Summary:

- Starbucks Corporation announced disappointing Q2 fiscal 2024 results on April 30 and spooked investors with a sharp drop in same-store sales.

- Having had SBUX stock on my watch list for more than two years now, yesterday’s sharp decline seems like a good opportunity to (finally) open a position.

- Starbucks’ valuation does indeed look compelling, but only on the surface, as I explain in this earnings update.

- In addition to sharing my view on the coffee giant’s Q2 results, I also share why I continue to practice one of the most important aspects of successful investing: patience.

LPETTET/E+ via Getty Images

Introduction

Starbucks Corporation (NASDAQ:SBUX) (NEOE:SBUX:CA) announced its fiscal 2024 second quarter results on April 30 and spooked investors with a sharp decline in same-store sales and a significant miss on earnings per share (EPS) and net revenues expectations. I have covered Starbucks stock in some of my more generalistic articles in the past, and it has been on my watch list for more than two years now. As mentioned in my article published in April 2022, I thought about opening a position but ultimately found the valuation too high, especially given the pronounced leverage, still far from perfect profitability, and growth concerns in China.

However, with Mr. Market in a very bad mood regarding Starbucks yesterday – the stock lost almost 16% – I think it’s time to reassess. In this update, I share my thoughts on Starbucks’ Q2 earnings report and explain why I still don’t think SBUX valuation is compelling enough to warrant a starter position – even though Starbucks is undoubtedly a great brand with a solid foundation.

Starbucks Q2 Fiscal 2024 Earnings – Was The Stock Rightly Punished?

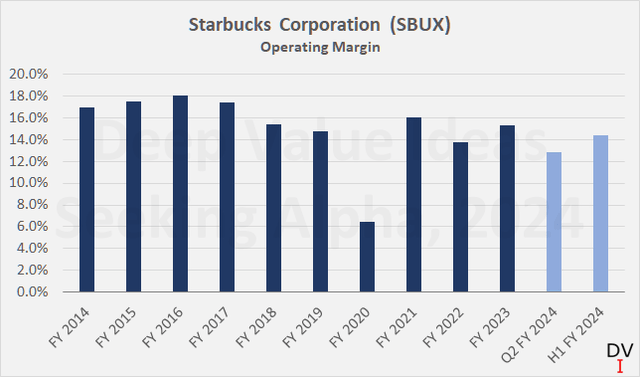

Starbucks reported Q2 FY 2024 EPS of $0.68, well below consensus of $0.80, primarily due to weak net revenue of just $8.56 billion (6.5% below consensus of $9.16 billion) and a 240 basis point decline in operating margin. Starbucks’ operating margin for the quarter was just 12.8%, well below the ten-year average of 15.1% (Figure 1). Granted, the company is currently investing in its “Triple Shot Reinvention” program with the “Two Pumps” strategy (sic!), but even after adjusting for estimated spending on the program and other factors, operating margin only improves by 53 basis points.

Figure 1: Starbucks Corporation (SBUX): Operating margin over the last ten years as well as for Q1 and H1 fiscal 2024 (own work, based on company filings)

Gross margin improved slightly compared to the previous year’s first quarter – by 120 basis points – to 69.0%. The main reason for the decline in the operating margin was operating costs of the stores – an increase of almost 180 basis points compared to the previous year. Higher wages and benefits as well as increased promotional activities were mainly responsible for the rather weak result. Without expenses which management considers to be one-off, operating margin would have been 12.8% – still nothing to write home about.

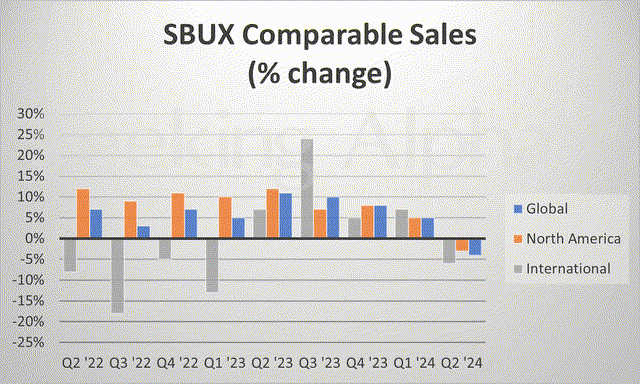

However, the elephant in the room was same-store sales (Figure 2), and I have to admit that I was a bit stunned that a company like Starbucks reported such a result. In the first quarter, global same-store sales were down 4% – pricing did not make up for this and only offset the 6% decline in comparable transactions by two percentage points. Particularly surprising, not to say shocking, was the decline in China – a 4% decline in comparable transactions and an 8% decline in ticket size – compared to what was still very strong growth in the first quarter (21% transaction-related growth, partially offset by a 9% decline in ticket size).

Of course, these times are anything but easy, and consumers are feeling the pinch of high inflation. This is visible in other companies as well – for example, the above-average decline in cigarette volume and the turn to discount cigarettes (see my update on Altria Group, Inc., MO) or the postponement of spending on discretionary items such as mattresses (see my update on Leggett & Platt, Inc., LEG). Starbucks CEO Narasimhan particularly highlighted the impact from a more cautious consumer in the second quarter earnings call, so one could argue that it’s only a matter of time before the company returns to solid same-store sales growth.

Figure 2: Starbucks Corporation (SBUX): Same-store sales on a quarterly basis (Seeking Alpha)

However, I think it’s fair to say that Starbucks has probably also been pretty aggressive with its price increases, and competition is not exactly insignificant. I don’t mean to call the company’s mission – to provide a third place for its guests – into question, but same-store sales trends are definitely worth keeping an eye on in the current environment.

Much of Starbucks’ expected growth relies on China, and I wouldn’t overemphasize the competition there from Luckin Coffee Inc. (OTCPK:LKNCY) due to the different approach. At the same time, it is worth critically questioning the investment case of Starbucks – which enjoys significant pricing power thanks to its comparable quality offerings around the globe (similar to McDonald’s Corporation, MCD) – as competitors with a smaller store footprint and more focused offerings could be increasingly favored due to their edge in transaction speed and better value proposition. McDonald’s serves the “bang for the buck” clientele very well – quite deliberately in part – and is known for offering the same quality around the globe. While the latter is also true of Starbucks, the former is something I’ve missed on my (infrequent) visits to Starbucks.

I would not want to be misunderstood to suggest that Starbucks has its best days behind it. Especially, sales in China – which still accounted for well under 10% of total revenues in the second quarter – indicate significant growth potential. But of course, significant efforts are needed to remain the leading brand in the world. In my view, the CEO’s related remarks during the conference call were somewhat superficial and sometimes came across more like advertising talk than a clear-cut and straight-to-the-point. Nonetheless, I think the issues can be fixed, but things are definitely not going well for Starbucks right now, and there is significant uncertainty around the investment case (i.e. that SBUX continues to grow strongly). In this context, interested readers should definitely take a look at Marcel Knoop’s article from December 2023. In my view, he did a great job of highlighting the company’s rather inadequate – or should I say unjustified, given the $80-$100 share price – internal growth. More on this later.

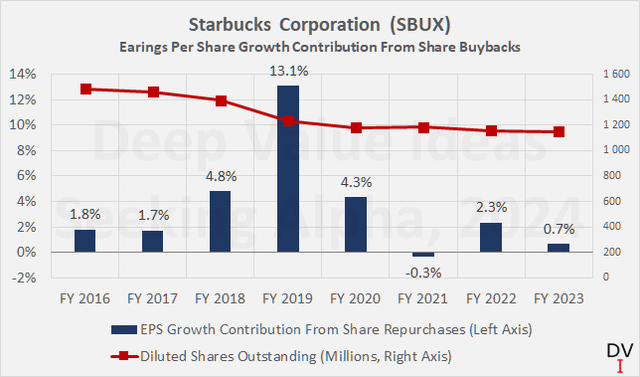

I also think it’s worth mentioning that a significant part of the past growth was due to share buybacks. In principle, there is nothing wrong with share buybacks, but I don’t like it when they are funded with debt and are conducted at times of an overly rich stock valuation. Put differently, I think a company with a certain amount of earnings growth attributable to debt-financed share buybacks deserves a lower multiple than a company that achieves the same growth organically.

As shown in Figure 3, the contribution of share buybacks to EPS growth has averaged 3.5% per year since fiscal 2016, or almost exactly a third of the average EPS growth over this period. At the same time, net debt rose from just $737 million at the end of fiscal 2015 to more than $11.4 billion at the end of fiscal 2023 – an increase of more than 15 times. Including operating leases – which is appropriate given Starbucks’ significant reliance on leased stores – net debt has tripled over the same period, so considerably less but still well ahead of net sales and adjusted EPS growth. In my view, the $10.2 billion worth of shares bought back in fiscal 2019 in particular was a far from ideal allocation of capital.

Figure 3: Starbucks Corporation (SBUX): Earnings per share growth contribution from share buybacks and diluted weighted-average shares outstanding (own work, based on company filings)

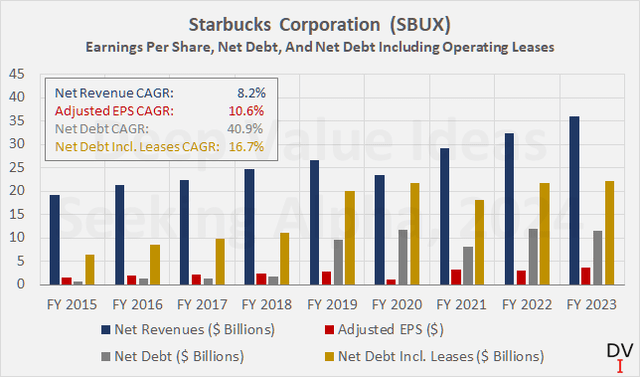

In terms of compound annual growth rate, net revenue has grown at 8.2% annually over the last eight years, adjusted earnings per share at 10.6% p.a. (1/3 of which is attributable to buybacks), net debt at 40.6% p.a. and net debt including operating leases at 16.7% p.a. (Figure 4). Of course, one could argue that net property, plant and equipment also almost doubled in the same period. However, since most of the value is tied up in leasehold improvements and land only accounted for $46 million (book value, market value probably much higher, but still not significant), I would not overstate this item on the balance sheet.

I therefore do not view Starbucks as the superfast growing company that it is often labeled as, and consider somewhat conservative valuation multiples to be appropriate. Let’s now look at the current valuation of Starbucks after the 15% drop in reaction to the disappointing earnings announcement, and whether the stock is now attractively valued.

Figure 4: Starbucks Corporation (SBUX): Historical net revenues, adjusted earnings per share, and net debt, excluding and including operating leases (own work, based on company filings)

Valuation Of Starbucks Stock – Attractive, But Only On The Surface

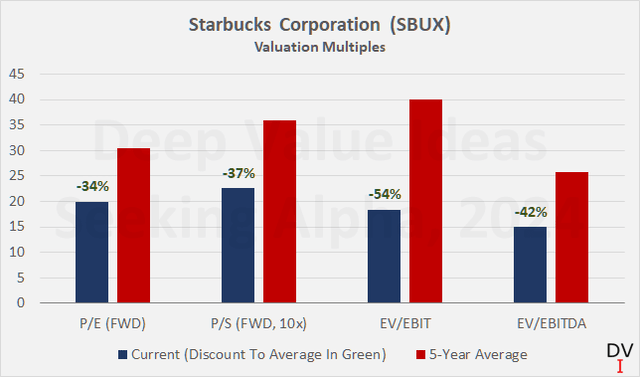

I calculated the current price-to-earnings (P/E) ratio and price-to-sales (P/S) ratio for SBUX stock based on yesterday’s closing price of $74 and using the current adjusted EPS and net sales consensus for fiscal 2024. The five-year average multiples were taken from Seeking Alpha’s valuation dashboard. Accordingly, Starbucks stock looks very cheap. Similarly, considering the long-term average adjusted EPS growth rate of 10.6%, a PEG (price-to-earnings-growth) ratio of 1.9 looks quite compelling for a company like Starbucks.

Figure 5: Starbucks Corporation (SBUX): Valuation multiples based on SBUX closing price on May 1, 2024 compared to the respective five-year average multiple (own work, based on company filings, current analyst consensus, and data from Seeking Alpha)

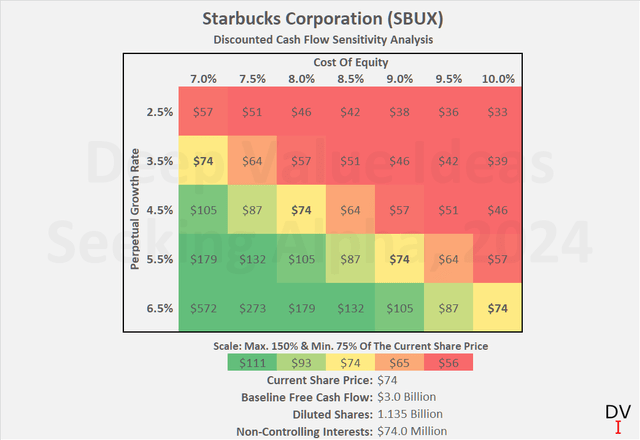

However, without the growth contribution of share buybacks, the PEG ratio would be 2.8 – not exactly a great deal. Of course, one can be divided on whether or not growth from share buybacks should be included in the PEG ratio valuation. In my view, a more transparent valuation can be done on the basis of the company’s free cash flow. Over the past three years, Starbucks has generated approximately $3.0 billion in free cash flow annually. Note, however, that I have adjusted the figure slightly to account for the pandemic-related pent-up demand which unwound in fiscal 2021. At the same time, one could argue that $3.0 billion is too conservative due to the prolonged lockdowns in China, but keep in mind that the segment still contributes less than 10% to net revenues. Finally, I have adjusted free cash flow for working capital effects and treated stock-based compensation as a cash expense.

If we perform a discounted cash flow (DCF) valuation based on this estimate, it becomes clear that Starbucks needs to show significant growth going forward to justify its current valuation – even after yesterday’s significant decline. My hurdle rate for Starbucks stock is a cost of equity of 8.0%, which is not particularly high given the risks and uncertainty underlying the investment thesis.

According to Figure 6, Starbucks’ free cash flow would have to grow by 4.5% in perpetuity for the stock to be fairly valued today. 4.5% growth in perpetuity does not sound like a lot but consider the notorious sensitivity of DCF analyses to the growth rate. A negative deviation of one percentage point from this rate, for example, would result in a $17 or 23% decline in fair value. A DCF valuation signaling fair value at a perpetual growth rate of 4.5% is significantly dependent on cash flows far in the future; in the case at hand, cash flows generated after fiscal 2034 have a weighting contribution of nearly 70%.

In other words, Starbucks could experience much stronger free cash flow growth of 6% to 7% annually over the next ten years and would still need to grow by nearly 4% thereafter to justify a $74 share price at the above cost of equity. Achieving such growth over the long term is by no means impossible, but given my expectation of a “higher for longer” environment (in terms of inflation, not necessarily interest rates) and pronounced geopolitical tensions, I think caution (read: a reasonable margin of safety) is definitely warranted.

Figure 6: Starbucks Corporation (SBUX): Discounted cash flow sensitivity analysis (own work, based on company filings and own estimates)

Conclusion – Is SBUX Stock A Good Buy Now After Q2 Earnings?

There’s no denying that Starbucks’ last earnings report was very disappointing. Of course, I wouldn’t write off the coffee giant just because of one quarter of abysmal same-store sales, same as one swallow doesn’t make a summer. I think inflationary pressures will take considerable time to subside, and given the premium pricing structure of Starbucks offerings, it will most likely take a while for the business to recover. First the pandemic and now an increasingly cautious consumer – these times are definitely not easy for Starbucks, and it would be inappropriate to blame only management for the poor results. In my view, the economy is in far less good shape than some indicators like unemployment suggest. In this context, I can wholeheartedly recommend Michael Gray’s recent article titled “The Financial Deterioration Of The American Consumer“.

Having had Starbucks stock on my watch list for more than two years, I was naturally pleased to see the stock trading back to levels seen in mid-2022 (China concerns), early 2022 (COVID-19 lockdowns) or even early 2019. A forward P/E ratio of now below 20 and a PEG ratio of less than 2 signal a solid value proposition – knowing that the stock typically trades in the high 20s price/earnings ratio range and with a PEG ratio well above 2.

However, knowing that a significant portion of EPS growth is due to share buybacks, I take a more conservative stance. Excluding the impact of share repurchases, I estimate Starbucks’ PEG ratio at 2.8. Valuing SBUX stock using discounted cash flow analysis suggests still significant implied growth, even after the sharp post-earnings decline. The DCF model’s valuation is heavily weighted toward cash flows far in the future, which of course are impossible to quantify. Starbucks stock is still trading at a free cash flow yield of well below 4%, even after yesterday’s decline. Given the uncertainties surrounding sustainable sales growth in China, ongoing inflationary pressures, and the leveraged balance sheet, I still find it difficult to take a position, despite Mr. Market’s undoubtably bad mood. However, if SBUX shares continue their downward trend, I can see myself initiating a modest position in the low- to mid-$60 range.

Thank you very much for reading my latest article. Whether you agree or disagree with my conclusions, I always welcome your opinion and feedback in the comments below. And if there’s anything I should improve or expand on in future articles, drop me a line as well. As always, please consider this article only as a first step in your due diligence.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO, LEG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The contents of this article, my previous articles, and my comments are for informational purposes only and may not be considered investment and/or tax advice. I am a private investor from Europe and share my investing journey here on Seeking Alpha. I am neither a licensed investment advisor nor a licensed tax advisor. Furthermore, I am not an expert on taxes and related laws – neither in relation to the U.S. nor other geographies/jurisdictions. It is not my intention to give financial and/or tax advice, and I am in no way qualified to do so. Although I do my best to make sure that what I write is accurate and well researched, I cannot be held responsible and accept no liability whatsoever for any errors, omissions, or for consequences resulting from the enclosed information. The writing reflects my personal opinion at the time of writing. If you intend to invest in the stocks or other investment vehicles mentioned in this article – or in any investment vehicle generally – please consult your licensed investment advisor. If uncertain about tax-related implications, please consult your licensed tax advisor.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.