Summary:

- Shares of cannabis companies soared after news that the US DEA is considering reclassifying marijuana as a Schedule III drug.

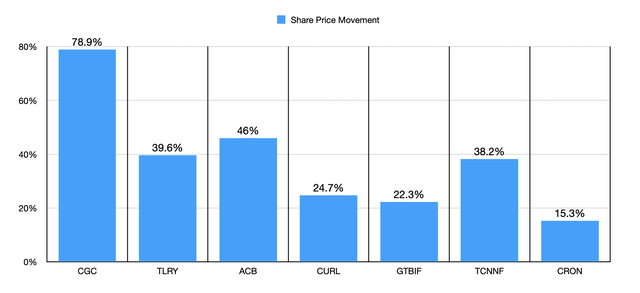

- Canopy Growth Corporation saw the biggest increase, with CGC stock closing up 78.9%.

- However, Canopy Growth faces financial challenges, including debt, cash outflows, and declining revenue, making it a risky investment.

Morsa Images

DEA to reclassify marijuana as Schedule III drug

April 30th ended up being a really remarkable day for investors in the cannabis space. Shares of several companies in this market skyrocketed after news broke that the US DEA (Drug Enforcement Administration) is about to reclassify marijuana as a Schedule III drug as opposed to the Schedule I classification it has stood at for decades. While this does not make the drug legal for recreational purposes nationwide, it is often viewed as a step in that direction. That’s because it will become easier for companies to work with cannabis firms. It will also make it possible, at a federal level, for it to be prescribed for medicinal purposes to the same extent that other medications like ketamine and Tylenol with codeine, can be.

Canopy Growth stock surge

While all companies in this space experienced upside, the firm that moved up the most was Canopy Growth Corporation (NASDAQ:CGC). Shares closed up 78.9% for the day, which just goes to underscore how optimistic this regulatory change is making investors. Some who did not own the stock previously might view this as an ideal time to buy in. However, I honestly don’t see much in the way of opportunity going this avenue. In general, the cannabis market is experiencing some major pressures because of years of over-investment and under-adoption. In addition to this, Canopy Growth on its own is not exactly the healthiest prospect to consider because of its debt, cash outflows, and competitive position. In fact, I view this as a great opportunity for those wanting to cash out to do so. I would even go so far as to say that the company deserves a ‘sell’ rating in light of these developments.

A big change for the cannabis market

For decades, the public’s perception of cannabis and what should be done about it from a regulatory perspective has been evolving. Back in 1969, for instance, only about 12% of Americans supported cannabis legalization. That number has since grown to 70%. Over that same window of time, we went from having 4% of the population having ever admitted to trying cannabis to having approximately 50% having tried it. In the past year alone, an estimated 17% of adults admit to smoking cannabis, which is up from 7% back in 2013.

Attitudes have been shifting, especially when it comes to younger demographics and those who are politically liberal. About 26% of those between 18 and 34 years old admit to having smoking cannabis in the past year. That compares to 18% for those aged 35 to 54 and only 11% for those aged 55 or greater. About 12% of Republicans have tried the drug in the past calendar year. That compares to 17% of independents and 22% of Democrats. From a regulatory perspective, adoption is already well underway. 24 different states have legalized cannabis for recreational purposes. 39 states, three territories, and the District of Columbia, have all made it available for medicinal purposes.

Based on these data points, I don’t think anybody would disagree with me when I say that, relative to the broader population, the federal government has been behind on the times. As I mentioned earlier in this article, under the Controlled Substances Act, cannabis is categorized as a Schedule I drug. This means that our government has had the position that there is ‘no recognized medical purpose’ for cannabis and that it exhibits a high potential for abuse. Other Schedule I drugs include heroin and LSD. Once official, the drug would be shifted to the Schedule III category, meaning that it can be used for medicinal purposes. Naturally, this doesn’t mean that full legalization will occur at the federal level. But it is highly probable that this will come to pass sometime in the next few years.

Assessing Canopy Growth

Author – SEC EDGAR Data

As you can see in the chart above, shares of major publicly traded cannabis companies skyrocketed in response to this development. As I mentioned already, Canopy Growth was the big winner for the day. However, the other companies listed showed increases of between 15.3% and 46%. Anybody owning stock prior to this rise is most certainly happy at this point in time. And it’s clear that the market is viewing this as a win, particularly for Canopy Growth.

Canopy Growth

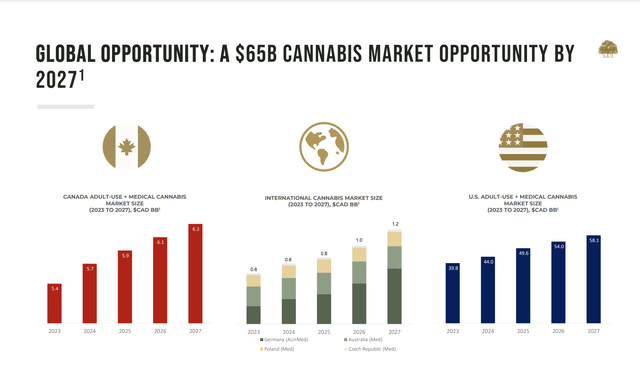

Unfortunately, I don’t have that same level of optimism. I do think that the company would stand to benefit from full federal legalization. After all, we are talking about a massive market opportunity here. According to the management team at Canopy Growth, the global opportunity for cannabis, defined as the markets in which it operates (the US, Canada, and Germany for both medicinal and recreational purposes, as well as Australia, Poland, and the Czech Republic for medicinal purposes only), will be worth around CAD$65 billion by 2027. That is up from the CAD$50.5 billion that it should be worth this year. The vast majority of this opportunity, the company claims, is in the US, with the revenue potential expanding from CAD$44 billion this year to CAD$58.1 billion in 2027.

Author – SEC EDGAR Data

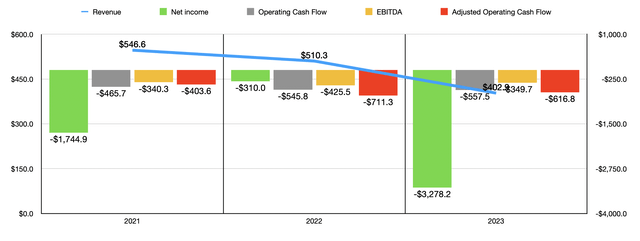

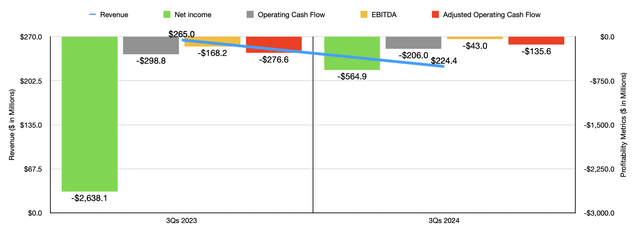

This is great to see if you are a supporter of this movement. It also leaves open the opportunity for growth in this space. However, Canopy Growth is a company that already has significant problems that need to be addressed. For instance, over the past three fiscal years, revenue for the company fell from CAD$546.6 million on a net basis to CAD$402.9 million. For the first nine months of the 2024 fiscal year, revenue of CAD$224.4 million was below the CAD$265 million generated one year earlier.

Author – SEC EDGAR Data

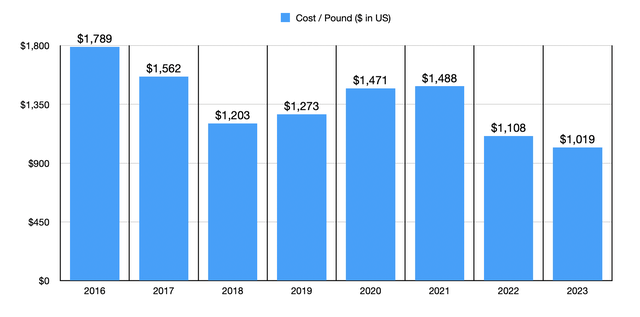

The company’s weakness from a revenue perspective has been driven by multiple factors. As you can see in the chart below, the pricing for cannabis at the wholesale level has fallen quite a bit, dropping from US$1,789 per pound to US$1,019 per pound from 2016 through 2023. For years, there was massive investment in the cannabis market, primarily in the US and Canada, with the hope that federal legalization for the US would allow the companies that were building capacity in order to seize on such a movement by the government. But over-investment, combined with a slower time to reach federal legalization, has created problems for the space.

Author – Cannabis Benchmarks Data

If it was only a decline in revenue, I wouldn’t be terribly concerned. However, as the charts in this article show, profits and cash flows have been significantly negative for the firm. Last year alone, the company saw adjusted operating cash outflows of CAD$616.8 million. Even EBITDA was negative to the tune of CAD$349.7 million. When it comes to the current fiscal year, the picture has been showing signs of improvement. Even though revenue declined in the first nine months of the 2024 fiscal year, net losses went from CAD$2.64 billion to CAD$564.9 million. Adjusted operating cash flow went from negative CAD$276.6 million to negative CAD$135.6 million. And EBITDA went from negative CAD$168.2 million to negative CAD$43.8 million.

To get these improvements, the company has worked hard on cost cutting initiatives. Since the start of 2023, the firm claims to have reduced annualized costs by $262 million. However, some of this has come at the expense of revenue. For instance, in December of last year, management entered the company into an agreement to sell the firm’s ownership interest in This Works, a company that produces natural skin care and sleep solution products. The sale price was for only CAD$6.1 million. But what’s painful about this is that, in 2023 alone, that enterprise brought in CAD$26 million worth of revenue. And in early 2023, management succeeded in selling off the rest of the firm’s Tweed and Tokyo Smoke retail locations, completely exiting the Canadian retail space.

Difficult times do call for difficult measures. And with significant cash outflows and CAD$418.6 million in net debt, it’s understandable why the company is trying to improve its operations. The firm has also made other steps at getting its house in order. For instance, in January of this year, management announced a private placement offering up 8.16 million shares of stock to investors in exchange for US$35 million. And on April 18th, the company announced that, in connection with some other restructuring activities that the firm has engaged in, two different wholly owned subsidiaries of Constellation Brands (STZ) exchanged 17.15 million common shares of Canopy Growth in exchange for an equal number of exchangeable shares. This aligned with another exchange agreement that Canopy Growth entered into with Greenstar (one of the subsidiaries) whereby Greenstar converted CAD$81.2 million of the principal amount of a CAD$100 million promissory note that was issued in April of last year in exchange for an extra 9.11 million exchangeable shares, effectively reducing Canopy Growth’s debt by that amount. But even with these maneuvers, the company’s financial condition is precarious.

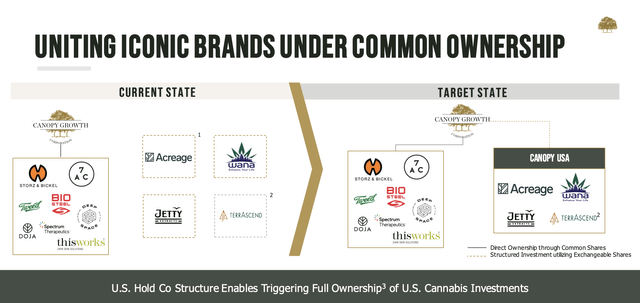

Canopy Growth

No true discussion of Canopy Growth can be had without mentioning Canopy USA. Over the past few years, the company entered into agreements to acquire four different firms. They essentially purchased options that would allow them to exchange shares for shares of those companies. Those companies are Acreage Holdings, Jetty Extracts, Wana, and TerrAscend. The biggest of these is Acreage Holdings. However, I don’t know the extent to which this maneuver will help the company or its investors.

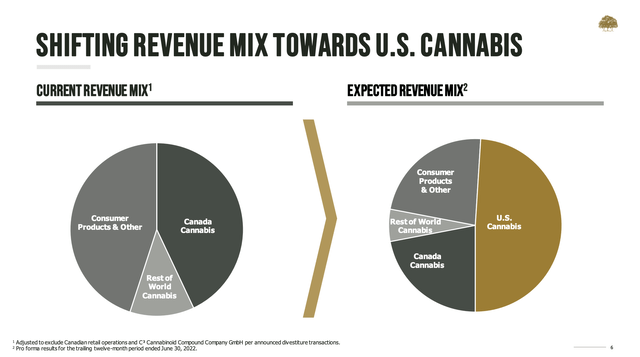

Canopy Growth

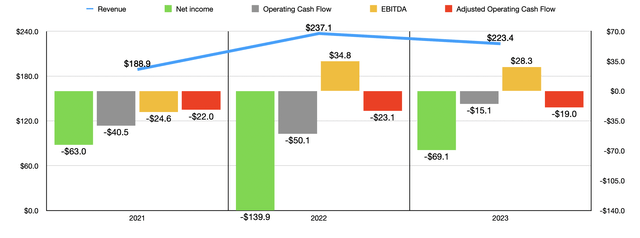

On the positive side, Canopy USA will essentially be a pureplay on the US cannabis market. It will result in around half of all the revenue seen by Canopy Growth’s shareholders coming from the US cannabis space. However, financial performance from Acreage Holdings on its own has been far from impressive. The company went from generating US$237.1 million in revenue in 2022 to generating US$223.4 million in 2023. Its net loss did narrow from US$139.9 million to US$69.1 million. And as you can see in the chart below, other profitability metrics mostly improved. However, just like Canopy Growth as a whole, Acreage Holdings is not exactly on the best footing. In addition to seeing an absence of growth and cash outflows, the company has net debt of US$219.3 million on its books.

Author – SEC EDGAR Data

CGC stock vs peers

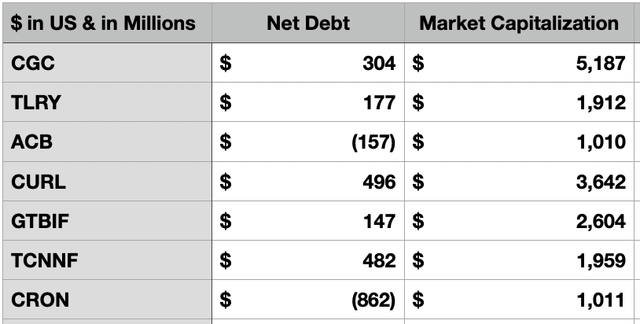

To be perfectly honest with you, I think that there might be better opportunities in the cannabis space than Canopy Growth at this time. One prospect that is popular is Tilray Brands (TLRY). However, for full transparency, I have been consistently bearish on it since rating it a ‘sell’ back in May of last year. However, it has a much smaller debt load of US$177.1 million. In addition to this, while the company does lose money, with a net loss of US$207 million in the first nine months of its current fiscal year off of US$559.1 million in revenue, it at least is diversified to the extent that only 35.9% of its revenue currently comes from cannabis operations, while the rest comes from other activities like distribution, the sale of alcoholic beverages, and more. Similarly, Aurora Cannabis (ACB) generates net losses and cash outflows. But unlike Canopy Growth and Tilray Brands, it has net cash in the amount of US$157.1 million. This could be valuable since any movement toward expansion will require the ability to fund significant investments. Having net cash as opposed to net debt can be a massive asset when it comes to getting the funds needed to grow market share.

Author – SEC EDGAR Data

One name that does not make sense to be terribly excited about is Cronos Group (CRON). And this is simply because it exited the US market in the second quarter of 2023. That also helps to explain why shares rose only 15.3% in response to this development, while the shares of its competitors shot up. It also generates significant losses and cash outflows. On the other hand, it does enjoy net cash in the amount of US$861.5 million. At the end of the day, this leaves a few other names. In my book, both Curaleaf Holdings (OTCPK:CURLF) and Trulieve Cannabis Corp. (OTCQX:TCNNF) are interesting plays. However, Curaleaf generated a net loss of US$281.2 million in its latest fiscal year off of US$1.35 billion in revenue, while the net loss for Trulieve amounted to US$526.8 million off of US$1.13 billion in revenue. Both companies had positive adjusted operating cash flow, but only marginally so, with readings of US$57.1 million and US$27.7 million, respectively.

The best prospect, in my view, has got to be Green Thumb Industries (OTCQX:GTBIF). With a market capitalization of US$2.60 billion, it’s one of the larger players in the space. It operates in 14 different markets in the US. Net debt stands at only US$146.9 million at this point in time. In addition to this, the company generated US$259.3 million in adjusted operating cash flow off of US$1.05 billion in revenue in 2023. The company does sell its own Consumer Packaged Goods, with a lot of these associated with the cannabis space. However, a large chunk of the firm’s revenue also comes from selling third party products through its retail operations. In all, about 59% of its gross revenue came from the retail space last year.

Regardless of who ends up winning, I have to wonder how much upside truly exists. Although cannabis consumption has been growing for a long time, a fact that I pointed out near the beginning of this article, it’s difficult to believe that upside potential would be much more than what we currently see, even if the US legalizes it at the federal level. While this concern may sound absurd, my thought process here revolves in just how much of the population in this country has access to recreational cannabis. According to one source, about 54% of Americans currently live in a state where recreational cannabis use is already legal. When you factor in the states where it’s only legal for medicinal purposes, that figure grows to 74%. So even in the best case, unless you assume that a large swath of Americans that have not consumed cannabis in the past year would start doing so, we aren’t even looking at a doubling of the market in the event of full federal legislation.

Takeaway

I understand the market’s excitement when it comes to this change in how the federal government plans to treat cannabis. This is clearly a net positive for all the companies involved in the market. In addition, it’s obvious that this is something that the American people want. Having said that, I struggle to see how Canopy Growth, given its own financial issues, is likely to truly benefit from this. The company is over leveraged, experiencing declining revenue, and is seeing tremendous cash outflows. Most other firms that operate in this space seem to have issues as well. One bright spot seems to be Green Thumb Industries. Next to that, Canopy Growth is rather disappointing. If I were a shareholder of the company, I would view this as an ideal time to cash out of my position. Because unless something changes in a very significant way, I have a hard time believing that the stock will stay at current levels.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights is an exclusive community of investors who have a taste for oil and natural gas firms. Our main interest is on cash flow and the value and growth prospects that generate the strongest potential for investors. You get access to a 50+ stock model account, in-depth cash flow analyses of E&P firms, and a Live Chat where members can share their knowledge and experiences with one another. Sign up now and your first two weeks are free!