Summary:

- Roku disappointed investors with guidance suggesting increased spending in the second half, affecting its profitability growth.

- Roku’s market leadership has not translated into sustainable profitability.

- ROKU stock’s uptrend bias has likely been invalidated as it dropped nearly 50% from its December 2023 highs.

- ROKU investors have experienced the stock nearly making a round trip. Being contrarian isn’t wise, as Roku has failed to deliver consistent profitability.

- With growth investors likely allocating toward AI growth stocks, I explain why ROKU’s FOMO days are likely behind it.

JHVEPhoto

Roku, Inc. (NASDAQ:ROKU) has continued to disappoint its investors as the headwinds of increased sales and marketing spending for Roku’s device segment likely led to a reversal on ROKU stock’s initial post-earning surge. Accordingly, Roku posted its first-quarter earnings release last week, surpassing Wall Street estimates. Roku headed into its Q1 earnings with relative pessimism, as ROKU buyers failed to defend the $60 level in early April. As a result, ROKU also felt the impact of the broad market pullback in April, as investors reassessed the ROKU’s growth premium. I upgraded ROKU to Buy in mid-February 2024. However, that thesis has not panned out, as the market correctly anticipated more intense profitability growth inflection challenges for Roku in 2024.

While Roku buyers had demonstrated an intent to defend the $55 level as Roku posted its first-quarter scorecard, buying momentum quickly dissipated. Investors assessed the potential impact of increased spending “leading to a slight moderation in adjusted EBITDA relative to the first half of the year.”

Accordingly, Roku delivered Q1 revenue growth of 19% YoY, beating Wall Street projections. The growth momentum was broad-based, driven by a 19% revenue uptick in Roku’s Device and Platform segments, respectively. However, Roku’s Device segment suffered a negative gross margin of almost -5%, although it improved from Q4’s -13% metric. In addition, Roku emphasized its confidence in a “positive trend” in Device margins growth trajectory “with anticipation of cost structure improvement over time.”

Therefore, given the mounting challenges in the media and entertainment scene, it should have been construed as a pretty solid report. Google’s (GOOGL) recent Q1 earnings showed that YouTube has also outperformed analysts’ estimates, suggesting a buoyant market. Therefore, it seemed like ROKU was well-positioned to rebound from its collapse from its February 2024 highs. However, the market’s concerns about increased spending affecting Roku’s anticipated profitability inflection aren’t welcomed and are justified.

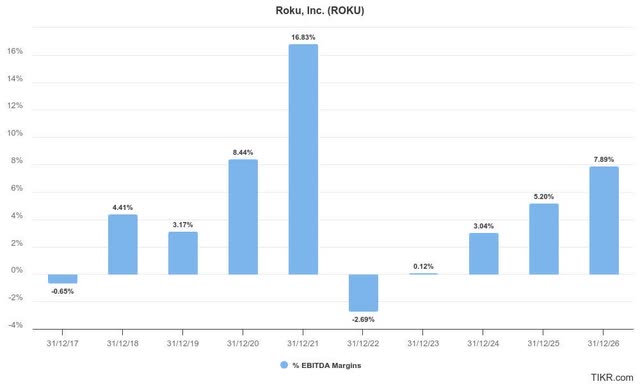

Roku adjusted EBITDA margins trend and estimates (TIKR)

As seen above, Roku has failed to demonstrate how Roku’s market leadership in the ad-supported video space has led to a sustainable profitability drive. The post-pandemic surge proved to be a bubble, as Roku’s adjusted EBITDA margins fell into negative territory in FY2022.

As a result, I believe the market is extra cautious about increased spending, suggesting Roku could face a tougher-than-expected ad market than anticipated. YouTube TV’s ability to drive gains in the subscription space shouldn’t have hampered the Roku platform’s ad-supported growth momentum. That was demonstrated in Q1 as Roku surpassed Wall Street’s estimates.

However, YouTube TV is gaining precious real estate in viewers’ homes. Gaining more eyeballs and engagement hours could bolster YouTube’s “appeal to advertisers during upfront TV ad negotiations.” In addition, it could also strengthen YouTube’s “ability to provide insights into viewers’ preferences across various content.” As a result, I believe the inability of Roku to translate its market leadership into predictable and sustainable profitability growth inflection will continue to weigh on investor sentiments. Given the lessons learned in 2021/22, I believe the market is pricing in much higher execution risks to reflect increased spending concerns and their possible impact on Roku’s margins.

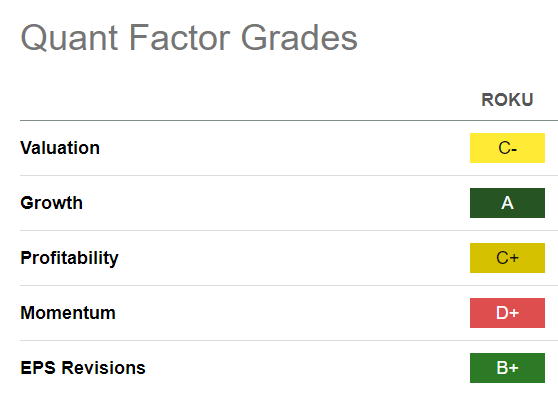

ROKU Quant Grades (Seeking Alpha)

With Roku not paying dividends, ROKU investors must rely on growth investors to drive buying momentum. However, ROKU’s uninspiring “D+” momentum grade suggests growth investors have likely rotated toward more attractive plays in the AI space, as prospects for near-term monetization in AI seem earlier than anticipated.

However, could ROKU be close to peak pessimism, as it plunged deep into a bear market, down nearly 50% from its December highs at ROKU’s lows last week?

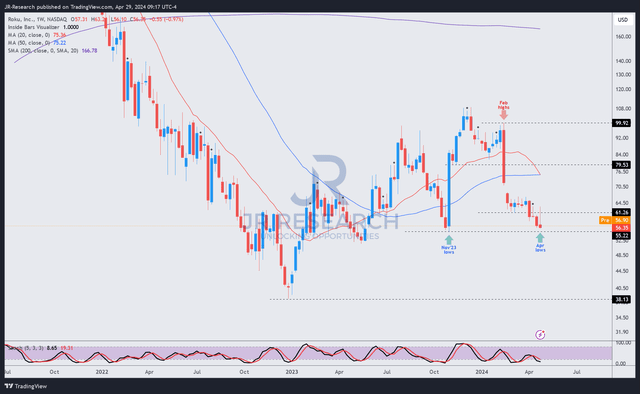

ROKU price chart (weekly, medium-term) (TradingView)

Unfortunately, ROKU’s upward bias was invalidated when ROKU buyers failed to underpin a constructive consolidation zone above the $60 level. Once that level was taken out decisively by intense selling in April, I’m not surprised that ROKU’s $55 level could be within reach, as further selling pressure could force a re-test of ROKU’s November 2023 lows.

As a result, ROKU has nearly made a round trip since bottoming out in late 2023. While more robust bullish sentiments could encourage me to retain my Buy thesis, I have yet to assess such optimism.

Therefore, I believe the stakes have changed for Roku as investors grapple with the possible impact on Roku’s profitability in the second half. While Roku is still expected to scale and gain operating leverage through 2025, ROKU isn’t priced at a discount. Therefore, investors will likely demand nothing less than robust execution without unanticipated negative surprises during this period as investor sentiments remain uncertain.

Consequently, I assessed the risk/reward on ROKU as less attractive, behooving me to return to the sidelines.

Rating: Downgrade to Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!