Summary:

- We recap Meta Platforms’ Q1 Earnings.

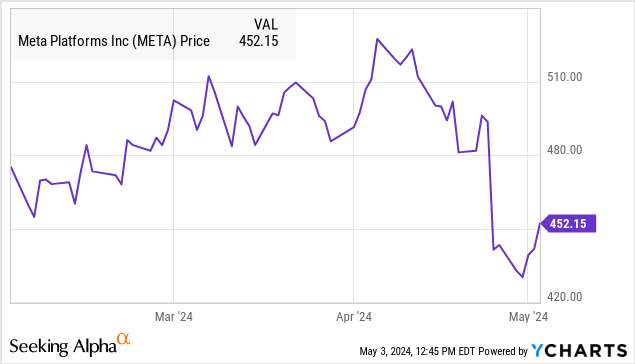

- The stock is down about 15% from its recent high amid skepticism towards the company’s plan to accelerate AI spending.

- We expect shares to remain volatile around the current level.

EKIN KIZILKAYA/iStock Editorial via Getty Images

Meta Platforms Inc (NASDAQ:META) Q1 earnings beat expectations highlighted by impressive growth across its app ecosystem. The social media giant has benefited from not only a strong macro backdrop but also steps to improve financial efficiency as a profitability driver.

Still, the stock posted its largest drop on the report in more than two years, with the market focusing on soft guidance and comments from CEO Mark Zuckerberg pointing to a ramp-up in spending toward AI opportunities.

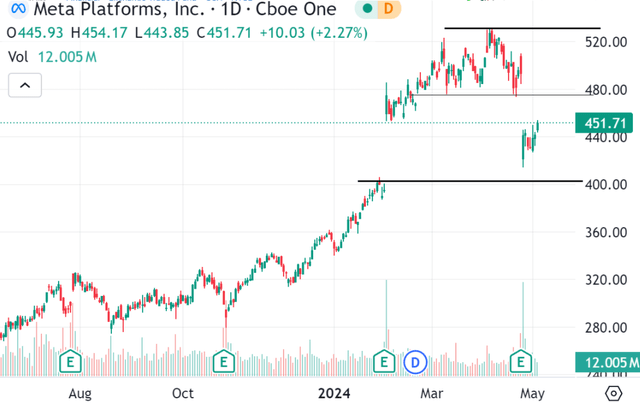

The implication is that this new direction pushes back on the earnings momentum strategy that helped shares return more than 300% since the 2022 low. The stock is still up this year, but down 15% from recent highs.

This turn of events wasn’t surprising to us. We last covered META back in February following what we called a “post-Q4 earnings euphoria” leading to a hold rating at the time. For what it’s worth, shares are flat since that article was posted nearly three months ago.

In our view, META faces a tough challenge to reclaim its all-time high. The following factors should keep shares volatile and limit the upside from here.

- Earnings pressure against accelerated R&D investments.

- Concern operating margins may be near a structural peak.

- Difficulty in exceeding high expectations.

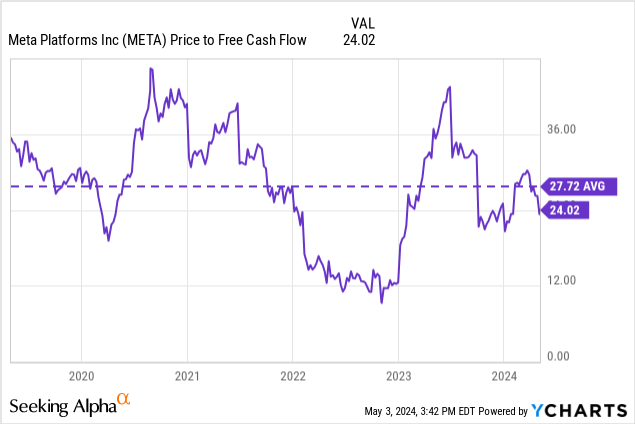

- Shares appear fully valued trading around 25x free cash flow.

- Skepticism toward the monetization potential of Meta AI.

META Q1 Earnings Recap

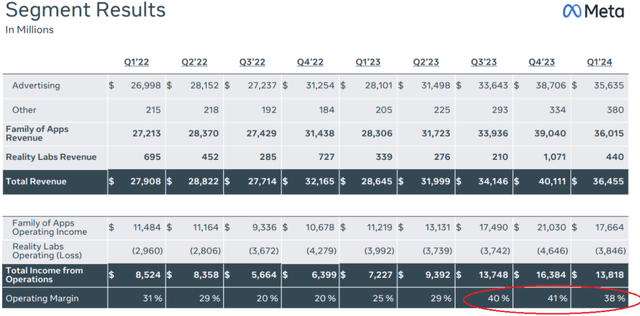

Meta reported Q1 EPS of $4.41 came in $0.39 ahead of the consensus and up from $2.20 in the prior-year quarter. Revenue of $36.5 billion was also above estimates, climbing 27% from Q1 2023.

Operationally, highlights include a 7% increase in family daily active people (DAP) to a record 3.2 billion. The number of ad impressions has climbed even stronger across the platforms, up 20% y/y, with Meta noting the impact of integrating new AI features working to drive conversions. The average price per ad is also up.

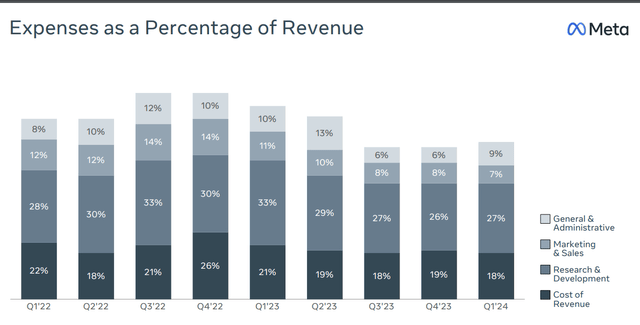

We mentioned the efficiency efforts which have been a major theme for Meta over the past year. That impact is evident as total expenses as a percentage of revenue at 62% this past quarter is down from as high as 80% back in Q3 2022.

Part of that considers a headcount reduction with the number of employees down by 10% y/y following several rounds of layoffs. The company has also pulled back in marketing and sales spending.

The result is that the operating margin of 38% is up from 25% in the period last year. Free cash flow this quarter at $12.5 billion has nearly doubled from Q1 2023.

Why Meta Shares Sold Off

By all accounts, Meta kicked off 2024 with a strong start. If there is a good explanation for the recent weakness in shares, what we’re seeing is a rebalancing of expectations compared to when Meta reached $530 in early April.

The company is guiding for Q2 revenue between $36.5 to $39 billion, which at the midpoint was slightly below market consensus. It appears the market needed something more to keep the rally going.

The other dynamic is the sense of skepticism toward Mark Zuckerberg’s apparent all-in approach toward artificial intelligence.

Citing the latest trends, Meta intends to invest more over the coming years. For the rest of 2024, CAPEX guidance was lifted to a range of $35 to $40 billion, increased from the prior range of $30 to $37 billion. In effect, the company expects to spend an extra ~$3 billion this year. This is the quote from the earnings conference call stood out:

While we are not providing guidance for years beyond 2024, we expect CapEx will continue to increase next year as we invest aggressively to support our ambitious AI research and product development efforts.

The translation is that near-term earnings will take a step back, and the trajectory of expanding operating margins which was in place since 2022 may now have stalled.

Margins May Have Peaked

Beyond the AI spending with R&D, it is fair to question how much more room there is for further cuts on the side of general & administrative, or sales & marketing expenses that defined 2023.

While the total revenue growth, is still expected to reach a solid 17% this year, the path is for the free cash flow conversion to narrow.

Meta shares are trading at 24x free cash flow is within 15% of its five-year average for the multiple. With an assumption that this valuation reflects fair value, we don’t see a good reason why the premium should significantly expand under the current circumstances.

Why META is a Hold

The call we have is that shares of META will remain volatile and continue to consolidate around this $450 per share range as it has since February.

The issue here is that as strong as the operating and financial results have been over the last few quarters, there’s a good case to be made that the most optimistic outcomes have already been priced in.

The outlook is fine, and fundamentals are strong, but the market may need to see signs growth and earnings are tracking above the consensus baseline for shares to break out higher.

The new layer of earnings uncertainty related to increased R&D spending and questions on where those AI investments will lead may limit the upside shares for the foreseeable future. On this point, Meta’s recent new product development record leaves much to be desired.

We know advertising on platforms like Instagram and Facebook is its bread and butter, but projects within the Reality Labs segment covering the Metaverse vision or even the “Quest” virtual reality headset have only delivered losses. It remains to be seen if a new game-changing application will arise from Meta AI.

Final Thoughts

Meta Platforms is a great company and has high-quality stock, but doesn’t quite deserve a buy rating in our book. A difficult path back to its recent high of $530 now faces significant resistance with that upside offering less than 20% upside from the current level.

On the other hand, we also wouldn’t go as far as suggesting META is a sell. Overall, strong fundamentals mean that there will be plenty of buyers willing to step in on any meaningful pullback which is what we saw over the past week. By this measure, we believe the $400 stock price level is an important area of technical support that should hold.

The main risk to consider is that operating trends remain exposed to still volatile macro conditions. A potential deterioration of economic growth or headwinds toward consumers would pressure the core advertising business a force a deeper reassessment of the earnings outlook. Monitoring points over the next several quarters include the trends in operating margin and free cash flow.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Add some conviction to your trading! Take a look at our exclusive stock picks. Join a winning team that gets it right. Click for a two-week free trial.