Summary:

- Advanced Micro Devices, Inc. continues to underperform in both stock performance and financial performance, as Nvidia takes the lead in the generative AI race and Intel in the x86 CPU race.

- With the gaming segment still reporting elevated inventory channels and slower IoT/ automotive recovery in the embedded segment, we are uncertain about AMD’s intermediate term prospects.

- While the consensus forward estimates remain moderately positive, it appears that its AI chip offerings are likely to remain a far second moving forward, along with Intel.

- With AMD consistently charting lower highs/ lower lows over the past two months, we believe that it may be more prudent to observe its movement/ execution for a little longer, resulting in our Hold rating.

John M Lund Photography Inc

We previously covered Advanced Micro Devices, Inc. (NASDAQ:AMD) in February 2024, discussing its overly premium growth valuations and inflated stock price, which we concluded offered interested investors a minimal margin of safety.

With the AMD investment thesis getting way ahead of itself, especially due to the management’s underwhelming FQ1 ’24 guidance and delayed H2 ’24 ramp, we then continued rating the stock as a Hold then.

Since then, AMD has declined by -19.4%, well underperforming the wider market at +1.2% over the same time period, with market sentiments turning pessimistic along with the macroeconomic outlook.

Despite this decline, we believe that there may still be moderate volatility ahead, with the company still losing more ground in both the generative AI race and the x86 CPU market, having underperformed its peers thus far.

As a result, we maintain our Hold (Neutral) AMD rating here.

The AMD Investment Thesis Remains Mixed Ahead

For now, AMD has reported a double beat FQ1 ’24 earnings call, with revenues of $5.47B (-11.2% QoQ/ +2.2% YoY) and adj EPS of $0.62 (-19.4% QoQ/ +3.3% YoY).

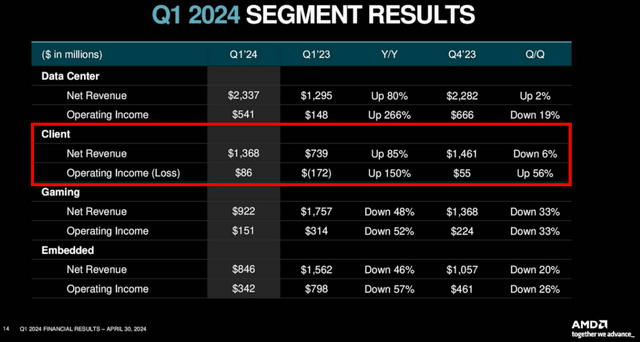

AMD’s FQ1’24 Revenue By Segment

Despite so, the semiconductor company led by Lisa Su has yet to show any promise in the generative AI race, with minimal Data Center revenues of $2.33B (+2.1% QoQ/ +80.6% YoY) in FQ1 ’24.

Gaming demand continues to deteriorate at sales of $922M (-32.6% QoQ/ -47.5% YoY) along with Embedded at $846M (-19.9% QoQ/ -45.8% YoY) as well, attributed to elevated inventory channels and weak IoT/ automotive markets, respectively.

For now, the only silver lining for AMD is the Client segment/ Personal Computers at revenues of $1.36B (-6.3% QoQ/ +85.1% YoY) in the latest quarter, with the “enterprise refreshment cycle” likely to continue through H2 ’24 as similarly reported by Intel (INTC).

Even so, readers may also want to note that AMD has been consistently losing the x86 CPU market share with 33.4% reported in Q2 ’24 (-1.6 points QoQ/ -1.6 YoY), with INTC’s gains to 63.9% (+0.2 points QoQ/ +1 YoY) partly aided by the recent launch of the 14th gen processors in October 2023 and the former’s Zen 5 only slated for release by H2’24.

At the same time, we are also looking at a relatively bloated inventory level of $4.65B (+6.8% QoQ/ +6.8% YoY) though well-balanced by the healthy balance sheet, with a net cash situation of $3.57B (+7.8% QoQ/ +2.8% YoY) in FQ1 ’24.

This is based on the cash, cash equivalents, and short-term investments of $6.03B (+4.5% QoQ/ +1.6% YoY) and total debts of $2.46B (inline QoQ/ YoY).

Nonetheless, while AMD has guided a relatively decent FQ2’24 revenue of $5.7B (+4.2% QoQ/ +6.5% YoY) and adj operating margins of 21% (inline QoQ/ +1 YoY), it is also painfully apparent that the MI300 ramp has yet to bear similar double-digit results as observed with Nvidia (NVDA) thus far.

This is especially since the AMD management only raised their FY2024 data center GPU revenue guidance from $3.5B to over $4B, implying that much of the AI chips consumer demand remains tied to NVDA’s ongoing ramp in H100 thus far and H200 from Q2 ’24 onwards.

For context, NVDA reported $47.5B of data center revenues in FY2024 (+217% YoY) and data center revenues of $18.4B in FQ4 ’24 (+26.8% QoQ/ +409.6% YoY), with AMD still at the “qualifying stage with its customers, both from the hardware and software standpoint.”

With the Jensen Huang-led Nvidia set to report the FQ1 ’25 earnings on May 22, 2024, market analysts will be closely comparing the announced results to the original revenue guidance of $24B (+8.5% QoQ/ +233.7% YoY), while awaiting the FQ2 ’25 guidance.

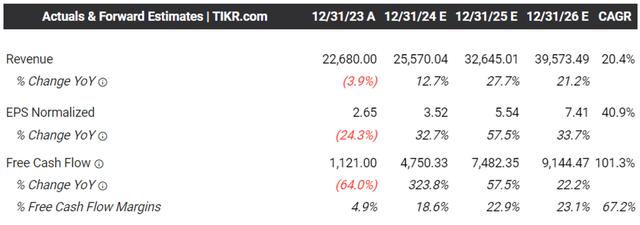

The Consensus Forward Estimates

As a result, while the consensus forward estimates remain relatively positive, with AMD expected to generate a top/ bottom line CAGR of +20.4%/ +40.9% through FY2026, it appears that its AI chip offerings are likely to remain a far second moving forward, along with INTC.

This is especially since NVDA has already recorded massive Data Center market share gains at 92% as of December 2023, against AMD at 3% and others at 5%.

So, Is AMD Stock A Buy, Sell, or Hold?

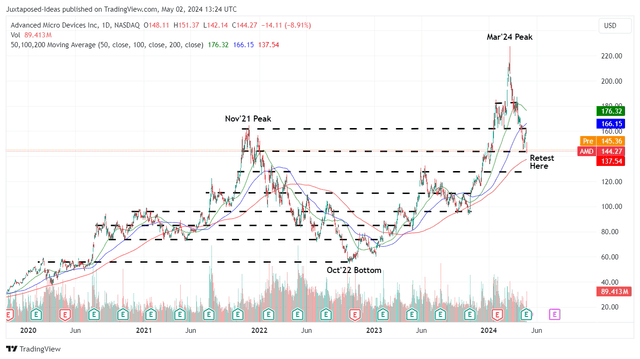

AMD 4Y Stock Price

Based on the stock prices of $144.27 at the time of writing and the LTM adj EPS of $2.67 (-11.2% sequentially), it is apparent that AMD still records an eye-watering LTM P/E valuation of 54.03x, relatively expensive compared to NVDA at 66.62x and INTC at 24.18x.

This is especially given AMD’s weaker adj EPS performance over the LTM, compared to NVDA at $12.97 (+289.4% sequentially) and INTC at $0.96 (+241.1% sequentially).

For now, based on the consensus’ raised FY2026 adj EPS estimates from the previous number of $7.04 to $7.41 and AMD’s 1Y P/E mean of ~33x, there appears to be an excellent upside potential of +69.4% to our long-term price target of $244.50, significantly aided by the recent pullback.

Despite so, we are uncertain if it makes sense to add more AMD stock here, especially since it is currently retesting the previous support levels of $140s.

With AMD consistently charting lower highs/ lower lows over the past two months, we believe that it may be more prudent to observe the stock’s movement and the management’s execution for a little longer, resulting in our Hold rating.

Combined with the fact that Advanced Micro Devices, Inc. is currently losing ground in both the generative AI race and the x86 CPU market, we may see the stock continue to underperform the overly premium P/E valuations ahead.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD, INTC, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.