Summary:

- Exxon Mobil forecasts steady production growth going into 2027 with volumes growing to 4.2MMbbl/d. This along with their $15b cost-savings will drive their 10% earnings CAGR forecast through 2027.

- Chemicals may be at the bottom of the cyclical upswing, positioning Exxon for margin expansion going into 2H24-2025. This business was offset by Exxon’s expansion in high-margin specialty chemicals.

- Once the Pioneer Natural Resources acquisition is approved, management voiced a move to returning $20b to shareholders through their share repurchase program.

Lanier

Exxon Mobil (NYSE:XOM) continues to perform exceptionally well with the anticipation of a stronger production roadmap going into 2027. Despite strength in upstream, downstream remains significantly suppressed with the cyclical downswing in the chemicals business pushing down margins offset by strength in the specialty chemicals business. With respect to the chemicals business, I believe we may be nearing a turn in the business come e2H24 that may result in stronger margins going into eFY25. I maintain my BUY rating on XOM shares with an increased price target of $128.23/share at 6.20x eFY25 EV/EBITDA.

Previous Exxon Mobil Reports To Review

Exxon Mobil Will Likely Push The Boundaries Of Energy Production – 2/7/2024

Exxon Will Remain In A Good Position Regardless Of Guyana – 12/2/2023

Exxon Has Huge Production Upside For 2024 – 11/17/2023

Exxon Mobil Operational Excellence

Exxon Mobil continues to perform with operational excellence as the firm maintains their hydrocarbon strategy while exploring new energy technologies as they pertain to hydrogen, direct air capture, and CO2 utilization. Management remains optimistic in their ability to transition to emissions reduction technologies and clean energy solutions. Despite the drive towards energy transition, management remains adamant in bringing these solutions to market when they’re viable, $1b+ businesses and affordable for customers. For example, Darren Woods, CEO, mentioned in their Q1’24 earnings call that with the current cost requirements, DAC requires $600k/ton of CO2 for the technology to be feasible and will enter the market as the cost approaches $100/ton of CO2 to cater to the broader global market. I believe this is a very prudent approach to adding new energy infrastructure to the operational mix. I would equate this approach to the early adoption of electric vehicles, as the mass majority of consumers are priced out of the market, resulting in a lackluster adoption of the vehicles. By that same logic, there are few customers that the higher cost DAC systems that Oxy (OXY) is developing cater to. One of the biggest risks involved in being the first to market is that the current technology may quickly become a technology of the past as more efficient and effective systems are developed at a lower cost. Though this novel technology has yet to reach commercial operations, the firm has sold all capacity to firms that can afford these higher costs, such as Amazon (AMZN). On an apples-to-apples basis, not many companies have the purchasing power that Amazon commands and simply cannot afford these expensive carbon offsets.

This approach is similar to Exxon’s approach to their lithium mining development in Arizona. Though Exxon could have easily jumped the gun during the EV hype-cycle, the firm elected to sit it out and wait for the economics to align. I believe that this strategy will play out well for the firm, as the early days of technology developments are often times the most volatile and experience the fastest decline rate in price and cost dynamics. Considering the outlay in the lithium futures market as well as the repositioning of the automotive OEMs, this strategy has played out to Exxon’s strength as they avoided the rug getting pulled before substantial capital investments were made. Given that batteries remain as the lion’s share of the cost of manufacturing electric vehicles and novel solid state batteries have yet to hit the market, Exxon finds itself in a strong position of having the bandwidth to push back the start date of first production if necessary without facing significant impairment costs.

TradingView

Other areas of renewable, new energy, and chemicals-related include closed loop chemicals recycling and production technology, using Proxxima to develop a lightweight, corrosion-resistant, and durable replacement for thermoset resins, and the development and scale of carbon products from low-value refinery streams. Though management does not discuss whether these projects are categorized within their feasibility spectrum, I would expect that each of these projects has a long-term trajectory in mind and isn’t necessarily expected to scale or reach the market until later in the decade.

Exxon Mobil and Pioneer Natural Resources (PXD) M&A Update

Since reporting Q1’24 earnings, Exxon & Pioneer have reached the final mile in closing the deal. Contingent on enforcing former CEO Scott Sheffield from joining Exxon’s board of directors, the acquisition is as good as closed. The push to ban Mr. Sheffield relates to collusive activity with OPEC to control production output in order to bolster oil prices in the 2020 pandemic era when oil prices declined to their lowest price in recent history, with oil futures reaching negative pricing for the first time. Since then, WTI experienced one of its fastest price recoveries over the next two years with energy producers, such as Devon Energy (DVN) and Diamondback Energy (FANG), outperforming the broader S&P 500 index in 2021 and 2022.

TradingView

At the time, there appeared to be a unified call for a disciplined approach to production growth in which operators produced to meet demand as opposed to producing to take market share. What I hadn’t known at the time, and what has come to light during the FTC antitrust investigation, is that Mr. Sheffield was in communication with Mohammad Barkindo, then secretary-general of OPEC, in discussions to cut oil output to prop up prices. The handover of merger documents between Exxon and Pioneer has led to the further investigation of Mr. Sheffield, which appears to be resulting in further investigations into the matter. As long as Exxon honors the agreement, I believe the deal will close sometime in Q2/Q3’24, assuming no other challenges arise. Mr. Woods remains confident that no other competition issues should hinder the transaction. Management anticipates the closing date sometime in Q2’24.

Exxon Is Building Operational Efficiencies For Future Cost Savings

Mr. Woods reiterated the firm’s target of $15b in cost savings initiatives by 2027. The firm has reached a significant milestone in this initiative by hitting $10.1b in Q1’24 when compared to Q1’19. Management voiced that savings will be spread roughly 50/50 between the upstream and product solutions businesses as the firm seeks to consolidate much of the organization to eliminate redundancies. Creating standardized back-office processes in procure-to-pay, record-to-report, and planning activities will allow the firm to automate many of the traditionally manual processes, allowing for the firm to alleviate both costs and operational time efficiencies. The firm is also focusing efforts in leveraging their scale to drive more efficient logistics and supply chain bottlenecks in order to improve the procurement process. This should also drive down materials costs and allow for the firm to manage both lower inventories and a leaner balance sheet. I anticipate that pulling in Pioneer’s Permian assets will significantly improve these efficiencies as Exxon will have a stronger Permian footprint paired with stronger enhanced oil recovery technologies. These cost savings are expected to be paired with a 10% CAGR for earnings potential from 2023 through 2027, much of which will be driven by upstream production. With the new Permian assets as well as Exxon’s continued drilling program in Guyana, I anticipate that the majority of the firm’s upstream growth will be derived from these two assets. Management also anticipates growth within their LNG business as the Golden Pass nears completion. Exxon is also in the process of determining FID for the Papua New Guinea LNG project and the Mozambique onshore LNG and should come to a decision in 2024 for each of the projects.

Exxon Mobil Production Forecast

Exxon’s top-line remains under pressure as average oil price levels are creating challenging comps on a year-over-year basis paired with a challenging chemicals market. Mr. Woods suggested that the broader chemicals market may be nearing the bottom; however, there may be further macroeconomic challenges as new chemicals facilities come online in regions such as China. Upstream may continue to be pressured in the coming years, as crude futures price WTI in the mid-$70s range for the duration of eCY24 and low-$70s in eCY25. Brent crude oil futures are priced down to the mid-$70s towards the end of eCY25. These pricing dynamics can result in a moderate decline at the top-line, net of growth through M&A as Exxon continues to produce with a disciplined approach.

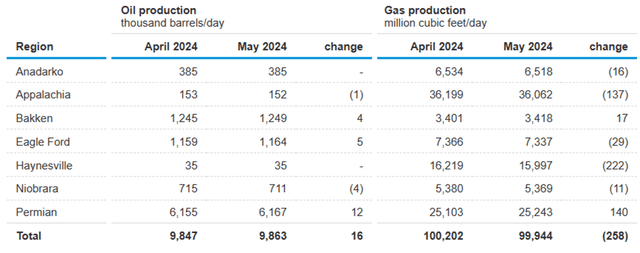

Natural gas, on the other hand, may experience significant upside potential in the coming years as market dynamics shift resulting from increasing power demand. The increased adoption of AI/ML applications across enterprises is driving the demand for data center capacity, which in turn is driving up the necessity for more sustainable power sources. For example, Oracle mentioned in their Q3’24 earnings call that the firm is building out 23 new data centers across multiple regions, which I anticipate will drive up power demand as data centers cannot risk downtime due to power failures. Though I believe nuclear power generation will become the solution to cater to this demand, SMRs are not expected to begin hitting the market until the end of the decade through 2035, which will create a lapse in power supply. I anticipate this gap will drive the necessity for natural gas-fired power plants and may result in a new wave of strong natural gas prices. It is clear that gas producers are acting responsibly by cutting product across all basins, resulting in a decline of 258MMcf/d when aggregating all basins. The majority of the production reductions in April occurred in the Haynesville Basin, which shouldn’t be a surprise to anyone, as the pause on new approvals for LNG export capacity has flatfooted the industry tied to that specific basin. The threat of limited new capacity offtake has nullified the economics behind the higher cost basin and may hinder future developments if new export capacity does not reach approval.

EIA

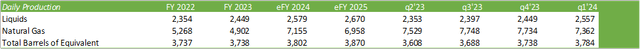

Management anticipates 3.8BMMboe/d of production for eFY24, primarily driven by their core assets in the Permian and Guyana. As discussed in their Q4’23 earnings call, Exxon will be taking their Liza 1 and Liza 2 projects offline in order to connect a gas pipeline for direct access to local processing and utilities. It was recently announced that this will occur in July and August for two weeks for each project. This will allow for Guyana to reduce import dependency as well as lower the price of electricity for the region, which in turn should strongly benefit the local economy.

Looking ahead to total production, management forecasted 3.8MMboe/d for eFY24 with growth to 4.2MMboe/d by 2027. I believe much of this forecast is dependent on a strong price per barrel, given management’s recent initiative to not generate any new dry gas and focus more heavily on liquids production. Total liquids accounts for ~68% of total production. I anticipate further growth into eFY25 as the firm continues exploring their Guyana assets as well as increasing production in the Permian Basin. As management had previously discerned, I anticipate Exxon to focus more heavily on liquids-rich wells in the US to offset the soft natural gas market.

Corporate Reports

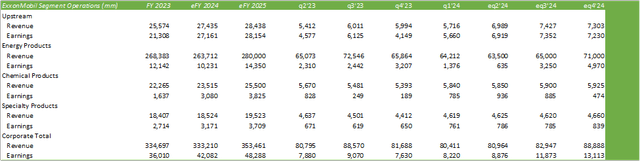

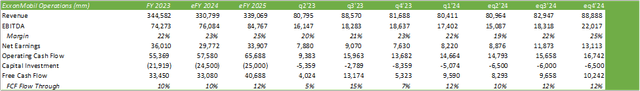

Mapping through financials, I anticipate chemicals & related products to begin to turn to an upswing in e2H24 in a cyclical upswing. Though I do not anticipate significant strengthening in the segment, I anticipate volumes to offset some of the pricing challenges that may continue to persist. I also anticipate much of the same for upstream as WTI prices are forecast to remain in the mid-$70s for the duration of eCY24 and low-to-mid-$70s in eCY25. Given that Exxon is expected to increase liquids production, I offset the pricing with an increase in volumes for the duration of eFY24 and into eFY25. There may be some interesting dynamics that will result from the court’s determination of Exxon’s arbitration suit for first refusal over Hess’s 30% stake in the Stabroek Block. It has been reported that a hearing may occur in Q3’24 with a final decision in Q4’24. Given that this could really go either way, I am not pricing in a determination and modeling the status quo. If Exxon were to take over the 30% ownership stake or split the stake with CNOOC, this could lead to significant upside potential for the firm’s total production output from the block.

Corporate Reports

I am also modeling in some margin expansion as a result of management’s cost-cutting efforts as the firm seeks to centralize the back office operations and lean out technology and headcount.

Corporate Reports

XOM Investment Thesis

Valuation & Shareholder Value

Corporate Reports

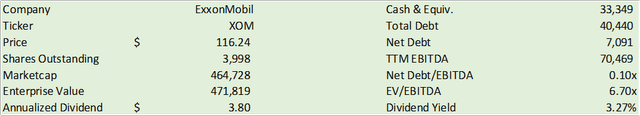

XOM continues to perform exceptionally well and holds a strong dividend yield of 3.27%, well above the S&P 500’s average dividend yield of around 1.78%. Aside from share price growth, this positions XOM shares well as a strong dividend-yielding stock as management remains focused on returning cash to shareholders through their dividend growth and share repurchase policy.

Exxon Mobil returned $7b to shareholders during Q1’24, $3.8b of which came from dividends. Management also resumed the share buyback program in the quarter following the Pioneer special shareholder meeting and is on pace to reach $20b in buybacks post-closing of the Pioneer acquisition.

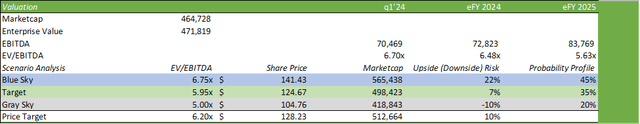

Valuing XOM stock, I’m increasing my price target for shares to $128.23/share priced at 6.20x eFY25 EV/EBITDA. I maintain my BUY rating as I anticipate significant upside potential for the firm as the firm continues operational excellence in their upstream and downstream businesses, as well as a potential cyclical upswing in their downstream business.

Corporate Reports

Though I remain bullish on XOM shares, there are some potential risks to take into account looking ahead. Geopolitical risks may swing oil prices to either the upside or downside as regional skirmishes and other factors take place. One major turning point to the upside on the geopolitical front is that much of the energy transition verbiage has shifted from energy sources to managing emissions, which should provide some comfort to producers. Other risk factors involve natural gas production, as prices remain suppressed and may not experience a significant upswing as regional nuclear reactors are being constructed or switched back on with extended life expectancies. Overall, I do not anticipate the negative risk factors to significantly impact Exxon’s core business, as nuclear and renewable capacity will take decades to offset natural gas-fired power plant capacity.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.