Summary:

- Bank of America, one of the world’s largest banks, has issued over $6 billion in new preferred stocks since 2017 and provides a coverage ratio of 9.3x.

- This article covers both the Series HH and Series SS fixed-rate preferred stocks issued by Bank of America.

- Because better yields are available for what I perceive as similar risks, I would only rate these two Bank of America preferred stocks as a Hold.

- For investors wanting to own a BAC preferred, my nod would go to the Series SS.

brunocoelhopt

Introduction

Over the past several months, I have been reviewing the main issuers of preferred stocks, banks, and other financial institutions. Based on the high interest overall, and in particular to my first Bank of America Preferred Stock article, I decided to tackle two more issues.

- Bank of America Corporation 5.875 NCM PFD HH (NYSE:BAC.PR.K)

- Bank of America Corporation 4.750% DP PFD SS (NYSE:BAC.PR.S)

Like the first set of preferred stocks reviewed, these are also fixed-rate securities. Unlike the others and the SS series, the HH series is currently callable. Because better yields are available for what I perceive as similar risks, I would only rate these two Bank of America preferred stocks as a Hold.

Bank of America review

Any preferred stock review should start with understanding the Issuer. Holders want to know that after all debts are paid, will there be funds left to pay off the preferred stockholders? Seeking Alpha describes this major bank as:

Bank of America Corporation, through its subsidiaries, provides banking and financial products and services for individual consumers, small and middle-market businesses, institutional investors, large corporations, and governments worldwide. Its Consumer Banking segment offers traditional and money market savings accounts, certificates of deposit and IRAs, noninterest-and interest-bearing checking accounts, and investment accounts and products; and credit and debit cards, residential mortgages, and home equity loans, as well as direct and indirect loans, such as automotive, recreational vehicle, and consumer personal loans. The company’s Global Wealth & Investment Management segment offers investment management, brokerage, banking, and trust and retirement products and services; and wealth management solutions, as well as customized solutions, including specialty asset management services. The bank was founded in 1784 and is headquartered in North Carolina.

Source: seekingalpha.com BAC

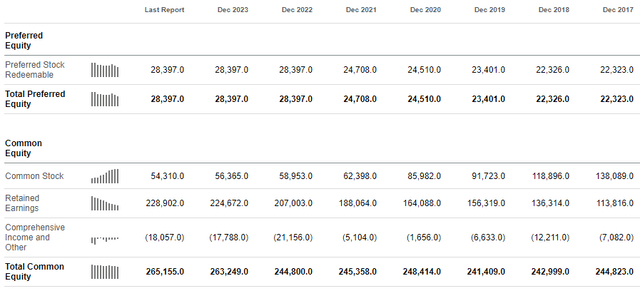

To try to answer that default question, looking at the Balance sheet is what I consider for that evaluation. The Last Report column includes the March-ending quarter’s data.

seekingalpha.com balance-sheet

Since 2017, BAC has issued over $6b in new preferred stocks, even more if old issues were redeemed partially or fully since then. In the meantime, Total Common Equity was flat for years but was up about 7% in 2023 and was again up slightly in the first quarter of 2024. With preferred stocks outstanding growing faster, we see that the coverage ratio (TCE/Pfds) dropped from over 11x to 9.3x; down but still a very good number. I would rate the odds of a missed dividend payment or redemption payment as next to nil. Also, keep in mind that BAC did not skip any payments during the 2008-09 GFC or during the COVID meltdown.

Comparing the preferred stocks

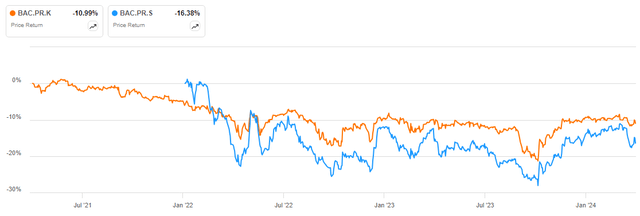

seekingalpha.com charting

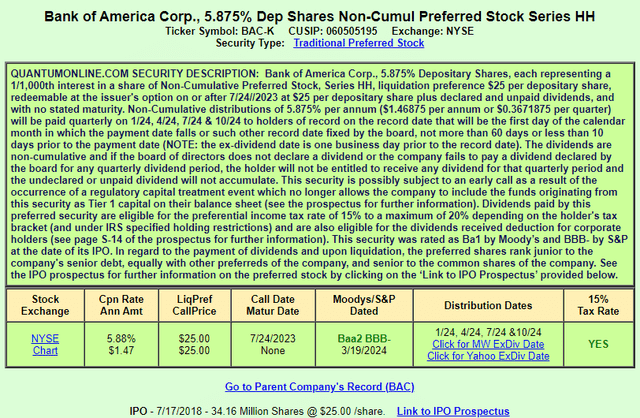

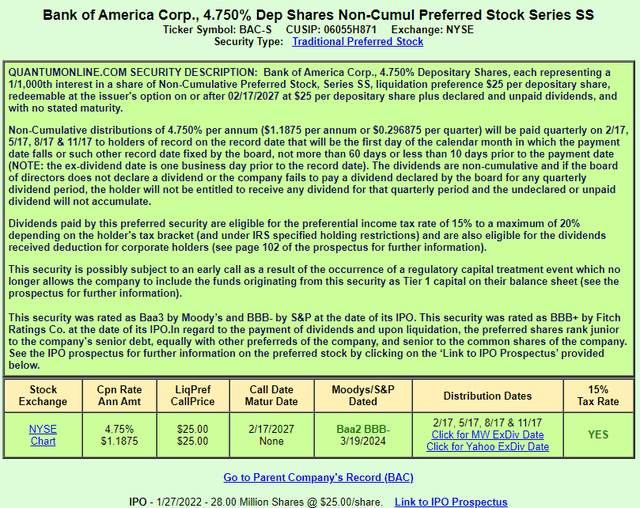

Being fixed-rate in a world of rising interest rates caused both issues to decline in price over the past few years. My go-to source for basic data for preferred stocks is QuantumOnline.com.

QuantumOnline.com

QuantumOnline.com

* Early Call permitted if issue no longer qualifies as Tier 1 capital

Along with the two reviewed here, I added data for the two from the prior article.

| Factor | Series HH | Series SS | Series LL | Series QQ |

| Issue Date | 7/17/18 | 1/27/22 | 9/10/19 | 10/21/21 |

| Issue size (shares) | 34.2m | 28m | 52.4m | 52m |

| Coupon | 5.875% | 4.75% | 5.00% | 4.25% |

| Call Date | 7/23/23 | 2/17/27* | 9/17/24* | 11/17/26* |

| Cumulative | No | No | No | No |

| 15% Tax rate | Yes | Yes | Yes | Yes |

| Price | $24.61 | $20.78 | $21.67 | $18.37 |

| Yield | 5.97% | 5.72% | 5.74% | 5.67% |

| YTC | NA | 11.9% | 44.7% | 17.3% |

The fact that the series LL is still under $22 with only a month before it can be called indicates the market does not see that happening. Add the fact that BAC has higher coupons that are callable backs that up.

Analysis

- Considering the fact that BAC has been able to issue more preferred stock since 2017 at reasonable coupons indicates the market does not see much chance of a default here.

- For those who do not believe it will be called, the Series HH offers a slightly better yield. For others, the almost three years of call protection offered by the series SS might be the better option.

- While the YTC on the series SS is attractive, the coupon is one of the lowest on any BAC preferred, making the odds very small this issue will be called after its Call date.

- When compared to the other BAC Pfds reviewed in my prior article, the Series HH offers the best yield, as it does against the series SS Pfd, with the series SS having the longest call protection, which I like.

Portfolio strategy

As stated above, financial institutions represent the vast majority of the preferred stocks available to investors. Most of these issues are non-cumulative, as required by Tier 1 rules. Investors mostly have to look outside banks and insurance companies to have their dividends protected. Numerous floating-rate formulas give investors an array of options to consider, too. These and other differences require each investor to consider the following:

- In theory, non-cumulative issues should have higher yields to compensate for that added risk. Is your risk analysis telling you it is worth taking any non-payment risk you see?

- Which direction are interest rates moving? Floating issues based on the 3-mo SOFR should outperform ones based on the 5-Yr UST rate when rates are climbing, the opposite otherwise, assuming reset dates are close.

- How much Call risk are you willing to accept? Two important factors here are the first Call date and the second is the coupon compared to current rates on similarly rated issues.

- Are you willing to trade some yield for greater Call protection? If rates are peaking, that becomes more important to consider.

Where each investor thinks rate are going probably drives whether they prefer fixed- or floating-rate coupons at this time. Last fall, everyone was convinced that the FOMC was ready to cut rates, with almost zero predicting more hikes. Recent inflation data has put cuts on hold, though I haven’t heard much talk about a hike in the cards. I only got C’s in my economic and banking classes, so keep that in mind as I say/believe with the election only months away, there won’t be a hike and the pressure for at least one cut will be immense if the polls continue to show the presidential race being a toss-up. Keep in mind, as I have, owning both fixed- and floating-rate assets is a valid strategy.

Conclusion

My prior article reviewed the Bank of America Corporation 5% NCUM PFD LL (NYSE:BAC.PR.N) and the Bank of America Corporation 4.250% DP PFD QQ (NYSE:BAC.PR.Q). Both offer call protection unlike the series HH, though the series LL expires this fall. Their current yields compare to the series SS yield, both near 5.7%. I would own the series SS over both for its longer call protection. If one accepts the fact that none of these four issues will be called in the near future, the only feature that differs amongst the four is the price and coupon; thus the only Buy criteria is whether an investor will like the YOC currently available. Based on that concept, the series HH is the clear choice.

In a declining rate environment, having a fixed-rate coupon should provide better price support compared to the floating-rate options listed next. For those okay holding floating-rate preferred stocks when we could (though it seems cuts keep getting delayed) be at a rate peak, Bank of America has issues to consider:

- Bank of America Corporation PFD PER1/1000E (BAC.PR.E) Yield: 6.27%

- Bank of America Corporation PFD DP1/1200 4 (BML.PR.J) Yield: 6.93%

Both of these issues are past their Call dates, are eligible for the 15% tax rate and have a 4% coupon floor and yield more than the two covered in this article. Like the others, the dividends are non-cumulative.

Having said all of that, there are preferreds with better yields for the same credit rating offered by Huntington Bancshares (article link) or Citigroup (article link). As are the BAC issues, all are rated on the cusp of investment/non-investment ratings. I suspect those ratings are negatively affected by the fallout caused by the optimistic rating many financial institutions had as the GFC overtook them, and then many saw their ratings downgraded at that time.

Over the past year or so, I must have reviewed dozens of preferred stocks. I look at basically three factors in placing a value on each issue, those being: yield, call protection, and whether payments are cumulative or not. Each factor is easy to find; YTC takes some work, but I discount that possibility for most issues, and the value is meaningless if past its call date. As stated in the previous paragraph, I would pass on the BAC preferreds as better values are available elsewhere for the same or close credit rating.

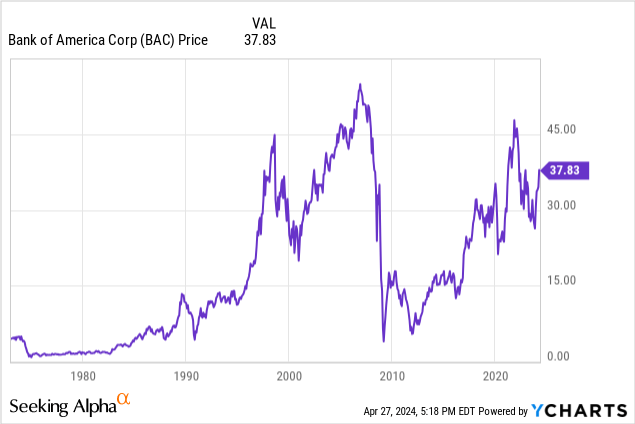

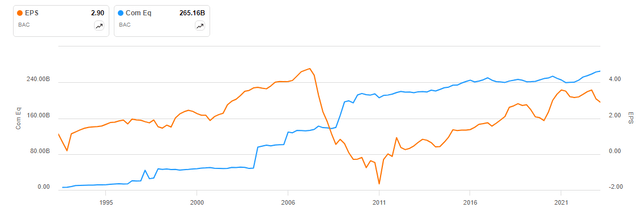

Looking at both the long-term changes on both Common Equity and EPS, we see Bank of America didn’t take a hit to Common Equity during either of the recent market meltdown, the 2008-09 GFC or COVID.

seekingalpha.com charting

While climbing steadily since the GFC, they are still below the peak prior to that event. The bottom line to me is the bank’s preferred stockholders have nothing to fear.

Because better yields are available for what I perceive as similar risks, I would only rate these two Bank of America preferred stocks as a Hold. That said, for an investor wanting to own a BAC preferred, my nod would be the Series SS reviewed in this article over the other five mentioned.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Alex Pettee is President and Director of Research and ETFs at Hoya Capital. Hoya manages institutional and individual portfolios of publicly traded real estate securities. Alex leads the investing group known as the Hoya Capital Income Builder, which uses the investment knowledge of several Seeking Alpha analysts provide members with insightful articles covering mostly individual stocks or funds. Occasionally an article cover will cover an investing strategy or other topic that investors need to be aware of, such as law changes that might effect their long-term strategy.

For more information about this Investors Group, click on this link: