Summary:

- AT&T revealed a decent earnings card for Q1 last week that showed progress in reducing debt and robust broadband momentum.

- The company is reducing its net debt and has a favorable deleveraging trend.

- AT&T confirmed its free cash flow guidance for FY 2024, indicating a dividend coverage ratio of up to 227%.

- Shares are attractively valued based on the P/E, forward P/E and P/FCF.

wdstock

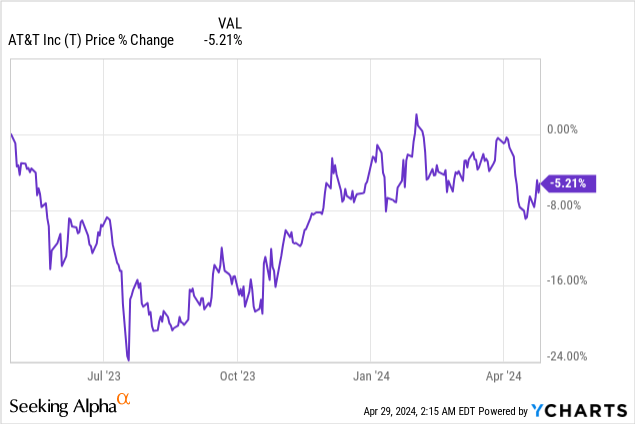

AT&T (NYSE:T) delivered a decent earnings sheet for its first fiscal quarter on April 24, 2024, that showed continual momentum in broadband, free cash flow strength and progress in terms of debt reduction. AT&T’s debt has been a burden in recent years, but the telecommunications company is finally making some progress in tackling this issue. Considering that AT&T beat adjusted Q1 earnings estimates by $0.02 per-share, repaid billions of dollars in net debt in the March quarter and confirmed its free cash flow outlook, which implies a FY 2024 dividend coverage ratio in excess of 200%, I believe AT&T continues to make an exceptionally strong value proposition for dividend investors, especially when the valuation is considered!

Previous rating

I rated shares of AT&T a strong buy in January, after the company reported Q4’23 results, due to its robust monetization trend in the fiber broadband business as well as strong free cash flow outlook that the telecom submitted at the time. Since momentum in broadband continued in Q1’24 and AT&T is starting to make some more meaningful progress reducing its debt, I believe AT&T continues to be a very interesting investment for dividend investors in FY 2024 and beyond.

Broadband momentum

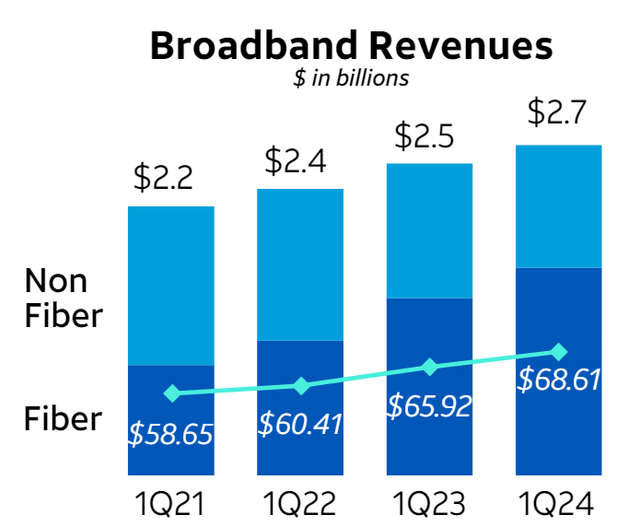

AT&T continues to have significant momentum in its broadband division, which, for the seventeenth straight quarter, added more than 200k fiber subscribers to its business. In Q1 ’24, AT&T added 252k AT&T Fiber to its broadband business, which was down from 270k in the fourth-quarter. However, the company is seeing robust revenue momentum in its increasingly important broadband segment: in total, AT&T generated $2.7B in revenues from its broadband operations alone in Q1’24, showing a year-over-year growth rate of 8%. AT&T also continued to make progress in terms of broadband monetization in the first-quarter, as its broadband average revenue per user/ARPU reached $65.98, showing 8% year-over-year growth. This ARPU momentum combined with consistent subscriber growth in the core fiber business is a key strength for AT&T that supports the company’s free cash flow… and most importantly, backs AT&T’s potential to pay back more debt going forward.

AT&T

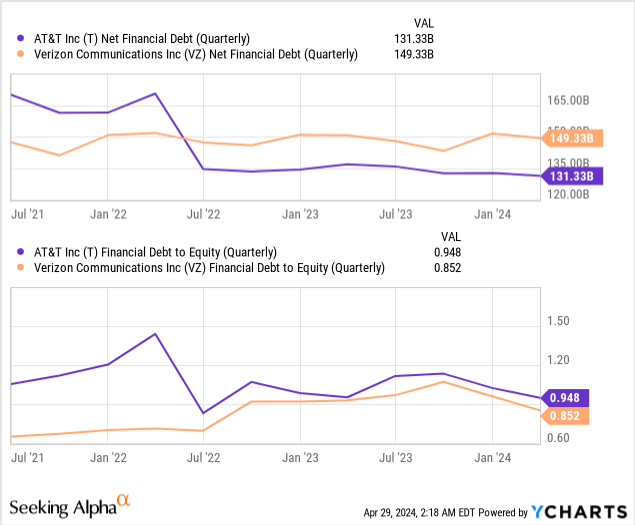

Update about AT&T’s debt situation

AT&T has a considerable amount of debt on its balance sheet which some (including me) have cited as a reason why shares, despite significant free cash flow generation, have failed to revalue higher in the last several years. AT&T had $131.3B in net financial debt on its balance sheet at the end of the March, and the telecom reduced its net debt by approximately $6.0B year over year. For comparison, Verizon Communications’ total net financial obligations were $149.3B as of the end of Q1’24. The debt repayment trend favors AT&T here as well: AT&T’s net financial debt declined a massive 23% while Verizon’s went up by 1% in the last three years.

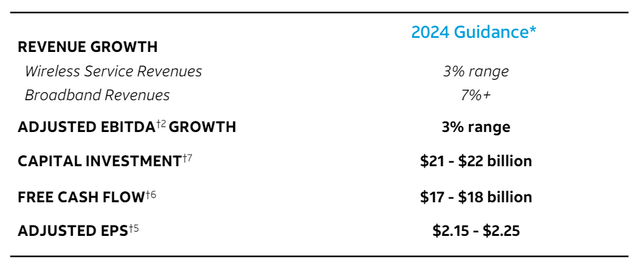

FY 2024 free cash flow guidance confirmed

When it comes to low-growth, high-FCF investments like AT&T, there is nothing more important than a company’s free cash flow guidance. AT&T guided for $17-18B in free cash flow earlier this year, which the company confirmed last week. With an unchanged free cash flow guidance for the current fiscal year, AT&T is set to achieve a dividend coverage ratio of up to 227%. In other words, while AT&T’s dividend is not growing, the security of the dividend should not be in question in FY 2024.

AT&T

AT&T is a bargain from an earnings and free cash flow perspective

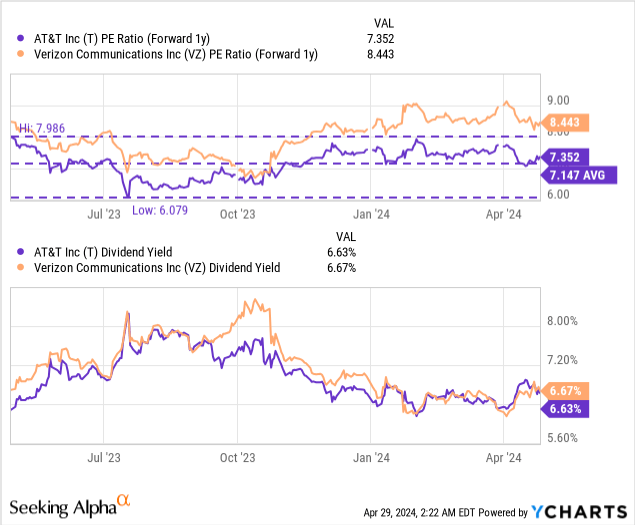

AT&T is still cheap based off both earnings and FCF. They’ve guided for $2.20, at the mid-point, in adjusted EPS for the current year, implying a P/E ratio of 7.6X. At the same time, a market cap of $120B and a free cash flow guidance of $17-18B imply a P/FCF ratio of 7X. Verizon Communications (VZ) guided for $4.50 to $4.70 in adjusted EPS for FY 2024 (unchanged to prior guidance) which means the company’s current valuation represents an 8.6X P/E ratio.

On a forward basis, AT&T is valued at 7.4X FY 2025 earnings, compared to 8.4X for Verizon. In my last work on the telecom in January, I said that I see a fair value P/E ratio for both AT&T (and Verizon) for 8-9X given the strength of the free cash flow, which implies a fair value of $19-21 per-share. Given a current share price of $16.75, I see up to 25% upside revaluation potential for AT&T… which would come in addition to the 7% dividend yield the shares pay.

Risks with AT&T

If AT&T were to see slowing broadband momentum, weaker dividend coverage and a lack of progress in terms of reducing its formidable debt (3 trends that I am monitoring), then I would change my mind (and my rating) about AT&T. Considering that AT&T this year, based off the confirmed free cash flow forecast, expects to see more than 200% dividend coverage, I don’t believe the dividend, or an investment in AT&T in general, is very risky at all.

Final thoughts

AT&T delivered a solid earnings sheet for the first fiscal quarter that showed an adjusted EPS beat and progress in terms of reducing debt. The free cash flow guidance for FY 2024 was confirmed, which implies an up to 227% dividend coverage ratio. AT&T also continues to see considerable momentum in broadband, in terms of subscribers, average revenue per user as well as revenue growth. With shares continuing to sell for a lower P/E ratio than Verizon and with a favorable deleveraging materializing lately, I believe the value proposition for AT&T remains strong for income investors!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T, VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.