Summary:

- Rivian stock reached a new all-time low in April 2024 as selling pressure intensified.

- Rivian faces immense challenges overcoming production scaling headwinds amid broad EV industry weakness.

- While buying RIVN’s weakness might seem tempting, investors must carefully consider Rivian’s fundamentally weak business model.

- Near-term growth catalysts are also noticeably absent, suggesting RIVN’s downtrend bias is unlikely to reverse.

- With Rivian’s growth story possibly broken, investors are urged to avoid buying and becoming a potential bagholder.

hapabapa

In my previous RIVN article, I urged Rivian Automotive, Inc. (NASDAQ:RIVN) investors to avoid adding to their pain. I enunciated why savvy investors shunned buying into RIVN’s fundamentally weak thesis. My caution has likely “saved” less aware investors from being fooled into thinking RIVN seems too “cheap” to ignore. Notably, RIVN reached a new all-time low in April 2024 as selling pressure intensified. Should investors consider buying into a possible mean-reversion thesis, with RIVN stock likely getting a respite this week from its recent battering?

Unless you are well-trained in price action trading and sophisticated enough to execute appropriate capital allocation and risk management strategies, long-term investors shouldn’t touch RIVN with a ten-foot pole.

| Quarter | Production | Deliveries | Deliveries/Production |

|---|---|---|---|

| Dec’22 | 10,020 | 8,054 | 0.804 |

| Mar’23 | 9,395 | 7,946 | 0.846 |

| Jun’23 | 13,992 | 12,640 | 0.903 |

| Sep’23 | 16,304 | 15,564 | 0.955 |

| Dec’23 | 17,541 | 13,972 | 0.796 |

| Mar’24 | 13,980 | 13,588 | 0.972 |

Rivian production and deliveries. Data source: Rivian filings

Rivian attempted to shore up confidence in March when it announced its R2 platform. Rivian’s production has been predicated on the opportunities afforded through its R1T (truck) and R1S (SUV). However, the weak deliveries/production ratio of 80% in December underscored the immense challenges for Rivian in scaling up sustainably. While the ratio has improved in Rivian’s Q1 production report, Rivian still needs to outperform its full-year guidance significantly to demonstrate its ability to scale.

Rivian’s decision to delay ramping production in Georgia is assessed to be apt, considering Rivian’s negative free cash flow and the broad industry headwinds. Tesla’s (TSLA) recent earnings release highlighted the difficulties faced by the EV leader. Tesla’s Q1 earnings saw the company deliver negative free cash flow, hampered by severe demand challenges and an increased investment in AI. Therefore, Rivian’s decision to focus on its Normal, Illinois facility to ramp production is prudent, as RIVN looks to manage its cash outflow judiciously and improve production efficiencies.

Rivian highlighted that its new R2 platform will be produced at the current production facility as the pure-play EV maker looks to expand its market penetration. Rivian’s expected foray into the mass market with its $45K R2 EV is expected to help the company scale.

However, RIVN investors will not have near-term clarity over its execution, as the R2’s anticipated launch is in 2026. Moreover, Rivian is expected to face immense challenges from Tesla and legacy automakers like Ford (F) as they launch their respective lower-priced versions to expand market penetration. The relative underperformance of RIVN stock relative to the legacy automakers indicates that the market has de-rated Rivian’s unprofitable EV growth thesis. While EV investors could point to TSLA’s underperformance to the S&P 500 in 2024, it has recovered most of its pre-earnings losses, finding support above the $150 zone.

In contrast, RIVN short-sellers have enjoyed a remarkable run, as they correctly anticipated its hammering. With RIVN’s short interest ratio above 18%, RIVN short sellers could be prone to a sudden short-covering, leading to a spike. However, it’s debatable whether such a metric really matters to assess RIVN’s thesis compared to other auto battleground stocks like CVNA. Despite CVNA’s short-interest ratio of almost 30%, CVNA still outperformed the S&P 500 markedly. Therefore, solely relying on RIVN’s relatively high short-interest ratio to determine its bullish/bearish take might lead to potentially misleading conclusions. I also explained my thesis in a recent CVNA article on why the market anticipated CVNA’s recovery correctly, as CVNA has a “B” profitability grade. Therefore, unless Rivian can move away from burning money consistently, it’s highly challenging to envisage growth investors returning with conviction to RIVN stock.

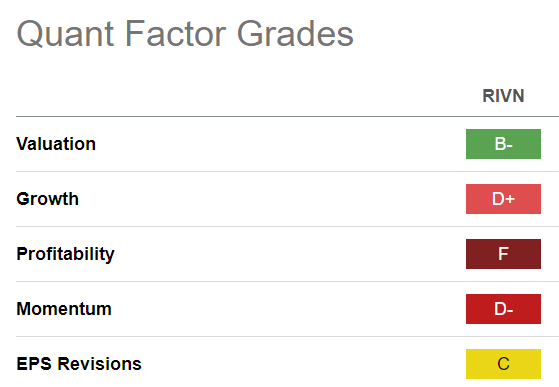

RIVN Quant Grades (Seeking Alpha)

As seen above, RIVN is assigned the worst possible “F” profitability grade, corroborating the market’s pessimism. Even though RIVN posted a strong order book for Rivian’s R2 platform, investors are urged to assess Rivian’s performance based on its production capabilities and free cash flow utilization.

As a reminder, Rivian didn’t upgrade its full-year production outlook, notwithstanding Rivian’s Q1 production update, which surpassed Wall Street’s estimates. With the Q2 platform not expected to drive growth until 2026, I didn’t assess material growth catalysts that could reignite Rivian’s bullish thesis. Moreover, RIVN isn’t priced at a steep discount, even though its “B-” valuation grade suggests relative undervaluation. However, RIVN stock’s “D-” momentum grade is consistent with RIVN’s price action, suggesting buying sentiment remains uninspiring.

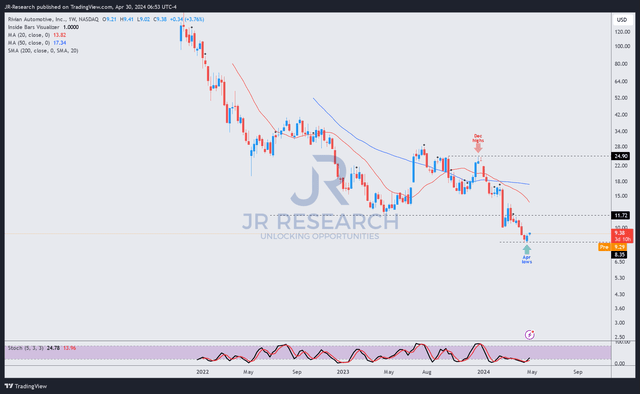

RIVN price chart (weekly, medium-term) (TradingView)

RIVN’s stock price action demonstrates the type of stocks investors should consciously avoid. RIVN exhibits lower-low and lower-high price levels consistently. In other words, RIVN remains in a downtrend, a red flag for investors looking to buy on weakness.

Catching RIVN’s falling knife has turned out to be a highly unprofitable endeavor since Rivian’s IPO during the late 2021 pandemic-inflated bubble. Has Rivian’s fundamental thesis shifted in favor of the RJ Scaringe-led company?

I haven’t assessed any solid reasons to turn even cautiously optimistic on RIVN. If you are sitting on RIVN shares, consider using the next mean-reversion opportunity to get out. If you haven’t gotten any, I urge you not to take the risk of potentially becoming the next bagholder.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!