud solutions since there are lower switching costs to migrate between providers.

2. PaaS

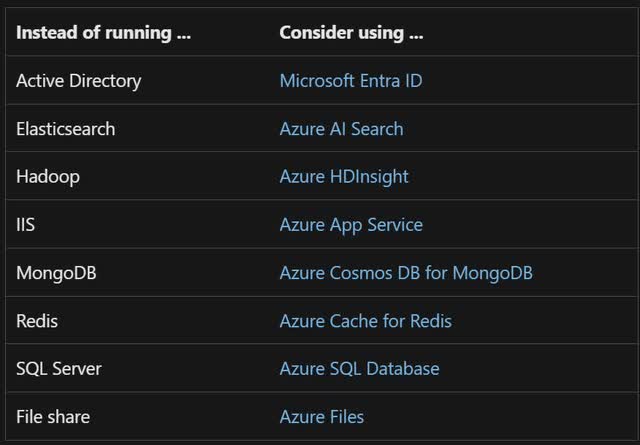

Software developers or organizations developing software or cloud applications may want to avoid the costs and hassles of licensing software or cloud applications from various providers. They will instead rent those services from a PaaS provider. On Microsoft’s website, the company lists several popular applications and alternative Azure PaaS replacement solutions:

Since developers build applications to work with specific PaaS solutions, making the application work with another PaaS platform often presents significant technical challenges. Consequently, PaaS providers have a high switching cost competitive advantage. Additionally, Microsoft integrates its PaaS platform into its other cloud solutions, meaning its PaaS platform is extraordinarily sticky.

3. SaaS

In the era before cloud computing, companies and individuals licensed productivity, security, and other types of software from various companies. Individuals hosted licensed software on their personal computers, and organizations used on-premise servers and storage to host licensed software. In the cloud era, organizations and individuals purchase software hosted in the cloud via subscription. Similar to PaaS providers, Microsoft’s SaaS solutions have high switching costs; once a customer starts using the company’s SaaS applications, they become reluctant to switch providers due to the inherent risks involved with changing to a different SaaS vendor, which includes the possibility of losing data during the transition, the time and costs to complete the switchover and the possible changes the company needs to make to its workflow.

Azure offers several SaaS applications such as Azure logic Apps, Azure App Service, and Azure DevOps services. In addition, Microsoft has Azure AI Services, which provides the following AI-based applications:

- Azure OpenAI Service.

- Azure AI Search.

- Azure AI Content Safety.

- Azure AI Translator.

- Azure AI Speech.

- Azure AI Vision.

- Azure AI-Language.

- Azure AI Document Intelligence.

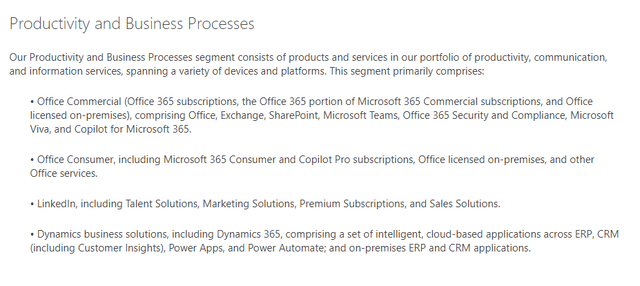

In addition, the company offers Azure Machine Learning, which helps organizations build Machine Learning models. However, Microsoft’s SaaS and AI products are not exclusive to Azure within the Intelligent Cloud. The following image shows a few of the company’s PBP products, including SaaS and AI applications.

Before the cloud era, all of Microsoft’s software applications were licensed products on individual computers or servers. Some products in the image above are versions of productivity apps that Microsoft used to sell as licensed products that the company now sells as SaaS products. For instance, Office 365 is a cloud-based version of the Office apps that many Microsoft users are familiar with, like Word, Excel, PowerPoint, and Outlook. The subscription also includes cloud storage and collaboration software. There is an Office version for commercial use and a version for consumers. Microsoft 365 is a subscription service that combines desktop Office apps with some cloud applications.

Microsoft Dynamics products took a similar path as Office products by starting out as licensed products on a desktop or server. Dynamics 365 is a cloud-based version that provides customers with a suite of enterprise accounting and sales software products, which includes applications like CRM (Customer Relationship Management), ERP (Enterprise Resource Planning), Finance, Human Resources, Marketing, Field Service and Supply Chain and other applications that customers can subscribe to as a bundle or individually.

Microsoft 365, Office 365, and Dynamics 365 all have some AI features to automate various functions. Additionally, Microsoft sells an AI feature called CoPilot to help users with some tasks. For instance, CoPilot can help summarize incoming emails or generate outgoing emails. The basic version of CoPilot is a free add-on with the subscription service. There is also a paid version of CoPilot for both consumers and businesses.

Last is LinkedIn. While it is not a pure-play SaaS business, LinkedIn does have some functions that use a SaaS model, like Talent Solutions and Sales Solutions.

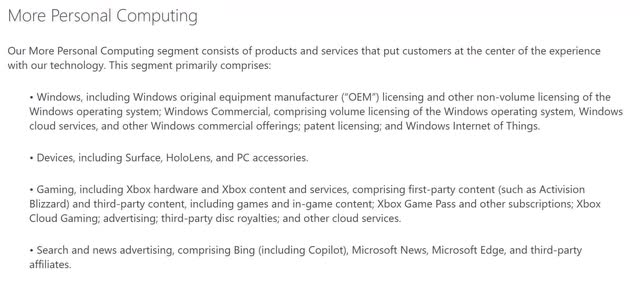

Next, let’s look at the few SaaS and cloud products within MPC:

Although some may not associate the MPC segment with cloud computing, some services within the segment have a SaaS model, and other areas make heavy use of Microsoft’s cloud infrastructure. For instance, the gaming area, specifically the Xbox business, has subscription-based Game Pass revenue, which technically is a SaaS business.

While not technically a SaaS business, the Search and Advertising news business is cloud-based. Microsoft’s main Search product, Bing, also utilizes OpenAI’s GPT-4 Large Language Model to add generative AI features to search results.

Let me briefly discuss generative AI, a business Microsoft entered through its partnership with OpenAI. Most of Microsoft’s generative AI technology uses OpenAI’s technology, like GPT-4 or DALL-E, a text-to-image AI model. However, OpenAI is not the only generative AI technology it plans to utilize. In late February, it formed a partnership with French startup Mistral AI. The deal would give Mistral AI access to Azure infrastructure, and Microsoft would provide its customers access to Mistral AI’s models.

Microsoft has also developed its own AI models independent of OpenAI. On April 23, 2024, Microsoft introduced its Phi-3-min Small Language Model (“SLM”), designed to be less resource-intensive while offering a strong performance. A Seeking Alpha article stated, “Phi-3-mini’s small size will allow users to run the model on the device without the need for an internet connection or access to the cloud, expanding access to AI in places without the infrastructure necessary to leverage LLMs,” said Microsoft in an emailed statement to Seeking Alpha.‘ Revenue from the Mistral AI partnership and the Phi-3-min model are under the Intelligent Cloud segment.

Microsoft is a complicated company with a lot of bells and whistles. If you ever listened to a Microsoft earnings call, trying to understand the difference between Microsoft Cloud and Intelligent Cloud and Azure may sometimes be confusing. Some people still think Azure represents all the company’s cloud products, which is false. When management starts talking about all of its AI products on top of its cloud products, sometimes people may need help understanding how it all fits together. I decided to include this section to outline how the company’s many cloud and AI services fit into its revenue reporting segments so that when I discuss the company’s earnings report in the next portion of the article, it should be more understandable.

Excellent earnings report

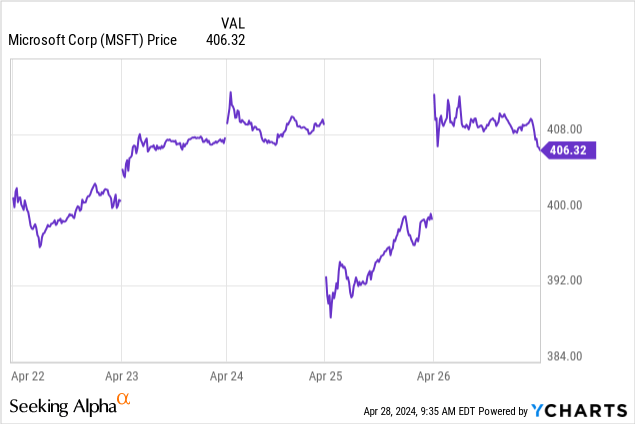

Within the last week, fears have risen that AI investments were in a bubble ready to pop. AI beneficiary Super Micro Computer, Inc. (SMCI) dropped around 30% on April 19 over worries over a potential sales slowdown, and Meta Platforms, Inc. (META), another AI beneficiary, dropped after earnings due to disappointment over guidance. Investors also didn’t like hearing that Meta would spend much more on AI investments and that the payoff might be way off in the distant future. Investor sentiment quickly turned hostile toward all companies perceived to be beneficiaries of the growth of AI. Microsoft’s stock dropped around 2.5% on April 25.

Before Microsoft reported earnings, some investors, and analysts looked to the company’s third-quarter FY 2024 earnings announcement to confirm whether the AI revolution was still alive and well. Investors wanted to see if Microsoft was like Meta and reported either subdued revenue growth or guidance. After investors saw the report on April 25 after the bell, they became reassured when the Intelligent Cloud, specifically Azure, exceeded revenue expectations during the quarter. Chief Financial Officer (“CFO”) Amy Hood said:

Next, the Intelligent Cloud segment. Revenue was $26.7 billion, increasing 21%, ahead of expectations with better-than-expected results across all businesses. Overall, Server products and cloud services revenue grew 24%. Azure and other cloud services revenue grew 31% ahead of expectations, while our AI services contributed 7 points of growth as expected. In the non-AI portion of our consumption business, we saw greater-than-expected demand broadly across industries and customer segments as well as some benefit from a greater-than-expected mix of contracts with higher in-period recognition.

That’s exactly what investors wanted to hear. Seeking Alpha published an article that contained the following quote from Dan Ives:

“With MSFT’s results acting as a barometer for cloud/AI spending, the company delivered another hall of fame performance quarter of robust results with beats on the top and bottom line led by Azure growth at 31% coming in above the Street’s 29% estimate and the company’s 28% guidance on the back of strong demand for the entire updated tech stack,” Wedbush Securities analyst Dan Ives wrote, calling the results a “drop the mic moment” for the company.

The AI business remains healthy, and the non-AI portion of the cloud business remains solid. Investors closely follow growth at Azure and Dynamics, as those products are the fastest and second-fastest growing portion of the company’s business. The following table shows Azure’s and Dynamics’ growth rates for the last nine quarters.

| Microsoft product | Q3 FY 2022 | Q4 FY 2022 | Q1 FY 2023 | Q2 FY 2023 | Q3 FY 2023 | Q4 FY 2023 | Q1 FY 2024 | Q2 FY 2024 | Q3 FY 2024 |

| Azure | 46% | 51% | 35% | 31% | 27% | 26% | 29% | 30% | 31% |

| Dynamics 365 | 22% | 33% | 15% | 13% | 17% | 19% | 22% | 21% | 19% |

The rising interest rates and cloud optimization trends that slowed cloud computing down last year look like they are in the rearview mirror. Management gave fourth quarter FY 2024 guidance for Intelligent Cloud to grow between 19% and 20% year-over-year and revenue growth of 30% to 31% for Azure, which analysts were happy with. In response to Microsoft’s earnings results, the stock reversed the previous day’s declines in reaction to Meta Platforms’ results.

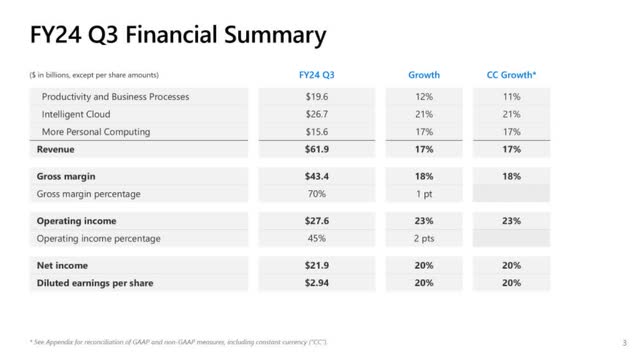

The following image shows Microsoft’s consolidated results for its latest earnings report. Its consolidated total revenue was up 17% to $61.9 billion in the third quarter of FY 2024, beating analysts’ revenue estimates of $60.89 billion. Diluted earnings per share (“EPS”) were up 20% year-over-year to $2.94, beating analysts EPS estimates by $0.10.

Microsoft Third Quarter FY 2024 Slides

The company achieved a one-point improvement in gross margin and a 2-point improvement in operating margin in the third quarter despite headwinds from costs incurred from Microsoft’s acquisition of Activision and an accounting change involving the useful life and depreciation in certain data center equipment. Expect these headwinds to remain in the fourth quarter. Management guided the fourth quarter FY 2024 cost of goods sold to rise by an additional $700 million and operating expenses to increase around $300 million due to the Activision acquisition. Despite the headwinds, management expects operating margins to remain up for the full fiscal year. CFO Amy Hood said:

We now expect full-year FY 2024 operating margins to be up over 2 points year-over-year, even with our cloud and AI investments, the impact from the Activision acquisition, and the headwind from the change in useful lives last year. This operating margin expansion reflects the hard work across every team to drive efficiencies and maintain disciplined cost management, knowing we will continue to grow our cloud and AI investments next year.

Amy Hood also gave guidance into FY 2025. Between the full-year impact of the Activision acquisition and the continued investments needed to build out the cloud and AI, the company guided operating margins to decline one point over FY 2025. Microsoft also forecasts higher FY 2025 capital expenditures compared to FY 2024. Investors should continue monitoring Microsoft’s spending and margins. Meta Platforms stock dropped after its earnings partially because of a higher-than-expected spending forecast to build out AI and the Metaverse. Although some experts believe we are on the upswing from the pandemic recession, some investors seem to need more time to be ready to support companies going back to a growth-at-all-costs strategy.

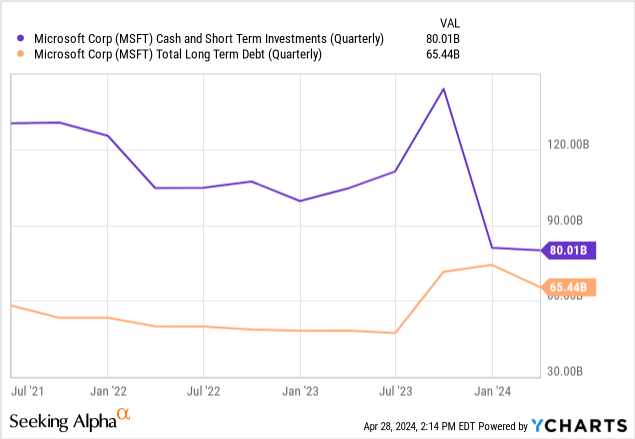

Financial condition

Microsoft ended its third quarter FY 2024 with $80 billion in cash and short-term investments and $65.44 billion in long-term debt. Its debt-to-EBITDA (earnings before interest, taxes, depreciation, and amortization) ratio is 0.60, which means the company can pay down its long-term debt. The company’s quick ratio of 1.23 means it can pay off its short-term obligations.

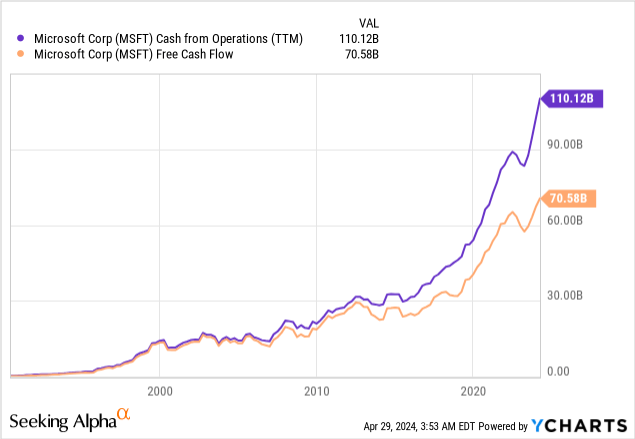

Investors may be willing to award Microsoft a higher valuation because of the company’s outstanding free cash flow (“FCF”) generating capabilities. The following chart shows Microsoft producing $110.12 billion cash from operations (“CFO”) over a trailing 12-month period. The gap between CFO and FCF has widened over the last several years as management has invested much more capital expenditures in building cloud and AI infrastructure. FCF may expand much faster in the medium and long term after the company finishes its infrastructure build-out.

Another observation on the above chart is the dip in CFO and FCF during the customers’ cloud optimization phase. The rebound suggests that the cloud optimization phase is over, and companies that paused plans to migrate more workloads to the cloud during the economic downturn may have restarted the migration process.

Risks

Microsoft faces significant competition in cloud computing. Although a considerable force, Microsoft Azure, its most important product, is currently second to Amazon.com, Inc.’s (AMZN) AWS for IaaS and PaaS solutions. Additionally, Microsoft Dynamics 365, arguably its second most important product, is a suite of products competing with several category-leading products like SAP SE’s (SAP) ERP and Salesforce, Inc.’s (CRM) Customer Relationship Management products. Although the company holds a solid position in the cloud today, the tech industry is notorious for new and old companies introducing new technologies that disrupt old business models. Investors in the company must carefully monitor the competitive environment.

Microsoft’s lack of a mobile presence can hurt its Search business. Android helps Google dominate mobile search. Since a majority of searches take place on mobile devices, Google has a considerable advantage in generating search advertising revenue. In addition, some AI inference tasks are moving from the cloud to mobile devices, which may disadvantage some of Microsoft’s AI initiatives.

Lastly, European regulators have started to examine Microsoft’s partnerships with other AI companies. The day before the company released its earnings, Seeking Alpha published an article highlighting potential issues that the Competition and Markets Authority in the U.K. has regarding Microsoft’s collaboration with Mistral AI. The European Commission may also be looking into Mistral AI. If governments stop Microsoft from making deals similar to the one it made with Mistral AI, it could potentially slow Microsoft’s march to AI dominance.

Valuation

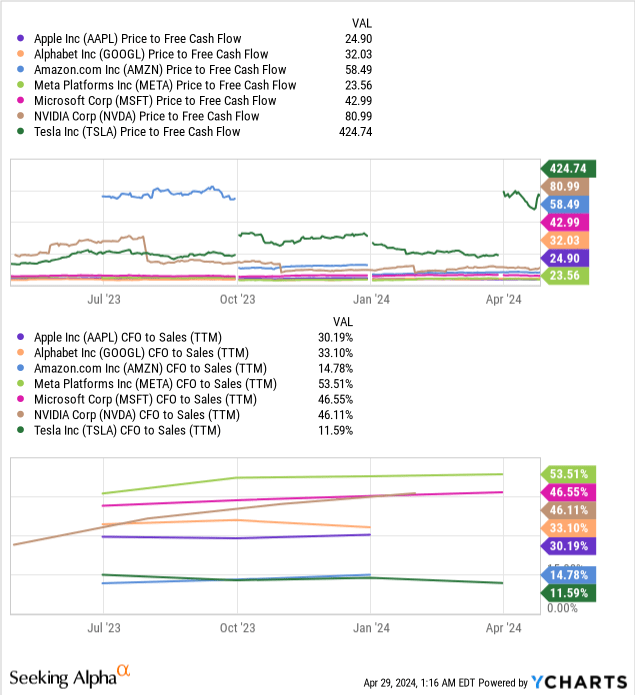

The following chart compares Microsoft’s price-to-FCF ratio to that of the Magnificent Seven, a group of popular, high-performing mega-cap tech stocks. On an absolute basis, Microsoft has a high price-to-FCF ratio. However, relative to its peers, Microsoft is only in the middle of the pack.

The second chart shows that Microsoft’s CFO-to-sales ratio is 46.55%, which indicates that the company excels at converting sales from its core business into cash. Microsoft may deserve to trade at a higher valuation because its ability to turn sales into CFO is elite. Some investors can make the case that the market undervalues the stock. However, the market may overvalue Microsoft based on other ways of valuing the stock.

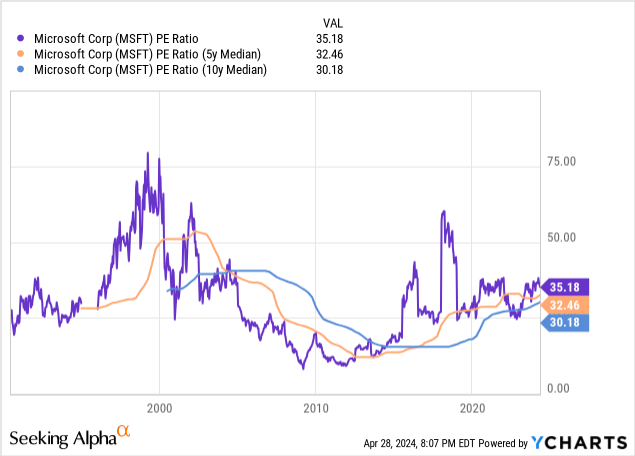

The following chart shows Microsoft’s price-to-earnings (P/E) ratio of 35.18, above its sector median P/E of 21.58 and five- and ten-year median P/E, suggesting overvaluation.

The following image from Seeking Alpha shows Microsoft’s forward P/E ratio, EPS estimates, and EPS growth rates for the next two fiscal years. Microsoft’s forward P/E for FY 2024, 2025, and 2026 exceeds the company’s growth rate, suggesting overvaluation.

Let’s look at what the current price implies about Microsoft’s FCF growth over the next ten years.

Reverse DCF

|

The first quarter of FY 2024 reported Free Cash Flow TTM (Trailing 12 months in millions) |

$67,440 |

| Terminal growth rate | 3% |

| Discount Rate | 10% |

| Years 1 – 10 growth rate | 18.0% |

| Stock Price (April 26, 2024, closing price) | $406.32 |

| Terminal FCF value | $363.559 billion |

| Discounted Terminal Value | $2002.396 billion |

| FCF margin | 29.63% |

According to Seeking Alpha, analysts estimate revenue will grow at a CAGR of 11.67% over the next ten years. If those estimates are accurate, I believe it would be nearly impossible for Microsoft to increase its FCF by 18% over the next ten years. Microsoft’s median FCF margin over the last ten years is 30.76%, so margin expansion helping FCF growth might not be in the cards. The market may overvalue the stock based on all the valuation assumptions I used to value it.

Aswath Damodaran valued Microsoft on his YouTube channel in February 2024 at $355.88. He identifies NVIDIA Corporation (NVDA) and Microsoft as overvalued and says the following, “It may be a coincidence, but these are the two companies that have benefitted most directly from the AI Buzz, and my overvaluation may reflect my lack of imagination on how big AI can get as a business.” Always remember that a valuation is only as good as the assumptions a person uses to make that valuation. If you underestimate the AI revolution, you might assume things that lead you to think Microsoft has valuation issues. If you overestimate AI adoption, you may assume things that lead you to overvalue the stock. Wall Street may have made assumptions about AI proliferating more than the assumptions currently priced into the stock.

According to Wall Street analysts, Microsoft’s stock has a 17.66% potential upside from its closing price on April 26, 2024. However, I believe a one-year price target of $476.06 doesn’t adequately reflect the short- and long-term risks. At the same time, I don’t believe Aswath Damodaran’s intrinsic value calculations of $355.88 adequately takes into account the potential upside from AI. The mid-point between an optimistic $476.06 and a pessimistic $355.88 is $415.97, so I believe the stock price of $406 sits approximately around Fair Value.

Why I recommend a Hold

Although Microsoft has tremendous upside if generative AI pans out, the opportunity is not risk-free. In the risk section of this article, I mentioned competition in the cloud business as a factor. Microsoft might face even more intense competition in its AI business, from businesses as large as other companies in the Magnificent Seven to smaller companies that no one might have heard of today. While many perceive Microsoft as an AI leader today, that may not be the case five or ten years from now, especially if governments get involved in regulating various aspects of the industry.

We are also not out of the woods yet concerning the economy. Inflation remains persistently high and the Federal Reserve raising rates instead of lowering them is still not out of the question. Microsoft is spending a lot of money building its cloud platform and AI tools. If the economy takes a turn for the worse, investors may not view that spending favorably.

If you are a cautious investor, avoid investing in Microsoft for now. However, if you already own it, I suggest holding it for its potential upside from continued cloud and AI adoption. I maintain my Hold rating on Microsoft.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.