Summary:

- Eli Lilly and Company delivered robust Q1 earnings, leading to an initial post-earnings surge in LLY stock.

- However, LLY has lost buying momentum, as selling intensity has overtaken Lilly’s earnings euphoria.

- Eli Lilly is still well-positioned to capture the market for weight loss drugs. However, its valuation bifurcation to Novo Nordisk stock is hard to justify.

- With LLY stock suffering from a post-earnings hangover, as sellers take profit, it’s time to get out quickly.

jetcityimage

Eli Lilly Raised Guidance Downplayed Fears

Eli Lilly and Company (NYSE:LLY) investors have continued to jump onto the bandwagon as the leading biopharma company delivered its recent earnings. Accordingly, LLY surpassed Wall Street estimates at Eli Lilly’s first-quarter earnings release. Eli Lilly management raised guidance for 2024, alleviating fears about extended supply constraints impacting the company’s near-term revenue recognition.

As a result, LLY buyers saw an opportunity to buy LLY’s recent pullback as it fell into correction territory from its March 2024 highs. However, LLY’s post-earnings fervor cooled as buying momentum quickly dissipated this week. Yesterday’s weakness could be attributed to the recent news highlighting downward pricing adjustments affecting GLP-1 drugs. As a result, the market is likely assessing Lilly’s execution and competitive risks on management’s raised guidance.

Accordingly, Lilly delivered revenue of $8.77B in Q1, up 26% YoY. Lilly attributed the robust performance to higher prices (10% increase) and stronger volume actualization (16% increase). In addition, Lilly raised its revenue outlook by $2B for 2024 and improved its adjusted EPS outlook by $1.30, anticipating a midpoint metric of $13.75.

Therefore, I’m not surprised that LLY buyers delivered an initial post-earning surge, suggesting Lilly’s supply constraints aren’t expected to hamper its second-half production momentum. Management has also indicated that Lilly anticipates a more robust second-half performance as it navigates near-term headwinds to meet underlying demand.

Eli Lilly’s Long-Term Roadmap Is Robust

Investors in LLY are likely betting on the long-term secular growth thesis in weight loss drugs. Varying estimates on the GLP-1 TAM suggest it could reach $40B by 2029. Bloomberg’s estimate indicates the market for obesity treatments could reach $80B by 2030. Peak sales are anticipated to be in the $100B range. NVO asserts leadership in GLP-1 sales, highlighting Novo Nordisk’s global GLP-1 market share of 55.3%. Given the robust performance of NVO and LLY over the past year, I believe the market believes there are sufficient growth opportunities for Novo Nordisk and Lilly in the medium- and long term.

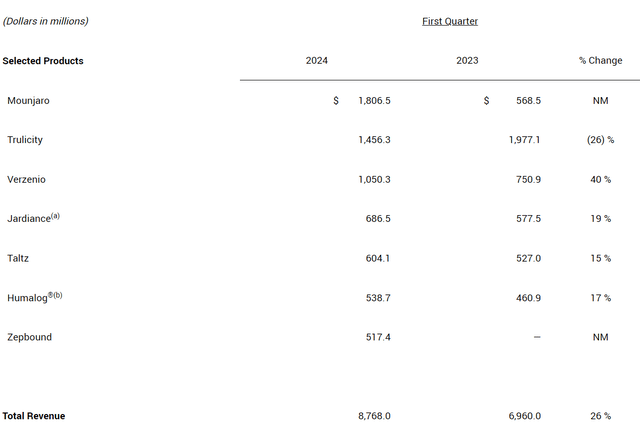

Eli Lilly Q1 revenue segments (Eli Lilly filings)

Eli Lilly highlighted Mounjaro, Zepbound, Verzenio, and Jardiance as key revenue drivers in Q1. As seen above, Mounjaro and Zepbound were pivotal to Lilly’s growth inflection, but Lilly is far from a one-product company. Therefore, the company has a solid product and development portfolio to assure LLY investors of Lilly’s well-diversified portfolio and long-term growth outlook.

Moreover, Lilly management also provided insights to investors about Lilly’s next-gen weight loss drugs, as an analyst on Eli Lilly’s Q1 conference call noted “development of around half a dozen candidates.” Lilly management provided several key differentiating factors to deliver its value proposition. In addition, Eli Lilly underscored that its “robust pipeline represents a multi-decade investment in treating abnormal metabolism and related diseases.” Therefore, I concur that LLY seems to be a solid long-term bet for early investors, but not now, as LLY is still overvalued.

But LLY Is Significantly Overvalued

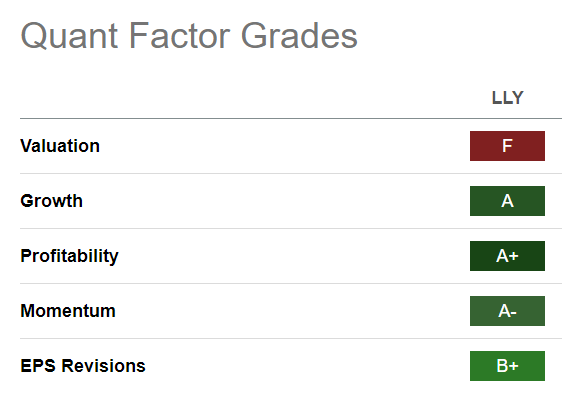

LLY Quant Grades (Seeking Alpha)

LLY is assigned an “F” valuation grade, which underscores its relative overvaluation to its peers in the healthcare sector. That’s unsurprising, given LLY’s tremendous performance with its GLP-1 drugs. Underpinned by a fundamentally strong business model (“A+” profitability grade), Lilly is well-positioned to justify its growth thesis at a less aggressive valuation.

LLY Vs. NVO forward adjusted EBITDA multiples (TIKR)

Moreover, the valuation bifurcation between LLY and NVO has surged to significant levels, behooving caution. Novo Nordisk is still the market leader and boasts a robust “A-” growth grade. Therefore, I assessed that the bifurcation seems unjustified, given that the optimism on NVO and LLY is mainly predicated on their dominance in the GLP-1 market. As a result, I believe LLY’s relative overvaluation against its peers and NVO seems increasingly hard to justify.

Is LLY Stock A Buy, Sell, Or Hold?

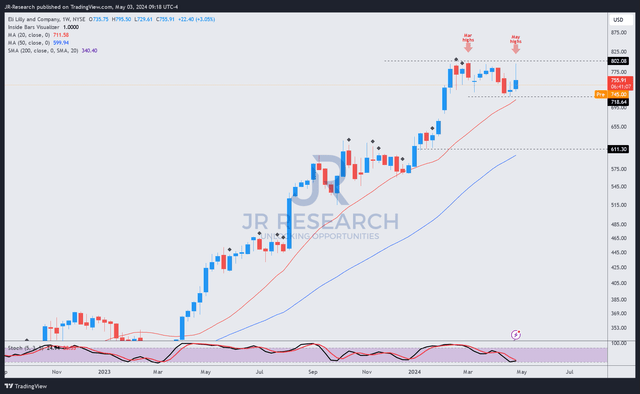

LLY price chart (weekly, medium-term, adjusted for dividends) (TradingView)

Accordingly, LLY suffered a pullback after its initial post-earnings surge, losing most of the gains made this week, as seen above.

The $800 resistance level has proved to be a robust take-profit zone for sellers, as they anticipated FOMO buyers rushing in as exit liquidity.

Therefore, the risk/reward for LLY is increasingly unattractive, with Eli Lilly needing to execute immaculately to justify its significant growth premium.

Healthcare investors who want to participate in the GLP-1 growth story through LLY should remain patient. The $600 zone remains a possible and less aggressive level to consider adding exposure.

With LLY’s selling resistance and relative overvaluation providing a fantastic opportunity for LLY investors to consider cutting exposure significantly, I maintain my Sell rating.

Rating: Maintain Sell.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!