Summary:

- Exxon reported a soft Q1 with earnings down 29% YoY as refining income declined by 67% on significantly weaker margins while upstream remained resilient despite weak gas pricing.

- Management introduced its new mid term target to grow cyclically adj. upstream unit earnings by ~50% to $13/boe by 27E in a $60/bbl Brent baseline environment.

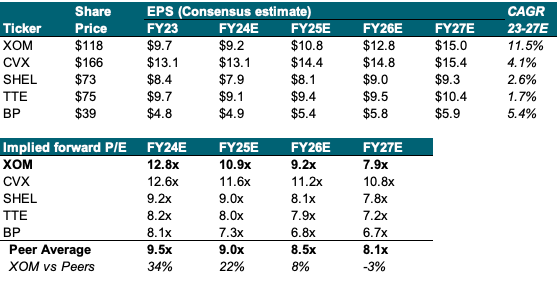

- At current Brent pricing estimates, I see upstream EPS growing at ~13% CAGR through 27E, driving annualized WholeCo EPS growth of ~12% vs peer average of ~3%.

- I reiterate my Overweight rating but slightly adjust my price target to $136 on an updated valuation method in line with the rest of my Oil & Gas coverage for 15% price upside.

typhoonski/iStock Editorial via Getty Images

I published my first note on Exxon Mobil Corporation (NYSE:XOM) in October 2023 when I initiated shares with an Overweight rating amid favorable oil tailwinds, a best-in-class balance sheet and management’s strong track record in delivering capital returns and structural cost savings. I also liked Exxon’s proposed acquisition of Pioneer, highlighting management’s strategy to build up an asset base centered around three core growth positions in Guyana, LNG and the US Permian basin, the latter heavily reinforced through the deal.

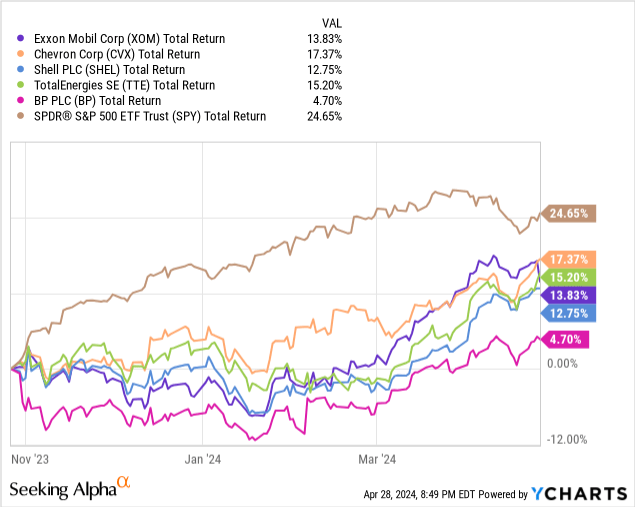

Since my initial Overweight rating shares have performed strongly, delivering the highest total return across the supermajors up until the most recent earnings and crucially beating arch rival Chevron which saw significant struggles arising in its proposed acquisition of Hess.

Despite the Q1 release sending shares down on a 29% YoY earnings decline, I believe the quarter was well in-line in terms of execution with Exxon delivering a solid return on capital and achieving further ramp-up in Guyana against a difficult pricing backdrop. More importantly, management offered new insight into its mid-term financial framework and now guides for a ~50% increase in cyclically adjusted upstream unit earnings through 27E vs FY23 baseline for a total upstream EPS CAGR of ~13%. Accounting for downstream earnings and corporate expenses, I see Exxon Mobil compounding EPS at ~12% annually through 27E, confirming the company’s premium valuation vs peers which consensus estimates to grow EPS at ~3% on average.

With the Pioneer acquisition expected to close during Q2 and Exxon offering superior EPS growth potential among the supermajors, I continue to like the shares and reiterate my Overweight rating. Applying an updated valuation model which I have previously introduced in my note on Chevron, I adjust my price target to $136 per share for ~15% price upside. Including dividends which currently yield 3.2% on a forward basis this implies potential for up to 18% total shareholder return through YE24.

[Note: Supermajor peers refer to Chevron (CVX), Shell (SHEL), TotalEnergies (TTE) and bp (BP). All company projections and figures taken from Q1 earnings presentation and supplement.]

Key discussion points

Softer Q1 earnings, but ROCE remains in target corridor and balance sheet continues to improve

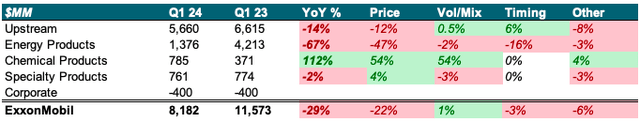

Total Q1 earnings of $8.2B were down almost 30% on a YoY basis, reflecting a significantly weaker downstream business with a 67% decline in Energy Products earnings. The key driver was weaker refining margins which contributed 47% YoY decline or $2B. Timing effects also had a negative $460MM impact due to a rising input price environment during the Q (-$660MM in total with positive $200MM impact for Q1 23). Weakness in refining portion of downstream business and a flat environment in Specialty Products (-2% YoY) was partially offset by a strong 112% YoY growth in Chemical Products, benefitting from record low feedstock gas prices (+54%) and higher volumes (+54%).

Upstream remained resilient in the face of lower Oil & Gas prices with segment earnings down 14% YoY to $5.7B. A key driver was lower realized pricing, especially in natural gas, while liquids pricing was actually slightly up YoY. Volumes remained largely flat as a significant ramp-up in strategic assets, including Guyana, was offset by declines in base production due to asset sales and divestments. Total Q1 daily output averaged ~3,784Kboed, down 1% YoY as 2.5% growth in liquids was more than offset by 8% lower gas volumes. Contrary to refining, rising commodity prices during the Q generated a total $370MM positive impact in timing effects as a negative $490MM improved to negative $120MM impact.

YoY Earnings Delta Matrix (Company Filings)

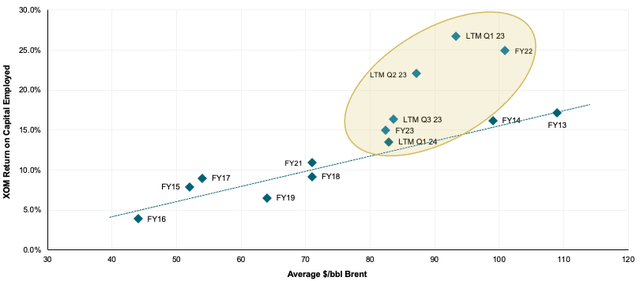

With $33.1B in LTM earnings and an average Brent price of $83/bbl for the period, I calculate 13.5% in ROCE (net income / assets less liabilities excl. debt). I note that this was below FY23 achieved levels of 14.9% at $82/bbl average Brent but remains in the “new” target corridor and 9% above FY13-19 regression estimated levels (please refer to my previous notes on Exxon for a more in-depth explanation of the concept).

Historical ROCE Matrix (Company Filings)

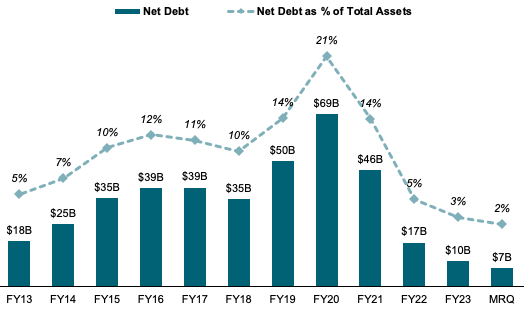

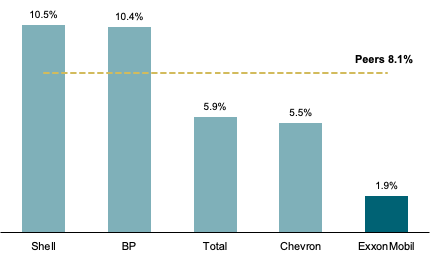

Exxon’s balance sheet has also continued to improve during the Q with period end net debt at ~$7B, down $3B from YE23 as the company paid down a further $1.4B in outstanding bonds and notes. Gearing (net debt/assets) has also continued to improve to currently 1.9%, down from 3% as of YE23, giving Exxon ample financial and operational flexibility.

Net Debt Development (Company Filings)

While I do like European majors on the back of their significantly discounted valuation, I admit that Exxon’s record-low gearing (1.9% vs 8.1% peer average) does give it a significant advantage in maneuvering the commodity price cycle.

Gearing Ratio (Net Debt / Assets) (Company Filings)

Upstream unit earnings guided to grow by ~50% vs YTD through 27E for a ~13% upstream EPS CAGR at midcycle $60/bbl Brent

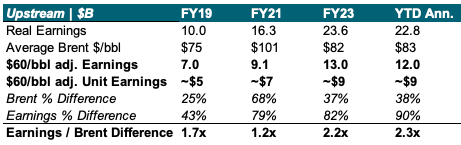

As part of the Q1 earnings call, management also took the opportunity to introduce a new metric which seeks to better track Exxon’s upstream performance by adjusting real earnings to a midcycle $60/bbl Brent environment. Since 2019 cyclically adjusted earnings have grown from $7B to $13B in 2023 with unit earnings as measured per boe growing at a ~16% CAGR from ~$5/boe to ~$9/boe. I believe this is a highly impressive feat for a company as mature as ExxonMobil and perfectly showcases the stellar execution management has achieved in focusing on high-return, low-cost oil plays such as Guyana and the Permian.

Upstream Cyclically Adj. Earnings (Company Filings)

I find that since 2019 real earnings have exceeded cyclically adj. earnings by on average 73% while average Brent prices have only been 42% above the assumed $60/bbl midcycle baseline. During Q1 and the last fiscal year, real upstream earnings of $5.7B and $23.6B have been 90% and 80% above the adj. figures while Brent pricing hovered in the low $80s or ~38% above Exxon-designated midcycle environment. This implies a recent ratio between difference in real and adj. earnings vs real and midcycle Brent prices of ~2.27x.

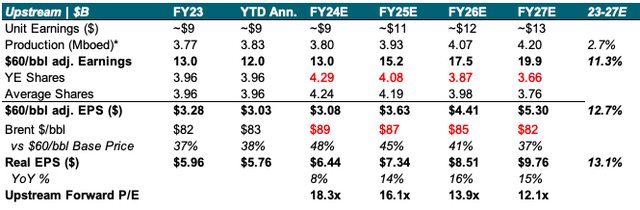

During the call management also revealed its mid-term ambition to grow upstream unit earnings (at $60/bbl Brent baseline) from ~$9/boe YTD to ~$13/boe by 27E, a ~50% expansion. This is to be delivered through further production share growth of key strategic projects (Permian, Guyana, LNG) which management notes deliver average unit earnings $9 above Exxon’s base portfolio. At projected standalone output levels which Exxon sees rising to ~4.2Mboed by 27E, I see total cyclically adjusted earnings growing to ~$20B for a ~11% 4-year CAGR. Adjusting for new shares issued in the Pioneer deal (expected close Q2) and share buybacks estimated at $20B (24E) and $25B (25-27E) I forecast cyclically adj. upstream EPS to grow at a 12.7% CAGR.

Using current forward oil pricing estimates consistent with the rest of my oils coverage of $89/$87/$85/$82 for 24E/25E/26E/27E and applying the observed 2.72x factor of real/adj. earnings vs real/$60/bbl Brent pricing, I estimate real achieved upstream segment EPS to grow at a slightly higher ~13.1%. At current share price this implies upstream-only multiples of 18.3x to 12.1x alone for the years 24E to 27E.

Upstream EPS Forecast (Company Filings, WSR Estimates)

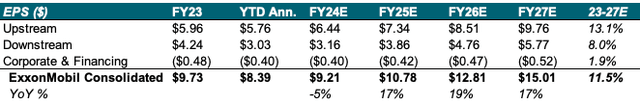

Assuming a $4.9B earnings growth vs FY23 across Exxon’s downstream business segments to reach ~$22B by 27E and with corporate expenses estimated to grow at 5% annually, I see consolidated EPS rising at ~12% CAGR as higher upstream growth is slightly offset by weaker downstream performance. I do note that my EPS estimates are 5%/16%/26% above current consensus estimates for 24E/25E/26E respectively. However given Exxon’s excellent delivery on previous targets including the achievement of ~$10B in structural cost savings vs 2019 baseline and an almost 50% expansion in upstream unit earnings, I believe there is significant potential for future upward revisions on estimates down the line.

Consolidated EPS Forecast (Company Filings, WSR Estimates)

Cross-checking consensus estimates across supermajor peers, I see Exxon offering a significantly higher EPS growth with group average at ~3% and prime rival Chevron expected to compound EPS at 4%. This also puts Exxon’s currently elevated forward valuation at ~34% premium to peers into a better context as shares are priced roughly at parity on P/E by 26E.

Bloomberg, WSR Estimates

Pioneer deal expected to close during Q2 with no FTC objections

Regarding the pending Pioneer acquisition Exxon remains confident that a close can be achieved “during Q2”. During the call management noted that they continue to work constructively with the FTC in their review of the merger and remain confident that no competition issues should prevent closing. Management didn’t comment further on the specifics but stated it supplied “an enormous amount” of documents, contracts and further information on production and sales.

Exxon has no intentions to acquire Hess in Guyana dispute, remains dedicated to enforcing its preemption rights

Since the onset of the dispute over Chevron’s pending acquisition of Hess (HES), Exxon management had made it clear that it does not intend to acquire Hess itself but solely focuses on its right to first refusal regarding Hess’ 30% stake in the Guyana development. In an interview with CNBC on Friday, Exxon CEO Woods reiterated this stance, noting that he has “made it clear in the past that this is not a play for Hess” and further confirming the company’s dedication to “protect the value that they have created”. He also noted Exxon will continue to focus on obtaining legal recognition of the preemption rights agreed to in the development’s Joint Operating Agreement and then evaluating its options to maximize shareholder value.

Woods further noted:

“They are a lot of options on the table […]. First of all we’ll confirm the rights of preemption and then will look to see what the cash value of this asset is within that transaction and then will explore the opportunities that are available to us.”

Since I am not a lawyer I will refrain from commenting on the legal basis and achievability of Exxon’s claim, however I do believe that management will ultimately strike a deal with Chevron regarding Hess. Chevron has made it abundantly clear that it does not seek to pursue the deal further should Hess’ Guyana assets come off the table and Exxon has no interest in buying the entirety of Hess. Therefore I see the most likely option in Exxon and Chevron agreeing to a deal on either %-ownership or future capital spending split on the development.

Risks: With a solid amount of downside protection, I see Exxon’s risk profile largely in execution

As all energy equities, Exxon shares are to some extent a function of global economic conditions and associated commodity price environments. However, due to its best-in-class balance sheet and more significant and diversified downstream earnings I see Exxon as better positioned than peers to withstand short-term price fluctuations. With management guiding for significant earnings growth and Guyana rampup continuing on a strong trajectory, I estimate most of Exxon’s current risk/reward profile to lie in execution on those targets. Should management fail to execute on its projected earnings improvement in upstream, partly driven by the Guyana ramp up, this could present significant near and mid-term issues and rerate the company’s current premium valuation. Other associated risks lie in post merger integration upon the Pioneer close.

Valuation

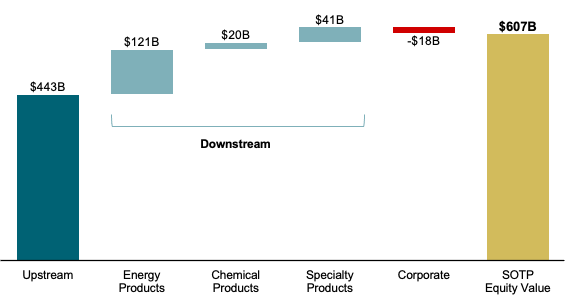

I want to use the opportunity to adjust my valuation method from a consolidated DCF to a more nuanced and in-depth Sum-of-the-Parts (“SOTP”) approach, using a PV10 net asset value model for Exxon’s oil & gas producing operations and multiples on FY23 earnings for its downstream and corporate segments.

Upstream

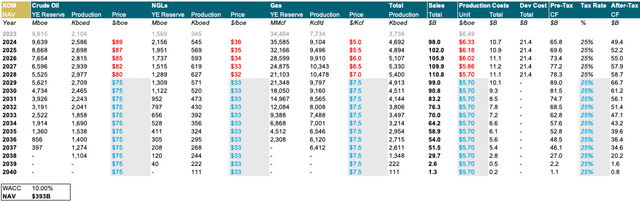

I value Exxon’s oil & gas producing upstream operations with a NAV model based on a PV10 approach. I do note that I use Pro-Forma figures for a combined Exxon/Pioneer entity given the near-certainty of the deal coming through. For a more in-depth explanation of the method and the concept behind it please refer to my note on Chevron (see here). Key inputs are declines rates of 9% for liquids and 6.5% for gas, slightly below estimates used for Chevron on Exxon’s lower shale exposure, a 60% assumed pricing discount of NGLs vs Brent crude and a total production growth to ~5.4Mboed by 28E. Tax rate is assumed similar to the Chevron model at 25%.

Brent prices are expected to match current EIA forecasts of $89/$87 per barrel for 24E/25E, after which I estimate a gradual decline towards a stable $75/bbl over the long term (90% price realization). Realized gas prices are further assumed to slightly rise from $5/Kcf to $7.5/Kcf due to improving US gas fundamentals and further growth in profitable LNG exports to Asia and Europe (I note that Exxon has a sizeable stake in some of the world’s largest and most profitable LNG projects including QatarGas). Under those assumptions and discounting cash flows with a 10% cost of capital I calculate a total value of $393B for Exxon’s oil & gas producing operations.

Company Filings, WSR Estimates

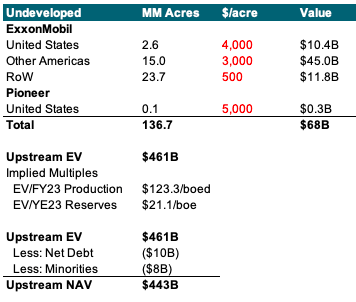

Adding currently undeveloped net acreage at conservatively estimated valuations of $4,000/acre in the US, $3,000/acre in other Americas and $500/acre in RoW locations I estimate the total enterprise value for Exxon’s upstream segment at $461B (including Pioneer Permian acreage at $5,000/acre). This valuation implies multiples of $123 per boe of FY23 production and $21/boe of proved reserves (Chevron: $94 and $16/boe respectively). Adjusting for Exxon’s corporate level net debt and minority interests, I see a total NAV of $443B for the company’s upstream segment.

Upstream NAV and Implied Multiples (Company Filings, WSR Estimates)

Downstream

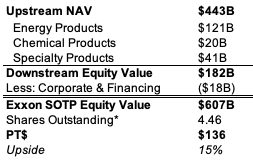

Exxon reports its downstream business (“Products Solutions”) via three different segments: Energy Products (refining & marketing), Chemical Products (commodity petrochemicals) and Specialty Products (specialty chemicals and lubricants). For FY23 the divisions generated $12.1B, $1.6B and $2.7B in earnings respectively for a total downstream profit of $16.4B.

I value Energy Products at a 10x P/E, Chemical Products at 12x and Specialty Products at 15x with all multiples in line with peer averages across the (US) refining, commodity chemicals and specialty chemicals industries. Overall this yields equity valuations of $121B, $20B and $41B for a total downstream valuation of $182B. This implies a consolidated P/E of ~11x on FY23 earnings, slightly above the 9.5x I used for Chevron’s downstream business given Exxon’s leading scale and profitability in the field (FY23 net margin 5.3% vs Chevron 3.8%).

Company Filings, WSR Estimates

SOTP

Adjusting the combined equity value for FY23 corporate expenses of negative $1.8B (valued at corporate level 10x P/E for a total value of negative $18B), I calculate a SOTP equity value of $607B for ExxonMobil. Including the shares issued upon closing of the Pioneer acquisition, this yields an implied value of $136/sh for ~15% price upside from current levels.

Company Filings, WSR Estimates SOTP Bridge (Company Filings, WSR Estimates)

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.