Summary:

- Amazon.com, Inc. Q1 results outpaced consensus estimates, with the ecommerce giant delivering a 13% YoY increase in net sales and a tripled operating income.

- Notably, the strong performance was fueled by online retail, AWS, and advertising services.

- Looking to the rest of 2024, Amazon is expected to see continued sales growth and profitability expansion, especially as growth in AWS is accelerating.

- Overall, reflecting on Amazon’s strong first quarter results, I increase my base case target price for AMZN shares to $204.

georgeclerk

Amazon.com, Inc. (NASDAQ:AMZN) delivered strong Q1 2024 results, beating analyst consensus estimates on both the top line and earnings. Over the past 3 months, the ecommerce giant’s net sales increased 13% YoY, while operating income more than tripled.

Looking ahead to the rest of 2024, Amazon is primed for more upside, as sales growth should maintain a healthy double-digit rate, while management also expects a continued expansion in profitability. On that note, Amazon shares look attractive at a projected 15x multiple for 2024 FY EBITDA.

Reflecting on Amazon’s strong first quarter results, I am confident in reaffirming my “Buy” rating on the company’s stock, and given stronger-than-anticipated earnings momentum, I increase my base case target price to $204 per share.

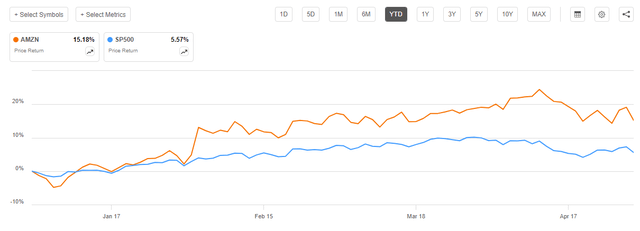

For context: Amazon stock has strongly outperformed the broader U.S. stock market, YTD. Since the start of the year, AMZN shares are up approximately 15%, compared to a gain of about 5% for the S&P 500 (SP500).

Amazon Beats Q1 Earnings

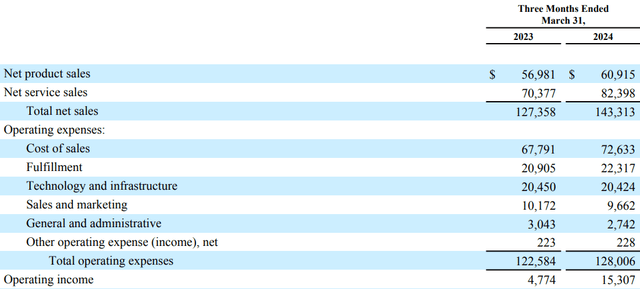

Amazon reported results for the first quarter of 2024 on Tuesday, April 30th, and delivered a beat against consensus estimates for both top-line revenue and earnings. During the period from January to the end of March, the global e-commerce and cloud computing giant posted $143.3 billion in sales, representing a robust 13% YoY increase compared to the same period one year prior. Notably, this growth was driven by strong performance in several areas. The company’s online retail service business grew by 7% YoY, while revenues for AWS (Amazon Web Services) jumped by 17 YoY. Advertising services surged by 24% YoY. On a conglomerate level, Amazon’s Q1 2024 revenue beat analyst consensus estimates by about $800 million, according to data collected by Refinitiv.

In terms of profitability, Amazon also delivered: The group’s operating margin widened significantly, increasing by approximately 690 basis points to 10.6%, up from 3.7% in the same period in 2023. In dollar terms, operating income climbed to $15.3 billion, up threefold from Q1 2023. This improvement in profitability was largely due to operational leverage; as revenue grew, operating expenses remained relatively flat. Sales and marketing expenses decreased by nearly 4% YoY, general and administrative expenses fell by about 10% YoY, general and administrative expenses fell 7% YoY, while technology and infrastructure costs remained flat YoY.

After accounting for approximately $4.9 billion in interest and tax expenses, Amazon reported a net income of about $10.4 billion, which translates to $1.0 per share, a significant increase from $0.31 per share in the same period the previous year (up more than 200% YoY), and higher than the $0.95 per share forecasted by analysts according to Refinitiv.

Lastly, Amazon concluded the quarter with a strong balance sheet, holding $57.6 billion in long-term financial debt compared to $73.3 billion in cash and cash equivalents. Free cash flow for the trailing twelve months has been recorded at an inflow of $50.1 billion, in contrast to a prolonged period of outflow.

Looking For More Strength In 2024

Looking to the rest of 2024, Amazon is poised to see more commercial upside, as the company’s retail business benefits from healthy consumer demand, while demand for the AWS business is accelerating on the backdrop of favorable GenAi momentum. In the context of AWS, Amazon management has commented that the company is seeing a “reaccelerating” growth trend and a significant whitespace opportunity for expansion upside. In fact, on top of the $100 billion of annual sales that AWS is currently generating, Amazon CEO Andy Jassy suggested in the earnings call (emphasis added) that there may still be a 5-7x upside opportunity as businesses are moving away from on-premise:

Yes, I think there are really unbelievable growth opportunities in front of us. And I think what people sometimes forget on the AWS side, it’s a $100 billion revenue run rate business, that we’re still 85-plus percent of the global IT spend is on premises. And if you believe that equation is going to flip, which we do, it means we have a lot of growth in front of us, and that’s before the generative AI opportunity, which I don’t know if any of us have seen a possibility like this in technology in a really long time, for sure, since the cloud, perhaps since the Internet.

[adding that] AWS has a meaningful edge, which is adding to the number of companies moving their AI focus to AWS. We expect the combination of AWS’ reaccelerating growth and high demand for gen AI to meaningfully increase year-over-year capital expenditures in 2024, which given the way the AWS business model works is a positive sign of the future growth. The more demand AWS has, the more we have to procure new data centers, power and hardware.

On a high-level, Amazon management has guided for net sales in the range of $144 billion and $149 billion, which would suggest a YoY growth in the range between 7% and 11%. Meanwhile, on profitability, Amazon has suggested to investors that they should expect more margin upside in Q2 204, albeit likely at a slower pace than what has been observed in the first quarter. According to management estimates, operating income is expected to be between $10 billion and $14 billion for the second quarter, ahead of the $11-12 billion expected by analysts, according to data collected by Refinitiv.

Valuation Update: Raise TP To $204/ Share

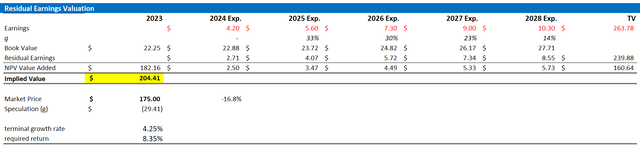

After a stronger-than-expected start to 2024, I am revising my valuation assumptions for Amazon stock. Utilizing analyst consensus estimates from Refinitiv, adjusted by +/- 10%, I now expect Amazon’s earnings per share for FY 2024 to range between $4.0 and $4.5 (non-GAAP). I project these earnings to increase to $5.6 in FY 2025 and $7.3 in FY 2026. Beyond FY 2026, I foresee a compound annual growth rate in earnings of approximately 4.25%, which is about 200 basis points higher than the projected nominal GDP growth and likely conservative. Concurrently, I maintain my cost of equity assumption at 8.3%, reflecting a strong moat to protect against competitive risk. With these updates, I now value Amazon stock at a fair value of $204, significantly up from my previous estimate of $169, and well above Amazon’s current market trading price of approximately $175.

For context, the value “Speculation” is just the difference to fair implied value. A positive value implies a premium; or in other words, markets are speculating to price more fundamental upside compared to my estimates.

Company Financials; Author’s EPS Estimates; Author’s Calculation

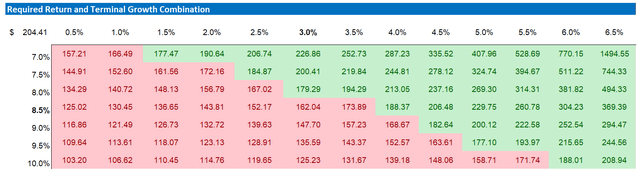

Below also the updated sensitivity table.

Company Financials; Author’s EPS Estimates; Author’s Calculation

Investor Takeaway

Amazon Q1 results outpaced consensus estimates, with the ecommerce giant delivering a 13% YoY increase in net sales and a tripled operating income. Notably, the strong performance was fueled by online retail, AWS, and advertising services. Looking to the rest of 2024, Amazon is expected to see continued sales growth and profitability expansion, especially as growth in AWS is accelerating. Reflecting on Amazon’s strong first quarter results, I have increased my base case target price for AMZN shares to $204.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.