Summary:

- Palantir Technologies Inc. delivered a beat and raise in its Q1 2024 report; however, investors are likely disappointed by the lack of AI-powered hypergrowth.

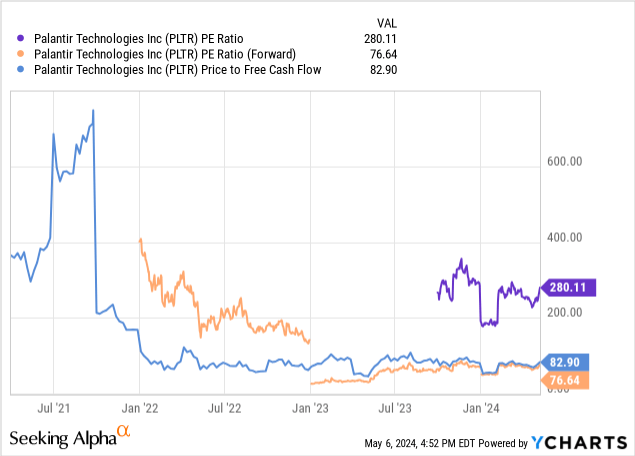

- The hype around Palantir is reflected in the company’s valuation of ~76x forward P/E, but this hype is unjustified for a business growing top-line at just ~21% y/y.

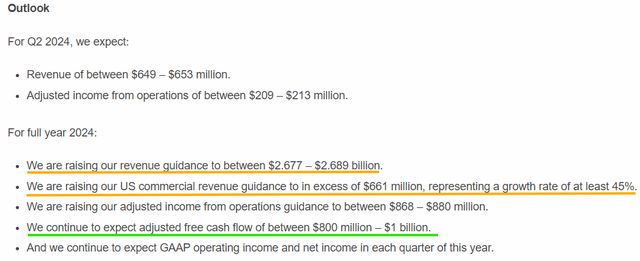

- While Palantir’s management raised guidance for 2024, the new revenue guide fell short of street estimates.

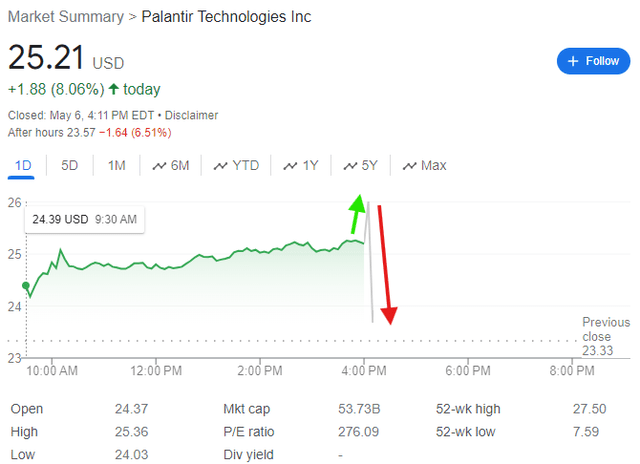

- Palantir’s earnings call will likely include a lot of hyperbole from its fiery CEO, Alex Karp; however, I expect the after-hours sell-off in PLTR stock to stick as it is well deserved.

Michael Vi

Introduction

In the immediate aftermath of reporting its Q1 2024 earnings, Palantir Technologies Inc. (NYSE: NYSE:PLTR) popped up by +3.5%, only to reverse sharply lower in a jiffy:

In today’s note, we will briefly review Palantir’s Q1 2024 report and then re-evaluate PLTR’s fair value & expected returns to see if Palantir is an attractive investment right now. Let’s crunch some numbers!

Brief Review Of Palantir’s Q1 2024 Report

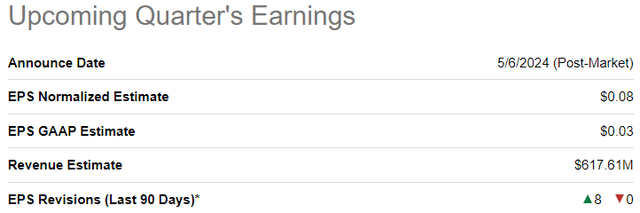

Going into its Q1 2024 report, Palantir was projected to deliver revenues and EPS of $617.6M and $0.08 per share, respectively. While Palantir beat top-line expectations and met EPS estimates, investors are seemingly disappointed by the lack of AI-powered hypergrowth!

SeekingAlpha Palantir Q1 2024 report

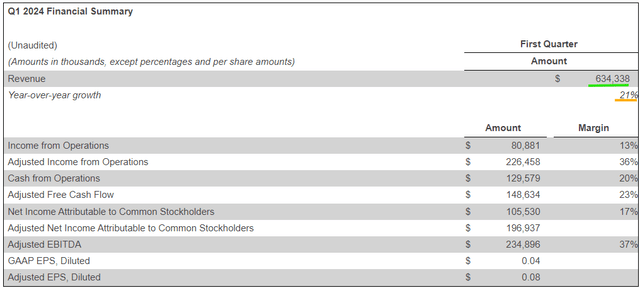

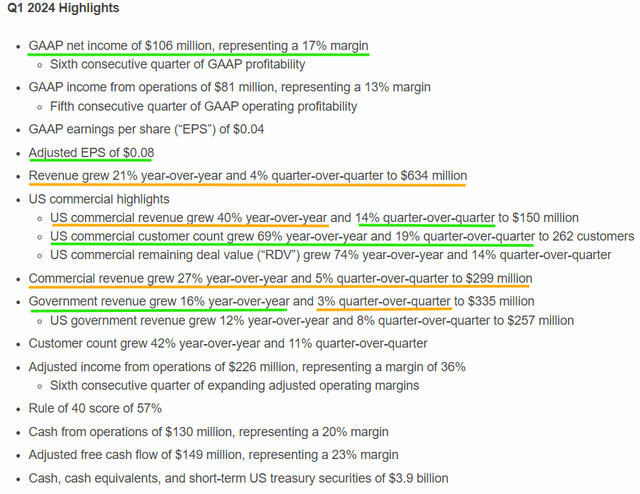

In Q1 2024, Palantir’s revenue grew by 21% y/y [+4% q/q] to $634M, marking a sequential growth slowdown. After an eye-popping +70% jump in Palantir’s U.S. commercial business last quarter, bullish investors were convinced about Palantir AIP’s ability to move the needle for PLTR stock in 2024. While Palantir is undoubtedly adding new commercial customers at a rapid clip [+69% y/y, with the help of AIP boot camps – 660 in Q1 2024], revenue performance (+40% y/y, +14% q/q growth) in the U.S. commercial segment failed to drive hypergrowth across the entire business, which was a prerequisite given Palantir’s lofty valuation going into the Q1 report.

Palantir Q1 2024 Earnings Report

While its adj. EPS of $0.08 was in line with estimates; Palantir generated $149M in adj. free cash flow (“FCF”) at a margin of 23.5% – increasing its cash balance from $3.7B in Q4 2023 to $3.9B in Q1 2024.

Palantir has real AI substance, and AIP’s rapid scale-up is ample proof. That said, Palantir’s valuation (~76x forward P/E) looks completely out of whack with reality for a business growing at just ~21% y/y!

Yes, Palantir’s management lifted their guidance for 2024 total revenues to $2.677-2.689B (+21% y/y growth at the midpoint of guidance range), with U.S. commercial revenues now expected to exceed $661M (growth of more than 45% [up from previous guide of 40%+ growth]). However, even this updated guidance for 2024 fell short of pre-ER consensus street estimates of $2.71B!

Palantir Q1 2024 Earnings Report

Given Palantir’s guidance history, management could be sandbagging us to set up an easy beat and raise, and 21%+ y/y growth is nothing to scoff at; Palantir investors are deservedly getting a reality check in the after-hours session. As I see it, a part of Palantir’s business (U.S. Commercial) is growing rapidly, powered by AIP; however, moderation in sequential growth [i.e., slowdown] across other parts of the business means the wild optimism priced into PLTR stock remains unwarranted.

Palantir’s Fair Value And Expected Returns

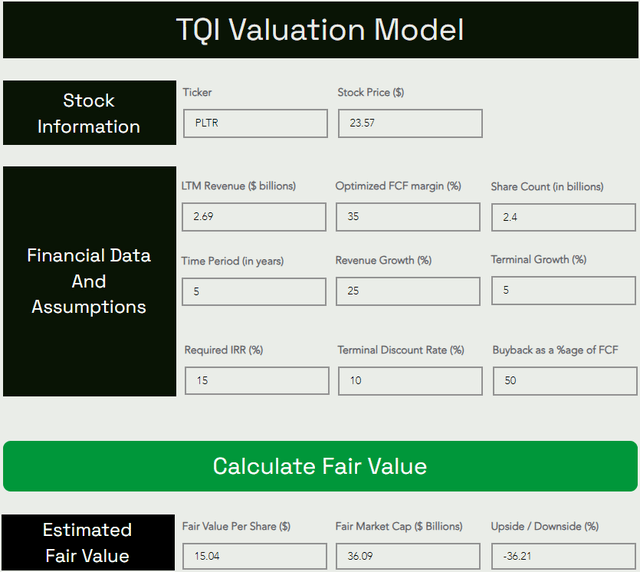

For today’s valuation exercise, I am maintaining my long-term sales growth and optimized free cash flow, or FCF, margin assumptions at 25% and 35%, respectively. These assumptions were explained in my previous article, “Palantir Stock: The Retail Army Is Winning, But Is It Too Late To Join The Party?”

All other assumptions are straightforward and self-explanatory, but if you have any questions, please share them in the comments section below.

Here’s my updated valuation for PLTR stock:

TQI Valuation Model (Free to use at TQIG.org)

From an absolute valuation standpoint, Palantir remains significantly overvalued, with PLTR stock having a potential downside of -36% to our updated fair value estimate of [$15.04 per share].

Now, I wouldn’t dismiss the idea of investing in Palantir solely due to its premium valuation, as history shows that winning stocks can be overvalued for long periods [e.g., Amazon.com, Inc. (AMZN), Tesla, Inc. (TSLA), Nvidia Corporation (NVDA), etc.]. Let’s take a look at Palantir’s long-term risk/reward to make an informed decision:

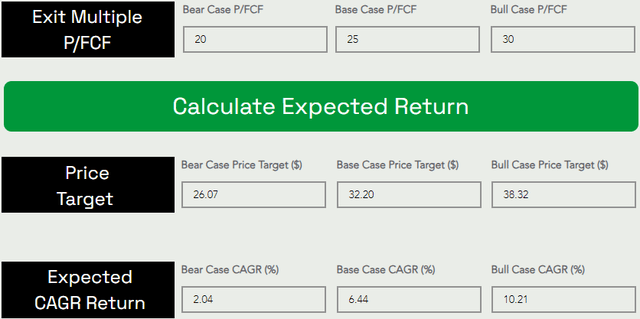

Assuming an aggressive exit multiple of 25x P/FCF, Palantir stock could rise from $23.57 to $32.20 at a CAGR rate of 6.44% by 2029.

TQI Valuation Model (Free to use at TQIG.org)

Since Palantir’s expected 5-year CAGR return fails to beat our minimum investment hurdle rate of 15% and average long-term S&P-500 (SP500) return of 8-10% per year, I am not a buyer of PLTR stock at current levels. Also, Palantir’s expected CAGR is better than treasury yields; hence, I am not an enthusiastic seller either.

Concluding Thoughts

While Palantir Technologies Inc. beat top-line expectations in Q1, the quantum of the beat was marginal, and management’s updated guidance for 2024 revenues falling short of consensus street estimates is quite a negative surprise. Given PLTR’s lofty valuation multiples, Mr. Market is rightly doling out some punishment to the stock in the after-hours session.

Overall, business momentum is building at Palantir, with the company delivering a solid mix of revenue growth and profitability. With a cash balance of $3.9B and no debt, Palantir has a solid financial foundation to support its AI ambitions. As a long-term investor, I am pleased with Palantir Technologies Inc.’s improving business fundamentals; however, in the absence of AI-driven hypergrowth, I think PLTR’s significant valuation premium remains unjustified. As such, I expect the after-hours sell-off to stick.

Now, to clarify, I am long on Palantir and a firm believer in its AI growth story. Palantir is a battleground stock – adored by millions of retail investors and frowned upon by certain institutional money managers. Recently, the retail army has been winning a lot, but the near-term upside looks capped due to PLTR’s valuation and long-term risk/reward [based on pretty aggressive valuation model assumptions] being unattractive at current levels.

At my investing group, we own a ~2.49% position in Palantir [effective cost-basis: $3.27 per share] within our moonshot growth portfolio, despite trimming gradually recently. In light of Palantir’s Q1 report, we will continue to refrain from further accumulation and trim opportunistically. To resume buying, I would want to see a price or time correction that boosts PLTR’s 5-year expected CAGR to 15%+.

Key Takeaway: Due to unfavorable long-term risk/reward, I continue to rate Palantir Technologies Inc. stock a “Hold/Neutral/Avoid” at $23.57 per share.

Thanks for reading, and happy investing. Please share your thoughts, concerns, and/or questions in the comments section below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

We Are In An Asset Bubble, And TQI Can Help You Navigate It Profitably!

Your investing journey is unique, and so are your investment goals and risk tolerance levels. This is precisely why we designed our investing group – “The Quantamental Investor” – to help you build a robust investing operation that can fulfill (and exceed) your long-term financial goals.

At TQI, we are pursuing bold, active investing with proactive risk management to navigate this highly uncertain macroeconomic environment. Join our investing community and take control of your financial future today.