Summary:

- Meta’s Q1 sales surged by 27% YoY and its net income more than doubled, but its stock tumbled due to lower revenue forecasts.

- META stock had experienced a significant increase in value and needed a pullback.

- Meta’s earnings beat estimates, and there is potential for significant EPS growth in the future, with analysts projecting upside potential for the stock.

- I recently increased my Meta stake due to the buying opportunity.

Derick Hudson

Meta Platforms (NASDAQ:META) stock recently tumbled due to its lighter-than-anticipated revenue forecasts. Yet, Q1 sales surged by 27% YoY, and Meta’s Family of Apps operating income increased by 57% to about $17.7B. The Reality Labs loss was also considerably narrower than expected, and Meta’s net income more than doubled to $12.37B last quarter.

So, why did Meta’s stock just crater and is about 20% cheaper than its recent high? The second quarter revenue guidance of $36.5B-$39B is lower than the $38.3B consensus figure. Meta also expects full-year expenses of $94B-$99B (relatively high) and increasing capex costs from last year.

Meta’s Stock Got Ahead Of Itself

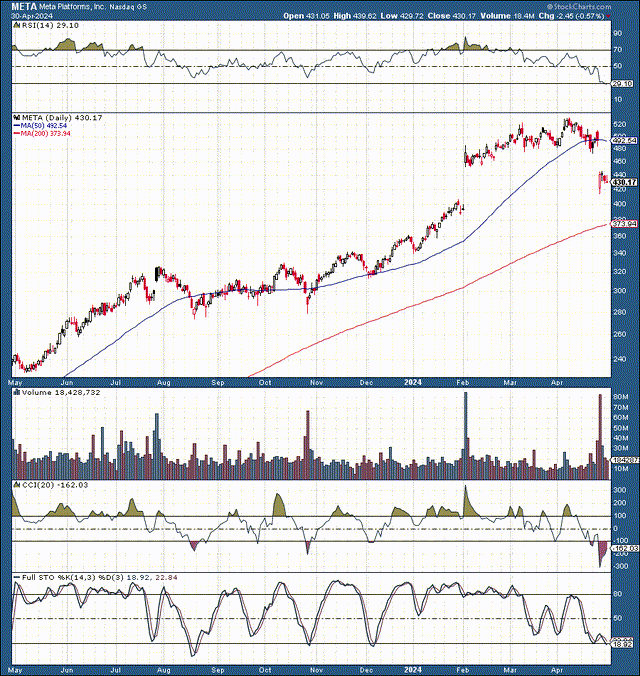

META (stockcharts.com )

Meta’s stock went up too much. Around a year and a half ago, Meta’s stock crashed to below $90, surging to over $520 recently (about a 500% increase). The bar was set extremely high, and the stock needed a pullback after such phenomenal recent gains. Meta’s stock filled the gap almost perfectly, declining to the $400-$420 range on very significant volume. However, this likely is not the end of the road for Meta’s bull run. Instead, Meta could use a cooling-off period, possibly consolidating in the $400-$500 range before moving higher again.

Meta’s unique position as a dominant social networking giant, its leadership in the metaverse, and its advancements in AI and other projects, all contribute to its significant long-term potential. Despite the recent surge, Meta’s stock is still considered undervalued. Consensus forecasts suggest that Meta trades at around 18-19 times 2025’s EPS projections, a relatively low valuation given Meta’s projected revenue growth and increasing profitability in the coming years. While short-term price fluctuations are possible, I maintain a positive outlook on Meta’s stock in the medium and long term.

Meta Earnings – Considerable Bright Spots

Meta reported GAAP EPS of $4.71, beating the consensus estimate by $0.39. Also, Meta reported revenue of $36.46B, up 27% YoY ($240M over the consensus estimate). “Family DAP” was 3.24 billion in March 2024, a 7% YoY increase. Reality Labs’ loss was $3.85B, smaller than the expected $4.5B loss. However, the tough news was the capped (lower than projected range) revenue growth and potentially less profitability due to higher costs. Still, Meta’s challenges appear temporary, and its stock could continue to increase as we advance.

Results vs. Estimates

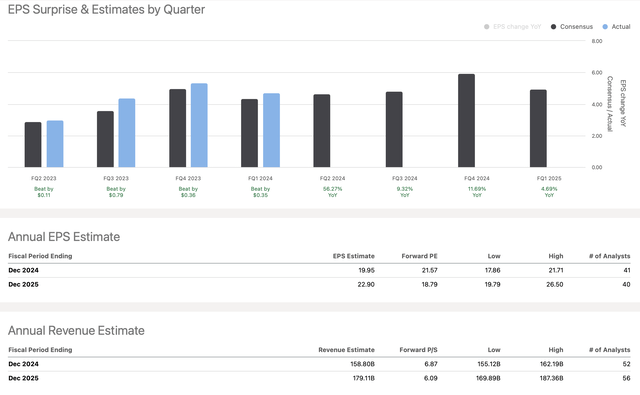

EPS vs. estimates (seekingalpha.com )

Nothing speaks louder than results. Meta’s have been excellent lately and could continue doing well. Meta reported EPS of around $15 last year, an outperformance rate of over 10%. Meta’s EPS could reach the higher end of the estimated range if we see a similar outperformance ratio.

This dynamic implies that Meta could earn $25 or more next year. Still, even if we use the modest consensus estimate of about $23, Meta’s forward P/E ratio is around 18-19 now, which is relatively cheap for a company in Meta’s advantageous position.

Meta Could Earn $30 In EPS Soon

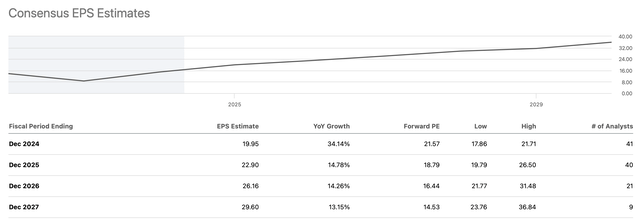

EPS growth (seekingalpha.com )

Meta could earn $23-$25 next year and provide $30 in EPS soon. Also, we could see a more significant EPS growth rate than the 15% suggested by consensus analysts’ figures, and Meta may achieve $30 in EPS in 2026-2027. Given Meta’s explosive earning power, its stock seems attractively priced, especially after the recent correction, and could be a strong buy here.

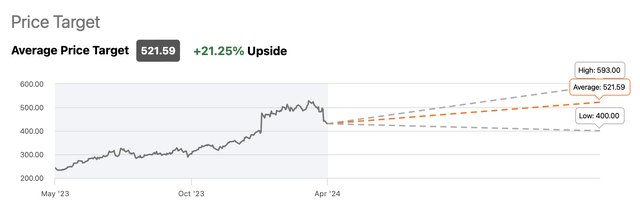

Price targets (seekingalpha.com)

Meta now trades around the lower end of analysts’ price target estimates. The average estimate is around $520, roughly 20% higher from here. Additionally, higher-end estimates range to nearly $600, implying a potential for approximately 40% upside in Meta’s stock over the next year. Meta’s stock could also benefit from multiple expansion, as its forward P/E ratio could increase to 20-25 in future years.

Where Meta’s stock could be in the future:

| ear | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $160 | $180 | $208 | $235 | $263 | $292 | $321 |

| Revenue growth | 18.5% | 13% | 16% | 13% | 12% | 11% | 10% |

| EPS | $20 | $24 | $29 | $32 | $37 | $42 | $47 |

| EPS growth | 33% | 20% | 21% | 11% | 15% | 13% | 12% |

| Forward P/E | 21 | 22 | 23 | 24 | 23 | 22 | 21 |

| Stock price | $505 | $638 | $736 | $888 | $966 | $1034 | $1120 |

Source: The Financial Prophet

Meta’s multiple could expand from its current 18-20 range to 20-25 as the stock goes through an improving growth phase with positive earnings tailwinds. EPS growth could also exceed estimates. Still, even my base case estimates provide a blueprint for Meta’s stock to move considerably higher in the years ahead.

Risks To Meta

Despite my bullish projections, Meta faces several considerable risks. Bearish macroeconomic forces and other factors could slow Meta’s growth. There are also higher cost risks due to Reality Labs research and other costly projects, including increased spending on AI. Meta platforms may lose users or report lower-than-expected/stagnant user growth. Regulatory concerns, lawsuits, and other uncertainties may persist. Investors should examine these risks and others before investing in Meta stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2023 47% return), and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!