Summary:

- UnitedHealth’s stock jumped 7% after beating Q1 expectations with revenue growth of 8.6% YoY and adjusted EPS of $6.91.

- The company’s managed care business holds a 36.4% market share and is rapidly growing with 2 million new domestic consumers in Q1.

- UnitedHealth’s health services arm, Optum, is reshaping healthcare delivery and experiencing a 16% increase in revenue.

- I give UNH a strong buy rating for the reasons laid out in this article.

Editor’s note: Seeking Alpha is proud to welcome MMMT Wealth as a new contributing analyst. You can become one too! Share your best investment idea by submitting your article for review to our editors. Get published, earn money, and unlock exclusive SA Premium access. Click here to find out more »

Wolterk

Investment Thesis

I’ve had my eye on UnitedHealth Group (NYSE:UNH) for a long time, but I’ve never felt comfortable buying at a time where there was a solid margin of safety. As you can see the stock has been a steadily moving up and up with no significant drawbacks up until February/March 2024.

UnitedHealth Group 5-year stock price (FinChat.io)

This presented a great opportunity for UNH which I rate as a buy.

Q1 Results

UnitedHealth Group’s stock jumped 7% this week after beating market expectations in Q1. This is after a substantial selloff earlier this year. A brief summary of the earnings report is as follows:

- Revenues grew 8.6% YoY to $99.8B. This beat expectations and highlights UNH is still an extremely dominant player in an extremely attractive end market, despite the issue they have faced earlier this year (See section below for a discussion on this).

- Adjusted EPS $6.91 per year, exceeding expectations.

- Earnings from operations reduced $872m related to the cyberattack we already knew about (See section below for a discussion on this)

- Net loss of $1.22B, but this shouldn’t be worrying for investors as this was a one-off disaster, rather than a long-term change in trend of the fundamentals of the company.

- Net profit forecast for 2024 ~$18 per share (this is below prior outlook of $26.20 per share) due to the cyberattack. I expect everything to be back on track by 2025.

As well as the numbers above, you can track managements commentary of these numbers here: Management commentary

Background On What Went Wrong

I won’t spend too much time on this section because this essentially was more of a one-off “disaster” rather than a longer-term fundamental deterioration in the business. But nevertheless, it’s important to understand why the sell-off occurred this year.

Change Healthcare, which was acquired by the Optum division, reported a large network outage due to a cyberattack. The result:

- The hack majorly affected billing and care authorization portals.

- Massively impacted payments to hospitals, pharmacies, & physicians.

- Cost UNH ~$870m (or $0.74 per share) in Q1 alone.

- Full-year impact estimated to be anywhere from $1.15 to $1.35 earnings per share.

These costs were so large, firstly because of the rapid platform restoration and other response efforts that were required, but also because of the loss of revenue associated with the services. Of course, this is a lengthy process for UNH and whilst the functionality and services have been restored, it appears that a return to pre-cyber performance levels won’t be until 2025.

Management are currently estimating ~80% functionality today and are focused on not only getting functionality back to pre-attack levels, but also introducing new products with better functionality.

This 80% functionality figure they quoted is of course very subjective. Purely looking at the numbers, the rate of revenue growth fell from 14.1% to 8.6% (UNH Revenue Growth (FinChat.io) on a quarter by quarter basis. To me, this shows solid support of a return to 80% functionality, though of course there are many more intricacies involved.

Also, there’s the famous Pareto principle as well.

It takes around 20% of the time and workload to do 80% of the work, and 80% of the time and workload to do the remaining 20% of the work.

Management are extremely focused on getting all the platforms returned to full functionality as quickly as possible, but the main risk is simply the fact that this remaining 20% of work could take a lot longer than originally planned which could lead to a more prolonged period of disruption and ultimately a loss of their dominant position in the market.

At the end of the day, their exact progress on this is something only really the C-Suite will know about.

Right, let’s chat the UNH business and why it’s such a compounder.

A Health Care Giant

UNH is a healthcare giant already in both the managed healthcare and the health technology sector. It’s already a leading business in their niche and therefore there’s the reduced risk of having to find the “next big thing”. We’ve already got it right here, and it’s undervalued.

Managed Care Business

This is the core of UNH and core of the health insurance sector in the US as a whole, as they boast a 36.4% market share. And on top of this, they’re still growing rapidly with total domestic consumers growing by 2 million in the first quarter of 2024. This growth is due to the quality of the offering through the innovation and affordability.

Optum

On top of the managed care business, UNH is actively attempting to reshape the future of healthcare delivery through Optum, which is their health services arm.

Though they aren’t quite as much of a leader as they are in the managed care business, they’re very well recognized in areas like population health managed and pharmacy benefit management. They’re also growing quickly, with a 16% increase in revenue compared to this period last year, and there’s no doubt that this arm can continue growing at rates well above 15% annually as Optum continues to expand the type and level of care they provide.

The Numbers

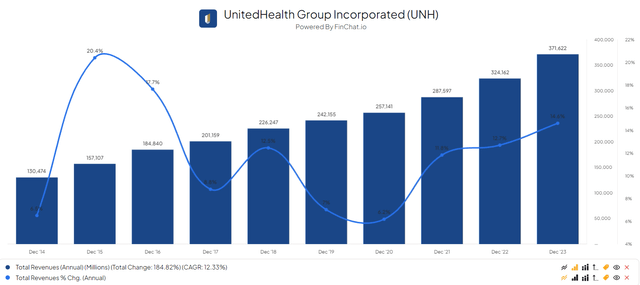

Revenue & Revenue Growth (FinChat.io )

For an investor, revenue growth as consistent as this is perfect. Granted, we saw a slight slowdown in the rate of growth back in 2020, but ever since then we’ve seen some great topline numbers. The best part is just the consistency of growth. That’s a sign of a very strong business.

EPS grew 13% last year, with an average growth of 14% yearly for the last 5 years. The best part of this is therefore that EPS growth is increasing at a faster rate than revenue growth, highlighting that not only is the company making more money, but they’re also making it more efficiently.

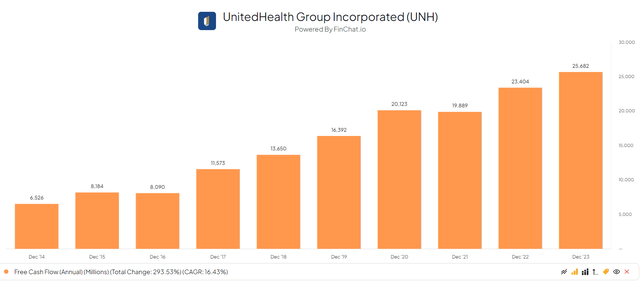

And then there’s free cash flow:

Another great graph for investors like us. Higher FCF keeps those dividends extremely solid, whilst also providing plenty of options for the management team in the form of reinvestment.

Pricing Power

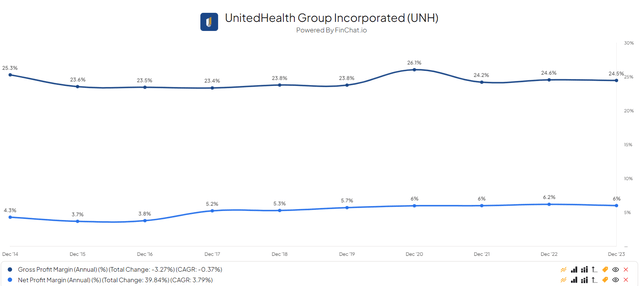

Gross & Net Margin (FinChat.io)

Competition in the healthcare sector is rife, and therefore only the best companies will be able to maintain (or even expand) their margins consistently year over year. UNH is one of those few companies.

One of the reasons for this is the diversified income streams that UNH has. Once you’re in the UNH ecosystem, it becomes very easy to get a wide range of services ranging from the UnitedHealthcare itself, across to Optum, Optum Insight, and Optum Rx.

Here’s What To Ignore

The US Healthcare System is complex. There’s no denying that. There needs to be improvements in quality, value simplification, and consumer responsiveness… amongst many other things. And well, it wouldn’t be going too far to suggest that this cyberattack was essentially an all-out attack on the US health care system.

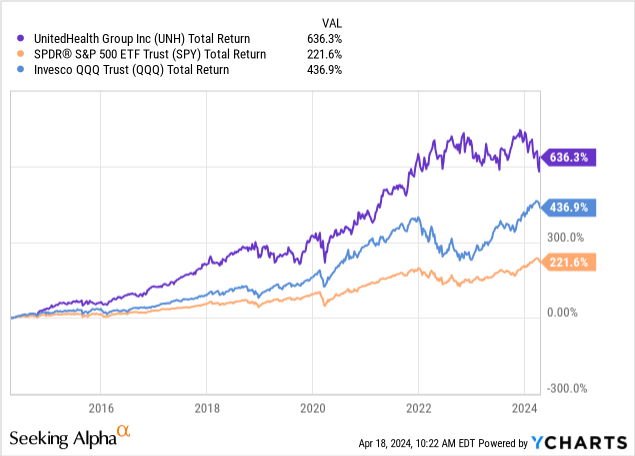

So with that being said, there are periods when the US healthcare and major players like UNH receive tons of scrutiny and bad press. Sometimes, this leads to investors losing confidence, and this period has been a prime example of that.

The important thing to remember is that healthcare is one of the most resilient industries in the world, with consistent secular growth. As long as a company can maintain their market share in an industry like this, essentially the compounding takes care of itself.

UNH vs S&P and QQQ (YCharts)

Valuation

With the current P/E sitting at ~18x compared to a 5-Yr average of 25.4x, UNH is no doubt sitting at a discounted price. Not only is it cheap compared to historical averages, but it’s also cheap compared to peers, which are currently trading at P/E’s of 27x.

With management estimating 13%-16% EPS growth YoY over the long term, let’s take the lower end estimate of 13% and a 5-year time horizon from this year’s EPS of $23.86. In 5 years, you’re sitting at EPS of $44.

Now let’s assign it a P/E multiple of 20x (slightly higher than today’s multiple, but still well below 5-year average and industry peers, which I even deem conservative) and you have a $880 stock. At current prices of $493, that’s a 78% increase, equivalent to 15.6% annually.

Although this may seem quite bullish, I used the lower end of EPS guidance and a lower P/E multiple.

Risks

For me, the main risks to the valuation of UNH lie with the macro state of the economy right now and with risks of Israel-Iran ever-growing a wider market pull back is perhaps likely, and if anything, overdue.

Although the healthcare industry will fundamentally remain extremely strong and resilient, there’s the possibility that the wider market could see a pullback of anywhere between 10-30% and with that UNH also faces risks.

On top of this, the recovery time from the cyberattack could of course last longer than what management are currently stating. The longer the period to return to 100% functionality, of course, will affect the key numbers which we as investors are most interested in.

Conclusion

UNH has no doubt had a rough start to the year, but fundamentally the company has not changed, and they have recovered from the cyberattack well. By 2025, management expect full functionality to be regained and this difficult period to be something in the past.

It’s worth just adding on here that even though UNH had this disaster, they still managed to grow revenues at just below double digits. This shows the strength that UNH holds within the industry.

The recent results report should provide investors with the confidence in the strength and long-term durability of the company. If they can get through this period unfazed, then the next 5-10 years will be an incredible period of compounding for this healthcare giant.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of UNH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.