Summary:

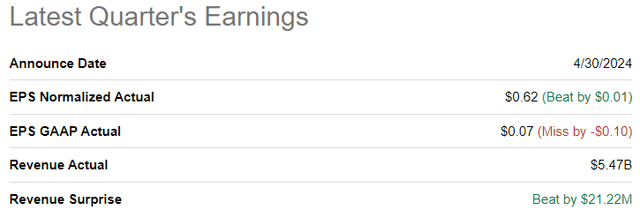

- Advanced Micro Devices, Inc.’s Q1 2024 report showed minuscule beats on revenue and earnings expectations.

- Data Center revenue grew by 80% year-over-year, indicating strong demand for AI GPU accelerators.

- In light of a significant price decline, AMD’s stock isn’t “dead money” anymore; however, it is still not an attractive investment, with a fair value estimate of $124 per share.

JHVEPhoto

Introduction

In late January 2024, I downgraded Advanced Micro Devices, Inc. (NASDAQ:AMD) from a “Hold” to a “Sell” rating and called the stock “dead money” for the next five years due to its unattractive long-term risk/reward:

Going into today’s Q4 2023 report, AMD stock is wildly overbought and could experience a correction in the absence of superlative forward guidance from management. While the stock has run up vertically in recent weeks, revenue and earnings estimates for Q4 have moved lower. That said, 2024 is expected to be a different story. Despite AMD’s significant AI potential, its stock is priced for perfection (and more). At $177 per share, AMD’s long-term risk/reward is unattractive. With AMD looking like dead money for the next five years, I’m downgrading it to a “Sell” ahead of its Q4 2023 report.

Source: AMD Is Dead Money (Rating Downgrade).

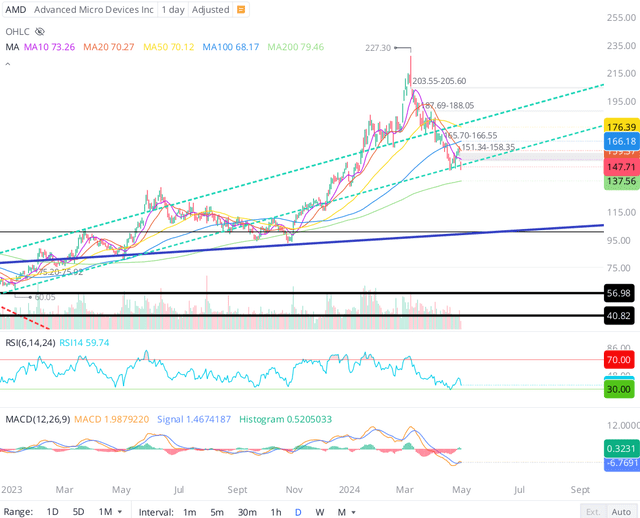

After showing some post-ER weakness, AMD stock went on another leg higher to strike a blow-off top at $227.30 per share by early March. However, since then, AMD’s stock has collapsed by ~35% to ~$147 per share, i.e., 17% below our “Sell” rating price of $177 per share.

Now, I am not here to gloat about being right on AMD; I am here to present my objective view of AMD’s Q1 2024 report and share our latest rating for the stock, which is (surprisingly) an upgrade! Let’s go.

Brief Review Of AMD’s Q1 2024 Report

For Q1 2024, AMD reported minuscule beats on its top and bottom-line expectations, with revenue coming in at $5.47B (vs. est. $5.45B) and normalized EPS landing at $0.62 (vs. est. $0.61).

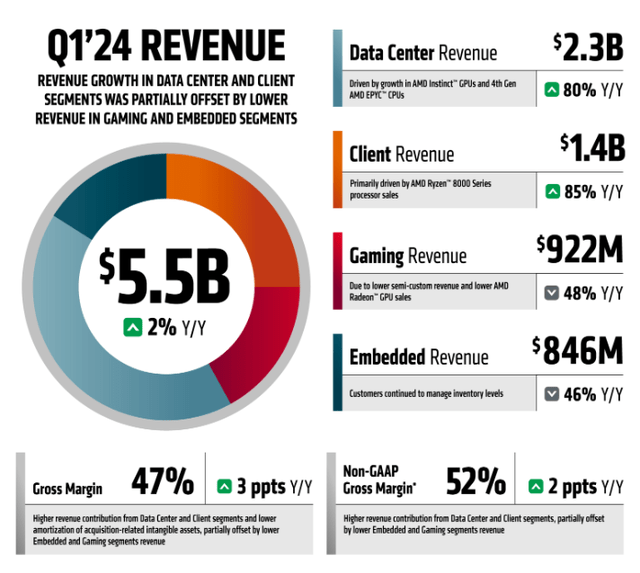

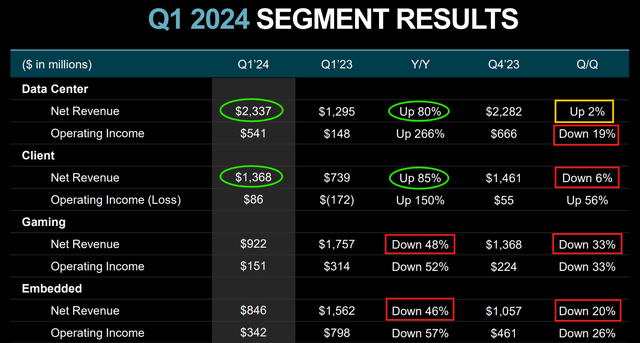

In Q1, AMD’s total revenue grew by a measly +2% y/y, with strength in Data Center and Client revenues getting offset by massive weakness in Gaming and Embedded segments. While I have highlighted the lack of AI-powered hypergrowth as a reason to avoid AMD stock in the midst of a parabolic run-up in the past, the +80% y/y jump in Data Center revenues is indicative of a strong ramp for AMD’s MI300 AI GPU accelerators.

On the earnings call, CEO Lisa Su reiterated that the MI300 accelerator ramp is on track, and shared that MI300 has become the fastest product in AMD’s history to ramp to >$1B in annual sales [over the past couple of quarters].

More importantly, Su highlighted the strong demand for AMD’s AI GPUs and raised 2024 data center GPU revenue guidance to $4B (up from $3.5B in Q4 2023 and $2B in Q3 2023):

MI300 demand continues to strengthen. And based on our expanding customer engagements, we netback data center GPU revenue to exceed $4 billion in 2024, up from the $3.5 billion we guided in January. Long term, we are increasingly working closer with our cloud and enterprise customers as we expand and accelerate our AI hardware and software road maps and grow our data center GPU footprint.

Source: AMD Q1 2024 Earnings Call Transcript (emphasis added).

Unfortunately, the recent growth in AMD’s AI GPU revenue and the expected numbers for upcoming quarters aren’t enough to move the needle for AMD’s business overall.

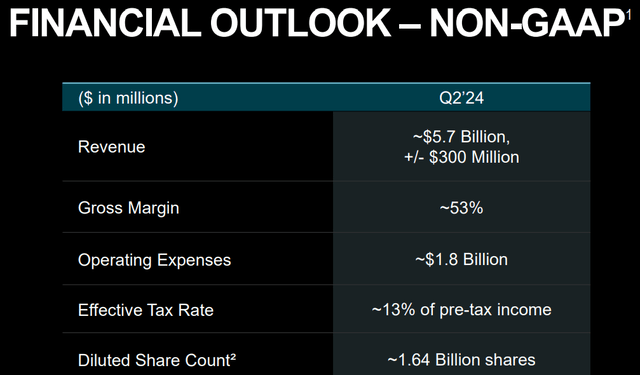

For Q2 2024, AMD is guiding for revenues of $5.7B (+/- $0.3B), which implies further acceleration in the business to ~6% y/y growth. However, the consensus estimates for Q2 going into yesterday’s report stood at $5.73B, which means AMD’s guide is more or less in line with consensus estimates. In comparison to peers such as Nvidia (NVDA) and Super Micro (SMCI), AMD’s revenue growth rates continue to look horrendous, and I think it is still fair to say that AI-powered hypergrowth is missing from the AMD story.

On a positive note, AMD’s non-GAAP gross margin improved to 52% in Q1 and is set to rise further to ~53% in Q2 2024. With operating expenses now growing at 10% y/y (only slightly faster than gross profits), AMD’s operating leverage should improve in the upcoming quarters.

Here’s what management had to say about Q1:

We delivered strong first quarter results with our Data Center and Client segments each growing more than 80% year-over-year driven by the ramp of MI300 AI accelerator shipments and the adoption of our Ryzen and EPYC processors. This is an incredibly exciting time for the industry as widespread deployment of AI is driving demand for significantly more compute across a broad range of markets. We are executing very well as we ramp our data center business and enable AI capabilities across our product portfolio.

– Lisa Su, AMD Chair and CEO.

AMD started the year strong, delivering record quarterly Data Center segment revenue. In addition, we drove solid gross margin expansion. Moving forward, we are well positioned to continue driving revenue growth and margin improvement while investing in the large AI opportunities ahead.

– Jean Hu, AMD EVP, CFO and Treasurer.

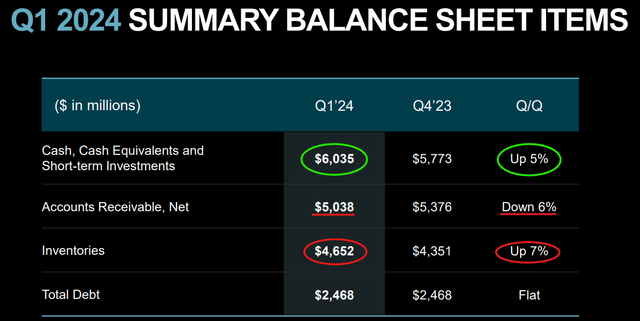

On the back of positive revenue growth and margin improvement, AMD generated $379M in free cash flow (margin: +7%), but executed no share buybacks in Q1 2024. As of the end of Q1, AMD’s net cash balance stood at $6.03B (up +5% q/q), giving the chip giant a strong financial foundation.

With AMD likely to deliver increasing amounts of free cash flows in upcoming quarters, I see no liquidity issues for the foreseeable future.

Now, AMD’s Q1 results met street expectations; however, with the stock running well ahead of its fundamentals, the post-ER sell-off in AMD stock should come as a surprise to nobody! AMD’s management provided positive demand signals for upcoming quarters during the earnings call, with AI GPU demand currently outstripping supply and the embedded segment projected to stabilize next quarter.

At some point in the next 2-4 quarters, AMD’s AI revenues should start pushing overall top-line growth rates to double-digits. However, in the absence of superlative guidance from AMD, I believe the stock will remain under pressure in the near term.

Concluding Thoughts: Is AMD A Buy, Sell, Or Hold After Q1 2024 Earnings?

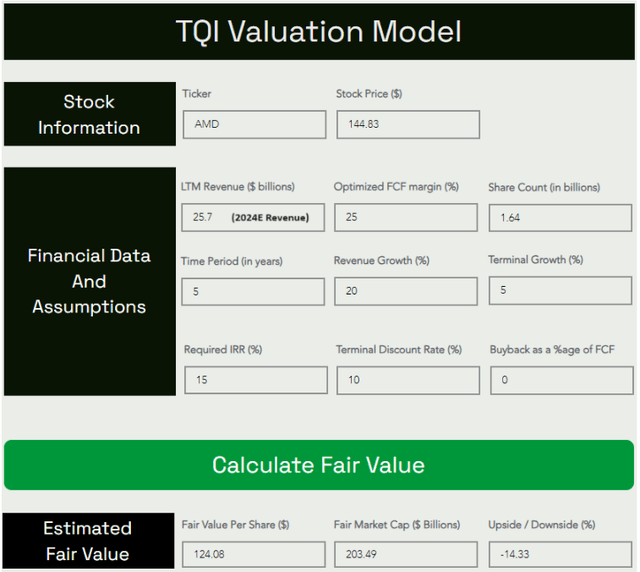

To answer this question, let’s reevaluate AMD’s long-term risk/reward using TQI’s Valuation Model.

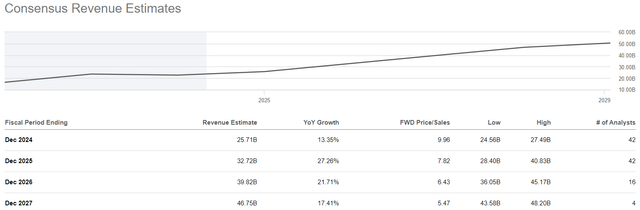

While AMD is still not showing that long-awaited AI bump in overall top-line growth, AMD’s data center business just grew at 80% y/y (up +2% q/q despite the seasonal slowdown in CPU servers), with management raising guidance for AI GPU revenue for 2024 to $4B (up from $3.5B). Now, AMD is not experiencing hypergrowth like Nvidia or Super Micro; however, with $1T worth of cloud & data center infrastructure set to be replaced over the next 10 years, AMD has a long runway for growth. As such, I am sticking to our 5-year CAGR growth assumption of 20%.

All other assumptions are relatively straightforward, but please let me know if you have any questions.

Here’s my updated valuation model for AMD:

TQI Valuation Model (TQIG.org)

As you can see above, our fair value estimate for AMD has moved up to $124 per share in light of its Q1 2024 report, which implies a downside of ~14% to fair value from current levels.

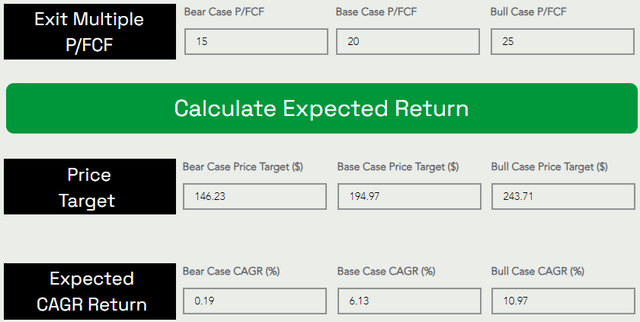

Assuming a base case P/FCF exit multiple of ~20x, we get to a 5-year price target of ~$195 per share for AMD, which implies a CAGR return of ~6%.

TQI Valuation Model (TQIG.org)

With AMD’s base case expected CAGR falling well short of my investment hurdle rate (of 15%) and long-term market (SPY) returns (of 8%-10% per year), I do not view AMD as an attractive investment. That said, AMD is no longer dead money, and its expected CAGR is now slightly above comparable treasury yields. Therefore, I am no longer bearish on AMD’s stock.

From a fundamental perspective, AMD is reporting green shoots in its Data Center business, driven by demand for its AI GPUs. The CAPEX guidance from cloud hyperscalers serves as a positive read through for AI chipmakers. While AMD is a distant second right now (given Nvidia’s dominance in the AI GPU market), I think AMD can carve out a sizeable market share in this rapidly growing market as enterprise customers will require an alternative provider to limit Nvidia’s dominance.

In my mind, AMD remains a show-me story after its Q1 2024 earnings report, with the stock still running ahead of business fundamentals, albeit the gap is much narrower now compared to just a few months ago.

Considering improving business trends and the seismic shift in long-term risk/reward (after a big price decline), I am upgrading AMD stock from “Sell” to “Hold/Neutral” in the $140s. While I am still not a buyer, you can expect me to become one, if AMD stock were to slide down to the low-$100s.

Key Takeaway: I now rate AMD a “Hold/Neutral” at $145 per share

Thank you for reading, and happy investing! Please share any questions, thoughts, and/or concerns in the comments section below or DM me.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

We Are In An Asset Bubble, And TQI Can Help You Navigate It Profitably!

Your investing journey is unique, and so are your investment goals and risk tolerance levels. This is precisely why we designed our investing group – “The Quantamental Investor” – to help you build a robust investing operation that can fulfill (and exceed) your long-term financial goals.

At TQI, we are pursuing bold, active investing with proactive risk management to navigate this highly uncertain macroeconomic environment. Join our investing community and take control of your financial future today.