Summary:

- Starbucks reported concerning earnings, leaving investors puzzled regarding one of the most highly recognized brands in the world.

- The company could reassure investors through a buyback, but I’ll show why this won’t likely happen.

- I will go over my investment in Starbucks and explain why I am no longer invested in the company.

cherdchai chawienghong/iStock via Getty Images

Starbucks’ Misses Earnings

Starbucks Corporation (NASDAQ:SBUX) missed earnings so badly that I was caught off guard, though I had become more weary in the past few months. “Unexpected pressure on locational customers, choppiness in China, challenges in the Middle East”, with these three reasons Mr. Narasimhan, Starbucks’ CEO, went on CNBC to explain right after the company’s earnings report was released, what went wrong during this very “tough quarter”.

Laxman Narismhan was appointed CEO starting April 1st, 2023. This means he has been in charge of the company for a full year and is thus accountable for this report.

There was no way around it, and he started the earnings call by saying “This quarter was disappointing”. As soon as the new data was out, the stock plunged over 15% and trades now in the low $70s.

In December, after McDonald’s announced its new concept CosMc’s, I started considering Starbucks’s market share could not be as solid as previously anticipated. So, I have been more watchful of Starbucks and this is why, this time, instead of writing an earnings preview, I decided to wait until the report was out to wrap up a review and see what to do with my position.

My bull case for Starbucks was grounded on its strong brand recognition, high returns on capital employed, international store count expansion, and the Starbucks Rewards Membership program, where customers load their cards upfront and then collect stars until they receive a free drink. Starbucks’ active members have continuously grown and over $3.3 billion was loaded, providing Starbucks with plenty of cash to fund its capex and its growth plans.

No later than a quarter ago after a “softer than planned January”, Starbucks’ management guided for full-year EPS growth between 15% to 20%. Let’s take a look at the report to see why it is highly questionable whether Starbucks will manage to come even close to this target or not.

Starbucks’ Q2 Earnings

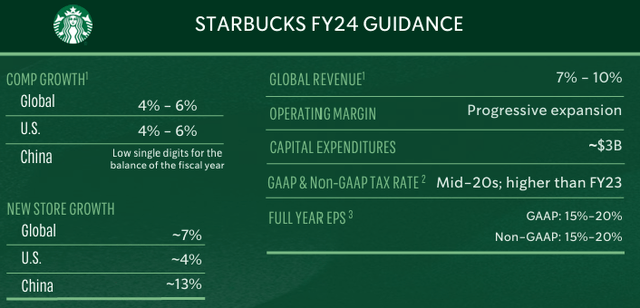

To understand how disappointing the earnings were, let’s move a step back and look at SBUX FY24 guidance issued a quarter ago.

Three months ago, Starbucks’ executives were guiding for 7-10% global revenue growth, with progressive expansion of the company’s operating margin and FY EPS growth between 15% to 20%. At the same time, the all-so-important comp sales growth was seen between 4% to 6% everywhere excluding China.

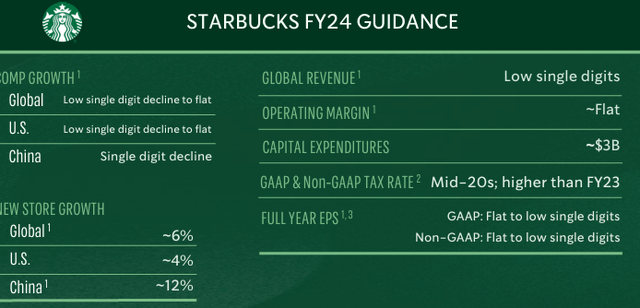

Now, take a look at Starbucks’ newly issued guidance and see for yourself what happened:

Global revenue is now expected to grow low single digits, with no operating margin expansion and full-year EPS growth barely positive (“flat to low single digits”. At the same time, comp sales growth should be negative or, at its best, flat.

What is going on? How can a company such as Starbucks, the global coffee drinks leader, all of a sudden be stopped from growing? But, most importantly, has something happened that caught it off guard?

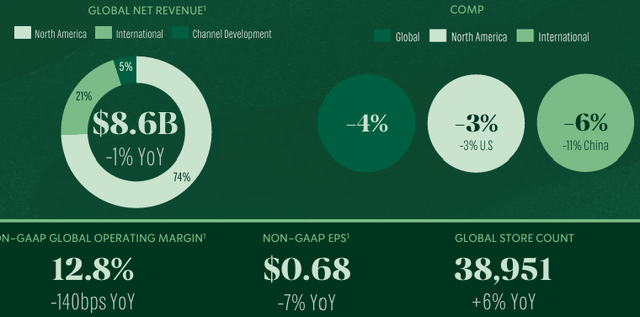

Here are the main financial highlights from Starbucks’ report.

Revenues were down 1% YoY to $8.6 billion. Comp sales declined 4% globally, with a 3% decrease in the U.S. and a staggering -11% in China. Now, China is for Starbucks of great importance because it is its second-largest market and could well become its first. However, China is now the country with the most branded coffee shops in the world and the explosion of new coffee shops, particularly popular among younger consumers, puts a lot of pressure on Starbucks’ pricey coffee. Luckin Coffee Inc. (OTCPK:LKNCY), for example, reported very solid growth in China (revenues up 34.6%, with traffic up 103.2%). This means Luckin Coffee is stealing market share from Starbucks. In a few days, Dutch Bros Inc. (BROS) will report, and we will be able to draw a better comparison to understand what truly went wrong in the U.S. For sure, lower-income consumers are pulling back on spending on unnecessary and costly drinks, which can easily be replaced.

Starbucks’ operating margin fell 140 bps to 12.8% and its Q2 EPS took a -7% hit, coming at $0.68.

To add even more negativity, we have learned that Starbucks’ 90-day active members in the U.S. were down from 34.3 million a quarter ago to 32.8 million. This is not a good sign because these are expected to be the most loyal customers, those who regularly visit Starbucks’ stores and who usually upgrade their drinks and thus pay more.

Now, I find it hard to simply say this report was disappointing. It seems more appropriate to define it as “concerning”. There are two reasons why I think so. First, of all, the decline was unexpected. This means that Starbucks’ executives were neither able to predict it nor willing, if aware of the coming challenges, to communicate them in advance to investors. In any case, investors lost some trust.

A different example to look at is The Hershey Company (HSY). Though not in the same industry as Starbucks, Hershey, too, deals with food and faces some challenges linked to the high cocoa prices. Three months ago, the company was very clear with investors about the challenges it had ahead and guided for a year of almost no growth. Even though it is far from its ATHs, Hershey didn’t plunge after earnings because investors felt the company’s management was communicating correctly, in my opinion.

The second concerning reason is that Starbucks is losing market share. Demand for coffee and caffeinated drinks is exploding to the point even McDonald’s wants to take a slice of the pie. Yet, Starbucks doesn’t seem able to present itself as the go-to place.

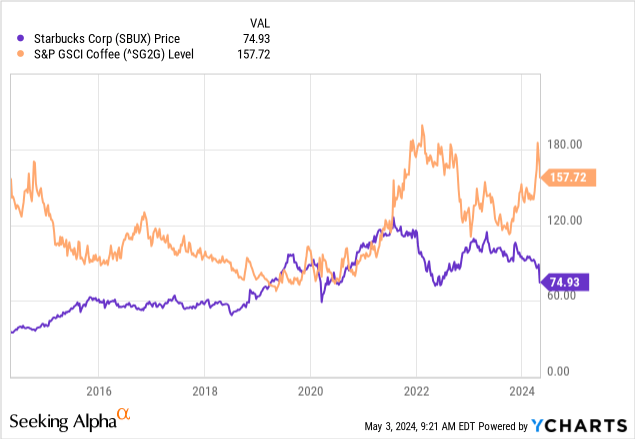

There are many reasons why coffee demand is high, some are related to increasing demand, and some others to weather and health issues in Vietnam, Brazil, and the Ivory Coast.

This puts pressure on Starbucks’ margins. As a result, the company has raised prices aggressively, but this is pushing consumers away. This ironically reinforces the inverse correlation between Starbucks’ share prices and the price of coffee, which we see below. I believe Starbucks prices drive away consumers and thus lose revenue and market share. There are times when a company needs to decide whether to protect its valuable consumers or bet on keeping margins high. Texas Roadhouse, Inc. (TXRH), for example, when it had to face, two years ago, high beef prices, decided to take a hit and only gradually increase prices over time. This helped its consumers perceive the true value its restaurants were offering. Its restaurants are now packed and Texas Roadhouse’s comparable sales increased 9.3% in Q1 2024.

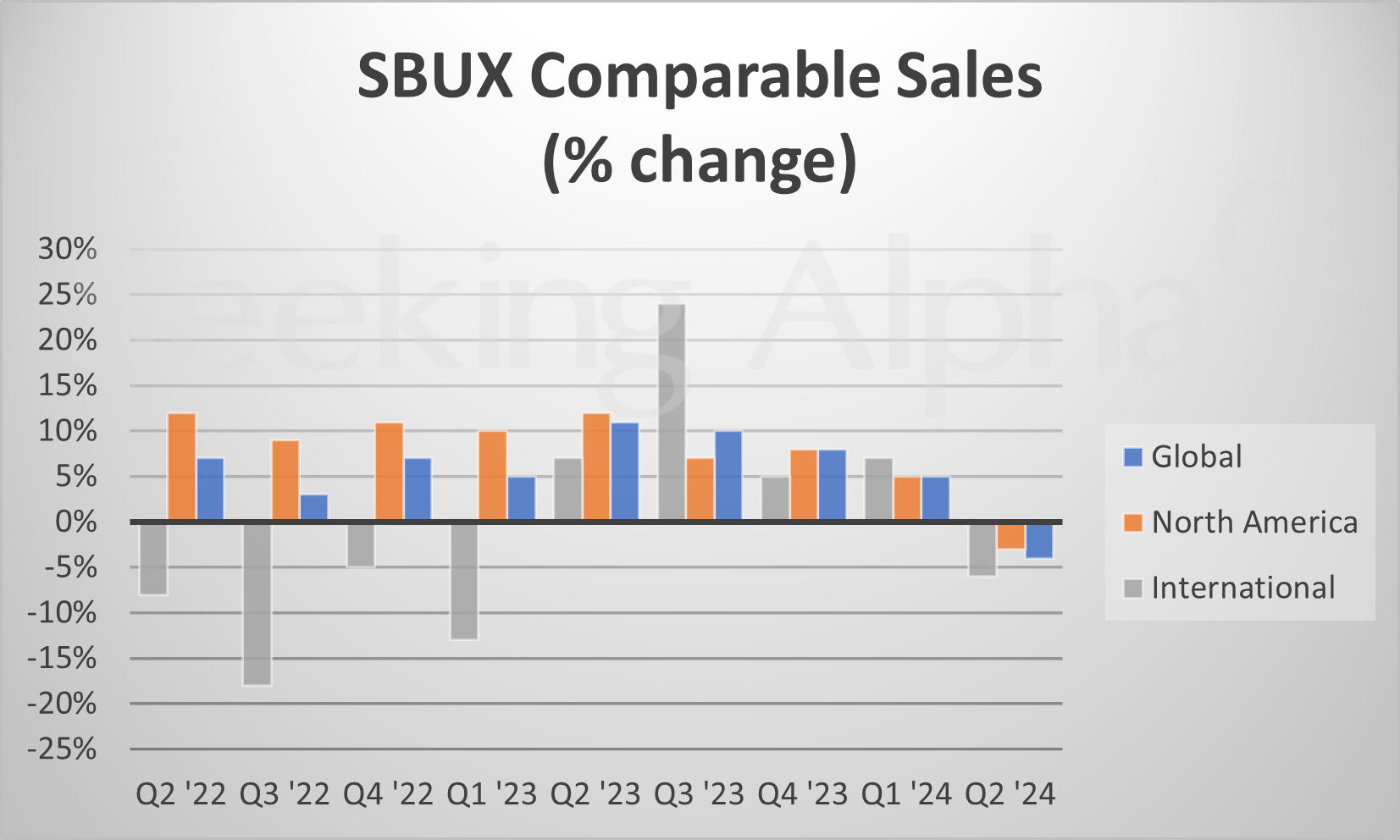

As we can see below, SBUX comp sales have been losing speed starting Q3 2023, which was almost a year ago.

Seeking Alpha

Starbucks’ Strategy Now

During the interview on CNBC, Mr. Narasimhan repeatedly said he thinks consumers didn’t perceive the value Starbucks was offering. Many objected that selling coffee for $6 or $7 is of no real value. But, no matter how we look at it, there was no real announcement about a strategy to fight back in my view. It was said Starbucks would offer some discounts on its app or bundle more products together. This is something, but it addresses only those who have the app. Of course, announcing price cuts now would be disastrous because I think it would make investors even more worried about the company’s prospects. But surely Starbucks needs to figure out a more attractive pricing strategy.

Moreover, I believe a company such as Starbucks could admit its errors, take some effective measures to steer its course on track and, in the meantime, take advantage of the depressed share price by buying back shares. However, Starbucks doesn’t have the balance sheet to do this in my view.

Starbucks Can’t Fund Buybacks

Starbucks has over $15 billion of LT debt while its total debt including leases equals $25.21 billion. Compared to the company’s EBITDA of $7.12 billion, we have a debt/EBITDA ratio of over 3.5x. In the past twelve months, the company took on over $2 billion in debt, which means it will pay higher interest. The TTM interest expense was already over $560 million, while in 2018 it was just $170 million.

At the same time, Starbucks TTM’s operating cash was about $6.5 billion. Its TTM capex is $2.6, and we know Starbucks will spend $3 billion during this fiscal year. This means the company will have $3 to $3.5 billion in free cash flow.

However, Starbucks pays over $2.5 billion in dividends. Therefore, Starbucks will only have between $0.5 to $1 billion left. Considering Starbucks’ growing interest expense, in the best case the company may have only $500 million left for share repurchases. This, of course, without taking on new debt, which I believe would not be wise given Starbucks’ current situation. So, shareholders should not expect the help of a buyback program to support the share price, leaving further room for the stock to go down unless Starbucks quickly adjusts its operations.

I don’t think Starbucks will cut its dividend to finance buybacks. But this situation makes me also wonder if the dividend is truly safe, or if it is in peril of a cut. If Starbucks continues to underperform, I believe it might not take long before we hear the announcement no dividend investor wants to receive.

Valuation

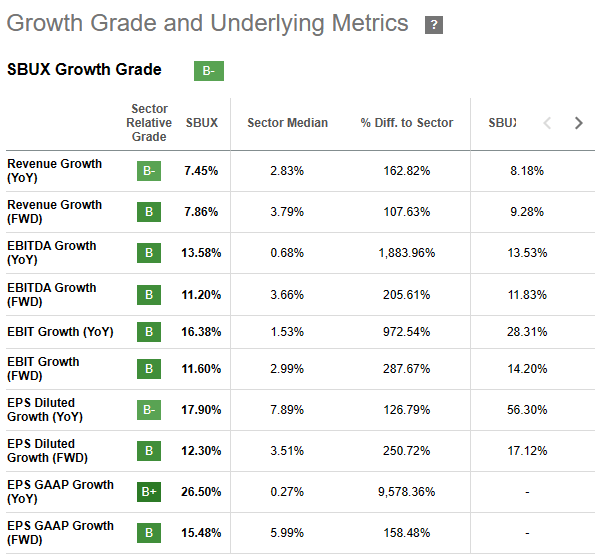

Starbucks’ Quant Rating is currently low: 2.82. Its valuation is steep: a D+ and its momentum is weak, earning another D. Revisions don’t look great, of course, and are currently graded as a D+. Only Starbucks’ profitability gets an A+, while growth is graded with a B-.

However, its growth grade doesn’t yet reflect the new guidance which expects little if non-existent growth. When these new numbers appear here, I expect the overall grade to be lower than a B. We could well see another D here. This would make Starbucks’ overall grade rating very poor.

Seeking Alpha

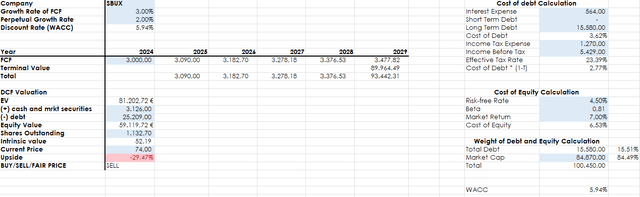

If I run a discounted cash flow model with the new financials available, even if I forecast a rather generous (under the current circumstances) 3% FCF growth, I see the company’s intrinsic value as radically down compared to the past. I have often considered the fair value for Starbucks $115 a share. But now this fair value has been cut in half and stands at just over $52.

As a result, I sold my position, judging it as too risky and too uncertain for my portfolio. My hit was around 15%, but I want my capital to be preserved and invested in companies with a more solid outlook and a higher rate of return than Starbucks. Stay tuned, and I plan to soon write an article saying where I am putting that money now.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.