Summary:

- Accenture continues to face challenges in the business consulting industry due to the depressed spend environment in the IT services sector.

- The company is strategically aligning itself for future growth by investing in digital transformation services and making acquisitions in growth areas such as cybersecurity.

- Management expects a growth uptick in the second half of 2024 and has guided for a significant ramp in revenue growth in Q4 FY24. Accenture still offers attractive entry points for investors.

HJBC

Investment Thesis

Accenture (NYSE:ACN) continues to face headwinds that are weighing down on the entire business consulting industry all over the world. One of the biggest challenges business consulting companies face at the moment is the depressed spend environment seen in the IT services sector. In light of the depressed IT spend, companies are reorganizing their organizations and reallocating their cash and capital towards investments and other priorities that position them for future growth.

In the Q2 FY24 call to discuss results, Accenture’s CEO said, “The corporates have put themselves on a diet,” when explaining the backdrop in IT spend. But the company is still aligning itself towards its future vision of growth intelligently.

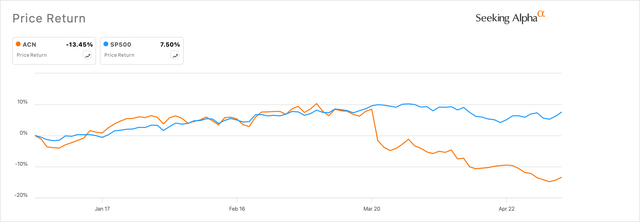

I had written about Accenture, where I expressed my optimism about how Accenture was “resourcefully working its cash to reposition itself” towards future growth. Since then, Accenture has reported its Q2 FY24 earnings and cut its guidance for Q3 FY24. The earnings report seems to have thrown cold water on any progress Accenture was making as it tracked the S&P 500 index, as seen in Exhibit A below.

Exhibit A: Accenture’s performance vs. the S&P 500 index on a year-to-date basis (sa)

However, after factoring in the latest estimates and adjusting my forecasts to reflect Accenture’s outlook, I still expect upside in the stock. I continue to recommend a Buy on Accenture.

Accenture continues to sustainably lay its building blocks towards growth

Management continues to work towards its goals of investing in the future growth of the company and positioning the company as a business strength to offer AI and digital transformation services. Digital transformation, or Industry X, as the company calls this sub-segment, Cloud and Security are some of the strongest growing sub-segments for Accenture. In the Q2 FY24 quarter, while Industry X grew at double-digit growth, Security grew at “very strong double-digit” growth rates.

At the same time, the arrival of GenAI last year changed the spend priorities of CIOs across the enterprise. This has impacted Accenture and its peers in the short-to-mid term, but Accenture has quickly moved to align itself with future spend areas, which are currently focused on GenAI, Cybersecurity and Digital transformation. Due to the rapid pace of innovation that the world has witnessed over the past ~15 months, Accenture’s management has indicated that it is investing its cash into acquiring startups that already have a client base in any of the growth areas I pointed out earlier. Purely from a growth-objective standpoint, I agree with Accenture’s approach at the moment because I believe acquisitions will help the company rapidly enter its growth markets, expand its presence, push scale, and acquire clients.

For example, I see that Accenture is able to witness strong double-digit growth in security due to the acquisitions they made throughout the year (Morphus, Innotec Security, MNEMO Mexico, etc.). All these acquisitions appear to be in the managed cybersecurity space, which I believe is a strong area of growth within cybersecurity. One of the leading cybersecurity product companies, CrowdStrike (CRWD), launched their own Managed Security Services last year in response to the demand. I had also covered this in previous research notes, where CrowdStrike’s peers are launching their own managed services, which is the consulting expertise Accenture has been ramping up via its acquisitions.

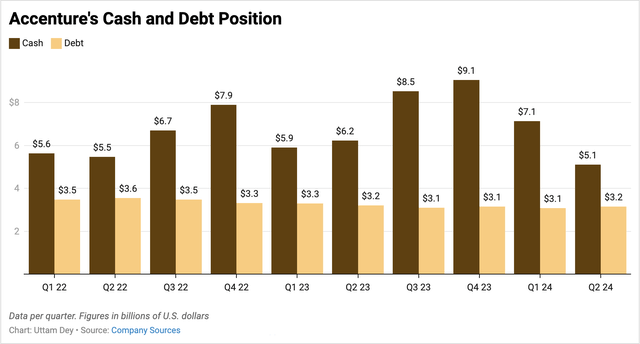

At the same time, the company is still keeping an eye on maintaining a robust balance sheet, as I see below. Per Q2, its cash and equivalents have declined ~17.7% to $5.1 billion.

Exhibit B: Accenture’s cash declines due to re-allocation of cash towards acquisitions (Company sources)

Although total debt has marginally increased to $3.2 billion on a sequential basis, total debt continues to trend lower from Q2 22, as seen above in Exhibit B. I strongly think that this certainly gives the company a competitive advantage that is “our investment capacity that allows us to pivot to higher areas of growth,” to quote management. I believe this provides management with more room to utilize its cash towards acquisitions and return cash to shareholders in the form of buybacks and dividends.

Management expects growth uptick next year

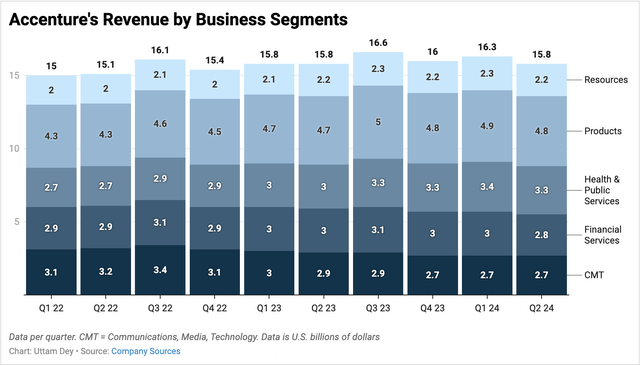

In Q2, Accenture saw its revenue remain flat on a y/y basis, with company sales of ~15.8 billion in its second quarter. Growth rates for Accenture flattened out across all its geographical segments, so the deceleration trends were the same for all its clients all over the world. As can be seen in Exhibit C below, sales in its Financial Services and CMT industry groups continued to decline on a y/y basis. However, its Products and Health+Public Services groups continued to expand. Most of the clients in these industry groups are either in the Food & Beverage and Retail industries or Healthcare and Health systems industries that are pushing through with their digital transformation projects.

Exhibit C: Accenture’s quarterly revenue trends by industry groups (Company sources)

However, I believe the company should see an uptick in the back half of 2024. For Accenture, that means the first half of its FY25 year since Accenture’s reporting year ends in August. Also, the second half of the year tends to get stronger as project budgets open up.

Management has guided towards a soft Q3 with just 1% growth but at the same time has guided for full year FY24 revenue to grow ~1.6% to ~$65 billion. This means management expects a relatively significant ramp in revenue growth of ~6% in Q4 FY24. I believe Accenture may be at the turn of the tide here as its revenue declaration rates stabilize from here on.

Accenture continues to offer attractive entry points

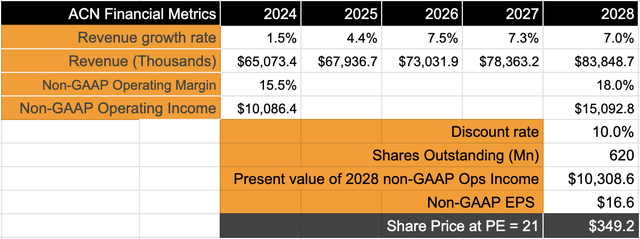

To estimate my target price for Accenture, I will assume a few things:

-

Based on my outlook for revenue that I stated in the earlier section, I expect Accenture will grow its revenue in the mid- to high single-digit range, ~6.5% CAGR.

-

I expect adjusted operating income to grow ~10.6% based on my growth outlook for Accenture. In addition, management has been cutting its workforce to increase productivity and adding other cost control measures, which should aid in faster growth in operating income relative to its revenue growth rates.

-

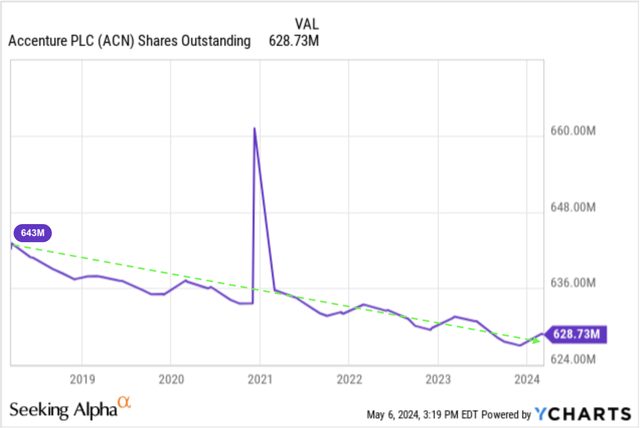

I have also tightened my outlook on shares outstanding based on their dilution rates, as seen in Exhibit E below.

-

Discount rates of 10.0% are based on micro-assumptions around discount rate items such as beta and risk premiums.

Exhibit D: Accenture’s shares outstanding since FY18 (YCharts)

Exhibit E: Accenture’s valuation model shows upside (Author)

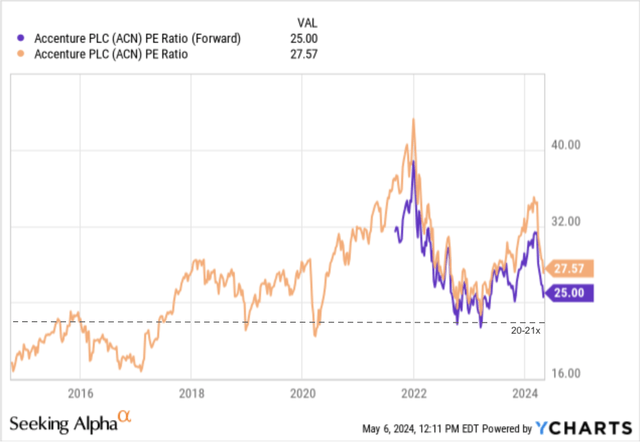

Based on my forecasts of 10–11% compounded growth in adjusted income, the company should fetch a valuation premium of 20–21x if I compare it to the S&P 500’s long-term earnings growth of 8%. I will assume a forward PE of 21x, which is at the lower end of its longer-term PE trend, as seen in Exhibit F.

Exhibit F: Long-term valuation multiples for Accenture (YCharts)

Taking a forward PE of 21x, I believe Accenture still offers upside with my target price of ~$350.

Risks and other factors to look for

The IT Services spend environment may continue to worsen from here on, in case of a deeper slowdown or recession. So far, the management of Accenture and other consulting firms is still not seeing signs of a pickup in discretionary enterprise spending. Most recently, management from another firm, Cognizant (CTSH), said that while “the timing of a return in discretionary spending remains unknown,” they also see that “clients continue to prioritize spending that can deliver cost savings quickly and continue to fund investments in transformation and innovation.” Moreover, Gartner continues to project stronger growth in IT services in FY24.

Takeaways

Accenture does face headwinds in terms of its slower revenue growth, but I believe revenue growth rates may be at an inflection point. At the same time, the company is demonstrating how it plans to position itself for growth by allocating cash towards intelligent acquisitions while maintaining a robust balance sheet.

I believe the company offers upside, and I rate Accenture as a Buy here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.