Summary:

- Intel Corporation’s first-quarter earnings showed decent growth in the Client Computing Group.

- Intel beat EPS estimates for the first fiscal quarter and the margin trend looks good.

- The estimated return to positive growth in device shipments in FY 2024 is positive for Intel, as the Client Computing Group continues to dominate the company’s revenue mix.

- New product launches could be a catalyst for EPS upside revisions.

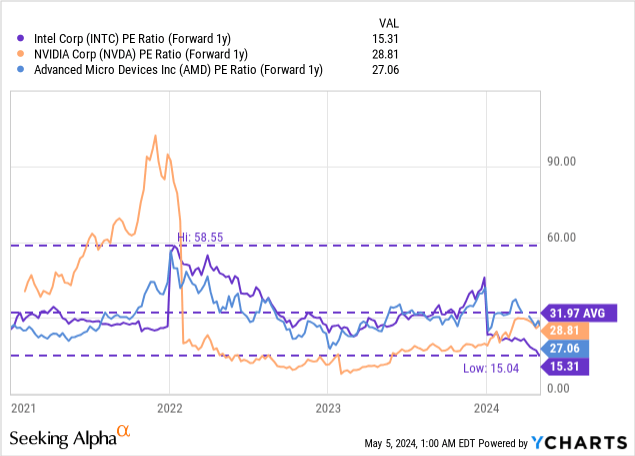

- The valuation is very appealing, with Intel now trading at about half its 3-year average P/E.

hapabapa

Intel Corporation (NASDAQ:INTC) delivered a decent earnings sheet for the first fiscal quarter that beat earnings consensus estimates, but that also showed a drop-off in revenues in the company’s core Client Computing Group. Intel unfortunately also presented a weak outlook for the second fiscal quarter, which explains Intel’s sharp drop after earnings. After Intel’s earnings release for Q1 ’24, Intel is set for a new round of EPS estimate down-side revisions, which could weigh on shares in the short term. In the longer term, however, I expect a revaluation to take place, as Intel’s shares appear to be undervalued relative to its rivals in the chip making business as well as to the company’s historical average!

Previous rating

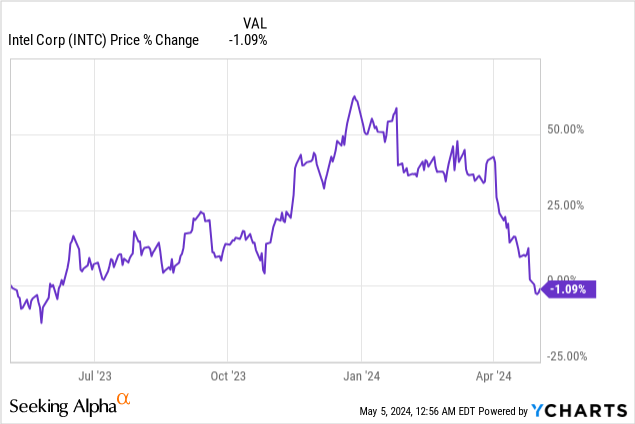

I rated shares of Intel a strong buy at the end of January — Time To Load Up The Truck — because the company’s financials, especially in the Intel’s all-important Client Computing Group, showed respectable growth. Since then, shares of Intel have declined 30% in value as Intel is seeing slowing growth in its core business segment, which together with a weak outlook for the second-quarter weighed heavily on Intel’s shares. The market is too short term focused, in my opinion, and I believe Intel could be set for a turnaround in the near future.

Intel beat EPS estimates

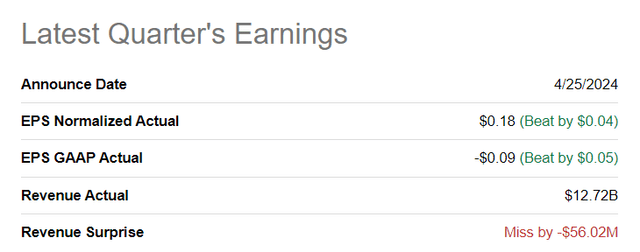

Intel beat bottom-line estimates for the first fiscal quarter: the chipmaker reported adjusted earnings of $0.18 per-share on revenues of $12.72B. Earnings came in $0.04 per-share ahead of the average prediction, while the top-line fell short of actual revenue numbers by $56M.

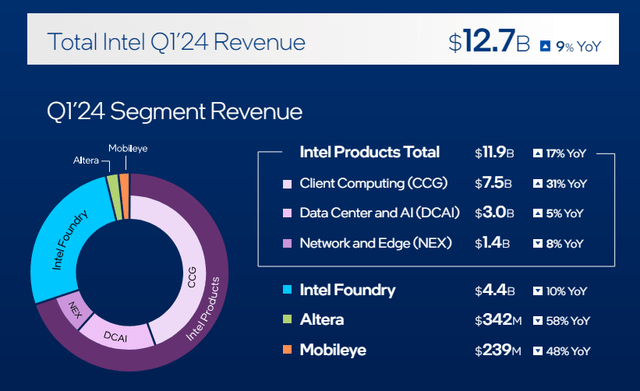

Intel’s CCG business still driving consolidated top-line growth, good margin picture

Intel’s total revenues increased 9% year over year to $12.7B, and this growth was chiefly driven by the chipmaker’s Client Computing Group, which is selling laptops and PCs to customers around the world. Its core business unit generated $7.5B in revenues in the first-quarter, showing 31% year-over-year growth. Client Computing Group revenues accounted for 59% of all revenues, while other core segments like Data Center and AI as well as Network and Edge delivered significantly lower growth rates of 5% and 8%, respectively.

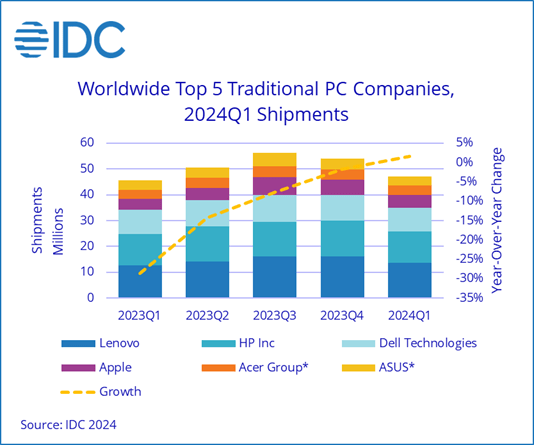

According to estimates made by research company IDC, the device market saw a return to positive growth in the first-quarter. The device market saw 1.5% year over growth in device shipments with major manufacturers Lenovo and Acer seeing high-single digit growth, while Apple (AAPL) even saw 14.6% shipment growth in Q1 ’24. IDC’s outlook for FY 2024 calls for approximately 2% growth in device shipments, which could further help stabilize results in Intel’s Client Computing Group.

IDC

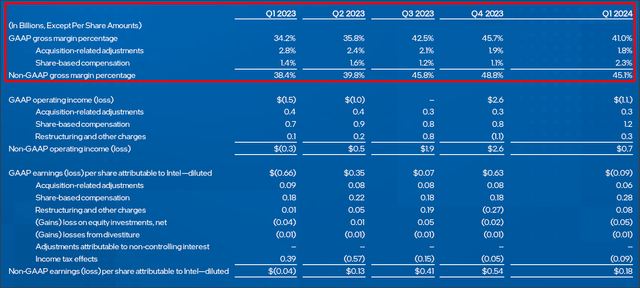

Intel’s margin trend is looking very solid, however, which indicates to me that the chipmaker is on the right track to improving its gross and operating income picture despite a weak outlook for revenue growth in Q2 ’24. Gross margins in Q1 ’24 grew 6.8 PP year over year to 45.1% and the company saw its fourth straight quarter of positive non-GAAP operating income.

Intel’s weak outlook overshadowed strong earnings performance

While Intel beat earnings easily, Intel’s outlook was tainted by its weak forecast for the second fiscal quarter. Intel expects to see $12.5-13.5B in revenues in Q2 ’24 (midpoint: $13.0B) which came in below mid-point expectations of $13.6B. The weak forecast resulted in an accelerating sell-off for Intel immediately after earnings.

Intel’s valuation and EPS downside revisions

Intel is profitable, but the weaker than expected outlook, driven by a slowdown in CCG and Data Center/AI, is set to result in a new round of EPS downside revisions… which may continue to weigh on Intel’s valuation in the short term.

The company is currently expected to grow its EPS only 5% this year, compared to earnings growth rates of 93% for Nvidia (NVDA) and 33% for AMD (AMD). Both Nvidia and AMD have stronger AI exposure and benefit enormously from the roll-out and shipment of new data center GPUs that are used to train large language models such as OpenAI’s Chat-GPT… which is why both companies have stronger EPS prospects and higher P/E ratios than Intel.

Intel has fallen behind its chip making competitors and started shipping its own Data Center-dedicated 4th generation Xeon processors — better known as Sapphire Rapids — last year. The company just announced, however, the upcoming launch of its Gaudi 3 AI accelerator, which is targeting the enterprise market, and which is seen as a lever for Intel to catch to Nvidia and AMD. Intel has said that it expects approximately half a billion in revenues from its AI chip sales in the second half of the year.

Intel is currently valued at a price-to-earnings ratio of 15.3X, which is less than half its 3-year valuation average. The post-earnings sell-off, in my opinion, is exaggerated, especially as Intel is still growing quickly in the CCG business and the launch of the Gaudi 3 AI chip could provide a lever for accelerating earnings growth toward the end of the year… which may then result in a correction of EPS estimates to the upside. Given the reasonably strong CCG momentum, new AI chip launch and solid margin trend, I believe Intel could return to its 3-year valuation average in the longer term. This implies a fair value of $65 per-share (my previous fair value estimate in January was $60-64 per-share).

Risks with Intel

Intel is, and will remain, chiefly dependent on the consumer electronics market, although the company is making efforts in other segments, like Data Center/AI and Foundry, to diversify its revenue mix and reduce the reliance on CCG-derived revenues. Going forward, the successful (or unsuccessful) launch of the Gaudi 3 AI accelerator used in the Data Center market could determine the short-term trajectory of Intel’s shares. If the Gaudi 3 fails to receive the backing of the enterprise market, shares of Intel may continue to get punished by investors.

Final thoughts

The return to positive growth in device shipments in FY 2024 would be a positive development for Intel, especially because the company’s revenue mix continues to be dominated by the Client Computing Group. This segment was responsible for more than half of all revenues in the first-quarter and with the company launching a new AI chip product soon, I believe the market may currently be too pessimistic about Intel’s growth prospects… which is also shown by Intel’s very low 15X P/E ratio. At the current price, Intel has considerable turnaround potential, and I believe the risk profile is highly favorable at half of the company’s 3-year valuation average!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.