Summary:

- PayPal delivered strong Q1 results, with $7.7 billion in revenue and $1.40 of non-GAAP EPS.

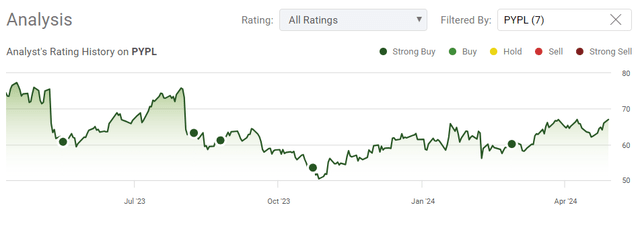

- The market is warming up to PayPal, with shares increasing by 37% since October 2023.

- PayPal faces risks such as regulatory compliance, competition, and cybersecurity threats, but its leadership and growth potential are promising.

Luis Alvarez

PayPal Holdings (NASDAQ:PYPL) delivered a top and bottom line beat with their Q1 2024 earnings as they generated $7.7 billion in revenue and $1.40 of non-GAAP EPS. I have been bullish on PYPL since the end of 2022, as I have felt it was one of the most undervalued companies in the market. As a shareholder, I was quite unhappy after last quarter’s conference call as I felt PYPL’s newly appointed CEO, Alex Chriss, missed the mark with his commentary, which overshadowed its Q4 earnings report. The market seems to be warming up to PYPL as shares are hovering around $69 after the earnings beat, which is an increase of around 37% since bottoming in October 2023. I think Alex Chriss did an exceptional job on the conference call and instilled confidence in PYPL’s ability to build off the Q1 2024 results. As a shareholder who was on the fence after the previous quarter, I must admit that my perception of senior leadership has completely changed, and I think the market will reward PYPL shares going forward. PYPL is a cash cow that continues to grow its top and bottom lines while allocating billions to buybacks on an ongoing basis. Alex Chriss and his team delivered first-class results while you could feel the conviction in his voice during the earnings call. I believe that PYPL is massively undervalued, and I am convinced that Alex Chriss and the team he has assembled can forge a new path forward and change the street’s sentiment on PYPL.

Seeking Alpha

Following up on my previous article about PYPL

I had previously written my last article about PYPL After their Q4 2023 earnings report on 2/27/24 (can be read here). Since that article was released, shares have appreciated by 14.42% compared to the S&P 500, which has increased by 0.15%. In that article, I discussed PYPL’s 2023 results, why I felt the company was undervalued, and my dissatisfaction with Alex Chriss during the earnings call and Q&A. Mr. Chriss made several comments that were negative toward PYPL, and maybe he didn’t intend for them to come off that way, but the investment community was not thrilled when the call ended. I am following up with a new article to discuss PYPL’s Q1 2024 results, and why I am reenergized as a shareholder after today’s remarks. I have felt that PYPL has been undervalued for some time, and I think the street is starting to recognize that PYPL isn’t riding off into the sunset, and its best days could still be ahead of them.

Seeking Alpha

Risks to investing in PayPal

While I believe that PYPL is a strong company to invest in, there are significant risks to my investment thesis. PYPL operates in a heavily regulated environment, as its products allow individuals and companies to move money from one place to another. PYPL needs to stay current with multiple regulatory statutes in different jurisdictions. If PYPL fails to implement safeguards to comply with updated regulations, they risk not being allowed to operate in specific regions. As crypto and new emerging technologies develop, PYPL has significant competitive risk factors as new payments systems or peer-to-peer networks become established. Large entities such as Alphabet (GOOGL) or Walmart (WMT) could partner with a legacy credit card company such as Mastercard (MA) or Visa (V), and in exchange for favorable terms, they could eliminate the PYPL option from their services. What could be the largest risk to PYPL is cybersecurity, as they are a prime candidate for cyberthreats. PYPL has a treasure trove of information within its systems, and if there happens to be a breach, they could lose customers and credibility. While the top-line continues to grow at PYPL, so does its business’s competitive risks and threats. Prior to making an investment in PYPL, investors should consider these risk factors.

PayPal came out swinging in Q1 and set the tone for 2024

PYPL delivered a strong Q1, but before I go through all the progress that PYPL has made, I will discuss the negative aspects in the numbers. Some of PYPL’s critical success factors have been their total payment volume, take rates, and transaction margins. Payment volume is self-explanatory as this is how much capital flowed through PYPL’s ecosystem throughout the quarter. Transaction payment volume is the foundation of PYPL’s business, as this is what the take rates and transaction margins are based on. The take rate is a processor fee that merchants charge for online transactions. If you were to purchase a product online for $1,000 you wouldn’t see a take rate fee in your itemized transaction, but on the backend, the vendor is paying a processing fee to somebody, whether its MA, V, or PYPL. As Venmo ramped up, part of the bull case was that transaction volumes would increase throughout PYPL’s suite of apps, and they would have more pricing power.

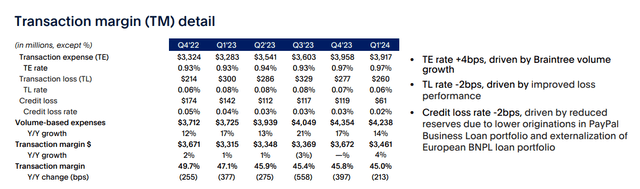

The first part of the bull thesis continues to play out the way many thought it would as PYPL’s total payment volume continues to increase. In Q1 2024, $403.86 billion of payment volume flowed through PYPL’s ecosystem, which was a 14% YoY increase. Unfortunately, PYPL hasn’t been able to scale its pricing power, and it relies on increasing payment volume to offset deteriorating margins. In Q4 2022, PYPL had a total take rate of 2.07% and a transaction take rate of 1.88%. This declined into Q1 2023 as the total take rate declined to 1.99% and the transaction take rate fell to 1.8%. In Q1 of 2024, PYPL’s total take rate fell to 1.91%, and its transaction take rate declined to 1.74%, causing a decrease YoY and sequential QoQ. This has led to its transaction margins getting tighter as PYPL’s margin was reduced by 213 bps YoY to 45%. As long as PYPL can grow the transaction volume and keep its expenses in line, a slowly declining margin can be offset. However, if PYPL recognizes increased costs or lower transaction volumes with a decreasing margin, it could put tremendous pressure on its top and bottom-line results.

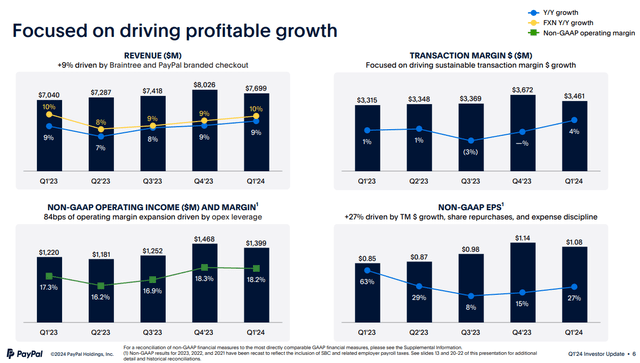

PayPal

There was a lot to be happy about regarding Q1, as it set the stage for the remainder of the 2024 fiscal year. Companies that are presumed to be fading away aren’t supposed to grow, but PYPL didn’t get the memo. While the sentiment about PYPL shifted and shares fell off a cliff from the $300 level they reached in 2021, PYPL has continued to drive ongoing results. Once again, PYPL proved that the demand for its products continues to be strong as Q1 revenue increased by 9% YoY to $7.7 billion. While the take rate and transaction margin compressed further, PYPL’s transactional margin dollars grew by 4% YoY to $3.46 billion. PYPL’s total payment volume grew by 14% YoY to $403.86 billion, which allowed PYPL to work off a larger top line number and increase profitability. PYPL grew its operating income by 17% YoY to $1.17 billion, and its net income by 12% YoY to $888 million on a GAAP basis. From a free cash flow (FCF) perspective, PYPL generated $1.76 billion in FCF, which was a 76% YoY increase.

This was a strong quarter for PYPL to build on, as management is guiding for 2024 EPS to grow in the mid to high single digits. The Fast Lane product could open up new revenue streams as PYPL is converting merchants at an 80% rate. While the threat of competition will always exist, PYPL is working with its large enterprise customers to focus on making their product offerings more enticing and enhancing the overall outcomes. PYPL is investing in innovation and recently deployed its fraud management solution and fraud protection advanced with DraftKings (DKNG), allowing DKNG to utilize PYPL’s intelligence with machine learning to protect themselves from more advanced threats. PYPL has also rolled out its complete payment platform in more than 34 countries, expanding into Canada, the U.K., and more than 20 European regions. One of the differentiators I am bullish on is that PYPL has deployed a package tracking solution and had 7 million active accounts utilize the feature over the past year. This should drive engagement and make PYPL a preferred method of payment because it streamlines the checkout process by reducing the places an end-user needs to go for information regarding their purchases.

PYPL is continuing to innovate and bring enhanced value to its customers from the enterprise level to the retail consumer. PYPL is playing offense by staying ahead of the competition and forming stronger alliances with its strategic partners. The proof is in the numbers as PYPL continues to grow its top-line on a YoY basis, and its cash flow from operations came in at $1.9 billion. This allowed PYPL to produce $1.76 billion in FCF in Q1 2024 and repurchase 25 million shares of PYPL For $1.5 billion. PYPL continues to see value in its shares and is rewarding shareholders who continuously buy back shares. Over the past year, PYPL has repurchased 81 million shares for $5.1 billion and expects to repurchase at least $5 billion worth of shares in 2024.

PayPal

PayPal still looks incredibly undervalued, and I think we see $100 per share before the year is over

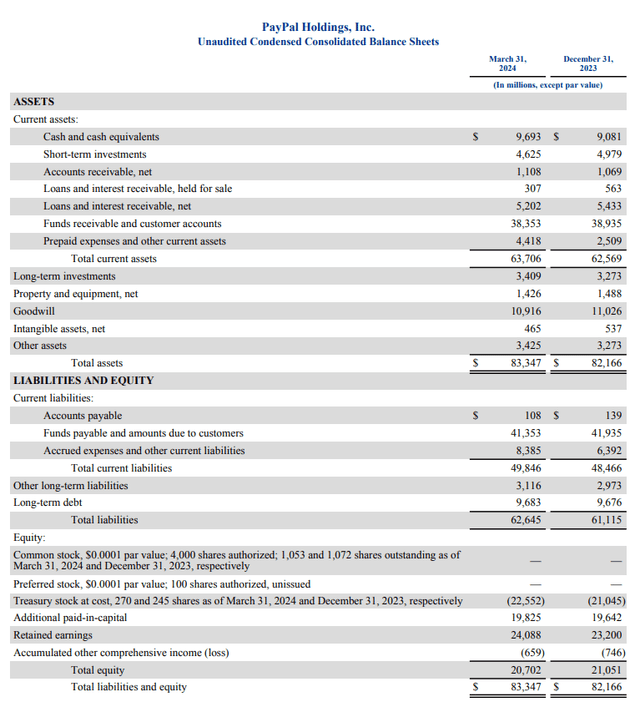

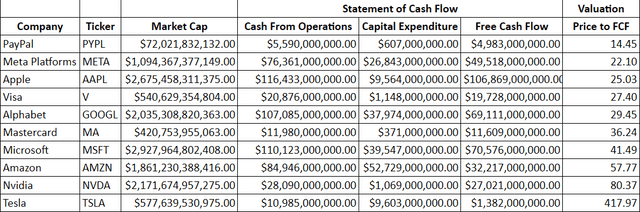

I still believe that PYPL is one of the most undervalued companies in which I am invested, and there is significant upside potential. PYPL has a market cap of $72 billion, and investors are getting a lot for their money. PYPL has one of the cleanest balance sheets I have seen from a large-cap company. PYPL is sitting on $9.69 billion in cash with an additional $4.63 billion in short-term investments. They have $14.32 billion in on-hand liquidity available to them, with only $9.68 billion in long-term debt obligations. PYPL could eliminate all their debt obligations and still have billions in liquidity on the balance sheet. In addition to having $20.7 billion of equity on the books, PYPL has generated $30.43 billion in revenue over the TTM and is guiding that they will produce at least $5 billion in FCF. Currently, shares of PYPL are trading at around 14.4 times its FCF, which is enticing. Since PYPL isn’t leveraged, this level of FCF allows them to continue repurchasing shares while investing for the company’s future.

PayPal

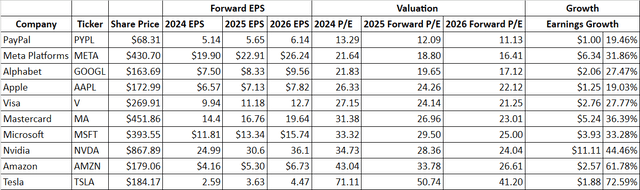

From a valuation standpoint, PYPL trades at an abnormal valuation, which could be an opportunity. I compared PYPL to big tech, and 2 of its competitors, Visa and MasterCard. From a forward-looking earnings perspective, PYPL trades at 13.29 times 2024 earnings and 11.13 times 2026 earnings. Visa and MasterCard are both trading above 20 times 2026 earnings, while both are trading at double the current valuation as PYPL on 2024 earnings. When I look at everything from an FCF perspective, PYPL has generated $4.98 billion in FCF over the TTM and is expecting to exceed $5 billion in FCF for 2024. Based on the current TTM number of $4.98 billion, PYPL trades at 14.45 times its FCF, and they are on track to continue replicating this number. The only company that even comes close to this valuation is Meta Platforms (META) at 22.10 times FCF. PYPL has been committed to buybacks since 2015, and at this rate, they could repurchase the entire company over the next 15 years. I think that the market is starting to come around. PYPL has been mispriced for some time, and trading at these valuations may not last much longer.

Steven Fiorillo Seeking Alpha

Steven Fiorillo Seeking Alpha

Conclusion

Thankfully, Alex Chriss proved me wrong, and he was a CEO filled with conviction not just during the prepared remarks but as he fielded questions during the Q&A portion of the earnings call. I believe that PYPL produced a strong Q1, and there are a lot of opportunities for them to expand on throughout 2024. The team at PYPL is setting the stage for revenue growth and increased profitability during a transformational year, and it’s going to be quite interesting to see what they can accomplish after their foundation is solidified. Hats off to PYPL, as I am no longer an angry shareholder. This is the type of leadership shareholders can get excited about. I won’t be surprised if we see shares of PYPL exceed $100 heading into 2025, as I believe PYPL is drastically undervalued, trading at 13.29 times 2024 earnings and 14.45 times FCF.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL, AAPL, GOOGL, TSLA, META, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.