Summary:

- Eli Lilly and Company’s stock has seen a significant rally due to excitement about its weight loss drug, Zepbound, among other products.

- It’s a healthy, growing business with higher revenues each year, but adjusting for cash outflows from M&A and patents reveals a different picture.

- Recent Q1 results showed positive signs with high gross margins and revenue growth driven by new drug sales, but this alone does not explain the multiple expansion.

- Investors would be better served picking up shares in companies with prices more tied to their fundamentals and cash flows.

NoSystem images/E+ via Getty Images

A friend of mine who works in billing for healthcare expenses asked for my opinion not long ago on Eli Lilly and Company (NYSE:LLY), as their products regularly come under her notice. LLY is a stock that’s gotten a lot of attention because its shares did this over the past year:

LLY 1Y Price History (Seeking Alpha)

Much of the rally has been tied to excitement about the approval of one of its latest weight loss drugs, Zepbound.

Yet, investors have to choose a different drug. If you take the Blue Pill, you buy shares of LLY because “everyone wants to lose weight” and “stocks only go up.” If you take the Red Pill, however, you will look at the cash flows of the business, realize its fair value, and agree that LLY is, at best, a Hold for now.

Financial History

First thing is to look at what this company does over a long stretch of time, across many health fads and the emergence of multiple drugs and breakthroughs.

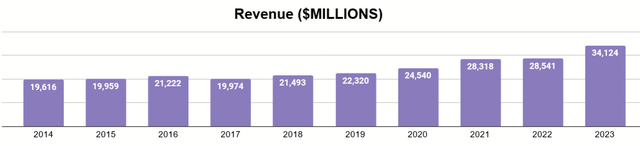

Author’s display of 10K data

We can see that it’s a growing business with revenues generally being higher each year at a CAGR of 6.3%. That being the average, it’s often the case that a brief spike occurs, followed by flatter years. Still, we need to understand it from a cash-flow perspective.

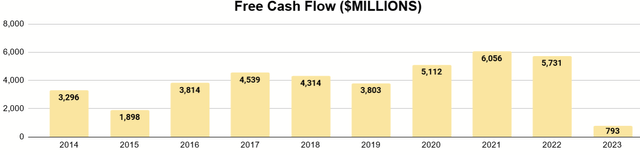

Author’s display of 10K data

If we look at free cash flow, we can see that’s it typically been making money. That is to say, if we look at FCF as it is traditionally defined (operating cash flows less capex), then it’s typically making money. Yet, FCF is a non-GAAP figure developed by value investors such as Warren Buffett in order to determine the real earnings available to owners of the common. Eli Lilly has significant and regular cash outflows due to acquisitions and purchases of patents as it grows and renews its portfolio of drugs, so what happens when we adjust for those things?

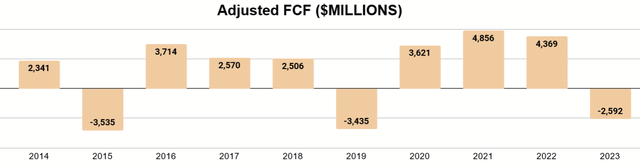

Author’s display of 10K data

We can see that this has a major impact on the actual cash generated from the business, with some of the years being net-negative as a result. The first figure of FCF averages to $3.9 billion per year, while the adjusted figure averages to about $1.4B. For valuation purposes, I think this is a major difference and something that long-term investors should not overlook.

Recent Q1 Results

Just a few days ago, the company announced their Q1 2024 results, and there were some positive signs.

Q1 2024 Company Presentation

The company boasted gross margins of 82.5% and revenue growth of 26%, driven by Zepbound, along with other new drug sales. This indicates that there has been some basis to the optimism around LLY’s price movement.

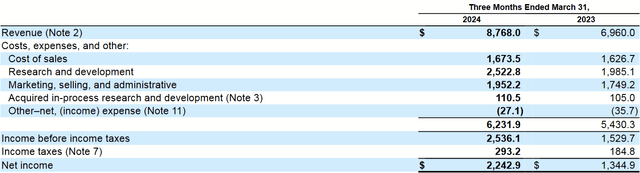

Income Statement (Q1 2024 Form 10Q)

The income statement shows to us the improvement to earnings from revenue growth well in excess of operating expenses. All of that is to say that I think the company is in a healthy position financially with plenty of momentum.

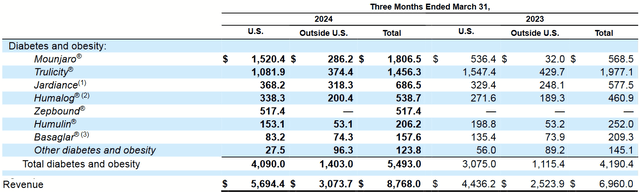

Impact of Weight-Loss (Q1 2024 Form 10Q)

Breaking it down further, we see that the biggest drivers of revenue are drugs related to “diabetes and obesity.” Zepbound offered new inflows of $517M compared to Q1 2023. Mounjaro also saw significant growth in sales, while the whole “weight loss” portfolio jumped $1.3B.

Capital Allocation

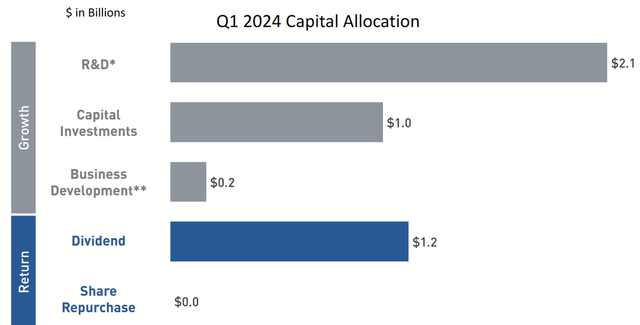

Yet, we know that the company regularly commits cash to growth and new products, and the current outlook indicates that more of this is likely going forward.

Q1 2024 Company Presentation

One thing I want to stress is the complete lack of buybacks in Q1. In fact, the company had a declining trend of this, hinting they feel more comfortable reinvesting in the business than enhancing returns on capital through buybacks. There was already a trend of this over the past decade.

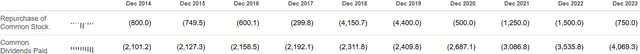

Buybacks and Dividends (Seeking Alpha)

Notice above that cash paid in dividends to shareholders steadily increased. Buybacks, meanwhile, have been more variable, sometimes outpacing dividends but shrinking as shares began to appreciate in 2023. I showed the price chart for the past year already, but let’s consider the chart for the past decade.

LLY 10Y Price History (Seeking Alpha)

Even without counting dividends, the stock alone is more than a ten-bagger, and much of that gain occurred in 2023. Thus, the return from buybacks to long-term holders declined significantly, and management’s missing appetite for shares seems to reflect this.

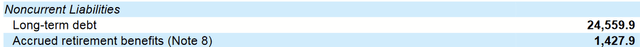

Long-Term Debt (Q1 2024 Form 10Q)

Meanwhile, the company is currently sitting on $25.6B of long-term debt as of Q1. The debt schedule available in the 2023 Form 10K (pg. 87) shows that most of this very staggered, with low interest rates and long-dated maturities. The difference between Q1 2024 and FY 2023 represents roughly a $6B increase in LT debt, indicating further the company’s ambitions for investing in its future.

Ultimately, this will all need to be repaid if it’s not refinanced. That said, much of the new debt issued in Q1 (Form 10Q, pg. 20) was used to refinance some of the upcoming maturities for this year. All of the new debt bore interest of 5% or less, which I think is a good rate. Overall, I see no troubles with the debt.

Valuation

None of this news is particularly bad. So far the key takeaway is that the company is reinvesting in its future and riding a wave of growing sales with some of its latest product approvals and releases. Yet, the historical revenues I showed indicate that sales do not grow 26% every year, hence the relatively low revenue CAGR of 6.3%. As large as this company is now, I don’t think it’s likely to have faster growth than it did before, but modest growth remains possible.

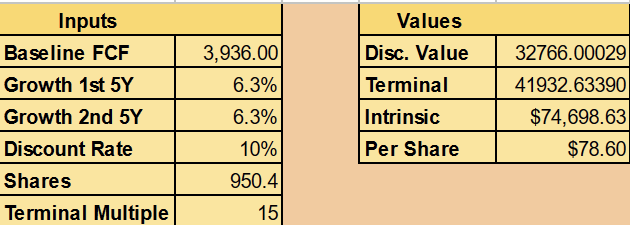

So what do I think it’s worth? I’ll determine that with a Discounted Cash Flow calculation with the following assumptions:

- $3,936M as baseline FCF

- Annual growth rates of 6.3%

- Terminal multiple of 15

Baseline FCF is calculated based on average FCF margin of the decade from 2014-2023 and applied to 2023’s revenues.

Since 6.3% is the CAGR as well and isn’t unsustainable for a business of this size (like 20% might be), that is also being used. A terminal multiple of 15 is also what I believe to be a middle figure, given the company’s high multiple right now but also because a steady, safe business like this may not often be heavily discounted.

Author’s calculation

Priced for a 10% discount rate (typical return of a broad market index), this suggests an intrinsic value of the company just over $74 billion, for about $78 per share. With the current price well over $700 now, one might wonder what the deal is.

5Y P/E History (Seeking Alpha)

Part of it is purely multiple expansion well in excess of the growth of the business. Considering this, it’s easy to understand the halting of buybacks that we’ve seen in Q1 at this peak. Moreover, we’re talking about a market cap of $700 billion for a company that only has a few billion in FCF each year (and less if you use the adjusted figure that I did not use in this DCF).

Eli Lilly is not a bad business, but this price certainly isn’t a good one to dive in. It’s hovering around ninth-or-tenth largest company by market cap. What bright future is left to price in that that market has missed? That’s the lingering question I find myself asking.

Conclusion

Eli Lilly is appreciated for its growing portfolio of weight loss drugs, the more recent being Zepbound. Yet, these don’t represent income streams of infinite money. These serve finite markets, and returns will be realized by shareholders gradually over time. This internal compounding is, historically, known to be incremental over the long run.

Perhaps LLY is one of those stocks that will always be valued at something of a premium, but today’s prices indicate a premium on top of a premium. Folks who take the Red Pill and invest with some grounding in fundamentals will see that there are companies with similar growth prospects, comparable or less-leveraged balance sheets, and smaller multiples out there, so the best that can be said for long-term investors is that LLY is okay as a Hold over time.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.