Summary:

- Three months have passed since I initiated coverage of Merck stock, during which time the company managed to report on the results for Q1 FY2024. Let’s review them.

- Merck had an impressive financial performance, with total worldwide sales hitting $15.8 billion – that was a significant 9% YoY increase, though slightly lagging 2022 results.

- I particularly like the way Merck managed its costs during the period. Gross margin increased to 77.6% for Q1 FY2024, compared to 72.9% last year.

- There are still a few months to go before the next report is published, but I have little doubt today that MRK will very likely continue to increase its business momentum and surprise us again with the strength of its financials when the time comes for the report.

- In my opinion, MRK’s valuation looks quite attractive if we consider its growth prospects. With a PEG ratio of 0.39, which is almost 80% below the sector median, I believe that MRK’s growth rates justify its valuation, even in light of the existing risks.

JasonDoiy

Intro & Thesis

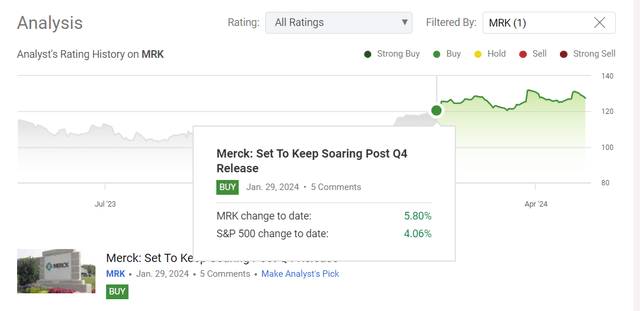

I initiated coverage of Merck & Co, Inc. (NYSE:MRK) stock in January 2024. Since then, MRK has gained 5.8%, slightly outperforming the S&P 500 (SP500) (SPY) Index.

Seeking Alpha, my coverage of MRK stock

My thesis at the time referred to Merck’s strategic collaborations and pipeline developments, which would contribute to increasing the value of the stock in view of the company’s expected substantial sales growth over the next few years. I also noted at the time that the MRK stock was heavily undervalued. Three months have passed since then, during which time the company managed to report on the results for Q1 FY2024 and make forward-looking comments. In addition, some important news items have appeared that need to be taken into account when updating my thesis, which incidentally has not changed. I’m still of the opinion that MRK is an undervalued great “Buy” pharma stock to consider.

Why Do I Think So?

First off, let’s start with an overview of Q1 FY2024 results, which were released on April 25, 2024.

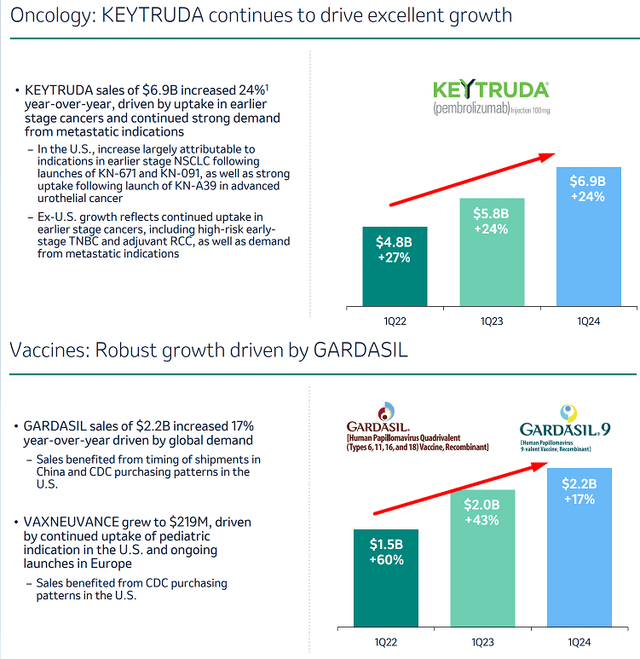

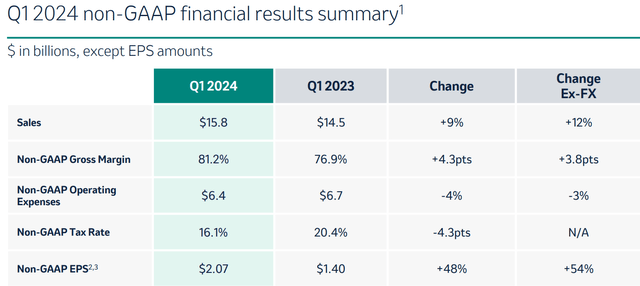

In Q1 2024 Merck had an impressive financial performance, with total worldwide sales hitting $15.8 billion – that was a significant 9% YoY increase though slightly lagging behind 2022 results. Excluding FX impacts, this growth surged to an even more remarkable 12%, primarily driven by a robust 10% sales increase in the pharmaceutical division. As I see it, the biggest contribution came from KEYTRUDA and GARDASIL/GARDASIL 9 with KEYTRUDA witnessing a remarkable 24% YoY sales surge, reaching $6.9 billion, and GARDASIL 9 showing solid growth of 14% YoY, amounting to $2.2 billion:

MRK’s IR materials, the author’s notes

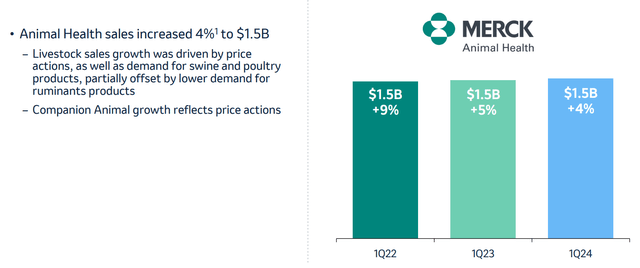

As the revenue share of only 2 of the above-mentioned drugs accounts for 57.6% of the total amount, the 24% decline in sales of JANUVIA/JANUMET (due to price and demand problems in the U.S.) was fully offset – the overall performance of the pharmaceutical division seems to stay robust. Also, Merck’s animal health segment contributed to the company’s Q1 financial success, albeit to a lesser extent: Sales in this segment reached $1.5 billion, representing a modest 1% increase from the previous year (+4% ex-FX), which was primarily attributed to higher pricing across Livestock and Companion Animal product portfolios, partially offset by lower volumes.

MRK’s IR materials

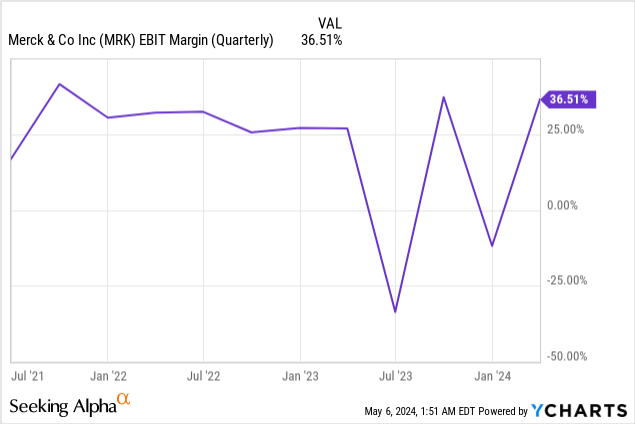

I particularly like the way Merck managed its costs during the period. Gross margin increased to 77.6% for Q1 FY2024, compared to 72.9% last year, which was primarily attributed to favorable impacts such as product mix, lower royalty rates related to key products like KEYTRUDA and GARDASIL/GARDASIL 9, and FX gains. The company’s SG&A expenses remained stable at ~$2.5 billion, reflecting effective cost-control measures despite higher administrative costs. Similarly, R&D expenses decreased to $4.0 billion, primarily “due to lower charges for business development activities, albeit partially offset by increased compensation and benefit costs.” As a result, MRK’s EBIT margin has recovered relatively quickly:

The company not only exceeded analysts’ forecasts for EPS and sales in the first quarter but also its forecast for the second quarter of 2024 now implies year-on-year growth in these key figures of 48% and 9% respectively:

MRK’s IR materials

If we circle back to my earlier thesis from January 2024, I can confidently say that the company has largely met my expectations. This can be seen above all in the improvement of margins and the change in management’s view of company growth (the conviction became stronger, from what I can see). The actual performance of the most important drugs is also quite satisfactory. Overall, I’m very pleased with the direction in which things are heading.

There are still a few months to go before the next report is published, but I have little doubt today that MRK will very likely continue to increase its business momentum and surprise us again with the strength of its financials when the time comes for the report. Why do I believe this?

First, let’s take a look at the recent developments. In a few days after the Q1 report came out, Merck’s new pneumonia vaccine – V116 – triggered strong immune responses against the bacteria that cause pneumonia, similar to their older vaccine, Pneumovax23. However, V116 performed even better for the nine strains it covers that Pneumovax23 doesn’t, according to a recent study. The safety of V116 was also like Pneumovax23. This new vaccine targets a large portion of the pneumonia-causing bacteria and is waiting for approval from the FDA and European Medicines Agency, with a decision expected by June 17. If approved, V116 would compete with Pfizer’s (PFE) Prevnar20, which covers 20 strains of the bacteria. According to Allied Market Research, the pneumonia therapeutics market was worth $12.3 billion in 2020 and is expected to nearly double to $25.5 billion by 2030, growing at a CAGR of 8.5%. So the TAM addition for MRK is significant in my opinion, and any further comments from management should, in my opinion, give the market even more hope for stronger growth than the market is indicating today. I’m talking about the “TAM addition for MRK” because the company previously lacked a vaccine for this particular ailment, based on the information I could find. So by adding a new drug to its product range, it is unlikely to cannibalize some of its existing revenue.

Second, on May 1, 2024, Merck announced good news about a treatment for advanced stomach or esophageal cancer. In a large study called KEYNOTE-811, a combination of Keytruda (pembrolizumab), trastuzumab, and chemotherapy was investigated. According to the source, the treatment worked best in patients whose tumors had a certain amount of a protein called PD-L1; this combo was already approved for another type of stomach cancer, HER2-positive. With these new results, it could now help even more people with advanced stomach or esophageal cancer. So again, I think we can expect this news to boost the growth of the company’s largest drug to date and that management will be positive about the results and plans during the conference call. In my opinion, this news indicates that Merck has another chance to solidify its position in the global market for stomach and esophagus cancer, which analysts predict should expand by 10.5% annually (“CAGR”) to reach a size of $24.1 billion by 2031.

Third, in addition to the above news, Merck’s diversified pipeline in vaccines, HIV, and oncology positions the company for further growth and impact. In vaccines, ongoing efforts to optimize disease prevention, expand protection against HPV-related cancers, and single-dose research for GARDASIL 9 demonstrate Merck’s commitment to addressing global health challenges – the management team commented during the latest earnings call. In oncology, the company’s three-pillar strategy of immuno-oncology, precision molecular targeting, and tissue targeting continues to show promising results, with “initiatives such as the initiation of Phase 3 trials for novel candidates and strategic collaborations reinforcing Merck’s leadership position in this area.“

In my opinion, the valuation of the company also supports the thesis of further growth in MRK stock. MRK is trading at about the same level as other large-cap healthcare dividend-paying companies. Furthermore, if we remove the recent fluctuations in MRK’s P/E multiple this year from the calculation and focus on the long-term average, we’ll see that MRK could be undervalued by almost 40%. But only if we assume that the EPS forecasts for 2024 and 2025 are accurate.

YCharts, author’s notes

I realize that the valuation of a stock based solely on the average P/E ratio cannot always be appropriate. However, analysts expect Merck’s earnings per share to grow by 7.4% over the next 5 years. Until 2023, MRK’s EPS growth rate was around this level (yes, it was slightly higher, but no by too much). This is precisely why I believe Merck’s valuation multiple should return to its long-term averages: At some point, the market may stop discounting the company’s valuation due to stagnant growth, as the company continues to innovate and bring new products to market, which mitigates this kind of risk.

In my opinion, MRK’s valuation looks quite attractive if we consider its growth prospects. With a PEG ratio of 0.39, which is almost 80% below the sector median, I believe that MRK’s growth rates justify its valuation, even in light of the existing risks, which I’ll discuss below.

So based on the above, I decided to leave my “Buy” rating unchanged today.

Where Can I Be Wrong?

Merck is facing many challenges, particularly due to the loss of exclusivity for important drugs. One example is Remicade, which was co-marketed with Johnson & Johnson (JNJ) many years ago and has to compete with biosimilars in both Europe and the USA. Another issue is Keytruda, whose patent expires in 2028 – given the significant contribution this drug makes to Merck’s current sales, the impending loss of exclusivity will be a significant blow to the company’s financials. This could be one reason for the current undervaluation I identified above: Looking at the growth prospects over a time horizon of only 1–2 years, the growth prospects appear relatively stable; only beyond this time frame do the challenges become potentially insurmountable.

It’s also important to keep in mind that the path to developing new drugs is full of risks and uncertainties and spans a decade with multiple phases of clinical trials. Another way of growing is M&A activity, and here comes another potential concern for investors as Merck’s approach to mergers and acquisitions, its criteria for a favorable deal may not match market expectations, which could unsettle Wall Street.

The Verdict

Despite the risks on the horizon, I’m confident that the company will go its way smoothly even once it loses the exclusive rights to sell certain products. The company seems to have plans in place to overcome these challenges by continuously conducting research and development to bring new drugs to market. It’s exciting to see that these initiatives are showing promising results and could extend the company’s TAM. All that should help protect the company from major financial setbacks.

Merck’s current valuation suggests good growth potential, especially with a projected dividend yield of 2.42%. I decided to reiterate my “Buy” rating today, as I see more room for MRK’s stock expansion going forward.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MRK over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!