Summary:

- Long-term trends and outlook looks strong, but there is still uncertainties.

- Texas Instruments will struggle to grow their dividend with such heavy Capital expenditures.

- According to estimated EPS and stock performance correlation, this would be the time to buy.

- Yet, my DCF assessment suggests a fair value of $162 per share and, considering this, I rate Texas Instruments a HOLD.

William_Potter

Introduction

Over the past decade, Texas Instruments (NASDAQ:TXN) shareholders have pocketed some handsome profits, riding on the back of an exceptional dividend and share buyback history. However, from time to time, they are exposed to the cyclicality of the semiconductor industry, which is sensitive to economic variations. Texas Instruments looks expensive with a forward P/E of 37x with earnings expected to continue to fall into 2024. According to my DCF valuation, I believe the market is too optimistic about this company’s future prospects, which is why I rate this stock a HOLD.

Further in this analysis, I’ll first explore Texas Instruments’ main areas of operations through a sector analysis. A company analysis that I’ll do later will highlight their capital management, historical and current financial performance, ongoing heavy capex, a brief look at their balance sheet, what their management has been doing, and their current company-specific risks. This will be followed by a comprehensive valuation analysis focusing on the current P/E ratios, earnings yield, and three different DCF scenarios.

Sector analysis

Analog semiconductors

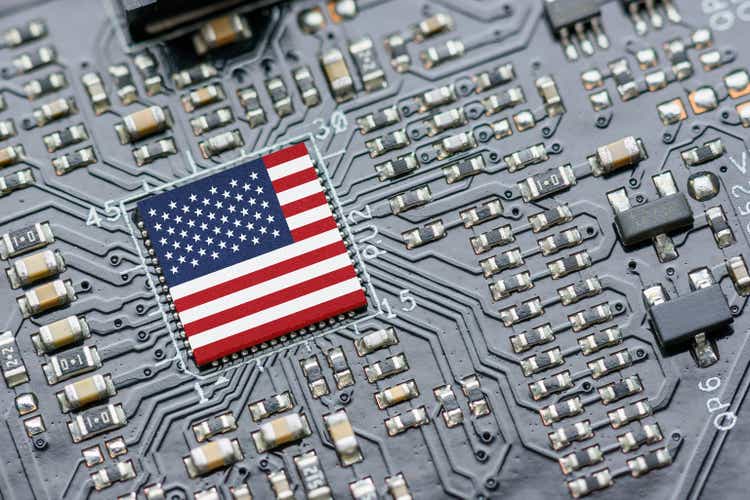

Texas Instruments’ two main segments are analog semiconductors and embedded processors. The largest segment is analog semiconductors, which accounts for over 74% of the revenue and contributed $13.04 billion in 2023.

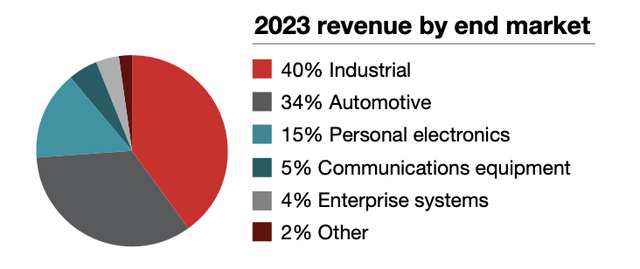

Revenue 2023 (Texas Instruments, Investment overview white paper)

The total market of analog semiconductors is about $81 billion in 2023, which means Texas Instruments is the largest producer in the analog segment, holding a market share of 16%. The analog semiconductor market is expected to register a CAGR of 5.9% by 2031, and the market value is projected to reach $151 billion. This market will be driven by the scope for continued technological advancements in consumer electronics and the “Internet of Things.”

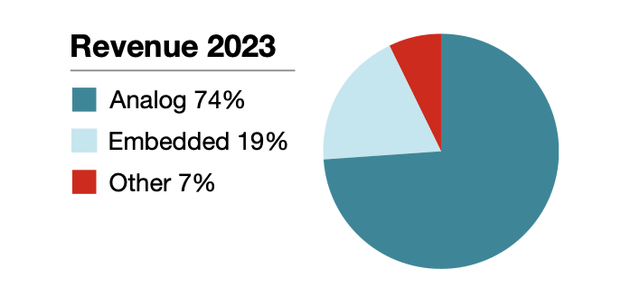

R&D investing (Texas Instruments )

The automotive sector accounted for the highest application in the analog segment in 2022: “This was probably due to rising demand for sensor networks with effective power. As the market for autonomous vehicles expands, so does demand for new chip designs.” The automotive sector is in a race to have the most advanced technology, which increases the demand for analog semiconductors and embedded processors. As a result, the automotive sector will probably continue to be a strong driver for the analog segment.

There is still continued heavy R&D investment in automotive, which means Texas Instruments still believe in the future of this segment. Another segment is industrial, which has even more R&D investing-why is this? Texas Instruments explains: “Our industrial and automotive customers are increasingly turning to analog and embedded processing technology to make their end products more reliable, more affordable, and lower in power.” Texas Instruments needs to follow customer demand and keep investing to be ahead of competitors. I believe this is an excellent investment allocation strategy, to invest in segments that continue to and grow.

Revenue by end market (Texas Instruments)

There is still continued heavy R&D investment in automotive, which means they still believe in the future of this segment. Another segment is industrial, which has even more R&D investing-why is this? Texas Instruments explains: “Our industrial and automotive customers are increasingly turning to analog and embedded processing technology to make their end products more reliable, more affordable, and lower in power.” Texas Instruments needs to follow customer demand and keep investing to be ahead of competitors.

Embedded processors

The second most important segment for Texas Instruments is embedded processors, which makes up 19% of the company’s total revenues. This means analog semiconductors are over 3x bigger than embedded processors. The total market for embedded processors reached just over $30 billion in 2023, and is projected to increase at a CAGR of 8.12%, reaching $47 billion by 2031. Where will this growth come from? According to Texas Instruments, the “massive adoption of Internet of Things devices in diverse industry verticals and consumer applications.” The company further explains: “Embedded processors are the digital ‘brains’ inside most types of electronic equipment. They are designed for specific tasks and can be optimized for performance, power, and cost per application requirements.” This specialization enables more efficient and targeted technology solutions, an important system in today’s fast-evolving electronic markets, which I believe, will continue into different areas like smart homes.

Company analysis

Capital management and current/historical financial performance

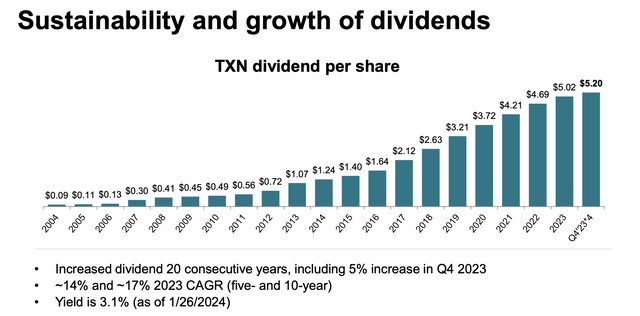

Most of you probably know that Texas Instruments has a strong historical performance track record. They have continuously increased the dividend for over 20 consecutive years, and the pay-out has grown at a CAGR of 17% in the past 10 years.

Dividend growth history (Texas Instruments)

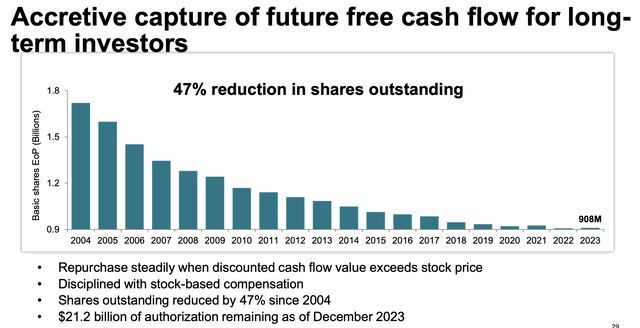

Additionally, Texas Instruments has occasionally utilized excess free cash flow for share repurchases. The total quantity of outstanding shares has come down by 45% since 2004.

Share buyback history (Texas Instruments)

Now, let me take a brief look at the company’s financial performance over the past few years. 2023 marked a 12.5% drop in revenues. This was expected because both 2021 and 2022 were really strong years for TXN. 2021 was a standout year, showing a 26% gain year-over-year. Over the last ten years, Texas Instruments has posted good growth, at a CAGR of 10%. The company has more than tripled its net income from 2014 to 2023; that’s an average yearly growth of 13%. Going forward, the growth is expected to be lower, with a CAGR of 7%, according to analysts. The lower growth projection is largely the impact of the negative outlook in 2024. If we remove 2024, then it will reveal a 10% CAGR for the next couple of years. I believe this outlook to be fair, when considering the value drivers and trends that I mentioned earlier.

Earnings estimates, Seeking Alpha (Seeking Alpha)

A brief examination of Texas Instruments’ margins reveals that their gross margins have remained relatively stable over the years. The primary impact has been on net margins, which have been impacted by the decline in revenues. Also, I would expect lower net margins in the short term because of lower revenue growth and higher depreciation from increased Capex. This will ultimately also impact the return on equity, which could get lower than 30% in the short term.

Texas Instruments, margins (Morningstar)

How can the negative revenue trend change its trajectory?

Texas Instruments’ product portfolio is more economically sensitive than other parts of the semiconductor industry. We could say that their revenues are more tied to the overall economic climate. Also, Texas Instruments came from a very profitable period during COVID-19, which saw strong demand for certain semiconductor products and supply chain issues pressing up prices.

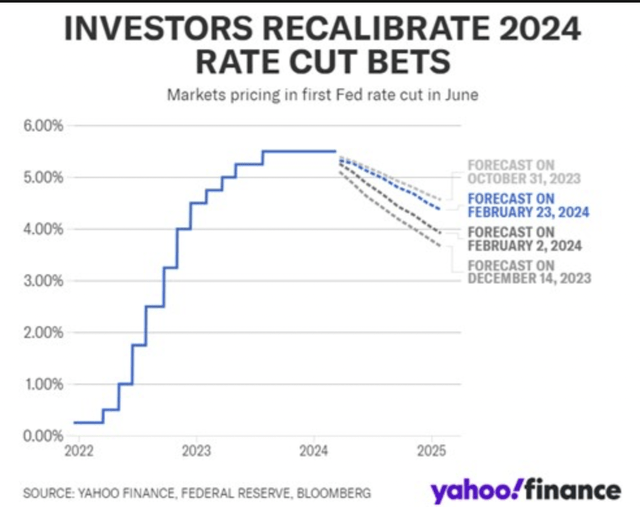

Interest rates outlook (Yahoo! Finance)

Even though the supply chain constraints impacted Texas Instruments, the company profited from lower interest rates and a highly consuming economy. I believe a turning point for Texas Instruments could come faster than expected if interest rates start getting lower. It looks like this will not happen as fast as people first thought earlier this year, and the interest rate cut expectations are fewer than just some months ago.

Capital expenditure

In 2021, Texas Instruments substantially ramped up its capital expenditures to previously unseen levels. The year-over-year increase from 2020 to 2021 was quite outstanding, with Capex increasing approximately 271% from $646 million to $2.4 billion. In 2023, the Capex will further escalate to just over $5 billion. Management has laid out that it means keeping an elevated rate, and Capex will remain at the 10% to 15% range of revenues through 2027.

Capex is expected to hurt buybacks in the short to midterm, as it significantly reduces free cash flow. If we look at share buybacks trailing 12 months Q1 2024 compared to Q1 2023, then there will be a 94% reduction YoY. I believe we can expect smaller amounts of buybacks in the next couple of years.

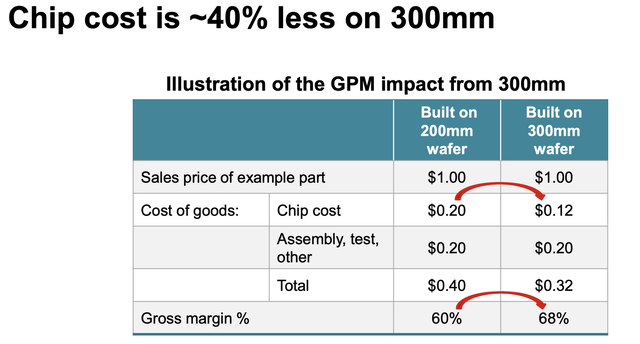

Cost savings from new investments (Texas Instruments)

What is the strategic decision behind these investments? The management response is as follows: “Invest to support new technology development and revenue growth. Extend our low-cost manufacturing advantage, including 300mm. Recognize that it may run higher if there is an opportunity to extend the long-term manufacturing advantage.” This would, in essence, bring down the cost of goods sold and, in the process, improve the gross margins and increase profitability.

In 2022, the Biden administration came up with a plan to take more control over their own supply chains, and they passed a bill that will give incentives and subsidies to manufacturers that want to expand their operations in the United States. Additionally, the government will provide tax credits for investments in semiconductor manufacturing. These incentives will probably help Texas Instruments in not only gaining a competitive advantage by reducing the costs of its goods, but also getting tax credits or other incentives offered by the government.

Ultimately, the main purpose for the intensive capital expenditures is to maintain and strengthen Texas Instruments’ competitive advantages, which will help the company reach its goal, which is that: “growth of free cash flow per share is the primary driver of long-term value”.

Balance sheet

Texas Instruments has changed its capital structure in the past couple of years. Since 2017, it looks like they have maintained a debt-to-equity ratio of 0.3, which is relatively low, but since 2017, they have increased their debt, and the ratio is now closer to 0.6 and sometimes as high as 0.75 since 2018. Even with a higher debt-to-equity ratio, the interest coverage ratio is still 17. They have had a current ratio of above 4 since 2019. I can conclude that Texas Instruments has solid liquidity, with a cash ratio that is more than double the size of its current liabilities.

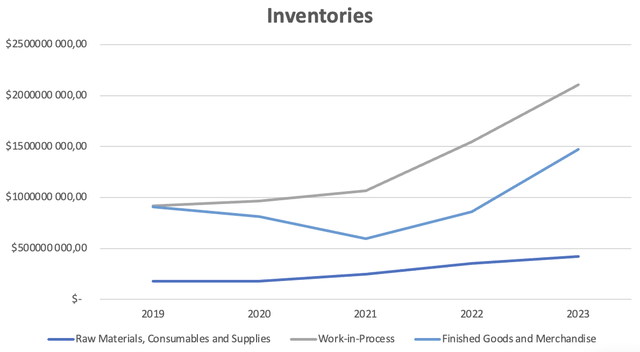

Financial health (Morningstar) Graph of inventories (Morningstar)

In the last two years, the inventory levels have surged approximately 72% from 2022 to 2023. The increase comes from finished goods, and originates from the lower demand witnessed in this part of the industry. The increased size of inventories is not all bad news because they can leverage this when demand picks up again eventually.

Company-specific risks

What do I consider to be Texas Instruments’ main risks? I believe their ability to grow their dividend at the same pace could be an issue. In the year 2023, Texas Instruments witnessed a drastic decline in free cash flow, a 77% decline. In 2023, their dividend payout was at three and a half times bigger than their free cash flow, with dividends of $5.2 per share versus a free cash flow of $1.49 per share, Texas Instruments resorted to the use of existing cash reserves and possibly also accruing debt to continue its dividend consistency. I don’t think Texas Instruments will have a problem maintaining their dividend, but if unexpected revenue declines, or they have to continue their Capex for a longer period than anticipated, then it can become a problem. However, I believe, the ability to keep growing dividends will be difficult, unless they issue more debt or use more cash reserves.

Additionally, I believe higher interest rates for longer and sticky inflation could cause a long-term problem for Texas Instruments. It could impact the broader population’s spending behavior and cause cost issues. Capex could become more expensive and cause problems.

How is the competition doing?

While a certain complexity and depth are inherently involved in every competitive analysis, I have decided to only focus on the current performance and the outlook for both Texas Instruments and its competitors. This should give a better look at how Texas Instruments stands against the competition.

Below are the main competitors. Texas Instruments has a negative levered FCF margin, which is the same as Intel (INTC) and Micron Technology (MU), because of the relatively high Capex compared to FCF.

Financial metrics, peers (Seeking Alpha)

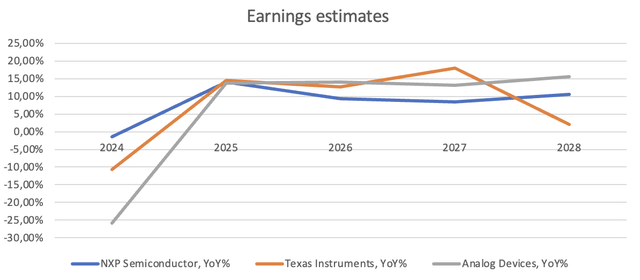

So, I have chosen Analog Devices Inc. (ADI) and NXP Semiconductors (NXPI) as Texas Instruments’ closest competitors. ADI produces data converters, amplifiers, and other analog integrated circuits, which closely relate to Texas Instruments’ analog segment. NXPI’s product portfolio competes in automotive and industrial businesses. NXPI specializes in the automotive industry, specifically industrial and IoT, mobile, and communication infrastructure.

From 2021 onward, the three companies have a very similar outlook for earnings estimates. Their earnings have a high correlation: 0.78 between Texas Instruments and NXP and 0.83 between Texas Instruments and Analog Devices. This shows that all three companies expect a decline this year but increased growth from 2025 onwards.

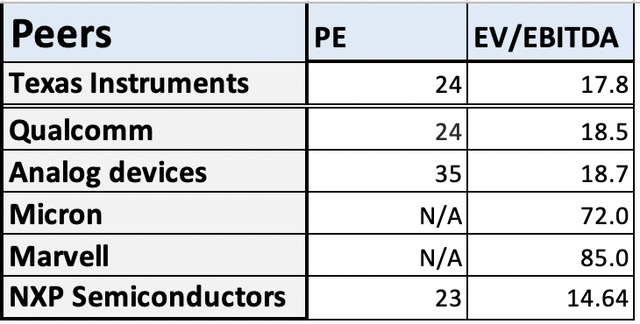

Earnings estimates (Seeking Alpha, earnings estimates) Multiples comparison (Yahoo! Finance)

Looking at Texas Instruments valuation among peers-comparing NXPI and Qualcomm (QCOM)-their multiples look quite similar. The multiples would seem to indicate that the market pricing on Texas Instruments accurately reflects the current opinion within this part of the semiconductor industry.

Valuation

Earnings yield

Texas Instruments’ current price is $174 per share, and it has an earnings yield of 3.7%. If I add the expected CAGR for the next couple of years, I get an earnings yield of approximately 10%. This looks promising, but if earnings fall, which they are expected to do according to estimates, and additionally, if the price falls as well, then the yield doesn’t look as promising. Also, the earnings yield of 10% is tied up against the growth rate. Therefore, several unknown factors make the yield less attractive.

Multiples

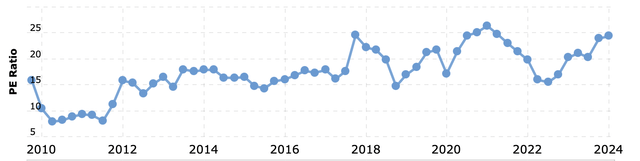

Looking at the P/E ratio, the current valuation of 27x almost looks like the peak P/E ratio around 2021 and late 2017, when earnings were growing at a fast pace, and interest rates were zero. Now, earnings are falling, and interest rates are a lot higher. Still, Texas Instruments has a P/E ratio of 27. This valuation will face some pressure in the next couple of months. In fact, it gets even more expensive if we look at the forward P/E ratio of 37. In my valuation, I believe a multiple of 22-25x is considered fair, which is the 5-year average, but 37x is too expensive if you ask me, especially considering that Texas Instruments could probably struggle to grow its dividend in the next couple of years.

PE ratio history (Macrotrends)

The S&P 500 was up 25% in 2023, and earnings equally saw an increase of 11%.

DCF Valuation

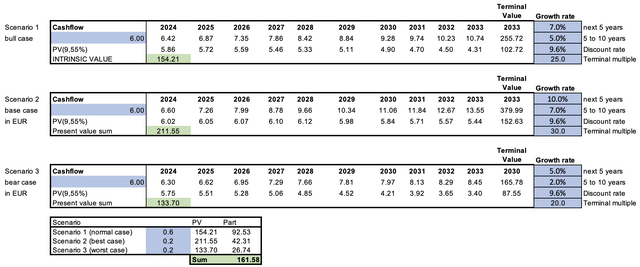

I did a DCF analysis for Texas Instruments. The base case has a CAGR of 7% over the coming five years, reflecting the average revenue growth forecast on Seeking Alpha of 7%, and then the following five years with a growth rate of 5.25%, which is the sector’s expectation. I use an EPS of $5.21 per share, which is the estimated EPS for 2024, according to Seeking Alpha. Further, I use a WACC of 9.55% and a terminal multiple of 22, reflecting the 5-year average. The base case calculated a price of $134 per share. I also did a sensitivity analysis with different growth rates and multiples. The bull case calculated a share price of $180 per share, and the bear case led me to a share price of $116. According to my DCF, the stock is almost valued equal to my bull case scenario at $180 per share, which gives little room for returns.

Other DCF scenario’s (Sven Carlin templates)

Conclusion

Texas Instruments is a renowned company and is known for its impressive capital management and profitability. However, it is currently navigating what appears to be a period of a slowdown, which is expected to continue through 2024. The long-term outlook looks solid and also what the estimates suggest, but regardless, I would rate this stock a Hold right now.

The substantial Capex does affect free cash flow. I believe it could be hard for Texas Instruments to keep growing its dividends over the next couple of years. The forward P/E ratio is 37, which is expensive and will put downward pressure on the current valuation. A current P/E ratio of 27 and a growth rate of 7% translates to an earnings yield of approximately 10%. Still, if earnings are expected to decline and the stock could follow suit in the short term, then there are several factors that could change that yield. According to my DCF, the current price of Texas Instruments is equal to my bull case scenario, which gives little room for improvement and price appreciation. I like Texas Instruments. I think it is a fantastic company, but I don’t think it is a great buy at the current price, which is why my rating is a Hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.