Summary:

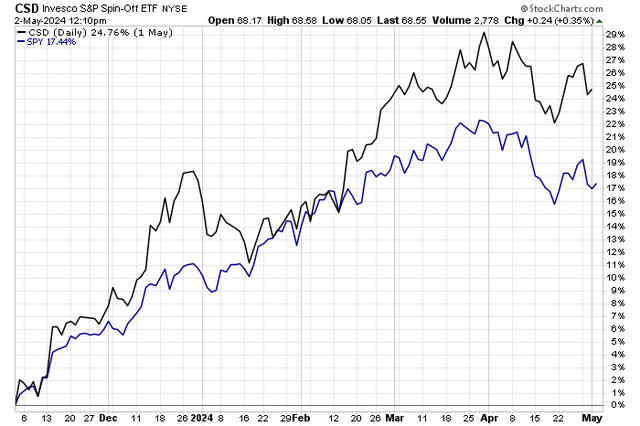

- Spinoff stocks have outperformed the S&P 500 in the past six months, while shares of parent companies have also done well lately.

- 3M Company’s spinoff of Solventum may result in the loss of its status as a dividend aristocrat, but the Industrials stalwart continues to work through litigation concerns.

- Despite challenges, 3M’s strong free cash flow and cheap valuation make it an attractive investment, and I highlight key price levels on the chart to monitor.

- 3M issued a strong double-beat late last month, which augurs well for better days ahead.

jetcityimage

There’s a significant rally under the market’s surface in one niche. Spinoff stocks have outperformed the S&P 500 over the past six months. Firms that have refocused management endeavors by separating one part of a conglomerate into a new entity have generally performed well lately. Notable spinoffs over the past year include Johnson & Johnson’s (JNJ) Kenvue (KVUE), General Electric’s (GE) GE Health Care (GEHC) and GE Vernova (GEV), Danaher’s (DHR) Veralto (VLTO), Kellanova’s (K) WK Kellogg (KLG), and 3M’s (NYSE:MMM) Solventum (SOLV).

Often, firms will engage in spinoffs to thwart activist investors or to simply focus on core operations. For 3M, there have been many outside factors keeping its management team busy, including lawsuits and settlements regarding its earplugs and “forever chemicals.”

Still, I reiterate a buy rating on 3M. While the firm may lose its status as a dividend aristocrat following the SOLV spinoff, free cash remains strong, and its valuation is cheap. Furthermore, technicals could be on the mend as we head into the middle of 2024.

Spinoff Stocks Beating the SPX

According to Bank of America Global Research, 3M Company was founded in 1902 as a mining concern. Today, the Minnesota-based company is a diversified, global manufacturer. Its businesses are technology-driven and organized under four segments: Consumer, Safety and Industrial, Transportation and Electronics, and Health Care. Its popular brands include Scotch, Post-It, 3M, and Thinsulate. It holds over 500 US patents.

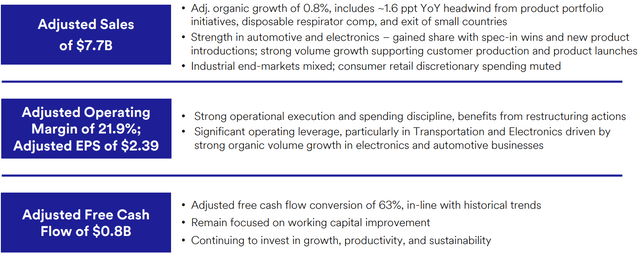

3M reported a double beat back in late April. Q1 non-GAAP EPS of $2.39 beat the Wall Street consensus estimate of $2.01 while adjusted revenue of $7.7 billion, about flat from year-ago levels, was a modest beat. The firm reported a healthy operating margin of 21.9%, up about 400 basis points from Q1 2023. The management team had expected just $2 to $2.15 in operating per-share earnings.

Looking ahead, 2024 guidance now shows flat to +2% adjusted organic sales growth with $6.80 to $7.30 of adjusted EPS from continuing operations. Of course, the numbers are adjusted for the Solventum spinoff.

3M Q1 Earnings Report Details

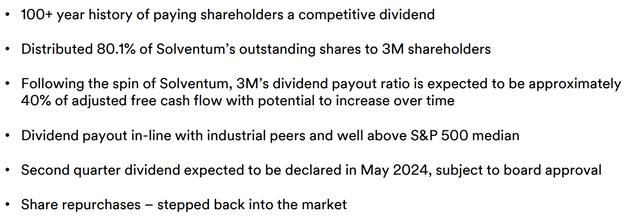

3M’s New Dividend Policy Post-Spinoff

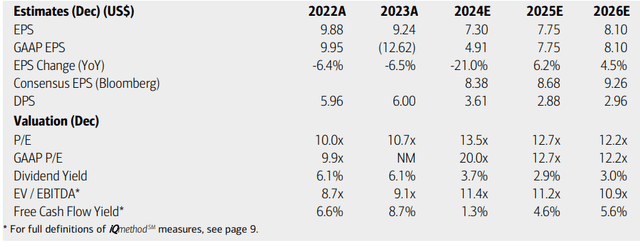

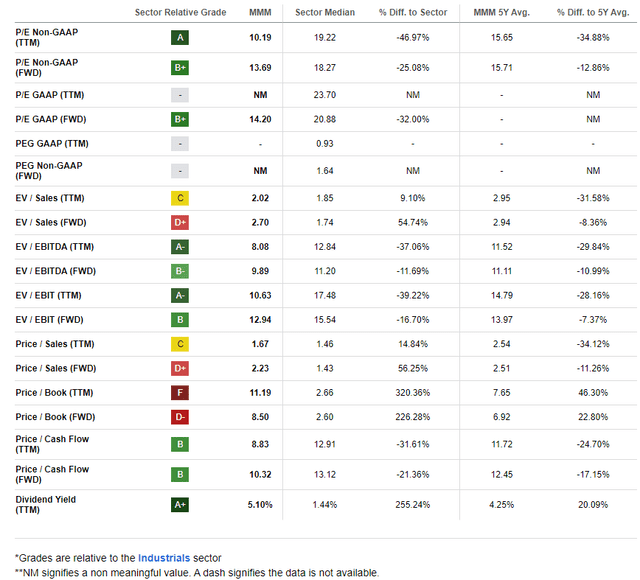

On valuation, analysts at BofA see earnings falling a troubling 21% this year but EPS growth is expected to be robust in the out year and still solid by 2026, potentially topping $8. The current Seeking Alpha consensus forecast numbers show a similar dip and then an upward earnings trajectory. 3M’s top line is forecast to fall 28% in 2024 but then hold a steady 3-4% range.

Dividends, meanwhile, are forecast to drop under $3 annualized after the split and then resume their increase. With a low-teens multiple and an EV/EBITDA ratio that is significantly below that of the S&P 500, there is still a valuation case to be made with this Industrials blue-chip stock. Finally, at latest check, free cash flow per share is high at $8.40 over the past 12 months, which is close to 9%.

3M: Earnings, Valuation, Dividend Yield, Free Cash Flow Forecasts

If we assume normalized EPS of $7.50 of operating EPS, ex-Solventum, and apply a 5-year average P/E of 15.7, then shares should trade near $118. Considering that SOLV has a market cap of about one-fifth that of MMM, adding 20% to my previous assumed earnings multiple is appropriate today to make it comparable. So, the fair value is likely in the $110 to $115 range. Also bear in mind that many of its Industrials peers trade with a mid-20s ’24 P/E.

3M: Shares Remain Cheap vs History, Strong FCF Yield

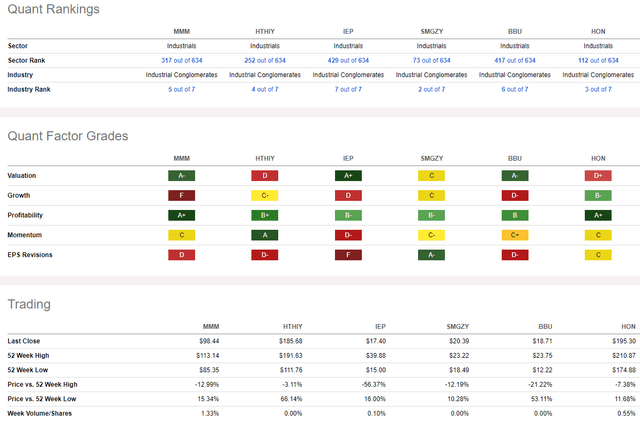

Compared to its peers, 3M features a strong valuation rating while its growth outlook is weak. Of course, once we get through the current troubled year, earnings growth is expected to return. Even still, profitability metrics appear robust, and share-price momentum trends have improved over the past handful of months.

Finally, 3M continues to suffer from a slew of sellside EPS downgrades, though the firm was recently upgraded at JPMorgan as a cleaned-up balance sheet could bode well for the quarters ahead.

Competitor Analysis

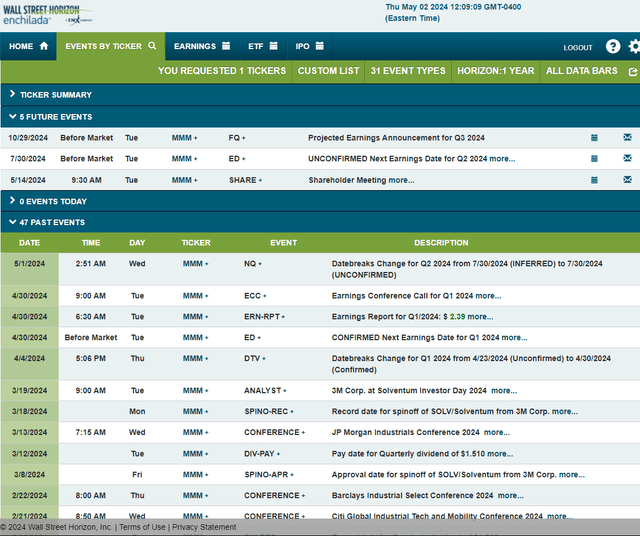

Looking ahead, corporate event data provided by Wall Street Horizon shows an unconfirmed Q2 2024 earnings date of Tuesday, July 20 BMO. Before that, be on the lookout for potential stock price volatility when 3M holds its annual shareholders’ meeting on Tuesday, May 14.

Corporate Event Risk Calendar

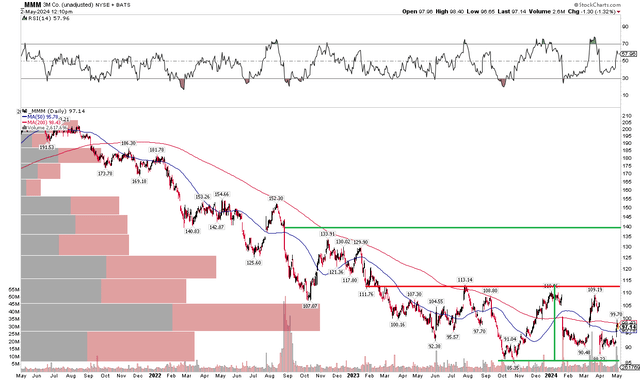

The Technical Take

In my previous reports, I noted key resistance near the $115 mark on MMM. That remains the big bogey. Notice in the chart below that the bears have lost their grip – the downtrend that began some three years ago has given way to sideways price action, but $115 remains an important test for the bulls to get MMM through. Last year, I noted that the downtrend might very well be ebbing considering that the RSI momentum gauge at the top of the graph hit deeply oversold conditions in October 2023. Since then, it has been a battle between the bulls and bears.

Right now, both MMM’s short-term 50-day moving average and long-term 200-day moving average are flattening out – further evidence that MMM is basing. Key support is in the mid-$80s. A bullish upside breakout above $115 would make for a measured move price objective to about $140 based on the height of the current range since late last year.

Overall, MMM’s trend has improved, but it’s by no means an outright buy yet.

MMM: Shares Basing, Eyeing $115 Resistance

The Bottom Line

I reiterate a buy rating on 3M. I continue to see the stock as undervalued following the spinoff while the technical situation looks better compared to late last year.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.